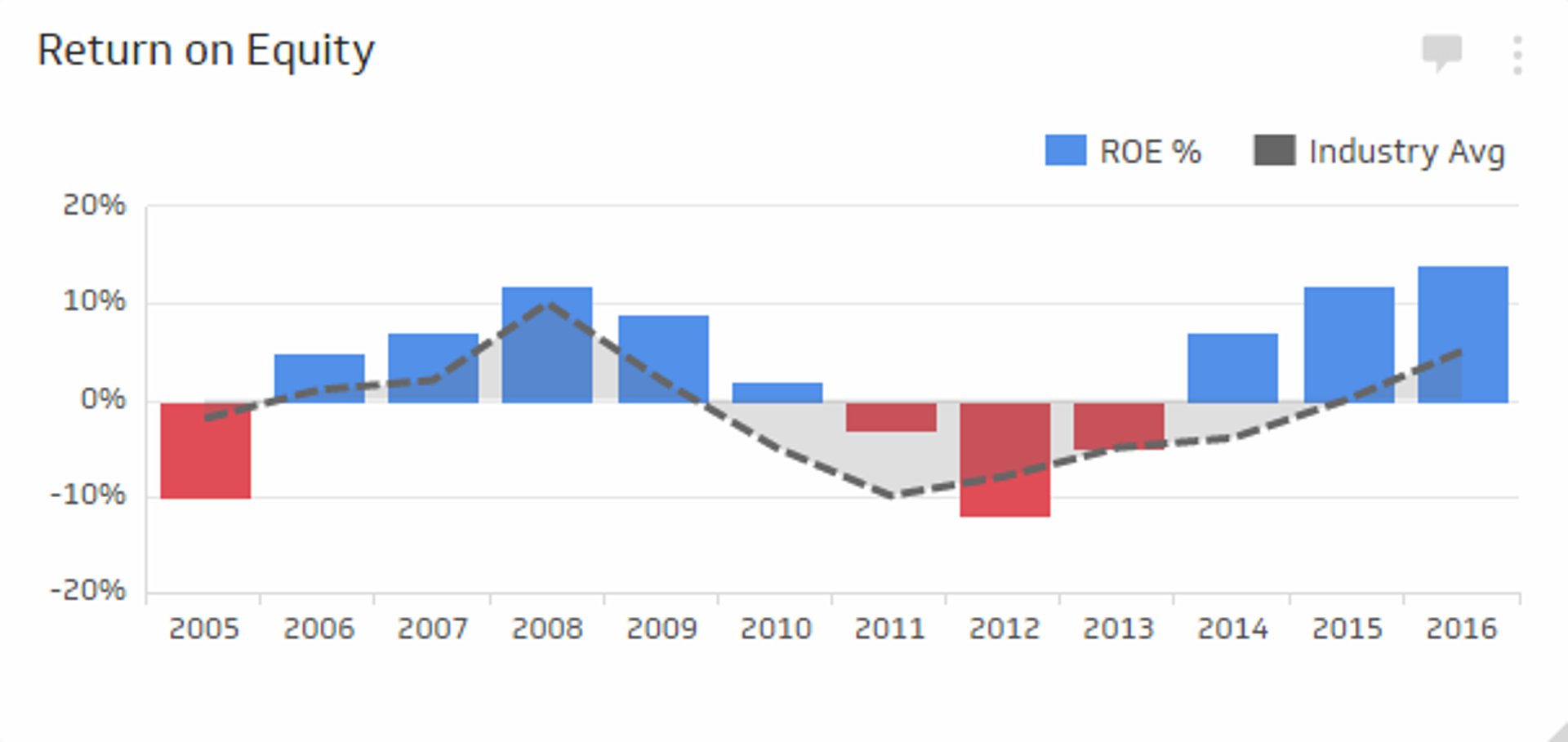

Return on Equity Metric

Measure profitability by examining your ability to generate revenue for each unit of shareholder equity.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Sign up with Google

or

Sign up with your emailFree for 14 days ● No credit card required

Overview

The Return on Equity KPI measures your organization’s ability to generate revenue for each unit of shareholder equity.

The return on equity ratio not only provides a measure of your organization’s profitability, but also your efficiency. A high or improving ROE demonstrates to your shareholder’s that you’re using their investments to grow your business.

Formula

Debt to Equity (D/E) = (Total Liabilities) / (Shareholders Equity)

Note: Total Liabilities and Shareholder Equity can be found on the balance sheet.

Key terms

- Shareholder’s equity: Financing acquired through selling common and preferred shares to investors.

- Net income: Also called net profit, this is the amount of earnings after you subtract cost of goods sold, taxes, and other expenses.

Success indicators

- A return on equity rate between 15% and 25% is generally considered good.

Related Metrics & KPIs