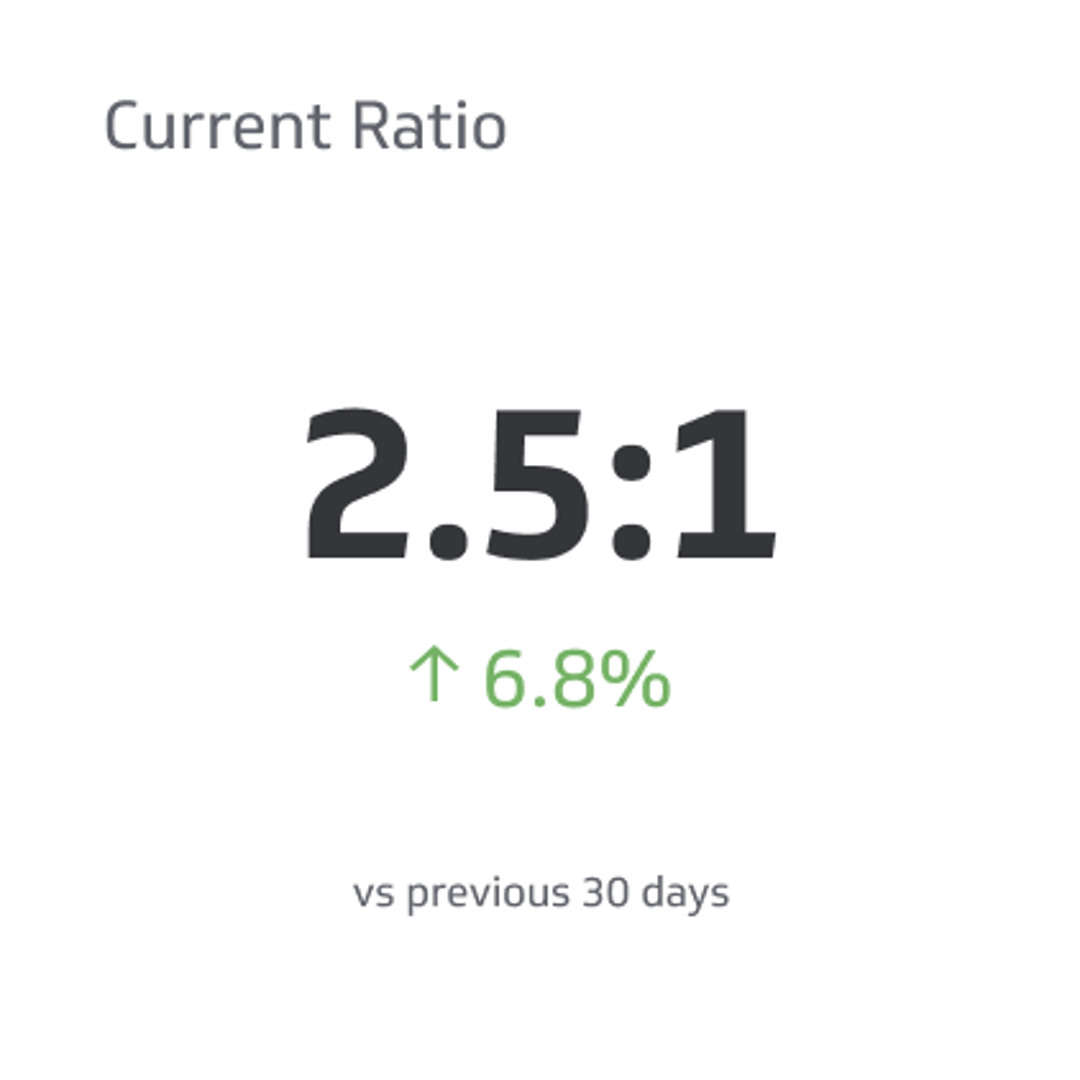

Revenue

Revenue represents the total earnings of a business from selling its products or services within a specified timeframe, typically a month or a year, excluding returns or refunds.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Why is revenue such a critical metric for businesses? Revenue is a vital indicator that directly influences profitability and growth. It represents the total amount of money a business earns from selling goods or services during a specific period.

In this article, we'll explore how understanding revenue helps businesses make informed decisions regarding pricing, marketing, and overall strategic planning. So let's start without further ado!

Definition of Revenue

Revenue represents the total earnings of a business from selling its products or services within a specified timeframe, typically a month or a year, excluding returns or refunds. Often referred to as the "top line," revenue holds the first position on the income statement, providing a snapshot of a company's financial performance during that period.

Significance of Revenue in Business

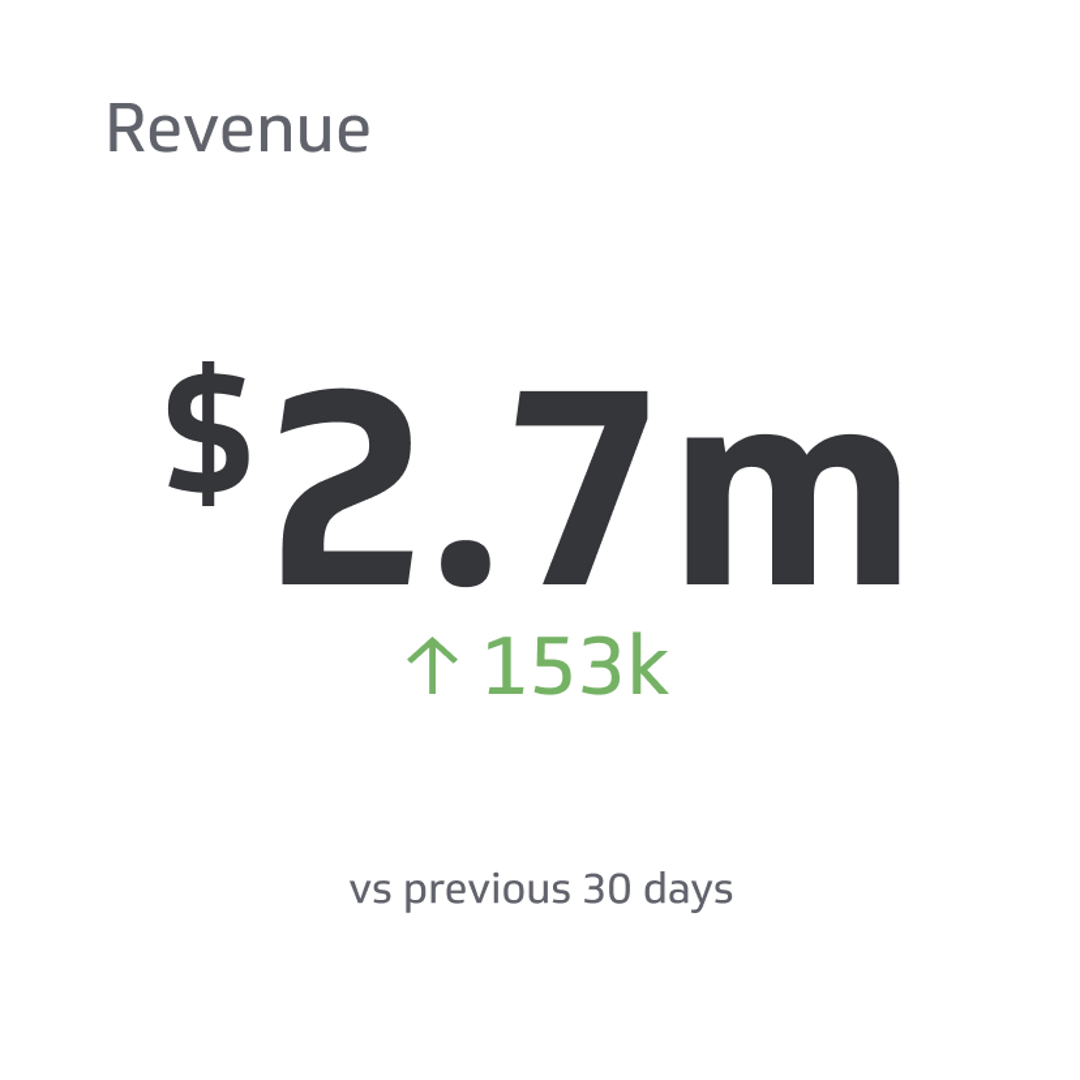

Revenue is a vital metric for businesses as it serves as a gauge of their financial health and performance. It enables businesses to measure their sales and growth within a specific timeframe. By closely monitoring revenue, businesses can identify sales trends, evaluate the effectiveness of their pricing strategies, and pinpoint areas for improvement in marketing and sales efforts.

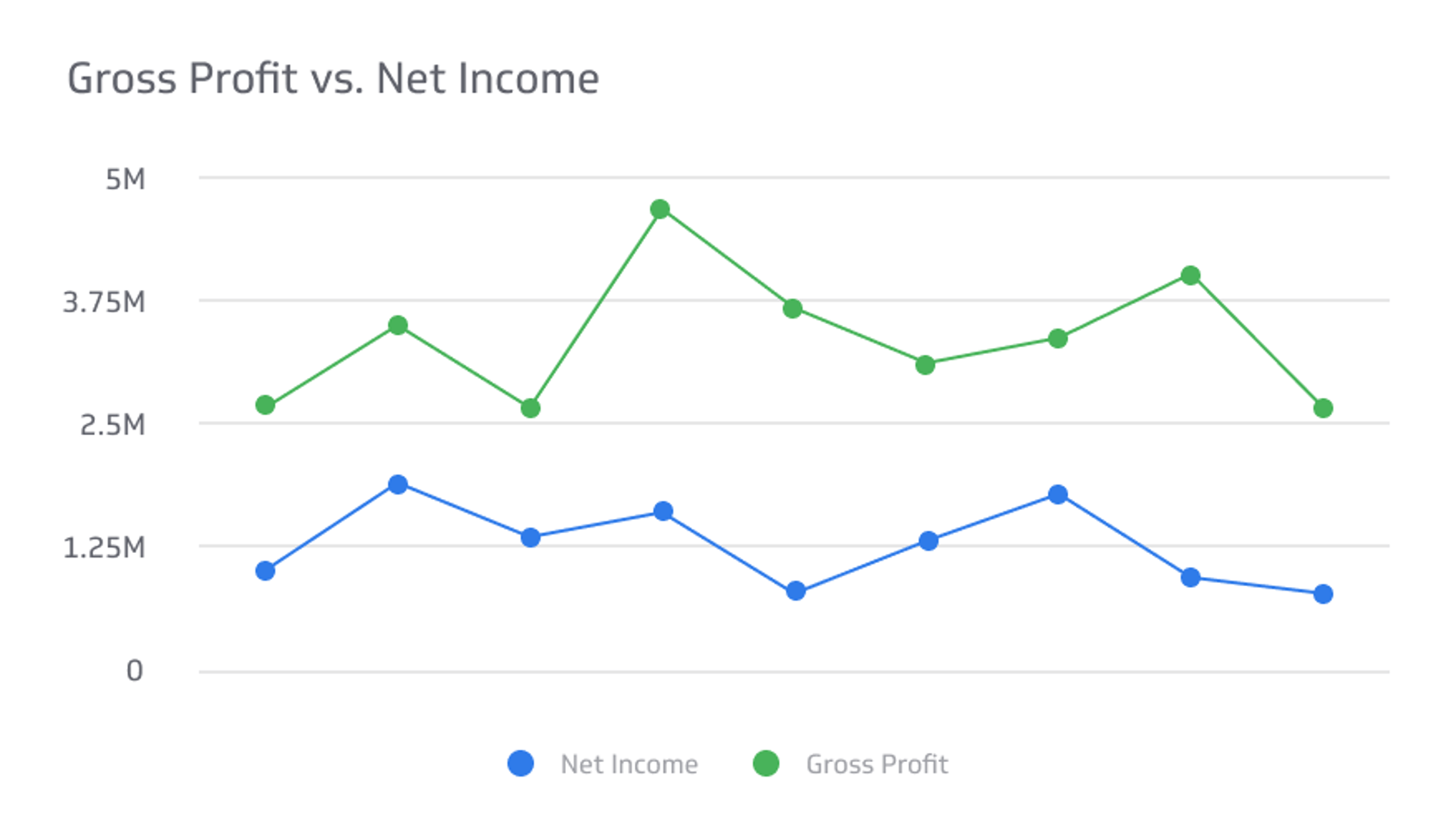

Difference between Revenue and Profit

Profit is the financial outcome that remains after subtracting all expenses from revenue. Unlike revenue, which represents the total earnings of a business, profit provides a more accurate measure of its financial health.

It accounts for all the costs associated with producing and selling goods or services. Often referred to as the "bottom line" on the income statement, profit is calculated by deducting expenses from revenue.

The Formula for Calculating Revenue

Calculating revenue is a crucial aspect of business management. The formula for determining revenue is:

Revenue = Price x Quantity

Here's what each variable represents:

- Price: The cost per unit of a product or service.

- Quantity: The total number of units sold.

This formula can be applied to calculate revenue for a specific product, service, or the entire business. It should be regularly utilized to monitor progress, identify requirements, and address shortcomings of a business.

Components of the Formula

Here are the components of the formula:

Price

The price is the amount of money that the business charges for each unit of product or service sold. The price can vary depending on factors such as market demand, competition, and production costs. Getting this number right is very important as it directly impacts the total revenue earned.

Quantity

Quantity refers to the total number of units sold during a specific period. It could be the total number of products sold or the number of services rendered and will vary depending on the type of business in question.

Quantity is also an essential component of the revenue formula because it determines how much revenue the business earns per unit of product or service sold.

Calculation of Revenue

Let's take a hypothetical business that sells an item for $10 per unit. During April, the business sold 500 items. To calculate the revenue generated by the business in April, we can use the revenue formula:

Revenue = Price x Quantity

Revenue = $10 x 500

Revenue = $5,000

Therefore, the revenue generated by the business in April is $5,000.

Interpretation of Result

The revenue calculation results show that the business earned $5,000 in revenue by selling 500 items at $10 per unit.

This revenue amount doesn't consider any expenses the business may have incurred in producing and selling the item. It's crucial to note that revenue alone doesn't indicate the profitability of a business. To determine profitability, the revenue must be compared to the total expenses incurred in producing and selling the products or services.

By monitoring revenue over time, businesses can identify trends in their sales and measure the success of their marketing and sales strategies. Revenue calculation is essential to a business's financial analysis and planning, and businesses need to track their revenue regularly.

Example of Revenue Calculation in Different Scenarios

Revenue calculations can differ depending on the nature of the business. For example, product-based businesses typically calculate revenue based on the number of units sold and the price per unit.

In contrast, service-based businesses may calculate revenue based on the number of hours worked and the hourly rate. But, with some adjustments, the revenue formula will work for everyone.

Examples of Revenue Calculations

Here are a few different calculations of revenue for various types of businesses that help clear up any confusion regarding revenue’s meaning and importance.

Product-based Business

Let's take an example of a clothing store that sells T-shirts. In June, the store sold 500 T-shirts for $20 each. The revenue for the month of June will be calculated as follows:

Revenue = Price x Quantity

Revenue = $20 x 500

Revenue = $10,000

Therefore, the revenue generated by the clothing store in June was $10,000.

Service-based Business

Let's take an example of a freelance writer who charges $50 per hour. In July, the writer worked for 20 hours. The revenue for the month of July will be calculated as follows:

Revenue = Price x Quantity

Revenue = $50 x 20

Revenue = $1,000

Therefore, the revenue generated by the freelance writer in July was $1,000.

Subscription-based Business

Let's take an example of a streaming service that charges $10 per month per user. In August, the service had 1,000 subscribers. The revenue for August will be calculated as follows:

Revenue = Price x Quantity

Revenue = $10 x 1,000

Revenue = $10,000

Therefore, the revenue generated by the streaming service in August was $10,000.

Using Revenue Calculation to Identify Potential Business Opportunities and Challenges

Revenue calculation can be used to identify potential business opportunities and challenges. For example, if a company experiences a sudden increase in revenue, it may indicate a new market opportunity or a shift in customer preferences.

In contrast, a decline in revenue may signal a need to adjust marketing and sales strategies, reduce expenses, or introduce new products or services to remain competitive.

Furthermore, analyzing revenue data can help businesses identify which products or services generate the most revenue and which are not performing well. This information can help businesses adjust their product or service offerings to optimize revenue generation.

Final Thoughts

In sum, revenue is an essential financial metric for businesses as it serves as a direct measure of the money generated through product or service sales. Tracking revenue regularly is crucial for businesses to assess their financial well-being and overall performance.

It enables companies to gain valuable insights into sales trends, evaluate marketing and sales strategies, and measure the success of business operations. Thus, understanding and analyzing revenue is essential for making informed decisions and fostering sustainable growth.

Related Metrics & KPIs