Average Sale Price (ASP)

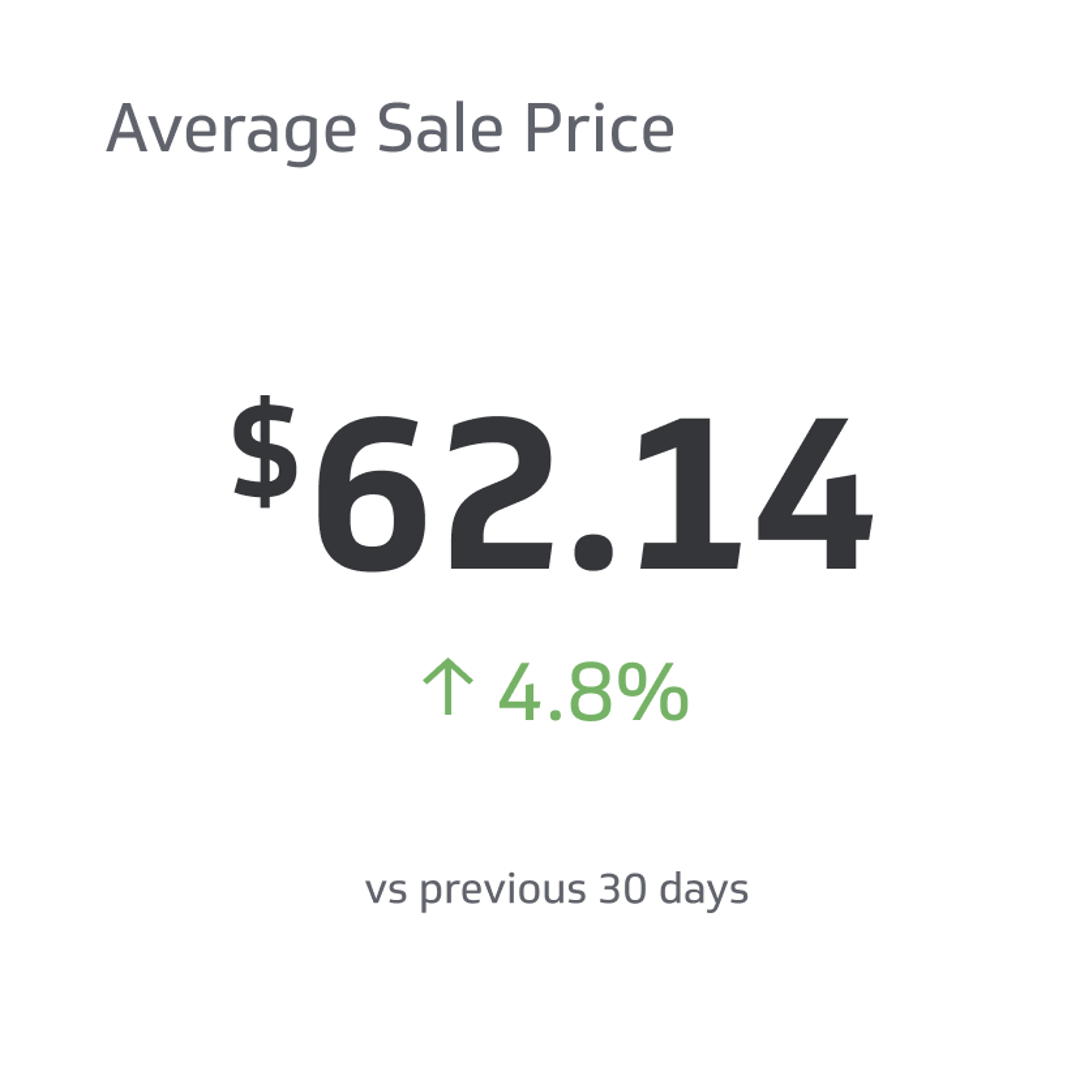

The average sale price (ASP) is the money customers spend on your product or service in a given period.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

As a savvy business owner or investor, knowing your product or service's average selling price (ASP) is crucial. The metric can enable you to make informed decisions about pricing strategies, market trends, and revenue potential. It can also help you identify growth opportunities and determine areas where you need to adjust your operations.

In this article, we'll delve into the concept of the average sale price and give you step-by-step instructions for calculating it accurately.

Understanding Average Selling Price (ASP)

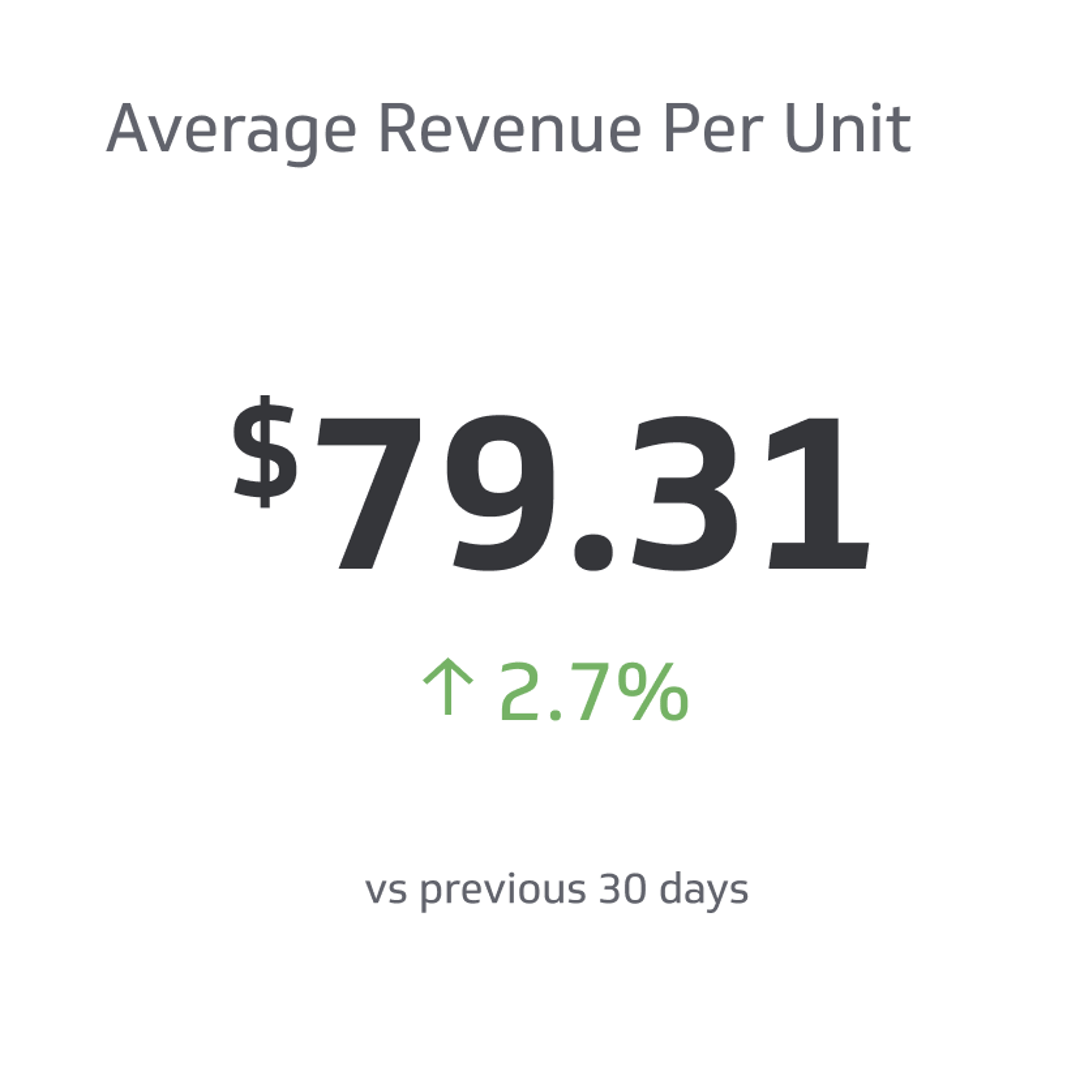

The average sale price (ASP) is the money customers spend on your product or service in a given period. It can vary depending on consumer behaviour factors, including competition, market demand, and product or service quality.

The metric is helpful in a Software as a Service business, for example, where revenue is generated from recurring subscriptions rather than one-time purchases. In such cases, calculating the ASP can provide insight into how much customers are willing to pay over the long term.

Calculating Average Selling Price

To calculate your company's Average Selling Price (ASP), you need just two pieces of data: the total revenue generated from sales during a given period and the corresponding number of units sold.

By applying these annotations in the formula, you can gain insight into the best pricing strategies.

Formula for Calculating ASP

The formula to calculate the average selling price is relatively straightforward:

- ASP = Total RGS / C.C.

Where:

- Total RGS is the total revenue generated from sales during a given period.

- C.C. is the customer count corresponding to the number of units sold during the same period.

To illustrate, let's say your company generates $50,000 in revenue from selling 500 units of your product in a month. The ASP would be:

- ASP = $50,000 / 500 units = $100

This means that, on average, each unit of your product is sold for $100.

Keep in mind that while ASP provides insight into the pricing behavior of your customers, it might not necessarily reflect the profitability of your business. You may need to consider other factors, such as variable costs, in calculating profit margins.

Factors Affecting an Organization's ASP

Understanding different factors that affect ASP can help you better analyze your company's current status. You can also know when and how to make adjustments to optimize profitability and competitiveness within the market.

Here are the main factors that affect a business’ average selling price:

- Market conditions: The overall market price for similar products or services can significantly impact a company's ASP. For example, if competitors offer lower prices, adjusting your pricing accordingly may be necessary to remain competitive.

- Sales volume: A higher sales volume often leads to economies of scale, resulting in lower production costs per unit and potentially decreasing the average selling price over time.

- Pricing power: Companies with strong brand recognition and customer loyalty have greater pricing power than those without. This means they can charge higher prices for their products or services without negatively impacting demand - leading to a higher ASP against competitors who must rely on lower prices due to their lack of such advantages.

- Tight profit margins: Companies operating under tight profit margins may need to maintain a higher ASP to cover their costs and remain profitable. This could make it more challenging to compete with businesses with lower pricing power or operate under less stringent profit margin requirements.

By understanding the formula for calculating average selling price and recognizing the factors that can affect it, organizations can use this information to their advantage.

Case Study: Apple's iPhone Average Selling Price

In a recent study, Apple's Average Selling Price (ASP) declined by 4% to $58.0 million due primarily to consumers preferring lower-priced entries from other brands like Samsung. This effectively expanded Samsung’s market from $58.3 million to $60.6 million.

Ultimately, the change in market preference simultaneously reduces demand among high-end segments traditionally dominated exclusively by iPhones. Here are the factors contributing to the decline in iPhone ASP and its impact on market position:

Factors Contributing to the Decline in Apple’s ASP

Here are significant factors contributing to Apple’s ASP drop:

- Rising competition: The emergence of new players such as Xiaomi, Oppo, and Vivo offering feature-rich smartphones at competitive prices increases consumer choices. As a result, many customers are opting for these alternatives over premium-priced iPhones.

- Economic factors: Economic slowdowns or currency exchange rate fluctuations affect consumers' purchasing power. This leads iPhone distributors to choose less expensive options when buying smartphones.

- Increase in refurbished devices: Many people choose refurbished iPhones over brand-new ones due to their lower pricing power. These devices offer similar performance levels but come with tight profit margins for sellers.

- Matured market: As smartphone penetration reaches saturation points in various regions globally, growth opportunities become limited. This leads companies like Apple to compete more aggressively on price points than ever before possible.

To enhance growth in their ASP, iPhone has to overcome these factors while still maintaining high standards for customer satisfaction.

Impact of Declining Apple’s ASP on Market Position

IPhone's declining average selling price has several implications for Apple's market position. Some of these include:

- Decreased profitability: Lower ASPs reduce the total revenue iPhone earns per unit they sell, potentially affecting the company's bottom line.

- Erosion of premium brand image: As consumers increasingly opt for lower-priced alternatives, it could erode Apple's perceived value as a premium smartphone manufacturer.

- Potential loss of pricing power: A continuous decline in iPhone ASP might force Apple to raise prices or introduce more affordable models to maintain its market share and profitability. Nevertheless, this could further diminish their ability to set prices and put additional strain on profit margins.

In an effort to combat the potential loss of pricing power, Apple has diversified its product line by introducing cheaper models like the iPhone SE and providing enticing trade-in deals for customers upgrading from older devices. By doing so, they aim to maintain their competitive edge while addressing consumer preferences effectively.

Conclusion

Understanding average selling price (ASP) is crucial for business operators, marketers, analysts, and investors. ASP can help businesses decide on pricing strategies and evaluate their performance in the market. By calculating ASP, organizations can identify factors affecting their sales volume and pricing power.

If you want to learn more about optimizing your business strategy with average selling price data, contact us today!

FAQs

Here are some frequently asked questions about calculating average selling price (ASP) that can help simplify the process:

What is the importance of calculating average sale price (ASP)?

Calculating the average sale price (ASP) can provide insight into how much customers are willing to pay for your product or service, allowing informed pricing strategies and identifying revenue potential.

When should companies calculate their ASP?

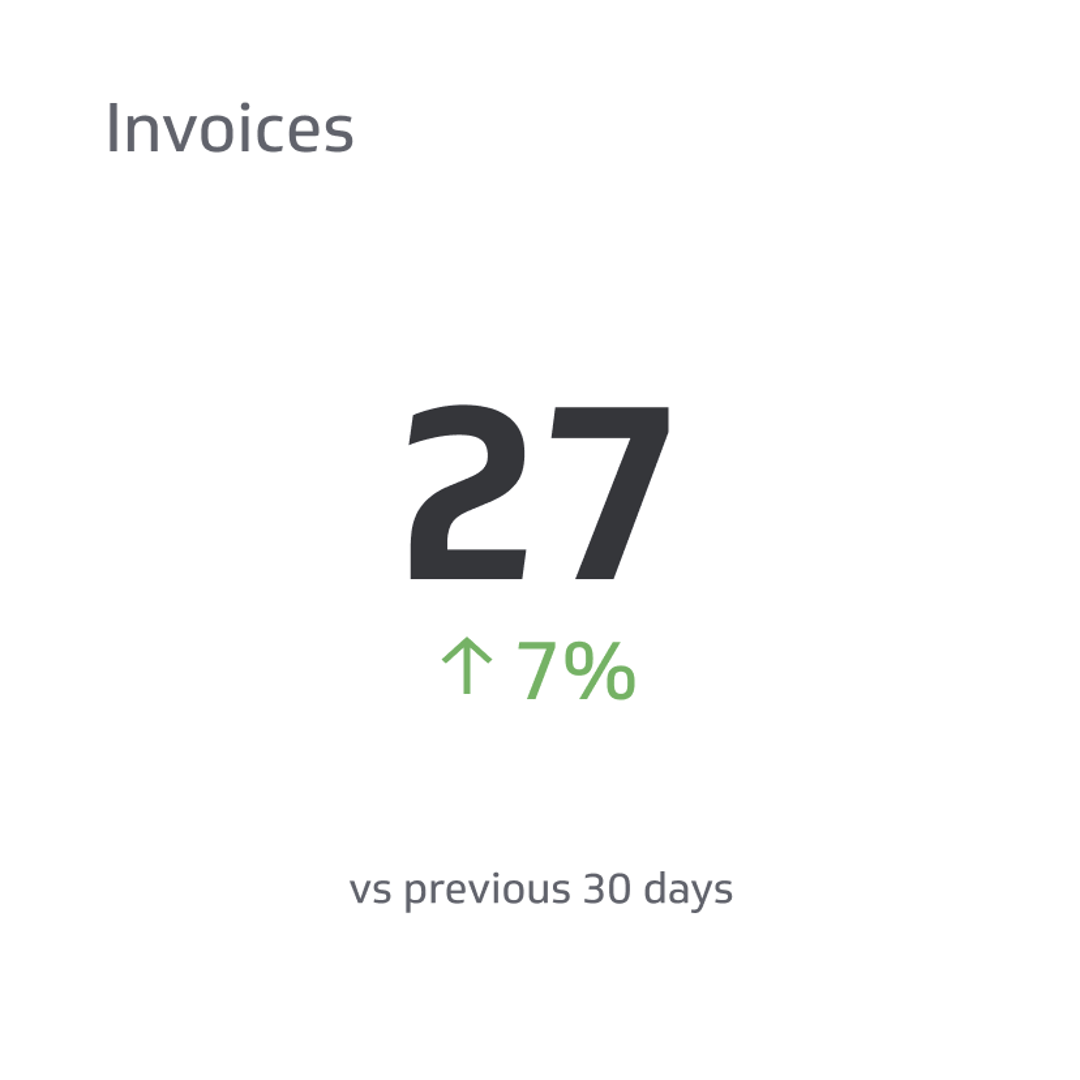

Companies should calculate their ASP regularly, such as weekly, monthly, or quarterly. This allows them to track changes in consumer behavior, market trends, and product or service quality and make data-based decisions.

It is essential to ensure the periods are even to help avoid inconsistencies and provide accurate comparisons. You should also keep a record between calculations to accurately track changes over time.

Can ASP help determine profit margins?

While ASP provides insight into the pricing behaviour of your customers, it might not necessarily reflect the profitability of your business. You may need to consider other factors, such as variable costs, in calculating profit margins.

Understanding your ASP can help you identify areas where you may need to adjust your operations to improve profitability, such as reducing production costs or increasing sales volume.

How can you know that your ASP calculations are accurate?

To ensure the accuracy of your ASP calculations, it is essential to have reliable and up-to-date data on your sales revenue and corresponding unit sales. You should also double-check and validate your calculations against previous periods to detect abnormalities or discrepancies.

If you suspect errors or inconsistencies in your data, you may need to investigate further and adjust your calculations accordingly.

Related Metrics & KPIs