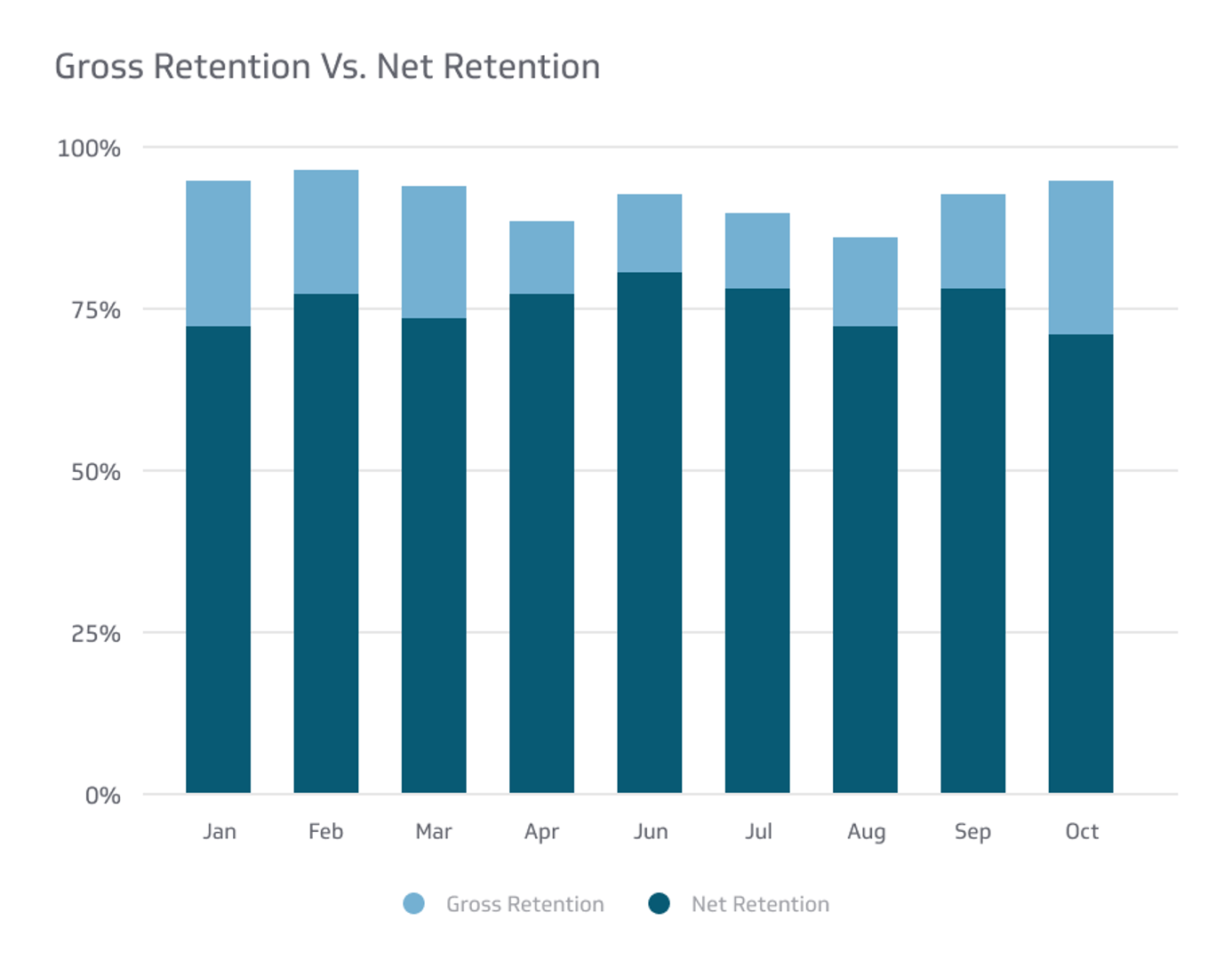

Gross Retention Vs. Net Retention

Understanding the difference between the two is crucial for making informed business decisions.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Retention is a crucial metric businesses use for measuring their success, particularly if they have a subscription-based model.

Net and gross retention are two metrics used to track customer retention, and many people may not fully understand the difference between the two as they are similar. But understanding the difference between the two is crucial for making informed business decisions.

This article will explain definitions, calculations, and examples of gross retention vs. net retention. We'll also discuss the key differences between these metrics, why they matter, and how to choose the right one for your business.

What Does Revenue Retention Mean?

Both gross and net retention are revenue retention metrics, so it's important to first consider what revenue retention is at a higher level.

Revenue retention refers to the ability of a business to retain its customers for a given period and generate consistent revenue from them. It's a vital financial metric for any business with a recurring revenue model, such as a subscription-based service.

More specifically, revenue retention considers the revenue generated from existing customers and compares it to the revenue generated from new customers to assess the business's overall health.

A high revenue retention rate indicates that the business has a loyal customer base and successfully retains those customers.

Measuring revenue retention can help businesses identify areas for improvement, such as reducing customer churn or increasing customer lifetime value, which can ultimately lead to increased revenue and profitability.

What Does Gross Revenue Retention Mean?

This is the revenue percentage generated from those customers who renew or upgrade their subscription during a certain period without taking into account the impact of any new customer acquisitions.

In other words, gross revenue retention focuses solely on the revenue generated from current customers and their decision to continue using the product or service.

By measuring gross revenue retention, businesses can better understand how much of their total revenue comes from current customers and their loyalty to the product or service.

Calculating Gross Revenue Retention Rate

One of the advantages of using gross revenue retention is that it's a straightforward metric to calculate.

The formula is as follows:

Gross Retention Rate = (R(t) - R(0)) / R(t) × 100

Where:

R(t) = revenue generated by retained customers in a given period

R(0)= revenue churn based on retained customers from the previous period

For example, if a business has $100,000 in monthly revenue from existing customers at the start of the month and $90,000 at the end of the month (after customers have renewed or canceled their subscriptions), the revenue churn would be $10,000.

Therefore, the calculation would be:

Gross Retention Rate = ((100-10,000)/100,000) x 100 = 90%

Thus, this business's gross retention rate would be 90%.

What Is Net Revenue Retention?

Net retention is similar to gross retention, but instead of focusing solely on existing customers, it also considers the impact of downgrades and upgrades.

That said, net revenue retention is a metric that provides a more accurate understanding of a company's ability to not only retain its customer base and generate recurring revenue but also to satisfy its customers enough to increase "expansion revenue."

In addition to providing insights into customer retention and revenue generation, net revenue retention can also help businesses uncover areas for improvement in their product or service offerings.

By understanding why customers churn or downgrade, businesses can make targeted improvements to their offerings to increase customer satisfaction and loyalty.

Calculating Net Revenue Retention Rate?

The calculation of net revenue retention considers any revenue changes from already existing clients due to customer churn, downgrades, or upgrades. The formula for net revenue retention is as follows:

The formula is as follows:

Net Retention Rate = (R(t) + R(U) - R(0) - R(d)) / R(t) × 100

Where:

R(t) = revenue generated by retained customers in a given period

R(U) = revenue generated from upgrades

R(0)= revenue churn based on retained customers from the previous period

R(d) = revenue lost from downgrades

For example, if a business has $100,000 in monthly retention revenue from existing customers at the start of the month and $90,000 at the end of the month (after customers have renewed or canceled their subscriptions), the revenue churn would be $10,000.

Let's also say this business had $5,000 in upgrades and $5,000 lost in downgrades.

The calculation would be:

Net Retention Rate = ((100 + 5 - 10 - 5) / R(t))× 100

Thus, this business's net retention rate would be 90%.

This means that the company could retain 90% of its revenue from existing customers after accounting for any lost revenue due to churn, downgrades, or upgrades.

Gross Retention vs. Net Retention: Key Differences

As you can see, gross revenue retention(GRR) and net revenue retention (NRR) are both important metrics businesses can use to measure customer retention and revenue generation.

While both NRR and GRR metrics provide valuable insights into a company's revenue streams, key differences exist.

Gross revenue retention focuses on the revenue generated from existing customers who renew their subscriptions and revenue churn without taking into account any lost revenue due to customer downgrades (or gained revenue due to upgrades or upsells).

This metric provides a snapshot of how well a company retains its existing customer base and generates recurring revenue.

Net revenue retention, on the other hand, takes into account any changes in revenue from existing customers due to customer churn as well as downgrades, upgrades, upsells, and other forms of "expansion revenue."

This metric provides a more accurate picture of a company's ability to not only retain its customer base and generate recurring revenue but also build on that same customer base with additional services or products.

Choosing Between Gross Retention vs. Net Retention for Your Business

When it comes to choosing between gross and net revenue retention metrics, it ultimately depends on the nature of your business.

Net Retention vs. Gross Retention for SAAS

Gross retention only looks at the money a business makes from customers who renew, but net retention also looks at things like upgrades, downgrades, or other types of extra money.

Suppose you have a software-as-a-service (SaaS) or other digital business that entails people upgrading or downgrading a lot. In that case, net retention is the better number to look at and would be the more appropriate metric to use.

Gross Retention vs. Net Retention for Business Operators and Analysts

If you are a business operator or analyst, it's important to understand both gross and net retention to gain a better picture of the health of your business.

By understanding both metrics, you can accurately assess where your customer retention stands and make informed decisions that will ultimately lead to better growth and success.

Gross Retention vs. Net Retention for Marketers

Looking at both gross retention and net retention is a wise idea for marketers as well.

Gross retention will give you key information about your main service or product and how it's doing, while net retention will provide crucial insights into your additional services and whether they're appealing or not to your audience.

Optimizing Your Retention

Optimizing customer retention is a key part of running a successful business. After looking at your Gross Retention Rate (GRR) and Net Retention Rate (NRR), you can utilize various strategies to increase both numbers.

Customer Segmentation and CLV

Firstly, you can employ customer segmentation and look at customer lifetime value (CLV) to identify which customers are most valuable to you. This will help you target them with better customer service and tailored offers, improving retention.

Grouping customers into segments will also help you test different strategies for each segment and measure their effectiveness.

Upsell & Cross-Sell Tactics

Another way to increase retention is to focus on upselling and cross-selling, not just to increase your NRR but also to increase customer loyalty or reward long-term customers.

If cross-selling and up-selling are done with the customer's satisfaction in mind instead of money-making alone, it will ultimately lead to more success in the long run.

Automated Marketing Campaigns

Additionally, you can use automated marketing campaigns to target customers at risk of churning.

Data-Driven Decisions

The prior techniques can be used in combination with customer surveys and analytics to gain a better understanding of the behavior of customers and their preferences.

Implementing these data-driven insights will help you make better-informed decisions, thus increasing customer retention and revenue generation.

More specifically, these data-driven insights can improve customer service, enhance product features, and better identify your target market.

Taking the time to analyze and optimize your retention metrics will be invaluable for the future of your business.

FAQ

Here are answers to four of the most commonly asked questions about gross retention vs. net retention.

What is the difference between NRR and GRR?

The main difference between the two metrics is that gross revenue retention (GRR) measures the revenue percentage generated from customers who renew their subscriptions during a given time period without taking into account downgrades or upgrades.

Net revenue retention, on the other hand, takes into account any changes in revenue from customers due to customer churn, downgrades, or upgrades.

Why is it important to track gross revenue retention and net revenue retention?

Tracking both metrics is typically important for businesses that rely on recurring revenue from existing customers. These metrics provide insights into customer retention, revenue generation, and areas for improvement in a company's product or service offerings.

Is GRR or NRR more useful for understanding a company's revenue generation efforts?

Both metrics are useful for understanding a business's revenue generation efforts. Still, net revenue retention provides a more accurate picture of a company's ability to generate expansion revenue in addition to the standard service.

How can businesses improve their gross revenue retention and net revenue retention?

For improved gross revenue retention, businesses can focus on offering exceptional customer service, delivering on their promises, offering targeted promotions for customers who may be at risk of leaving, and offering incentives for customers to renew their subscriptions.

For improved net revenue retention, businesses can focus on upselling existing customers to higher-tier plans and offering targeted promotions to retain customers at risk of downgrading.

Conclusion

The question "What's the difference between gross retention vs. net retention?" is a common one, especially among new businesses. While both metrics are important, gross retention is more straightforward to calculate and analyze. In contrast, net revenue retention is often considered a more valuable metric as it provides a more accurate understanding of a company's entire revenue generation efforts.

By tracking both metrics, businesses have a chance to gain insights into customer retention and revenue generation efforts. It allows them to make decisions from the data obtained, which can improve their offerings and increase customer satisfaction and loyalty.

Related Metrics & KPIs