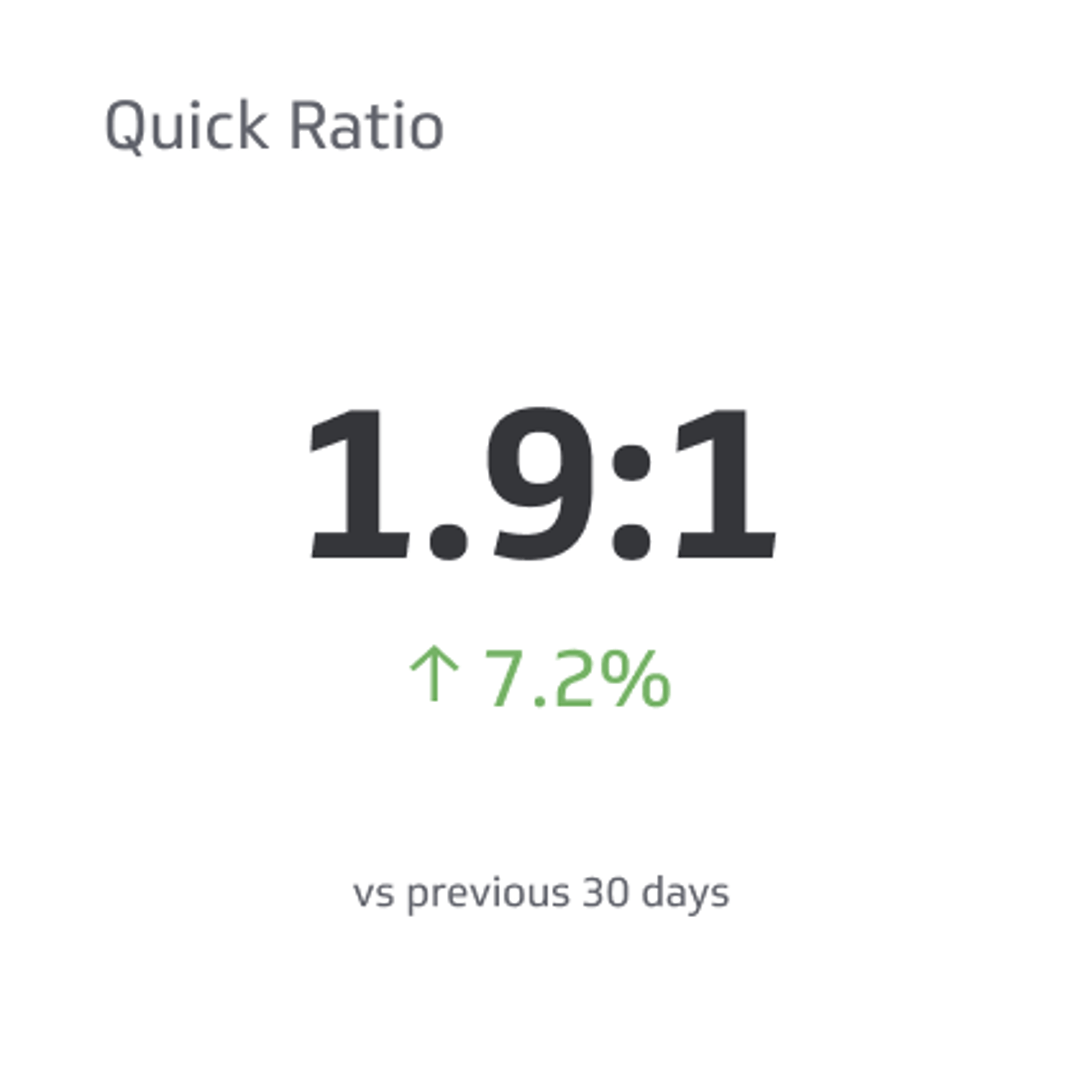

Quick Ratio

Measure the ability of your organization to meet short-term financial obligations.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

What is Quick Ratio?

Quick Ratio measures the ability of your organization to meet any short-term financial obligations with assets that can be quickly converted into cash. This ratio offers a more conservative assessment of your fiscal health than the current ratio because it excludes inventories from your assets, removing assets that may not be easily converted to cash. Like your current ratio, a quick ratio greater than 1 indicates that your business is able to meet its short-term financial obligations.

Quick Ratio Formula

The formula for calculating the Quick Ratio is as follows:

Quick Ratio = (Current Assets - Inventory) / Current Liabilities

Example of Quick Ratio

A company has the following:

- Current assets = $6,877,756

- Inventory = $1,500,000

- Current liabilities = $438,332

The quick ratio is therefore calculated as follows: ($6,877,756-$1,500,000) / $438,332 = 12.27

This company is able to cover its current liabilities 12 times with its assets that are quickly converted to cash.

Quick Ratio Best Practices

Two of the best ways to use the Quick Ratio metric are for tracking and insights.

In terms of tracking, Annie Musgrove from ChartMogul says to take note of accounts that are on contract as they may skew the calculation.

She also suggests the best insights come from tweaking your analysis to discover new ways to improve. Segment the metric into different business elements (such as payment plan or business vertical) to identify any weaknesses in specific parts of your business. Tightening up there will boost your score.

Additionally, examine the metric for specific periods. Though the formula is defined across a monthly period, analyzing quarterly or yearly periods could yield different results and prompt further investigation.

Key terms

- Assets: An economic resource that has a cash value.

- Liability: A financial obligation that stems from previous transactions, such as a purchase order.

Success indicators

- A quick ratio between 1.5 and 3.

- A current ratio that is greater than one and that is stable over the long term.

Quick Ratio Challenges

For companies in the first year of business, Quick Ratio isn’t so helpful. With young customers and customers still in a commitment period, the ratio isn’t a reliable indicator of anything. These newly established companies should focus their attention on individual metrics instead.

How to monitor Quick Ratio in real-time

Once you have established metrics for measuring your Quick Ratio, you’ll want to establish processes to monitor this and other financial KPIs and metrics on a continual basis.

Quick Ratio: Top Resources

- Mamoon Hamid of Social+Capital: Why Sh*t Really Gets Funded (Video + transcript), SaaStr

- The Top SaaS Metrics of the Most Influential Venture Capitalists, Insights Squared

- Benchmarking The SaaS Quick Ratio, Insights Squared

- SaaS Metrics: How to Calculate Your Quick Ratio, Revenue Wired

Related Metrics & KPIs