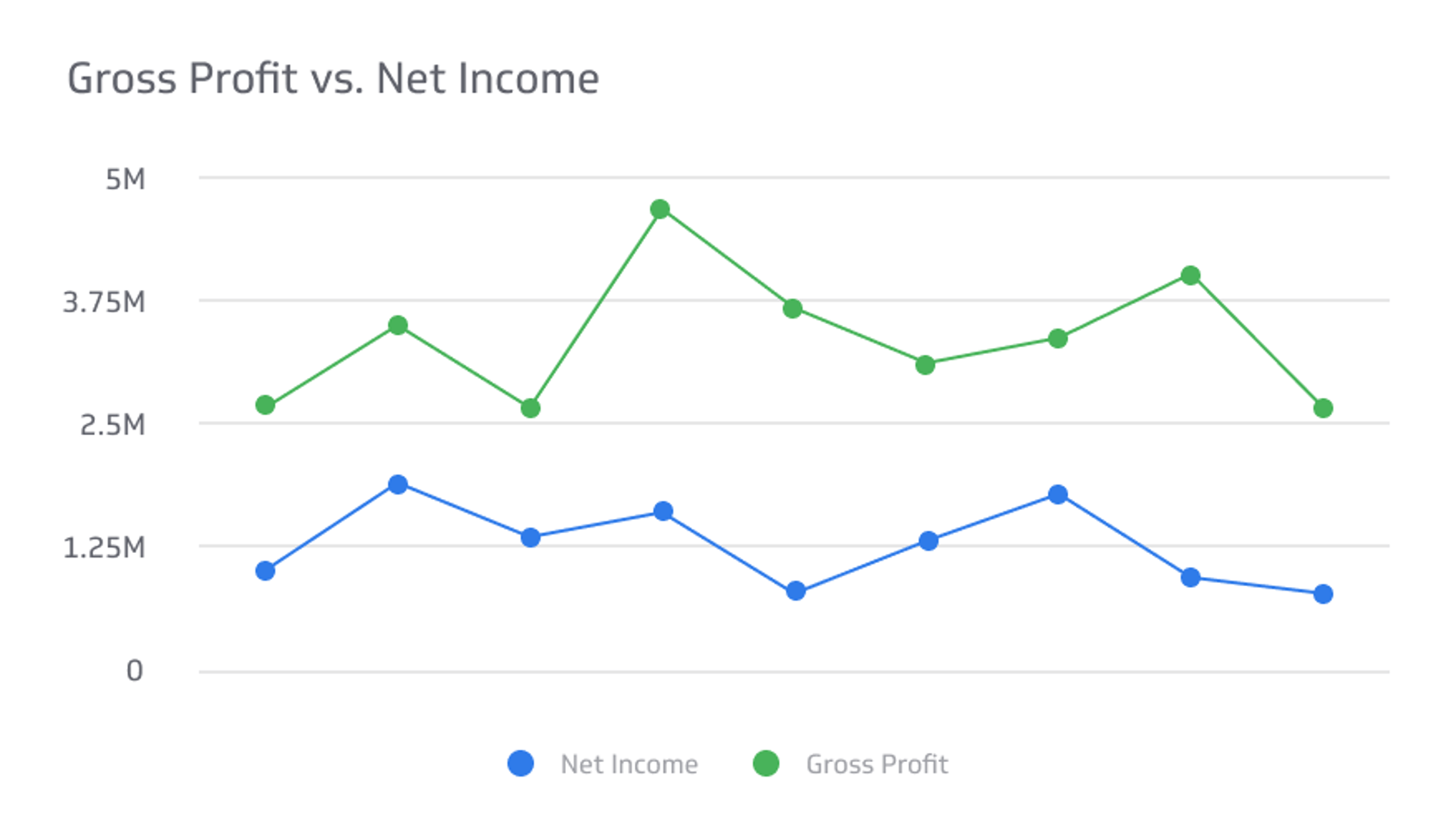

Gross Profit vs. Net Income

In finance and accounting, gross profit and net income are two fundamental concepts that are crucial in evaluating a business's financial health and performance.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Why Gross Profit & Net Income Are Important

In finance and accounting, gross profit and net profit (sometimes called net income) are two fundamental concepts that are crucial in evaluating a business's financial health and performance.

Gross and net profit are critical numerical values for every business since they serve as the make-or-break selling point for any investor, bank, and loan out there and are necessary when filing taxes. They also help monitor whether you're making or losing more money.

And while you might be tempted to use these terms interchangeably, it’s important to distinguish between them as it provides insights into various aspects of a company's operations, profitability, and overall financial success.

In this article, we'll delve into the nuances of gross profit and net profit, exploring their definitions, differences, and applications in the finance and business realm.

What is Gross Profit (Gross Income)?

Gross profit, sometimes called gross income, is the money a company makes from its core operations after deducting the costs directly associated with producing or acquiring the goods or services it sells.

It gives insights into the profitability of a company's primary revenue-generating activities without considering other operating expenses, such as overhead costs, administrative fees, or taxes. To calculate gross profit, you only need to subtract the cost of goods sold (COGS) from the revenue over a select period, such as a quarter.

You can use the formula below:

Gross profit = Revenue - COGS

Gross Profit and Operating Expenses

Gross profit is a valuable tool that allows you to maximize production efficiency and make cuts when necessary. It indicates the amount of money available to cover operating expenses and contribute towards other business activities, such as research, development, marketing, or expansion.

With gross profit, you can also determine your net profit, another important financial metric you must keep track of when managing a business.

What is Net Profit (Net Income)?

At the end of the fourth quarter, when a business announces how much they made for that year, the number they'll provide is always the net profit.

Net profit, also called net income, net earnings, or bottom line, is the total profit made after all expenses have been deducted. Think of net profit as the total amount of money a company actually has left over after the year instead of how much it made overall. When an investor evaluates a company's profitability, this number is often the first value they'll look at.

Calculating net profit is merely subtracting revenue from your expenses, which is:

Net Profit = revenue - total expenses

Of course, you'll generally have these expenses already broken up, so it'll probably look more like this:

Net Profit = Gross Profit - Operating Expenses - Interest Expenses - Taxes - Other Business Expenses

Positive net profit shows that a company is generating profits, while negative profit, referred to as a net loss, signifies that the company's expenses exceed its revenue.

Net Profit Example

Net profit includes the cost of production and all the expenses related to managing the business. Some things this might involve are:

- Taxes

- Selling, general, and administrative expenses (SGA expenses)

- Interest on debts (debt payments are often a fixed payment while interest isn’t)

- Cost of operation (electricity bills, rent, utilities, etc.)

- Depreciation

Understanding Profit’s Relationship With Revenue and Cost of Goods Sold

To fully understand gross profit and net profit, we must go more in-depth about revenue and the cost of goods sold.

Revenue is the total money made from sales over a certain period, including physical products, digital wares, services, and anything else a customer might buy from a company. It's also known as net sales.

Revenue includes any discounts or markdowns a business may offer but doesn’t deduct taxes. Even though you may walk into the grocery store and buy a product for more than the price tag advertised, this tax is merely set aside for the business to pay separately and is included in revenue.

Here's a basic example: Rob walks into the supermarket and sees an apple for $1. He buys five apples. After taxes, Rob pays $5.33. Thus, the revenue the business generates from Rob is $5.33.

Meanwhile, the Cost of Goods Sold (COGS) is the direct expenses incurred by a business in producing or acquiring goods sold to customers. The cost of goods sold is essential to calculating gross profit.

COGS often includes:

- The cost of the materials

- Expenses of equipment used for making the product

- Labor wages of the manufacturer's workers

- Shipping and handling costs

- Equipment repair cost

- Any additional fee charged by a manufacturer

Remember that the COGS doesn't include the costs of operating a seller's business. These expenses are deducted to get net profit, which we will discuss further. COGS only includes expenses directly related to the making and delivering of a product.

It also doesn't include fixed expenses (expenses that don't change), such as rent costs, utilities, and insurance.

COGS primarily includes variable expenses such as shipping which fluctuate depending on circumstances. Since these costs are ever-changing, keeping track of COGS is essential.

What Is the Difference Between Gross Profit and Net Profit?

Gross profit and net profit are how much a company makes from sales but at different stages.

- The first stage is revenue, which is how much a company makes from sales.

- The second stage is gross profit, which deducts the cost of making and shipping said products to the business.

- The final stage is net profit, which adds up all expenses, including gross profit, and subtracts them from the revenue.

While gross profit is vital for calculating and evaluating production efficiency, it doesn't indicate a company's profitability.

On the other hand, net profit is handy for determining profitability since it tells us how much money a company makes versus what they're earning on paper before expenses.

Applications of Gross Profit and Net Profit For Your Business

You might wonder: why is gross profit necessary when you can simply include it in your total expenses to calculate net profit?

Breaking income into segments is helpful for different business functions and is much more advantageous than adding everything into one uniform value.

For instance, isolating gross profit can help business owners better identify the costs associated with production, compare them to the quality of products they receive, and make critical business decisions based on that.

These business decisions include producing new products, switching manufacturers, or changing designs.

And while gross profit is essential from within the business, net profit is the most critical value you'll need for all external dealings.

This includes:

- Submitting your income taxes: Remember, the government only looks at your net profit, not your gross profit.

- Applying for loans and attracting investors: People and companies looking to invest in your business will do so based on your profitability or net profit.

- Making business decisions: This category ranges over a broad matter of subjects and can include anything from increasing your employees' wages to halting the sale of a specific product.

In short, despite both values giving off different stages of profit, they're both essential for maximizing a business's efficiency.

Understand What Really Makes Your Business Profit

Gross profit and net profit are two profitability-determining values that dictate many company decisions and highlight how much money they generate or lose overall.

While it can be easy to overlook gross profit since it's merely a cog in the greater scheme of things, it's essential to keep a close watch on this value since you'll often need to go in-depth when looking at each aspect of a business.

By understanding the distinction between gross profit and net profit, stakeholders can better understand a company's financial performance and make informed decisions regarding investments, pricing strategies, and overall business operations.

Gross Profit and Net Profit FAQs

Which is higher: gross profit or net profit?

Gross profit is always higher than net profit since it's the money a company generates from its core operations after deducting the cost of goods sold (COGS).

The net profit, however, includes additional expenses beyond COGS, such as administrative costs, overhead expenses, and taxes, resulting in a lower figure than gross profit.

Is net profit before or after taxes? How about gross profit?

Net profit is the number you get after you deduct taxes. Gross profit and operating profit are both before.

Is 20% net profit considered "good?"

Yes, 20% income is excellent, especially when you realize that the average for general retail is 4.38%.

Related Metrics & KPIs