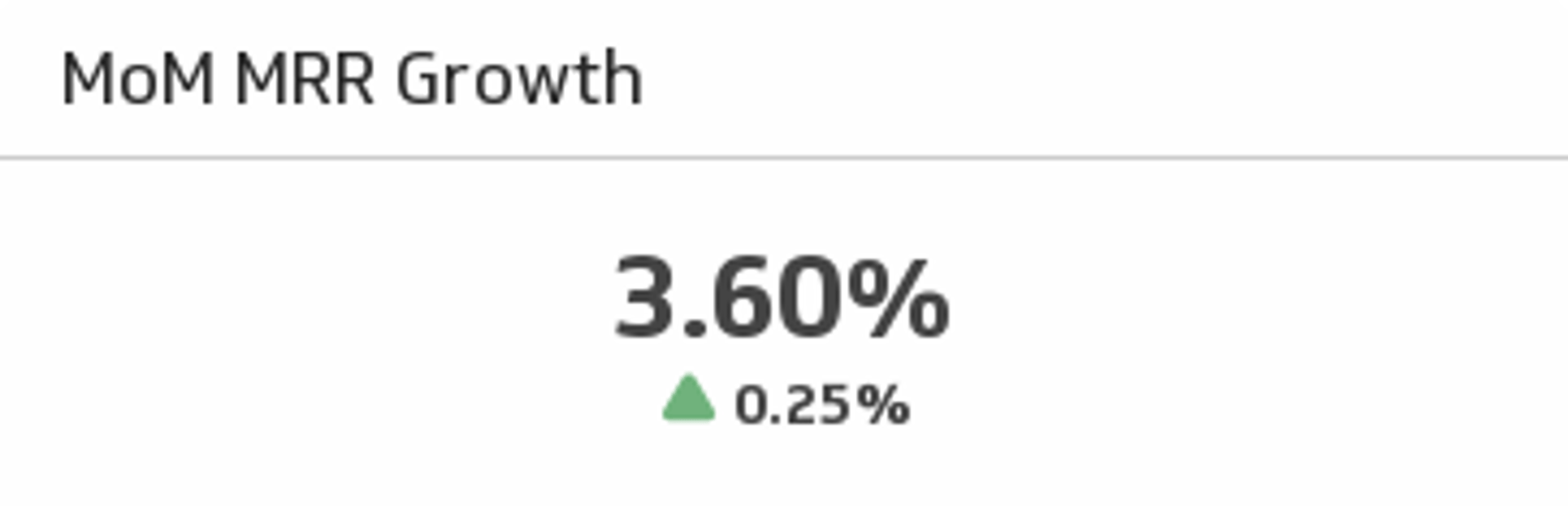

MoM MRR Growth Metric

Your guide to calculating, tracking, and benchmarking the ultimate SaaS momentum metric.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

.png)

Track your month-over-month momentum to scale your SaaS business effectively.

Month-over-month (MoM) MRR growth is a key performance indicator (KPI) that measures the monthly increase in a company's predictable, recurring revenue. For any subscription-based business, especially in the SaaS industry, tracking this metric is crucial for understanding growth, market traction, and overall business momentum. It provides a clear, real-time signal of what’s working and what isn’t, allowing you to make smarter, faster decisions.

What is MoM MRR Growth?

MoM MRR Growth measures the percentage change in your Monthly Recurring Revenue (MRR) from one month to the next. MRR itself is the predictable revenue a business can expect to receive every month.

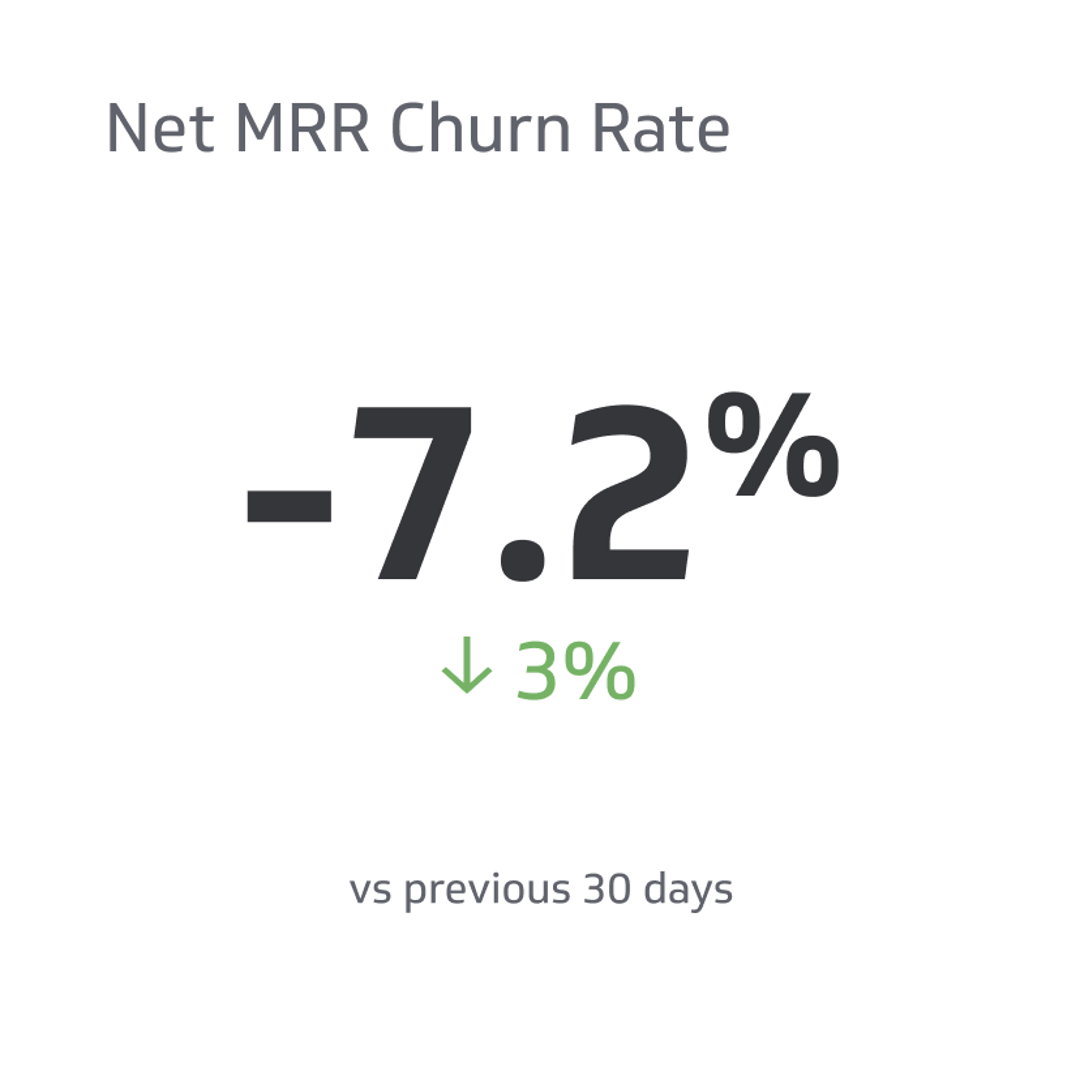

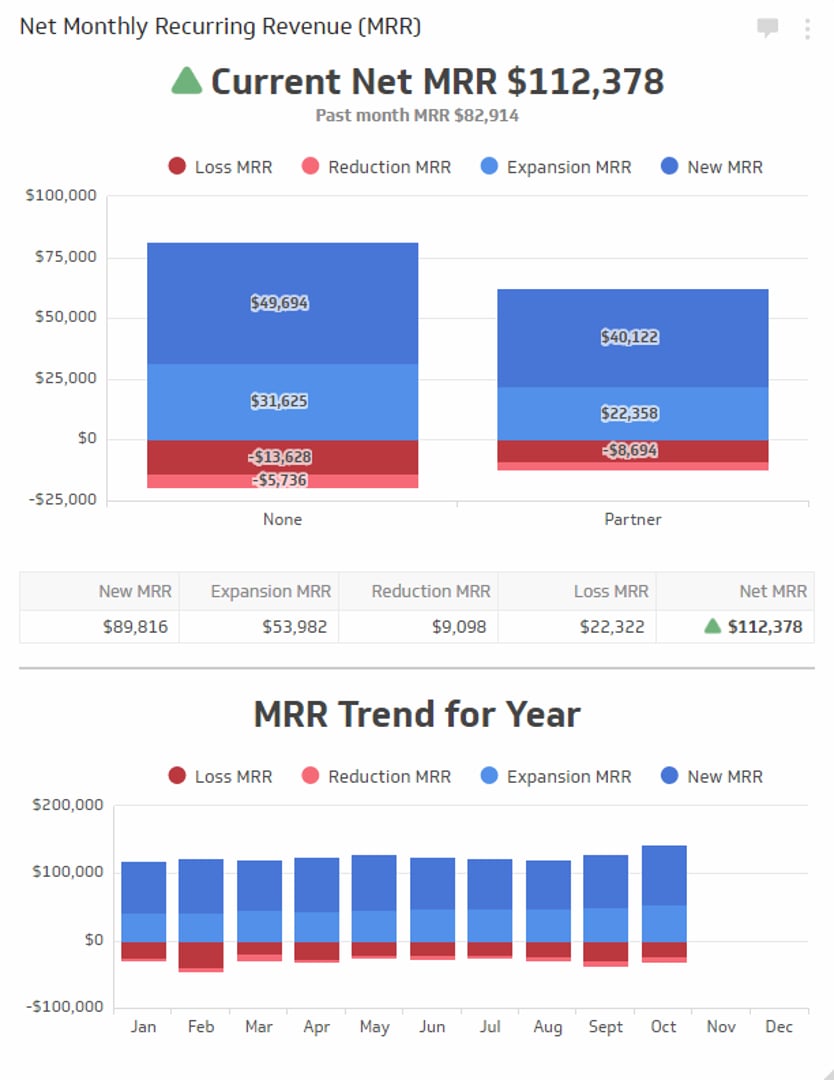

The growth calculation isn't just about new sales. It provides a holistic view by incorporating revenue from existing customers (upgrades and add-ons) and subtracting revenue lost from cancellations or downgrades (churn). This makes it an essential KPI for gauging the health and forward momentum of your business.

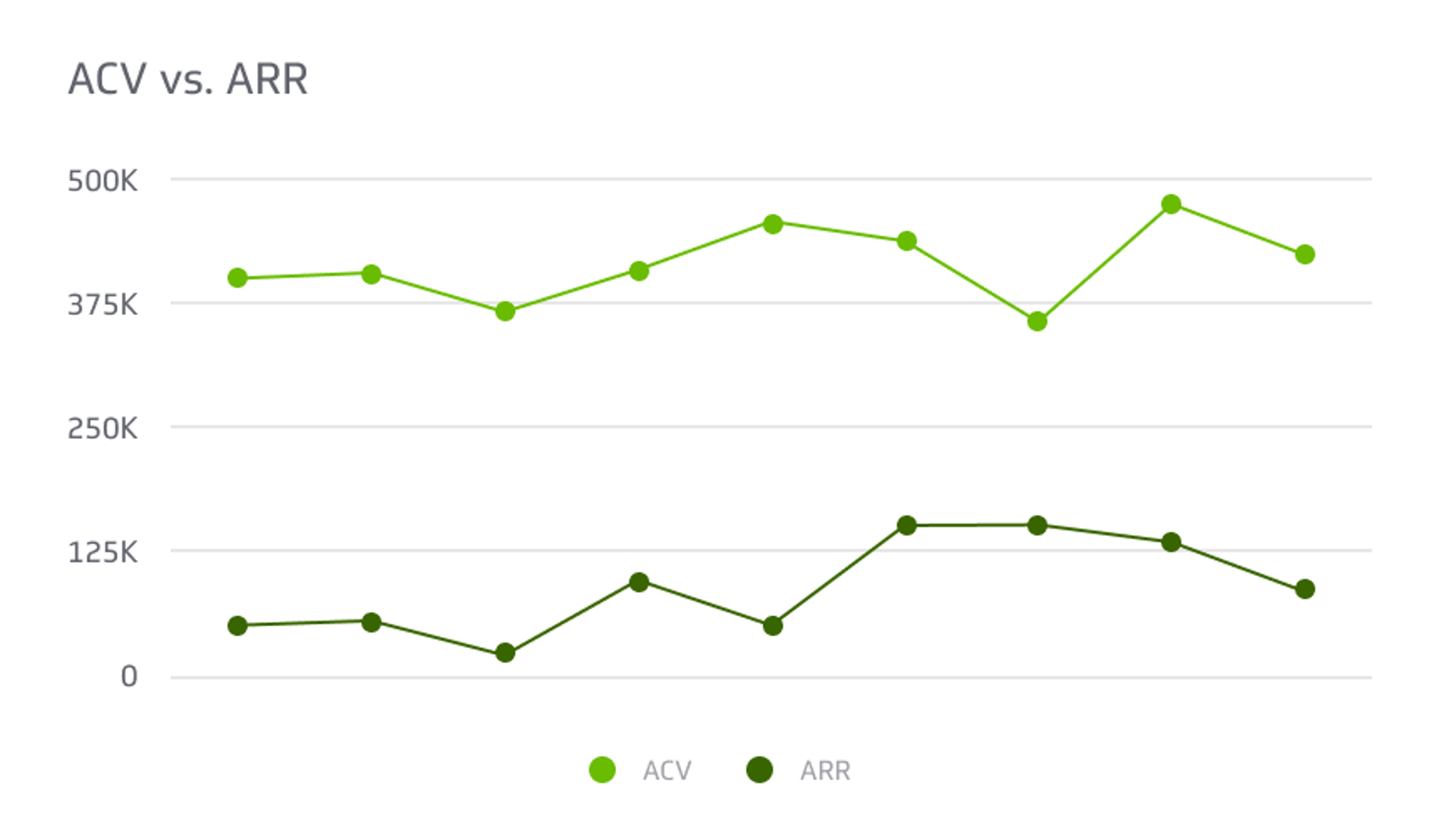

To get a complete picture of your revenue streams, you should track MoM MRR Growth alongside Net Revenue Retention Rate (NRR), which measures the percentage of revenue retained from existing customers over time. For a longer-term view, you can also look at the Annual Recurring Revenue (ARR) Growth Rate.

How do you calculate MoM MRR Growth?

To calculate your MoM MRR Growth, you first need to determine your Net MRR for the current and previous months. Net MRR is the sum of new business and expansion revenue, minus churn.

The formula is:

(Net MRR (This Month) - Net MRR (Last Month)) / Net MRR (Last Month)

Let's walk through an example:

Imagine a SaaS company had a Net MRR of $550,000 in August.

In September, they achieved the following:

- New MRR: $100,000 from new customers.

- Expansion MRR: $50,000 from existing customers upgrading their plans.

- Churned MRR: $20,000 from customers who cancelled.

First, calculate the Net MRR for September:

$550,000 (starting MRR) + $100,000 (New) + $50,000 (Expansion) - $20,000 (Churn) = $680,000

Now, use the MoM MRR Growth formula:

($680,000 - $550,000) / $550,000 = 0.236

This company has a MoM MRR Growth rate of 23.6%.

What is a good MoM MRR growth rate?

There's no single benchmark for a "good" MoM MRR growth rate, as it heavily depends on your company's stage.

Early-Stage Startups (Under $2M ARR): At this stage, a higher growth rate is a strong indicator of product-market fit and traction. While there are no strict rules, aiming for a consistent 15-20% MoM growth for over six months can attract significant investor interest. As venture capitalist Jason Lemkin notes, the time it takes to reach your first $1 million in revenue doesn't matter as much as demonstrating that you can sustain momentum once you find your footing.

Growth-Stage Companies ($2M - $20M ARR): As your revenue base grows, maintaining a high percentage growth rate becomes more challenging. At this point, many companies shift their focus from month-over-month to year-over-year growth. A healthy goal is to aim for a growth rate that keeps you on track to double your ARR annually.

Established Companies (Over $20M ARR): For larger companies, single-digit MoM growth can still be impressive. The focus often shifts to capital efficiency and sustainable, profitable growth rather than pure speed.

Common challenges and best practices

Monitoring your MRR growth is essential, but it comes with its own set of challenges and best practices to keep in mind.

Challenges:

- Identifying growth drivers: Is your growth coming from a successful marketing campaign, a new sales strategy, or just one-time events? Pinpointing the source is key to building a repeatable process.

- Forecasting accuracy: SaaS growth is rarely linear. Relying solely on past performance to predict future revenue can be misleading. Sustainable growth is what truly matters.

Best Practices:

- Be transparent with your data. Don't try to spin your numbers, especially with investors. When your MRR is low (e.g., under $20k), it's often more insightful to discuss growth in absolute dollar amounts rather than percentages.

- Develop a repeatable sales process. According to Greg Beaufait, a partner at Dundee Venture Capital, hitting 15-20% MoM growth for over six months shows that you've built a scalable and profitable sales engine. This is a major green flag for Series A investors.

- Focus on the right timeframe. Once you hit "initial traction" (around $1-2 million in ARR), consider shifting your primary growth reporting from a monthly to a yearly perspective. As Christoph Janz of Nine Point Capital suggests, year-over-year growth is often more intuitive for stakeholders at this stage.

How to monitor MoM MRR Growth in real-time

Once you've established your key metrics, the next step is to set up a system for continuous monitoring. A real-time dashboard is the perfect tool for this, allowing you to track your MoM MRR Growth and other critical SaaS KPIs in one place. With a dashboard, you can automate data collection, visualize trends, and share insights with your team to keep everyone aligned and focused on growth.

Learn more about how to track your MoM MRR Growth on a SaaS Dashboard.

Top resources for MRR Growth

- The Problem With Month-Over-Month Growth Rates, Christoph Janz, The Angel VC

- How Fast Must a SaaS Startup Grow to Raise a Series A?, Tomasz Tunguz

- What is a good month over month (MoM) growth rate for a SaaS company?, Jason Lemkin via Quora

- Understanding MRR, SaaSOptics

- Bessemer Cloud Computing Law #5: Play Moneyball with the 5 C’s, Byron Deeter, Bessemer Venture Partners

Related Metrics & KPIs