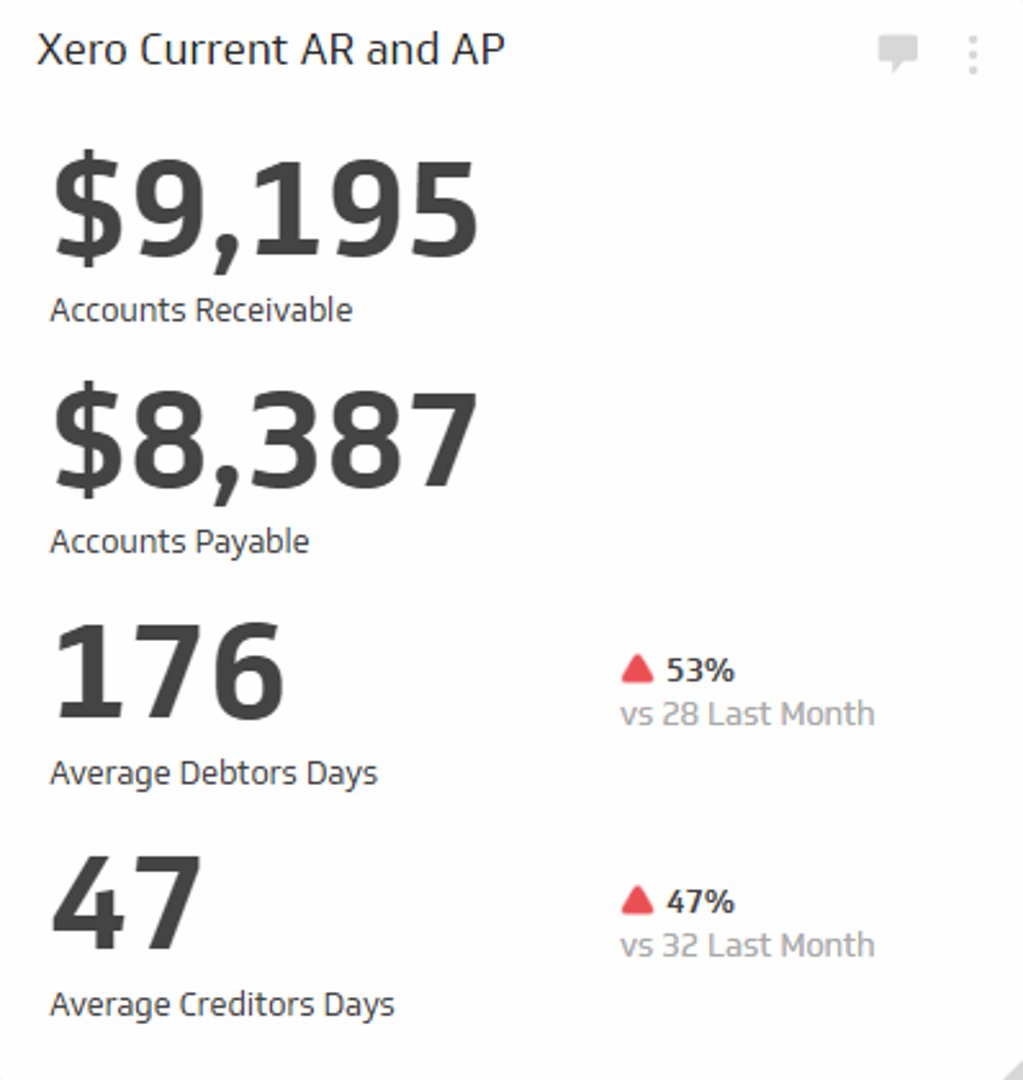

Accounts Payable Turnover Ratio Metric

Measures the rate at which your company pays off suppliers and other expenses.

Track all your Financial KPIs in one place

Sign up for a 14-day free trial and start making decisions for your business with confidence.

The Accounts Payable Turnover is a KPI that measures the rate your company pays off suppliers and other expenses. This is an important indicator for understanding your company’s liquidity and ability to manage cash, by reflecting the number of times your business paid off its accounts payable and short-term debt over the course of a period of time (month, quarter, year). This ratio is often used in conjunction with Current Ratio or Quick Ratio, for a well rounded assessment of your company’s liquidity. Overall, a high ratio is good and indicates that a business pays its bills and suppliers on time.

Formula

Accounts Payable Turnover Ratio = (Total Purchases / Average Accounts Payable)

Note: Total purchases is often a reflection of COGS on the Income Statement, and Accounts Payable is on the Balance Sheet.

Example of Accounts Payable Turnover Ratio

XYZ Company purchased $5,000 of materials in 2021. Its account payable at the end of 2020 and 2021 is 2,000 and 3,000 respectively.

Account Payable Turnover Ratio = [5,000/(2,000+3,000)/2] = 2.0

This means that on average company XYZ paid its average accounts payable twice during 2021.

Related Metrics & KPIs