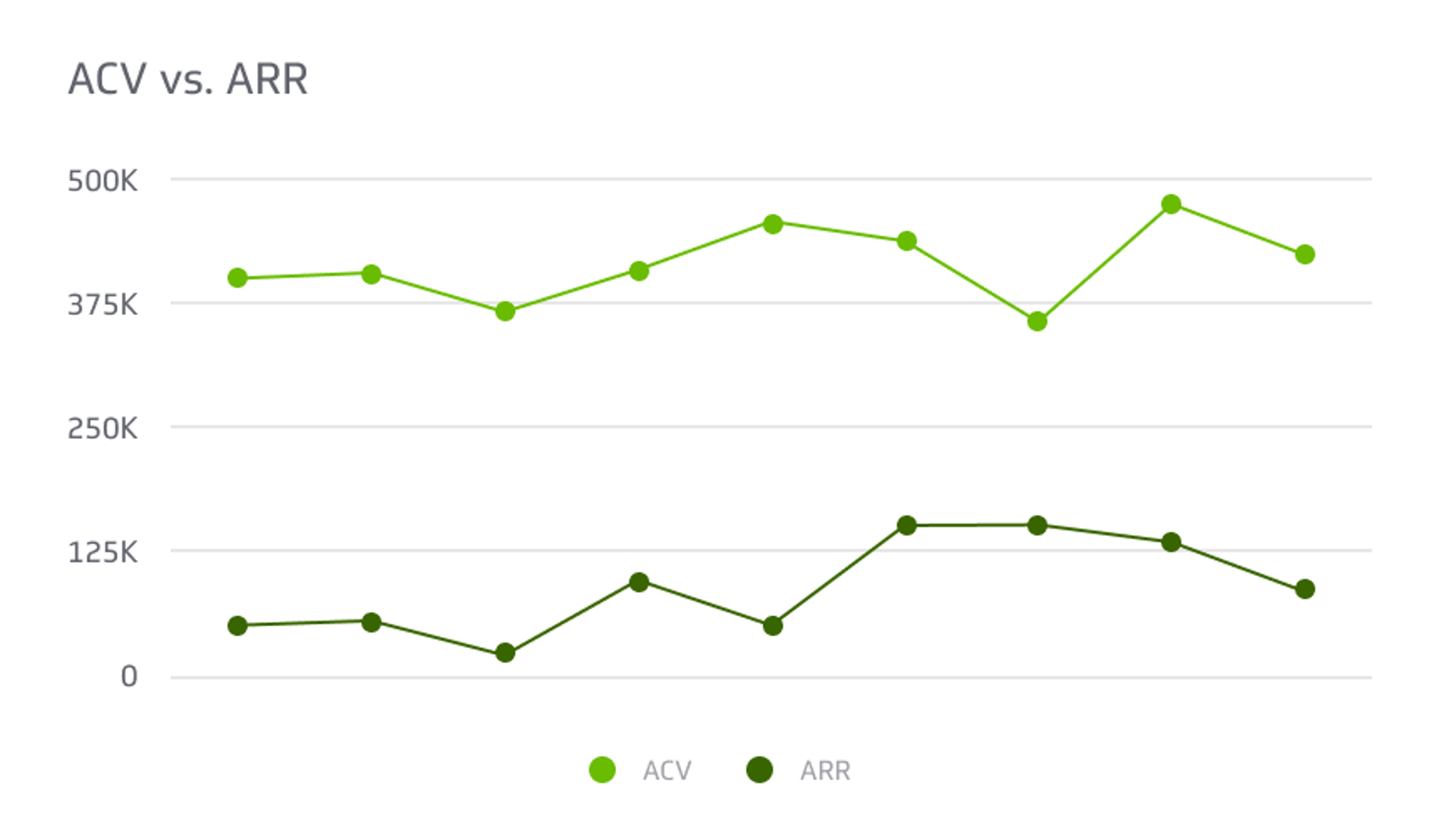

ACV vs ARR

ACV metric measures the total annual contract value of all customer contracts, while ARR refers to the total annual revenue from recurring sources.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In 2022, the software-as-a-service (SaaS) industry growth reached 140.6 billion dollars. With this surge, there has been an increased need to understand different metrics that can help calculate and measure the success of any SaaS venture. Two such metrics are ACV (Annual Contract Value) & ARR (Annual Recurring Revenue).

ACV metric measures the total annual contract value of all customer contracts, while ARR refers to the total annual revenue from recurring sources. Both metrics are important for understanding the health of a business and its growth trajectory. They also provide insight into the customer base and the overall financial stability of the business.

Keep reading to understand these two metrics in more detail and learn how to calculate them.

What is ACV (Annual Contract Value)

Annual Contract Value (ACV) is based on the recurring revenue generated from a customer, usually annually. The metric shows the total value of all contracts with customers. It is especially important for SaaS companies as it helps to understand how well a company does regarding customer retention and loyalty.

It consists of the total amount that a company is paid for its services over one year. It also indicates how much revenue a company can expect from its customers for a year. However, the metric does not consider any discounts or incentives offered to a customer.

How to Calculate Annual Contract Value?

ACV can be calculated by adding up all customer contracts for a year and dividing them by the number of years. Here is a simple formula for this illustration:

Annual Contract Value = Total value of all contracts / Number of years

For example, if person A takes a SaaS annual subscription contract active for 5 years, with a total value of the contract is $120,000, then the ACV would be:

ACV = Total value of all contracts / Number of years

= 120,000 / 5

= $24,000

It is important to note the example uses an annual subscription of 5 years, but what if the subscription is calculated monthly?

For example, Person B takes a monthly subscription of $70 for 3 years; then, to calculate the ACV it is important you first calculate the annual subscription rate and the total contract value.

Annual subscription rate = $70 x 12 = $840

Total value of contract = $840 x 3 = $2,520

After getting the annual value, you can now calculate the ACV as follows:

ACV = Total value of all contracts / Number of years

= 2,520 / 3

= $840

It is important to differentiate the annual and monthly rates, as using the monthly rate can lead to a significant difference in the ACV.

How to Calculate ACV for More Than One Contract

When dealing with numerous clients, it is possible;e to have different contracts that may vary in value and duration. In this case, you may be limited to calculating the Annual Contract Value of a single contract.

To calculate the ACV for multiple contracts, you need to add all the ACV and divide them by the number of contracts. Here is the formula:

Annual Contract Value (Multiple Contracts) = Total ACV of all contracts / Number of contracts

Here is an example:

Suppose you have 6 different individuals who take different contracts with varied values as follows:

- 3 individuals take a 1-year contract worth $ 25,000

- 2 individuals take a 2-year contract worth $ 50,000

- 1 individual takes a 5-year contract worth $ 150,000

Here, you first calculate the ACV for each group;

ACV 1 = $25,000 / 1 year = $ 25,000 x 3 individuals = $ 75,000

ACV 2 = $ 50,000 / 2 years = $ 100,000 x 2 individuals = $ 200,000

ACV 3 = $ 150,000 / 5 years = $ 750,000 x 1 individuals = $ 750, 000

You can now add the three ACVs to find the total value of the ACV:

Total ACV value = 75,000 + 200,000 + 750,000 = $1,025,000

Finally, divide the total ACV value by the number of contracts to calculate the average ACV:

Average ACV = $1,025,000 / 6

Average ACV = $170,833.33

When you get a decimal, always round up to the nearest whole number as you are calculating monetary value.

Benefits of Annual Contract Value

ACV is a great SaaS metric for understanding customer retention and loyalty. It also gives you insights into the customer's buying patterns and helps to determine the profitability of a company, and can be used to identify areas that need improvement.

Here is a more comprehensive analysis of the advantages of ACV:

- ACV helps to identify which customers generate the most revenue for your company and which require more attention.

- Annual Contract Value helps to analyze customer loyalty and provides insights into the effectiveness of marketing efforts.

- It allows companies to forecast future revenue accurately and set realistic goals.

- Annual Contract Value enables businesses to set customer incentives such as discounts and loyalty programs to encourage customers to stay with their service or product.

- The metric helps to identify areas of improvement and can be used to optimize pricing strategies.

It is essential to use ACV to assess the success of a company’s sales and marketing efforts which can help you.

What is ARR (Annual Recurring Revenue)?

In every business, the most important metric is revenue. It’s essential to know the exact amount of money you can make each year as it provides a more realistic view of the health of your business.

ARR (Annual Recurring Revenue) is an important metric that measures the total revenue generated by recurring customers overof one year. The metric also includes any additional revenue generated from upgrades, discounts, and incentives.

It is useful for companies that offer subscription-based services or products and can be used to measure growth in revenue over time. It is also used to compare the performance of different services/products.

How to Calculate Annual Recurring Revenue

ARR is calculated by taking the total value of recurring revenue generated in a year, including upgrades and discounts. Here is the formula:

Annual Recurring Revenue (ARR) = Monthly Recurring Revenue (MRR) × 12 Months

For example, if your company generates a total monthly recurring revenue of $12,000. The ARR would be:

ARR = $12,000 × 12

ARR = $120,000

The formula, however, does not consider the change in the rate of customer subscriptions. The subscriptions may be increased or decreased time period. Also, if the business has long-term contracts, it is important to calculate the revenue generated over a longer period.

You can incorporate a more inclusive formula such as:

ARR = ARR at the beginning of the year + ARR gained from new customers + ARR gained from subscription upgrades – ARR lost to subscription downgrades – ARR lost to customer churn

Here is an example:

Suppose your company gets a customer subscription of about 200 individuals at the start of the year, with each valued at $2,000; then, if nothing changes all through the year and your company has no non-recurring revenue, the ARR will be:

ARR (No changes in subscription and no non-recurring revenue) = $2,000 x 200

= $ 200,000

In a scenario where throughout the year, the company gets several changes as follows:

Event 1 - 30 new individuals subscribe for the $ 2,000 package

Event 2 - 50 continuing customers upgrade to a $ 3,000 package

Event 3 - 10 continuing clients downgrade to the $ 1,500 package

Event 4 - 5 clients cancel their subscriptions completely

To calculate your Annual Recurring Revenue, you can add and minus the events as they happen throughout the year. That is:

ARR = ARR (No changes in subscription and no non-recurring revenue) + Event 1 + Event 2 - Event 3 - Event 4

= $ 200,000 + (30 x $2000) + (50 x $1000) - (10 x $500) - (5 x $2000)

= $ 295,000

With this formula, you can easily calculate the Annual Recurring Revenue of your business while considering changes that occur throughout the year.

Benefits of Knowing Annual Recurring Revenue

Having accurate knowledge of your ARR helps to understand the health of your business. It can help you:

- Analyze the growth of your business

- Estimate future cash flow

- Make better pricing decisions

- Allocate the marketing budget effectively

- Track progress toward long-term goals

- Monitor customer satisfaction

If you are making any estimates for your business, you can use the Annual Recurring Revenue metric as one of your focal points. It can help to provide a more realistic view of the health of your business and the amount of money you can make each year.

Differences Between Annual Contract Value and Annual Recurring Revenue

Although both metrics measure the revenue generated within a year, some key differences exist. For instance, the Annual Contract Value (ACV) includes sums from one-time purchases, while ARR only considers money generated from recurring services.

Here is an elaborate analysis of these differences:

- Annual Contract Value (ACV) includes all purchases made in a year, while ARR only considers recurring revenue.

- ACV measures the total revenue generated in a year, while ARR shows only how much is recurring within that same period.

- ACV is used to measure the total revenue, while ARR is used to measure revenue growth over time.

- ACV gives the total scope of a customer’s purchase, while ARR tells how much the customer will spend over time.

- ACV shows all one-time purchases made by a customer, while ARR is used to measure the revenue of a customer’s recurring services.

By understanding the differences between ACV and ARR, businesses can make better decisions on pricing, investments, and budget allocations.

Who Uses ARR and ACV?

Different sectors and businesses use ARR and ACV to measure their revenue. Here are some examples:

Software Companies

Software companies are the main users of the ARR metric, as it measures the recurring revenue generated from subscription-based services. The company uses it to identify growth opportunities and measure progress toward its goals.

The companies also use ACV to measure the revenue generated from one-time purchases and services. It helps them to make decisions on financial management and product pricing.

Retail Companies

Retail companies use ARR and ACV to measure the success of promotions, discounts, new products, and other strategies. With ARR, they can measure the recurring revenue from subscription-based services or loyalty programs. They use ACV to measure the revenue generated from one-time purchases.

Financial Services

Financial services such as banks, credit unions, and wealth management companies use ARR to measure the recurring revenue from deposit accounts, debit cards, and other services. They also use ACV to measure one-time purchases such as mortgage loans, credit cards, and investments.

Telecom Companies

Telecom companies use ACV to measure the revenue generated from purchases such as new phone plans and add-ons. They also use ARR to measure the recurring revenue from subscription-based services such as roaming charges, data plans, and other services.

Conclusion: Use ARR and ACV to Make Better Decisions

Annual Recurring Revenue and Annual Contract Value are two important metrics for businesses to measure their revenue. Although they measure different types of revenue, both metrics provide important insights into the health and performance of a business.

By understanding these two metrics and how they differ, businesses can make more informed decisions about their finances and budget allocations. Businesses can also measure their progress toward their goals and ensure customer satisfaction.

Contact us to learn more about Annual Contract Value and Annual Recurring Revenue.

FAQ's

Analyzing the Annual Contract Value (ACV) and Annual Recurring Revenue (ARR) is essential for businesses to measure their success. That's why numerous questions arise when it comes to these two metrics. Here are some of the commonly asked questions concerning ACV and ARR:

Are there specific timeframes for ACV and ARR?

No, ACV and ARR do not have specific timeframes. The timeframe used varies from company to company, depending on their business needs. However, it's advisable to use a consistent timeframe to benchmark them accurately.

For instance, when your company decides to use a one-year timeframe for the calculations of the first three years, it is essential to use the same for the fourth and consecutive years. It can help you analyze and compare the results more accurately.

What factors influence ACV and ARR?

The main factor influencing both ACV and ARR is pricing, as your pricing strategy can affect the revenue your company can generate. ACV and ARR are also affected by customer behavior, marketing efforts, and the company's overall goals. Considering all these factors when analyzing ACV and ARR is essential, as they can have a major impact on the metrics.

How can you increase ARR and ACV?

Increasing ARR and ACV can help businesses to maximize their revenue and grow faster. To increase these two metrics, businesses need to focus on pricing strategies, customer experience, product marketing, and customer retention. ARR and ACV, when combined with the previously mentioned metrics, will drive revenue forward, making ARR and ACV essential for new businesses.

Which department should calculate ARR and ACV?

As ARR and ACV are financial metrics, the finance department is usually in charge of calculating them. However, other departments, such as marketing and sales, can also be involved in the process, as they can provide valuable insights into customer behavior, data analytics, advertising efficacy, and other factors that affect these metrics.

Churn.png)