Gross MRR Churn Rate

Date created: Oct 12, 2022 • Last updated: Mar 18, 2024

What is Gross MRR Churn Rate?

Gross Monthly Recurring Revenue Churn Rate (Gross MRR Churn Rate) is the percentage of recurring revenue lost due to both cancellation and downgrades. Note that it is common to express this metric as a monthly rate, though it can also be expressed as Gross ARR Churn Rate.

Gross MRR Churn Rate Formula

How to calculate Gross MRR Churn Rate

For example, if the total MRR churned (downgraded and cancelled) this month was $2000 and the total MRR (measured at the start of the month) is $100,000, then the Gross MRR Churn Rate would be 2%. $2000 (churn for entire month) / $100,000 (MRR as of beginning of month) = 0.02 or 2%

Start tracking your Gross MRR Churn Rate data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data.

Get PowerMetrics FreeWhat is a good Gross MRR Churn Rate benchmark?

Best in class MRR churn for enterprise companies is 1% per month. For small and mid-size focused businesses, that number is between 2% and 2.5%. At 5% annually, you're losing half of your subscription revenue every year.

Gross MRR Churn Rate benchmarks

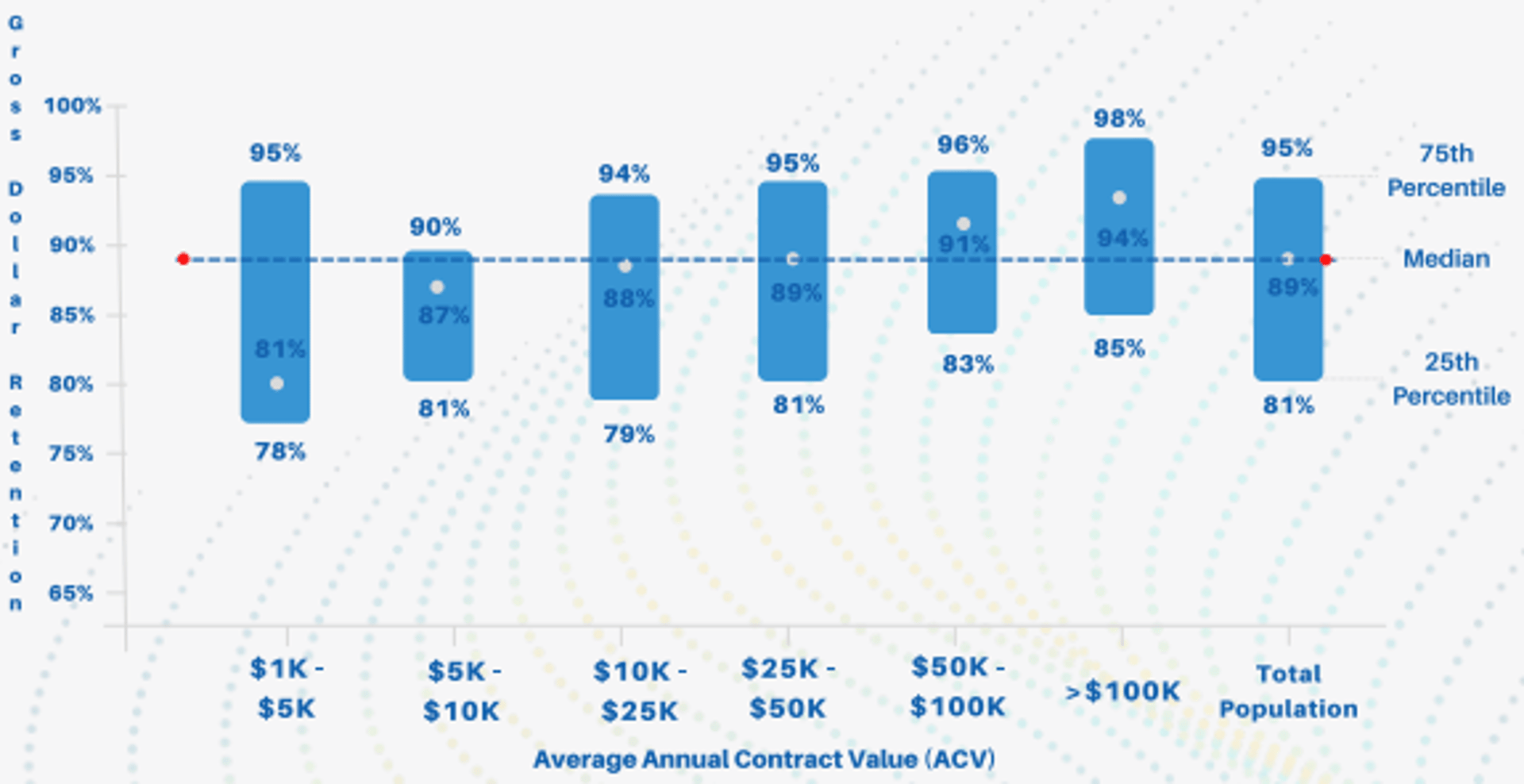

Gross Revenue Retention by ACV

How to visualize Gross MRR Churn Rate?

A line chart can help you optimally visualize your Gross MRR Churn Rate data by letting you see how this metric trends over time. You can then adjust your strategy to meet your goals.

Gross MRR Churn Rate visualization example

Gross MRR Churn Rate

Line Chart

Gross MRR Churn Rate

Chart

Measuring Gross MRR Churn RateMore about Gross MRR Churn Rate

In contrast to Net MRR Churn Rate that looks at expansion, downgrades, and cancellations, Gross MRR Churn reports only downgrades and cancellations.

Gross MRR Churn Rate is a critical KPI for subscription-based companies, because as the number of customers scale, a high churn rate will eventually surpass growth. High churn rates also point to fundamental product-market fit problems, buyer remorse, or an increasingly competitive landscape.

Calculate Gross MRR Churn Rate by dividing the total MRR churn (for the month) by the total MRR (at the beginning of the month).

Metric Toolkit

Start tracking your Gross MRR Churn Rate data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data.

Get PowerMetrics FreeContributor