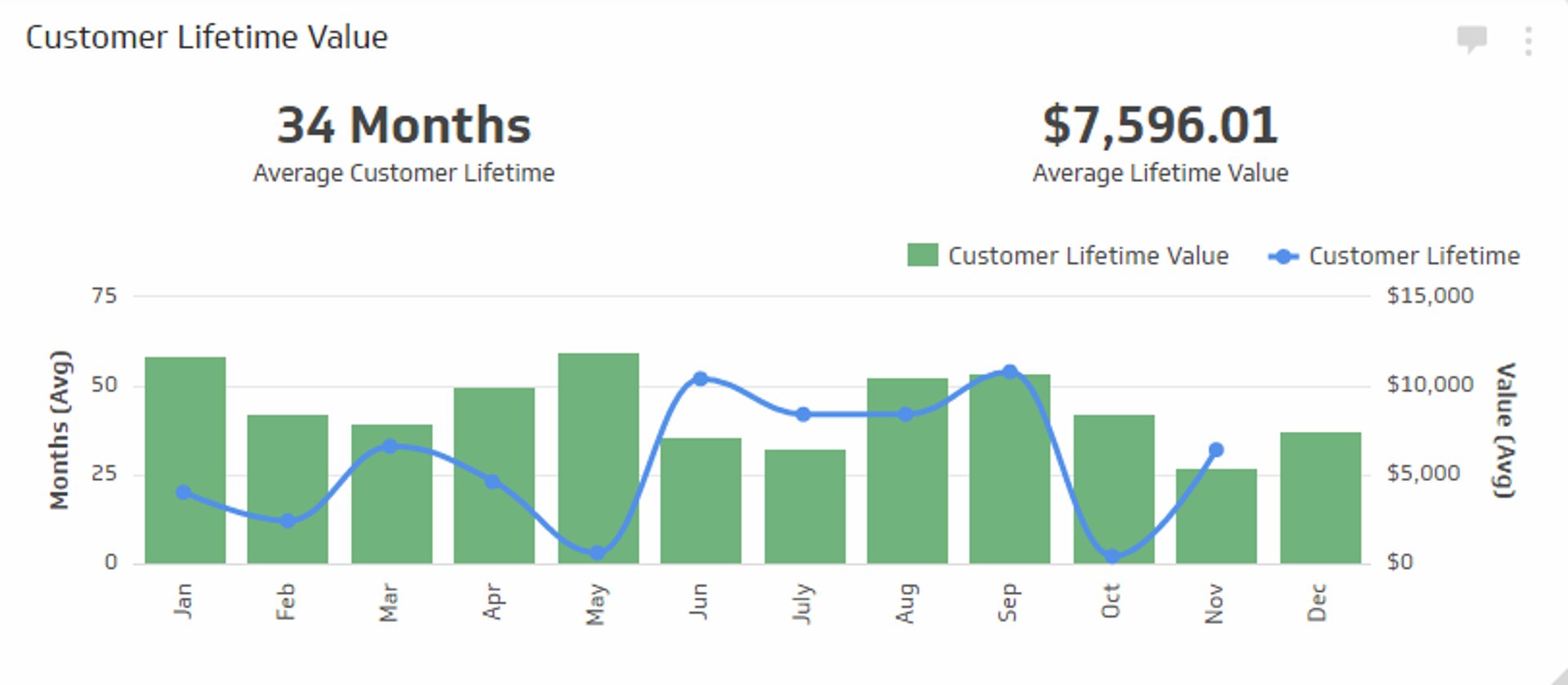

Customer Lifetime Value (CLV)

Measure The Monetary Value of Each New Customer With The Customer Lifetime Value (CLV) KPI

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

LTV (individual account) = Average Period Payment (Monthly or Yearly)

X Average Gross Margin

X Expected Number of Payment Periods

LTV (company) = MRPU * Gross Margin / Churn

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is a metric that predicts the total net profit a business can expect to earn from a customer throughout their entire relationship. It helps companies understand the value of each customer, guiding decisions on customer acquisition, retention, and marketing strategies.

For SaaS businesses (software companies that employ a subscription-based business model), CLV is calculated by multiplying the average period payment (this may be a monthly or annual payment depending on the SaaS company), by the average gross margin, by the number of periods, the customer is expected to make a payment.

How to Calculate Customer Lifetime Value

The formula for Customer Lifetime Value is:

Lifetime Value = (Average Revenue per Account) x (1 / Logo Churn Rate) x (Gross Margin %)

Customer Lifetime Value (CLV) Example

Consider a SaaS company with a customer paying a $50/month software license fee. The average gross margin on this license is 85% and based on historic trends, the customer is expected to be a customer for 52 months. In this situation:

LTV = $50 * .85 * 52 = $2,210

Customer Lifetime Value (CLV) Benchmarks

There are no SaaS industry or sector benchmarks for Customer Lifetime Value. CLV goals and benchmarks should be set based on internal costs, product/service revenue, and the business lifecycle stage. Here’s some expert advice and rules of thumb:

David Skok, General Partner, Matrix Partners

- Customer Lifetime Value (CLV) should be at least 3 times greater than Customer Acquisition Cost (CAC).

How to monitor Customer Lifetime Value in Real-time

Once you have established metrics for measuring Customer Lifetime Value (CLV), you’ll want to establish processes to monitor this and other SaaS KPIs on a continual basis. Dashboards can be critical in this regard.

Customer Lifetime Value (CLV) Challenges

Estimating Customer Lifetime Value can be challenging. Projections are usually based on historical customer trends, but these trends may not hold in the future due to a number of internal (product changes, PR, customer support, etc.) and/or external (economy, industry, sector, competition, etc.) business factors.

Moreover, startups are not likely to have much historical customer data (for insights into how startups can get to CLV without historical data, see Infer CEO Vik Singh’s blog on estimating CLV with rolling sales and marketing periods).

Estimating Customer Lifetime Value can also be complicated by a diverse customer base or in situations where pricing is unique for each customer. Dynamic pricing models can further complicate LTV estimates, as predicting product usage for growing and declining businesses can be difficult. On the costs side of the equation, it can be difficult to attribute the proportion of marketing and sales expenses that should be tied to specific sales/accounts.

Finally, accurately measuring and monitoring LTV accurately and continuously can be big challenges; these are perhaps the most important challenges to be met for high-growth SaaS companies.

Customer Lifetime Value (CLV) Best Practices

Following best practices for measuring, monitoring, and optimizing Customer Lifetime Value can help you grow your business profitably. Here are a few tips and best practices:

- Invest in “good customers,” customers who require little maintenance and support and who promise strong CLV. Focus your marketing, sales, product, and support efforts to attract, win and retain these customers.

- Get rid of “bad customers,” customers who are costing you more to maintain (via customer support demands, discounting, etc.) than they’re paying you to be customers. Don’t be too quick to take this advice; however, small accounts can grow with time, and there are many benefits to holding customers beyond the direct revenue that can be generated from them (word-of-mouth marketing, referrals, etc.).

- Increase customer satisfaction to increase CLV. The more satisfied a customer is with your product or service, the more loyal and the longer their customer lifetime is likely to be. Measure customer satisfaction and loyalty with an NPS program.

- Segment customers to get better CLV readings. If your customer base is diverse, segmenting your customers by size, industry, sector, or another relevant dimension will give you more granular and more useful CLV data.

- Use predictive modeling to estimate CLV. In cases where you have a lot of historical data, a diverse customer base, and a complex product offering (multi-tiered, many add-ons, service options, etc.), predictive modeling may be the best route to estimate LTV.

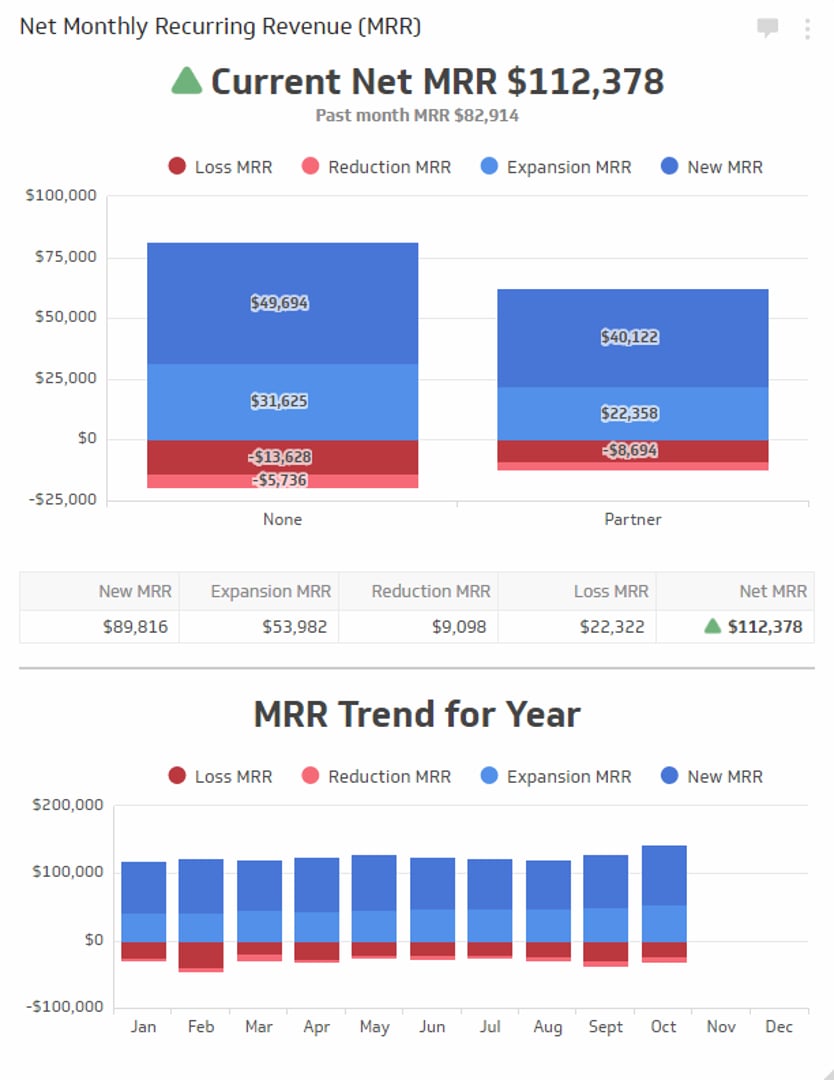

Measure The Return On Sales and Marketing Investments with the LTV:CAC Ratio

The Customer Lifetime Value to Customer Acquisition Ratio (LTV:CAC) measures the relationship between the lifetime value of a customer and the cost of acquiring that customer. This is a particularly crucial measure for subscription-based companies.

Now that you have the lifetime value of a customer, you can turn your attention to calculating how much you spend acquiring a customer.

The cost of acquiring a customer is the entire sales and marketing budget divided by the number of new customers acquired in a given period. This works really well if your sales cycle is short, where your sales and marketing costs can be tied to new customers in the same period. If it’s longer, you may want to stagger your costs, and new customer wins for more accuracy.

Cost to Acquire a Customer = Sales and Marketing Costs / New Customers Won

If you had total monthly sales and marketing expenses of $500K and you acquired 500 new customers in a given month, the calculation would look like this: $500,000 / 500 = $1,000 CAC

Ideally, you want to recover the cost of acquiring a customer within the first 12 months or so. In other words, if the average customer brings you $1,500 over 50 months, you should be spending about $360 to acquire customers.

An ideal LTV:CAC ratio should be 3:1. The value of a customer should be three times more than the cost of acquiring them. If the ratio is close, i.e., 1:1, you are spending too much. If it’s 5:1, you are spending too little. In fact, you are probably missing out on business.

These are important numbers to track. The more you understand what drives your business, the better the picture you will get of the levers you can pull to grow your business.

Learn more about how to track your Customer Lifetime Value on a SaaS Dashboard.

Customer Lifetime Value: Top Resources

4 SaaS Customer Acquisition Best Practices, David Skok

The Math Behind SaaS Startup Customer Lifetime Value, Tomasz Tunguz

How customer lifetime value equals more digital revenue – November 2017, Xavier van Leeuwe, Matthijs van de Peppel, and Matt Lindsay

Calculating Lifetime Value, Kiss Metrics

Insights Periodic Table of SaaS Sales Metrics, Insight Venture Partners

Related Metrics & KPIs