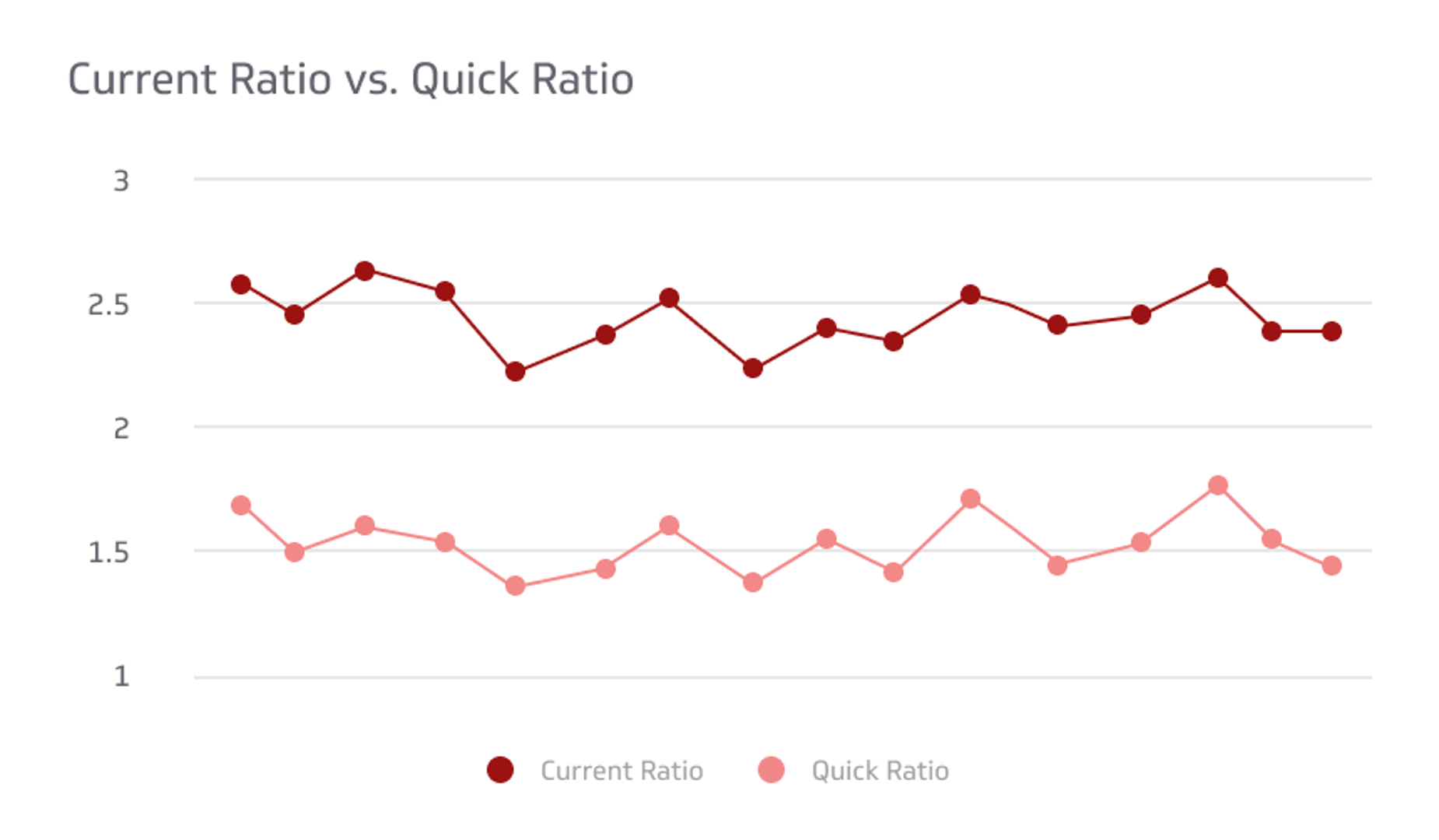

Current Ratio Vs Quick Ratio

Financial ratios are valuable tools used by business professionals and owners to evaluate a company's overall financial health, performance, and efficiency.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In today's competitive business landscape, understanding a company's financial health is more important than ever. Two key metrics used to assess this are the current ratio and quick ratio - both liquidity ratios that measure a company's ability to pay off short-term debts.

But what exactly do these ratios entail, and how do they differ from one another? Below, we will dive into the nuances of each ratio, discover their significance in financial analysis, and provide insights on when to use each for making informed decisions.

Understanding Financial Ratios

Financial ratios are valuable tools used to measure a company's financial health and performance by comparing different aspects of its operations, such as profitability, liquidity, and efficiency.

Definition And Importance Of Financial Ratios

Financial ratios are valuable tools used by business professionals and owners to evaluate a company's overall financial health, performance, and efficiency. They provide a quantifiable means of comparing different aspects of a business's operations over time or against industry standards and competitors.

The importance of financial ratios cannot be overstated. They allow for easy identification of trends, strengths, weaknesses, and potential opportunities for improvement within an organization.

For instance, liquidity-related ratios such as the current ratio and quick ratio help assess whether or not a company has sufficient resources available to pay off its short-term liabilities without negatively impacting its operations.

By incorporating these metrics into their analysis strategies, investors can better determine if a company is financially stable or at risk of failing due to inadequate cash flow management.

What is Current Ratio

The current ratio is a liquidity ratio that measures a company’s ability to pay its short-term obligations or those due within one year. It compares the company’s current assets, such as cash, marketable securities, accounts receivable, and inventory, to its current liabilities, such as accounts payable, short-term debt, and taxes payable. The formula for the current ratio is:

Current Ratio = Current Assets / Current Liabilities

A current ratio that is higher than 1 indicates that the company has more current assets than current liabilities and can pay its debts comfortably. A current ratio that is lower than 1 indicates that the company has more current liabilities than current assets and may face liquidity problems. However, the ideal current ratio may vary depending on the industry and the nature of the business. For example, a company with a lot of inventory may have a lower current ratio than a service company. The current ratio is also known as the working capital ratio because it reflects the amount of working capital available to the company.

What is Quick Ratio

The quick ratio is a liquidity ratio that measures a company’s ability to pay its short-term debts with its most liquid assets, such as cash, marketable securities, and accounts receivable. It excludes inventory and prepaid expenses, which are less liquid. The formula for the quick ratio is:

Quick Ratio = (Quick Assets) / (Current Liabilities)

A quick ratio above 1 means the company can pay its current liabilities without selling its inventory. A quick ratio below 1 means the company may have liquidity problems. The ideal quick ratio depends on the industry and the business. The quick ratio is also called the acid-test ratio because it only considers assets that can be easily converted to cash. It is more conservative than the current ratio, which includes all current assets.

Calculation Of Current Ratio And Quick Ratio

Calculating the current ratio and quick ratio is a straightforward process that provides valuable insights into a company's financial health. To determine the current ratio, simply divide a company's total current assets by its total current liabilities, as shown on the balance sheet.

Current assets include cash, short-term investments, accounts receivable, and inventory, while current liabilities consist of short-term debts and other obligations due within one year.

The quick ratio is calculated similarly but narrows down the focus to only those assets that can be readily converted into cash – known as quick assets. Quick assets include cash equivalents (such as money market funds), marketable securities (stocks or bonds easily sold), and accounts receivable but exclude inventory.

To find the quick ratio for your company or subject of analysis, take the sum of these quick asset components and then divide this figure by your overall short term debt obligations which are designated under “current liabilities”.

This ensures that you have an accurate representation of just how liquid certain components of an organization are when considering their ability to settle debts promptly.

Differences Between Current Ratio And Quick Ratio

The significant differences between the two ratios lie in the components included in their calculation, their significance in financial analysis, and their time sensitivity - keep reading to find out more!

Components Included In Calculation

One key distinction between the current ratio and quick ratio lies in the components that comprise each calculation. For the current ratio, both short-term assets and liabilities are taken into account.

Short-term assets include cash, accounts receivable, inventory, and other liquid assets that can be changed to cash within a year.

In contrast, when calculating the quick ratio, only quick assets are considered. Quick assets represent those which can be easily transformed into cash or equivalent without losing value – typically cash itself, marketable securities (e.g., stocks or bonds), and accounts receivable from customers who owe money for goods sold on credit terms.

Significance In Financial Analysis

Both the current ratio and quick ratio are important indicators when it comes to assessing a company's financial health. These ratios provide insight into a company's liquidity, or its ability to pay off short-term debts.

The components included in each ratio vary slightly, which allows for a more nuanced understanding of a company's liquidity position. For example, the quick ratio only looks at assets that can be quickly changed into cash, giving a clearer picture of how easily the company can meet its obligations.

In financial analysis, these ratios are often used to compare companies within an industry or sector. A company with a higher current ratio or quick ratio may be seen as more financially stable than one with lower ratios.

However, it is important to note that no single ratio should be viewed in isolation; multiple metrics and ratios should be considered when evaluating financial performance.

Time Sensitivity

In addition to the differences in components included in their calculations, another key difference between current ratio and quick ratio is their time sensitivity. Current ratio reflects a company's liquidity at a specific point in time, taking into account both short-term assets and liabilities that are due within one year.

This time sensitivity can be particularly important for companies with fluctuating cash flow or those facing sudden financial challenges. For example, if a business unexpectedly loses a significant customer or experiences an unexpected increase in costs, its quick ratio may be more indicative of its ability to meet immediate payment obligations than its current ratio.

Current Ratio Vs Quick Ratio: When To Use Each

In this section, we'll explore the scenarios and purposes for each ratio, providing examples of industries or companies where each ratio is more relevant – understanding these will enable you to make informed decisions about which ratios are most appropriate for your financial analysis.

Scenarios And Purposes For Each Ratio

The current ratio and quick ratio both serve different purposes in financial analysis. The current ratio is best used to assess a company's ability to pay off short-term liabilities with its current assets.

This makes it useful for creditors and suppliers who want to ensure that the company they are dealing with has enough liquidity to meet its obligations.

For example, let's say you're considering investing in a retail business that relies heavily on inventory turnover. In this case, the quick ratio would be more relevant because you want to see if the company can quickly turn its inventory into cash when needed.

Examples Of Industries Or Companies Where Each Ratio Is More Relevant

The current ratio and quick ratio are both important for assessing a company's liquidity and financial health, but the relevance of each ratio may depend on the industry or type of business.

For example, companies with high inventory turnover rates or fast-paying customers may find the quick ratio more relevant because it focuses on cash equivalents, marketable securities, and accounts receivable that can be quickly changed into cash.

This applies to industries like retail, where companies need to have enough cash available to pay off short-term debts quickly.

In addition, some industries such as construction or manufacturing companies typically require large amounts of working capital in their operations which makes assessing their liquidity using only one single metric unreliable.

Limitations And Criticisms Of Current Ratio And Quick Ratio

Limitations of current and quick ratios include the fact that they do not take into account a company's future cash flow or long-term obligations, and may not be applicable to all industries or companies with different business models.

Additionally, these ratios may be affected by accounting practices such as inventory valuation methods, making them less comparable between companies.

Factors That May Affect Accuracy And Applicability Of Ratios

While current ratio and quick ratio can be helpful tools in assessing a company's financial health, there are several factors that may affect their accuracy or applicability.

For example, the ratios can be skewed if a company has unusual working capital needs due to seasonality or other factors. Additionally, differences in accounting practices or inventory valuation methods can also impact the ratios' accuracy.

It's important to keep these limitations in mind when using liquidity ratios like current ratio and quick ratio for financial analysis. Companies should consider supplementing these metrics with other asset management ratios from the cash flow statement or balance sheet as well as qualitative analyses of industry trends and competitive pressures for more comprehensive insights into their financial performance.

Alternative Or Supplementary Ratios To Consider

While the current ratio and quick ratio are important for assessing a company's liquidity, there are also other ratios that can provide additional insights into a company's financial health.

Another useful ratio is the inventory turnover ratio, which measures how quickly a company's inventory is sold and replaced over a given period of time.

Finally, the debt-to-equity ratio provides insight into a company's capital structure and indicates how much of their operations are financed through debt versus equity.

While no single financial metric tells you everything you need to know about an enterprise’s viability, these alternative ratios used alongside current and quick ratios can provide investors with different angles on understanding financial performance across various industries.

Conclusion: Choosing The Right Ratio For Your Analysis

In conclusion, understanding the differences between current ratio and quick ratio is crucial for every business owner or financial analyst. Both ratios provide important insights into a company's liquidity, financial health, and ability to pay off debts.

While current ratio may be more suitable for certain industries or purposes, such as retail businesses with high inventory turnover, quick ratio may be preferred by companies that require fast cash flow, like service-oriented businesses.

It is important to keep in mind that no single ratio can fully represent a company's financial situation; therefore, it is necessary to evaluate multiple ratios and metrics when conducting thorough financial analysis.

Related Metrics & KPIs