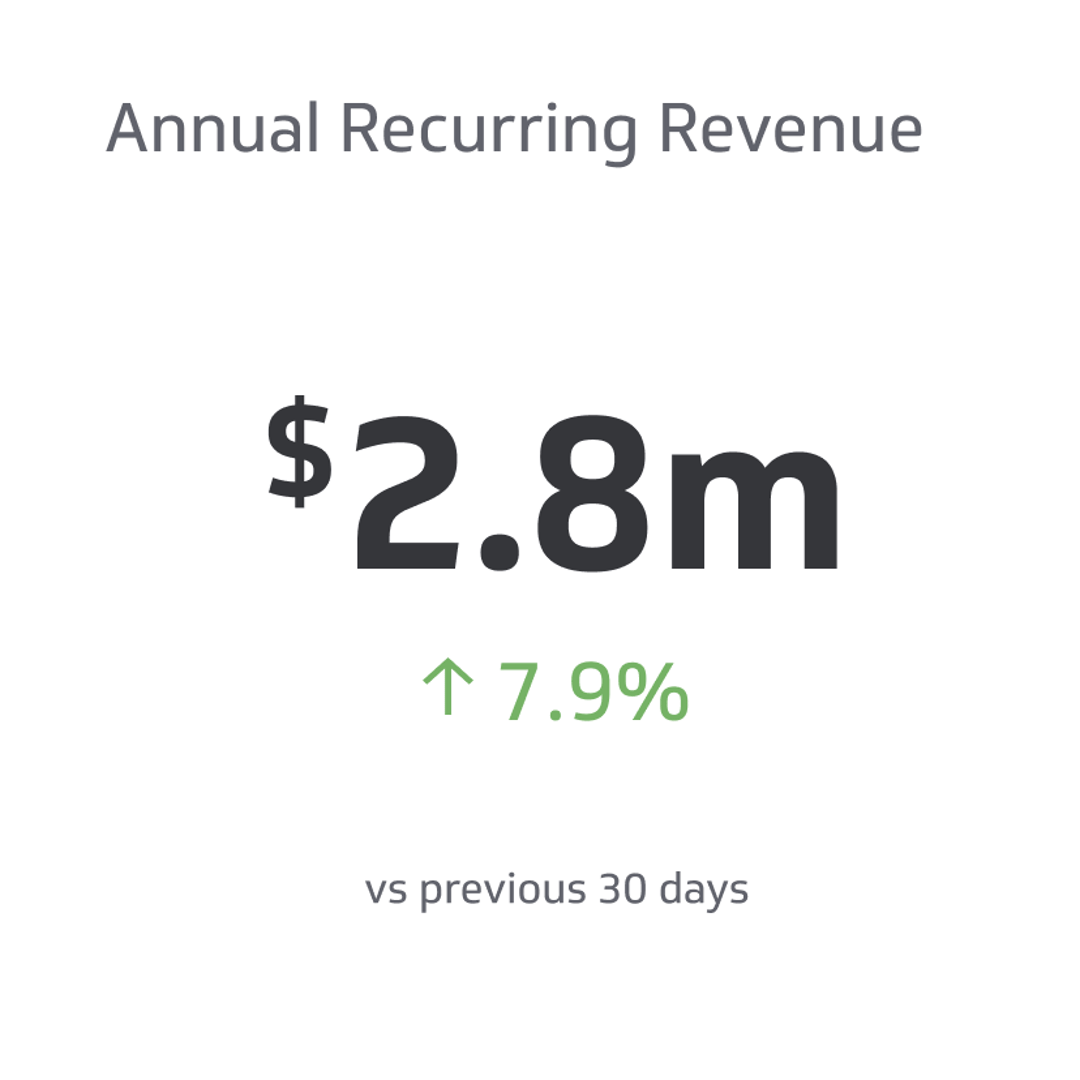

Annual Recurring Revenue (ARR)

Annual recurring revenue (ARR) evaluates the recurring revenue generated by a business over 12 months.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In this fast-paced business world, metrics are the lifelines that keep companies on track. From measuring success to forecasting future growth, the right metrics can provide invaluable input and direction.

If you run a subscription-based business like software as a service (SaaS), say hello to annual recurring revenue (ARR): a crucial metric to track company progress. With this ultimate game-changer, you can get a bird's-eye view of your business’ health and determine the pace of growth required to keep your success soaring.

In this blog post, we’ll delve into the world of ARR and provide you with insight into this vital SaaS metric. So, to learn how to calculate annual recurring revenue, keep reading!

Annual Recurring Revenue Explained

Annual recurring revenue (ARR) evaluates the recurring revenue generated by a business over 12 months. Though it involves monthly subscriptions, this metric’s calculation extends beyond a simple multiplication by 12.

It specifically accounts for contracts lasting a year or longer, excluding partial subscription revenues and contracts ending mid-year. This nuanced definition comprehensively explains a company's yearly subscription-based revenue.

How to Calculate Annual Recurring Revenue

The ARR formula is a nifty little calculation that factors in all the recurring revenue streams within your enterprise. To determine your ARR, add your yearly subscription revenue and the cash earned from expansion revenue. Then, take away the losses incurred from account downgrades and canceled subscriptions.

- ARR = (recurring revenue for the year + revenue from upgrades and add-ons) - revenue lost from downgrades and cancellations

Let's break it down using a practical example.

Picture a company with a subscription-based service where customers pay $100 per month. And let’s just say they currently have 500 subscribers.

To calculate the total monthly revenue, multiply the subscription cost by the number of subscribers:

- $100 x 500 = $50,000

Next, we need to consider the number of yearly subscriptions. Assuming the company bills monthly, there are 12 subscription periods in a year.

To determine the ARR, multiply the monthly revenue by the number of subscription periods:

- $50,000 x 12 = $600,000

Voilà! The company's annual recurring revenue is $600,000. Assuming the company maintains its current subscriber count and subscription pricing, it can anticipate a yearly revenue of $600,000 exclusively from recurring subscriptions.

But wait, we’re not done yet.

Let’s say the revenue from add-ons and upgrades for the year is $200,000, and the revenue lost from cancellations and downgrades is $80,000.

Use the ARR formula to calculate the final amount:

- ($600,000 + $200,000) - $80,000 = $720,000

And there you have it! The final ARR for the year is $720,000.

Expansion revenue, which stems from the recurring charges associated with upgrades and add-ons, directly impacts the annual subscription cost, thus necessitating its inclusion.

To accurately compute this metric, be sure to also avoid non-recurring charges like installation, consulting, and setup fees. This way, the metric is not skewed by one-time costs, allowing for an accurate and fair calculation.

Five Reasons Why ARR is Important

Annual recurring revenue plays an instrumental role in measuring the momentum of your business and forecasting future growth. With this vital information, you can actively work toward achieving your goals and dominating the industry.

Here are five reasons why ARR is crucial for you and your company.

It Forecasts Revenue

Simply put, ARR is the key to forecasting revenue like a pro. It provides valuable insight into projected revenue, enabling businesses to improve their financial planning and analysis. This, in turn, enhances cash flow management and resource allocation across the organization.

With stable recurring revenue forecasts, companies can confidently strategize their financing and make well-informed decisions. Anticipating future income empowers them to navigate uncertainties and seize opportunities proactively.

It Attracts Investors

Capturing investors' attention during your company's early stages is crucial to foster sustained growth. It is imperative to provide interested parties with a dependable means to evaluate performance and ascertain the potential for long-term success.

One practical approach to attracting investors is focusing on the ARR metric, which is widely regarded as the benchmark. Investors are naturally drawn to companies with recurring revenue streams since they provide stability and predictability. A subscription-based business model with annual term contracts, in particular, instills great confidence in parties due to its consistent cash flow throughout the year.

It Measures the Success of a Business

Starting a subscription-based business or SaaS company usually involves significant trial and error. As an entrepreneur, you’re bound to encounter challenges while perfecting your business models for success.

To assess the effectiveness of your model, consider using the ARR. By doing so, you can identify your strengths and weaknesses and gain valuable insight into areas that require improvement within your enterprise. Adjustments based on this calculation can ultimately lead to a sustainable and profitable venture over time.

It Assesses Customer Satisfaction

Evaluating customer satisfaction is crucial in gauging the success of a product or service. To measure said success, businesses can observe changes in the ARR over time. While recurring upgrades and add-ons indicate that customers highly value the product or service, churn and downgrades suggest a sense of uncertainty or dissatisfaction.

Not only does ARR assess customer satisfaction, but it also provides valuable insight into customer acquisition and retention. By closely monitoring ARR, businesses can understand how their strategies for acquiring and retaining customers impact their revenue streams. The information empowers them to pinpoint areas that require improvement and make necessary adjustments to bolster revenue growth.

It Leads to Improved Budgeting

ARR is crucial in helping businesses plan their significant expenses more effectively. This encompasses allocating funds for sales and marketing initiatives, hiring new employees, acquiring or enhancing equipment, strategizing, and introducing new products and features.

With increased visibility into your revenue and a clear view of your overall financial situation, you can make well-informed budgeting decisions. Use the information provided by this metric to create a budget that allocates resources effectively and puts you on the right path to achieving your strategic goals.

Seven Ways to Optimize Your ARR

As the old saying goes, there is always room for improvement. Businesses must consistently develop and implement well-thought-out strategies to boost revenue and enhance organizational growth.

Here are seven ways you can optimize your ARR.

Offer a Freemium

Providing a freemium version of your product allows potential customers to explore its capabilities firsthand. If they find your product valuable during this trial phase, they may feel enticed to upgrade to a paid plan.

The freemium option becomes even more advantageous when we take into account the network effect. As more people join and interact with your product, its value grows exponentially, and this positive cycle only enhances the attractiveness of your freemium offering.

Moreover, when customers utilize your service, they aren't just benefiting themselves. They naturally involve others within their network, creating a ripple effect that transforms your customers into lead generators.

Enhance Customer Base Value

Elevating your customer base's lifetime value (LTV) is vital for augmenting ARR and overall business success. To achieve this, it is crucial to concentrate on bolstering customer retention strategies. This entails optimizing the user experience within your application and providing personalized customer service to cater to individual needs.

Minimize the Expense of Acquiring Customers

Let’s face it: the expenditures involved in attracting new customers can accumulate rapidly. And the more you invest in customer acquisition, the less returns you'll ultimately reap from contracts and subscriptions.

When analyzing and interpreting your ARR, it is crucial to assess how it aligns with your customer acquisition cost (CAC) and identify areas where you can curtail expenses or optimize the utilization of marketing funds. By doing so, you can boost your ARR to profound heights of success.

Enhance Customer Subscriptions by Offering Enticing Upgrades and Add-Ons

Strategically evaluating your current upgrades and add-ons can increase your ARR like never before. Consider integrating new features into a new subscription tier for optimal results. By regularly assessing and adapting, you can maximize engagement and cater to the evolving needs of your customer base.

Promote Annual Plans

Another excellent way to optimize ARR is by delicately engaging with valued customers and gently prompting them to transition toward annual plans. By highlighting the array of additional perks they can enjoy by making this switch, you can create an appealing proposition that entices customers and persuades them to contemplate switching seriously.

Manage Customer Churn

Managing customer churn is a pressing concern for businesses today. The perplexing nature of this challenge lies in understanding why customers choose to discontinue their relationship with a company.

One solution for this problem is enlisting the help of an expert who can evaluate your customer churn rate and identify the root cause of the problem. By pinpointing the sources of high churn, you can determine precisely where things are going wrong in the customer journey and take corrective action to improve the process and reduce the churn rate.

Identify the Most Suitable Avenues for Fostering Growth

Discovering the optimal avenues for promoting growth is pivotal in augmenting your annual revenue. Consider pinpointing one or two specific channels that possess the potential to propel you toward success.

Here are some promising options:

- Banner ads: Employ these ads to showcase your product on external websites.

- SEO: Embrace content marketing strategies to enhance your website's online visibility organically.

- PPC: Engage in search engine marketing, such as Google ads, to secure a favorable position for pertinent keywords.

- Cold emails: Construct a list of prospective clients and establish contact with them through well-crafted email outreach.

- Social media: Harness the power of various social platforms to engage with your target audience.

Feel free to experiment with these channels and determine the ones that yield the most favorable outcomes for your unique business requirements.

Conclusion

All in all, carefully monitoring your annual recurring revenue over time can provide valuable insight into your business’ health and guide your product development, sales, and marketing strategies.

By diligently tracking ARR, you can gain a better understanding of your company’s financial performance, thus allowing you to make informed decisions and seize growth opportunities effectively. We wish you all the best in your future endeavors!

Related Metrics & KPIs