EBITDA Margin

EBITDA margin is a financial metric that helps companies determine how much earnings they're generating.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

EBITDA margin is a financial metric that helps companies determine how much earnings they're generating. This metric is a revenue ratio that shows how efficiently a company operates. To calculate the EBITDA margin, you must first compute your operating income and add depreciation and amortization.

It's critical to note that this metric doesn't factor in the company's capital expenses. It's also not inclusive of taxes or the cost of borrowing, making it rather barebones. However, you can use the EBITDA margin to evaluate a company's financial health alongside other leverage and profitability ratios.

In summary:

- EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

- EBITDA is a value that includes net income plus amortization, interests, taxes, and depreciation

- Billionaire John Malone invented EBITDA in the 1970s

- EBITDA margin assumes that companies can control or manipulate factors such as depreciation, taxes, and capital costs vis-à-vis John Malone's leveraged growth strategy

- It is an effective metric for evaluating the operational efficiency of distressed companies.

- It doesn't give a true profitability picture and is not a GAAP metric

- The US securities exchange SEC prohibits companies from reporting EBITDA per share and requires publicly traded companies to reconcile EBITDA with net income

The Making of The EBITDA Margin

John Malone, A.K.A Cable Cowboy, is the mastermind of EBITDA. He developed this metric in the 1970s to support and sell investors on his leveraged growth strategy. It provided reliable estimates of whether a company had enough profitability to offset debts incurred in acquisition.

Later, EBITDA became widely used in the 1980s by investors and lenders. However, some companies misused EBITDA during the dot-com bubble to exaggerate their financial performance and woe equity investors.

In 2018, WeWork faced backlash for using "Community Adjusted EBITDA," which excluded critical expenses like marketing costs. Despite its controversy, EBITDA remains a critical financial metric for many businesses today.

What's The Working Principle Behind EBITDA Margin?

EBITDA margin is the ratio of EBITDA to revenue. The margin makes it easy to compare companies of different sizes or industries. It shows the operational efficiency of companies in the short term, disregarding taxes, depreciation, and expenses.

This metric assumes that companies can influence or manipulate factors such as depreciation, taxation, and capital costs to their advantage. That may entail using tax strategies and optimized maintenance schedules.

By ignoring the non-operating expenses, EBITDA shows the operating cash a company generates per dollar of its revenues. The metrics feature promptly in the accounting reports of companies with very little on their bottom line.

For investors, the EBITDA margin serves as a quick litmus test to gauge a company's operational profitability without the noise of financial engineering or accounting decisions.

A higher EBITDA margin indicates that a company is maintaining its operating costs efficiently, leading to better profit margins. Conversely, a declining EBITDA margin over time might signal operational inefficiencies or increased competition, affecting the company's core business.

It also levels the playing field by eliminating variations caused by different financing structures or tax strategies. For instance, two companies might have similar revenues and net profits, but if one has a significantly higher EBITDA margin, it suggests that they are better at controlling their operational costs, which can be a competitive advantage in a tight market.

While the EBITDA margin offers valuable insights, businesses must use it with other financial metrics. Since it excludes interest, taxes, and capital expenditures, it doesn't provide a complete picture of a company's overall financial health.

The EBITDA margin might paint an overly rosy picture for businesses with significant debt or capital expenses. As such, investors and analysts should consider it as one of many tools in their financial analysis toolkit.

Where to Find EBITDA Data

Some companies do not explicitly report their EBITDA. Even so, it is still possible to calculate it from the information in the financial statements, which typically contain the net income, tax, and interest figures.

You'll also need to find depreciation and amortization figures. These exist within the notes related to operating profit or on the cash flow accounting.

You can quickly calculate EBITDA by starting with an operating profit or earnings and adding interest, taxes, depreciation, and amortization. Once you get the EBITDA figure, you can divide it by revenue to get your EBITDA margin.

EBITDA margin = EBITDA/Total Revenue

Which Type of Industry Should Use EBITDA Margin and Why?

Most companies use EBITDA to measure the company's operating profitability and efficiency. However, it's not suitable for every industry or every company. Here's a closer look at which companies should use EBITDA margin and why.

EBITDA for Asset-Intensive Industries with High Depreciation Costs

EBITDA benefits companies operating in asset-intensive industries. That is utilities, telecommunications, and manufacturing. These companies have high non-cash depreciation costs. And it may obscure changes in the underlying profitability of the business.

Therefore, it makes sense to exclude such costs from the calculation. The above companies may focus on operating profitability and cash flow through EBITDA. As a result, it becomes easier to compare the relative profitability of two or more companies of different sizes in the same industry.

Slow depreciation can often create a dent in the financial statement of asset-intensive companies, creating a perception of lesser profitability. Thus, EBITDA provides a clearer image by eliminating depreciation and amortization costs. This attribute makes EBITDA a particularly favored metric in sectors like real estate, manufacturing, or telecommunications, where depreciation can be a significant expense.

EBITDA for Early-Stage Technology and Research Companies

EBITDA is also useful for early-stage technology and research companies. These companies often have significant intangible assets. For instance, it could be an intellectual property that must be expensed over time.

Amortization is used to expense the cost of these assets. And by excluding it from the calculation, EBITDA gives a more precise picture of a company's current underlying profitability. It thus allows the company to focus on growth.

For young tech firms and research companies, EBITDA serves as a more relevant and pragmatic measure of performance. As these companies often rely on large-scale investments in research and development, which are then amortized over time, their profitability may appear distorted. EBITDA, by subtracting these costs, provides a useful picture of the potential profitability of their core operations.

EBITDA for Comparing Operating Profitability and Cash Flow

You can calculate EBITDA by adding interest, tax, depreciation, and amortization to net income. This metric helps track and compare the underlying profitability.

EBITDA margin helps to compare the relative profitability of different companies in the same industry. If a company's EBITDA margin is high, then its operating expenses would be lower and are about the same as total revenue.

The use of EBITDA extends to making comparative assessments of operating profitability. It provides a single, straightforward figure that allows a clear contrast between companies, free of the potentially distorting influences of tax systems, capital structures, and differing levels of asset investment. This sort of comparison is beneficial for investors and analysts keen to understand a business's core financial performance.

EBITDA for Cost-Cutting and Operational Performance

EBITDA margin helps measure how companies efficiently cut costs. Companies with a higher EBITDA margin have lower operating expenses, which may indicate they are more efficient at managing costs.

A high EBITDA margin can often be considered a testament to a company's strategic cost control measures. Companies posting consistently high EBITDA margins are presumed to have effective cost management strategies, ensuring optimum resource use. This reveals cost efficiency, one of the critical factors that potential investors and shareholders look for while assessing a company's attractiveness.

Understanding the EBITDA Formula and Calculation

First, you must determine your earnings before accounting for interest and taxes (EBIT) to calculate EBITDA. Then, add back depreciation plus amortization expenses to EBIT. The EBITDA formula is as below:

EBITDA = (EBIT) + Amortization + Depreciation

To calculate the EBITDA margin, divide EBITDA by the net sales using the following formula:

EBITDA Margin = EBITDA / Net Revenue

Example Calculation

Suppose your company had a net profit of $2,000,000, excluding interests and taxes. The net sales reported were $ 1 million. Then, total depreciation and amortization expenses were $150,000.

Using the EBITDA formula, the EBITDA calculation for your company would be $2,150,000. Dividing EBITDA by the net sales of $1 million, we get an EBITDA margin of 21.5%.

The figure means the company's core operations generate 21.5% of the sales revenue. The remaining 78.5% goes to operating expenses, capital expenditures, and taxes.

Interpreting EBITDA Margin

If the EBITDA margin is high, there are smaller company operating expenses to total revenue. Such a company runs profitable operations, is financially stable, and is even attractive to investors.

Suppose another company has an EBITDA of $1,200,000, and its total revenue is $4,500,000. Using the EBITDA margin formula, we get:

EBITDA margin = EBITDA / Total revenue EBITDA margin = $1,200,000 / $4,500,000 EBITDA margin = 0.2667 or 26.67%

This calculation shows that the company's EBITDA margin is 26.67%, indicating that it generates higher earnings from its operations.

How Can My Business Benefit from EBITDA?

EBITDA margin shows a business's core performance by excluding taxes, interests, and capital expenditures. It makes it easier for buyers to benchmark the operational performance of different businesses in different sectors.

A high EBITDA indicates the potential of a business to generate stable earnings and operate efficiently. That can be a positive sign for investors and owners. However, a low EBITDA margin may indicate profitability problems and cash flow issues, which can cause concern.

The EBITDA margin metric can serve as a benchmark for comparing the performance of different distressed businesses. It allows investors and owners to evaluate an underperforming business's profitability and efficiency potential. In return, it may help them make better-informed decisions about investing in or buying the company.

However, remember that the EBITDA margin is not a comprehensive measure of a business's financial health. You should use it with other financial metrics and analysis tools for higher accuracy.

The Disadvantages of EBITDA Margin

Although widely used to measure a company's profitability and efficiency, EBITDA margin has several drawbacks.

Misleading Metric

First, the EBITDA margin must estimate a company's cash flow generation by excluding non-operational expenses. The resulting information can be misleading about a company's financial health, especially cash flow.

EBITDA might offer a simplified view of profitability, but it often oversimplifies the financial condition of a company. It does not consider the eventual impacts of these vital financial obligations.

Reliance on EBITDA alone can create a misleading image of a company's true cash flow and obscure potential financial frailties hidden beneath.

Masks Poor Decisions

In the history of this metric, companies have had promising EBIDTAs with shrinking bank accounts. A company with a large EBITDA can have mountains of debt in the background, as with Vivendi, Cablevision, and Crown Castle in the early 2000s. Further analysis of the books of these companies revealed cash crises and a slew of poor financial decisions.

Remember, a seemingly impressive EBITDA doesn't absolve a company of poor decisions or mismanagement. A high EBITDA may paint a glamorous facade, hiding a weakening cash position or building debt. Recent history suggests that a superficial analysis might trick investors into overlooking a company’s dire financial state, making EBITDA a double-edged sword.

Doesn't Account for Interests

Interest costs can significantly impact the profitability of a business, and stripping it out from a company's financial analysis vis-à-vis EBITDA is folly.

Investors should always look closely at a company's cost of borrowing before closing deals on mergers, acquisitions, or stock purchases. The costs should be subtracted from a company's earnings in the specified periods for its accurate financial picture.

It Doesn't Account for Taxes

Taxes can sometimes run in the millions for some companies, and sometimes accounting for this cost can reveal that an entity is making losses. Therefore, relying on EBITDA alone can lead to poor decisions about a company's profitability.

Taxes can sometimes run in the millions for some companies, and sometimes, accounting for this cost can reveal that an entity is making losses. A company's tax obligations can significantly impact its net income. Therefore, relying on EBITDA alone can lead to poor decisions about a company's profitability.

Assumes There Are No Capital Expenditures

Companies need money to maintain or upgrade their machines, buildings, and equipment. Sometimes, the amount of money channeled here runs in the millions, and subtracting it from EBITDA can reveal a loss-making venture.

Assuming that a company incurs no capital expenditures is another potentially deceptive aspect of EBITDA. Every business needs to invest regularly in maintaining and upgrading its infrastructure and assets.

But EBITDA doesn't account for capital expenditure, and because of that, it shouldn't qualify as a decision-making metric on its own. Ignorance of these outlays can render the EBITDA misleading, making it an incomplete measure of a company's financial health.

It's Not a GAAP Measure

It is also worth noting that the EBITDA margin is not a recognized metric under GAAP generally accepted accounting principles. The renowned investor Warren Buffet has repeatedly discounted EBITDA as a reliable valuation method.

EBITDA margin can provide a quick insight into a company's profitability and efficiency. But, investors must be aware of its limitations and consider other financial metrics to understand its financial health better.

EBITDA Margin Alternatives?

Now that you know some of EBITDA's margin drawbacks, you should explore other alternatives for revealing an accurate picture of a business's profitability and operational efficiency:

Operating Income

Operating income is the earnings before interest and taxes (EBIT), a financial metric that calculates a company's income from its core business operations. You can calculate it by obtaining the difference of the company's operating expenses from its revenue.

Free Cash Flow

Free cash flow measures a company's probability of generating cash after accounting for capital expenditures. You can calculate it by determining the difference in a company's capital expenditures from the operations' cash flow.

Net Income

Net income, also known as the bottom line, is the total profit a company generates after accounting for all expenses, including interest, taxes, and depreciation.

Gross Profit Margin

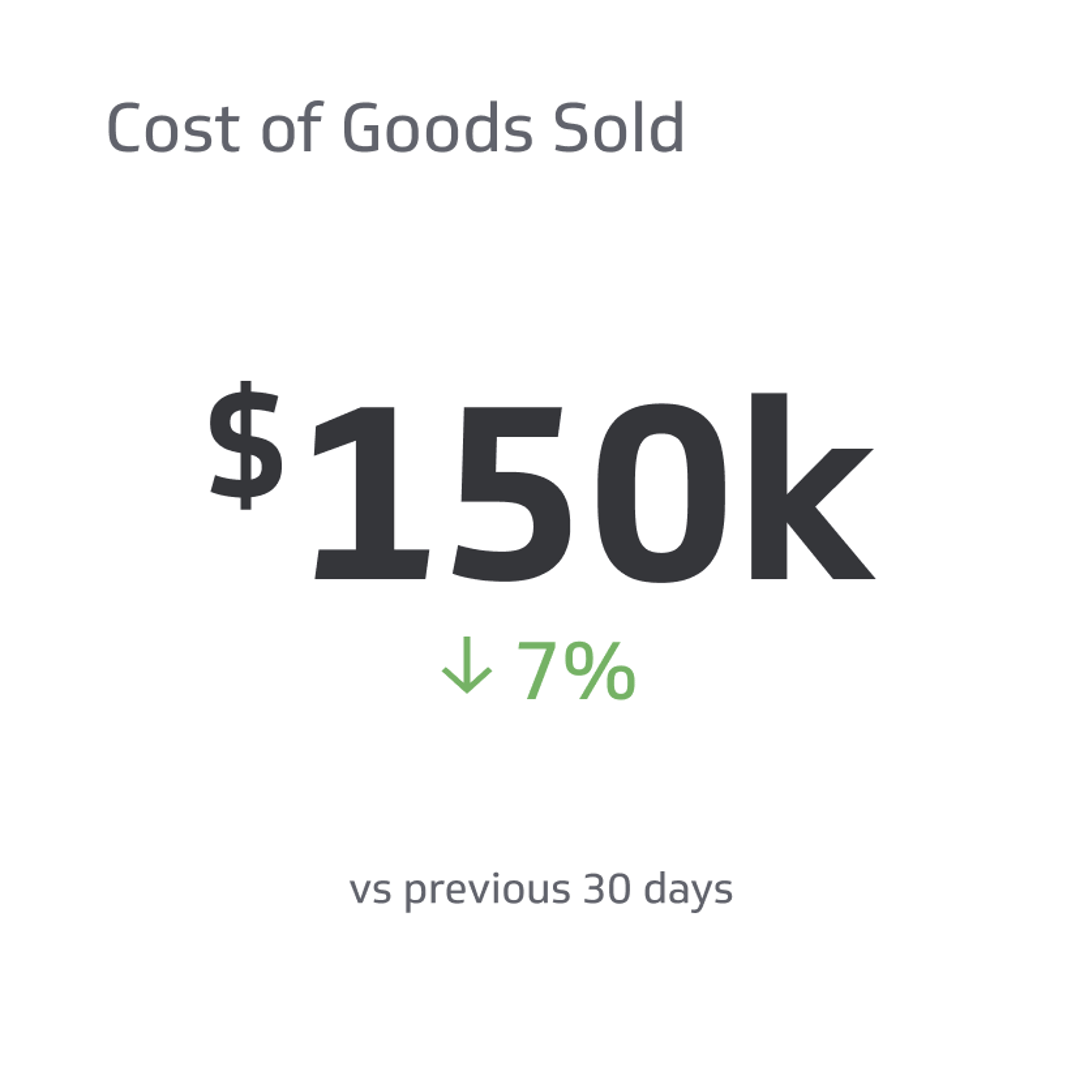

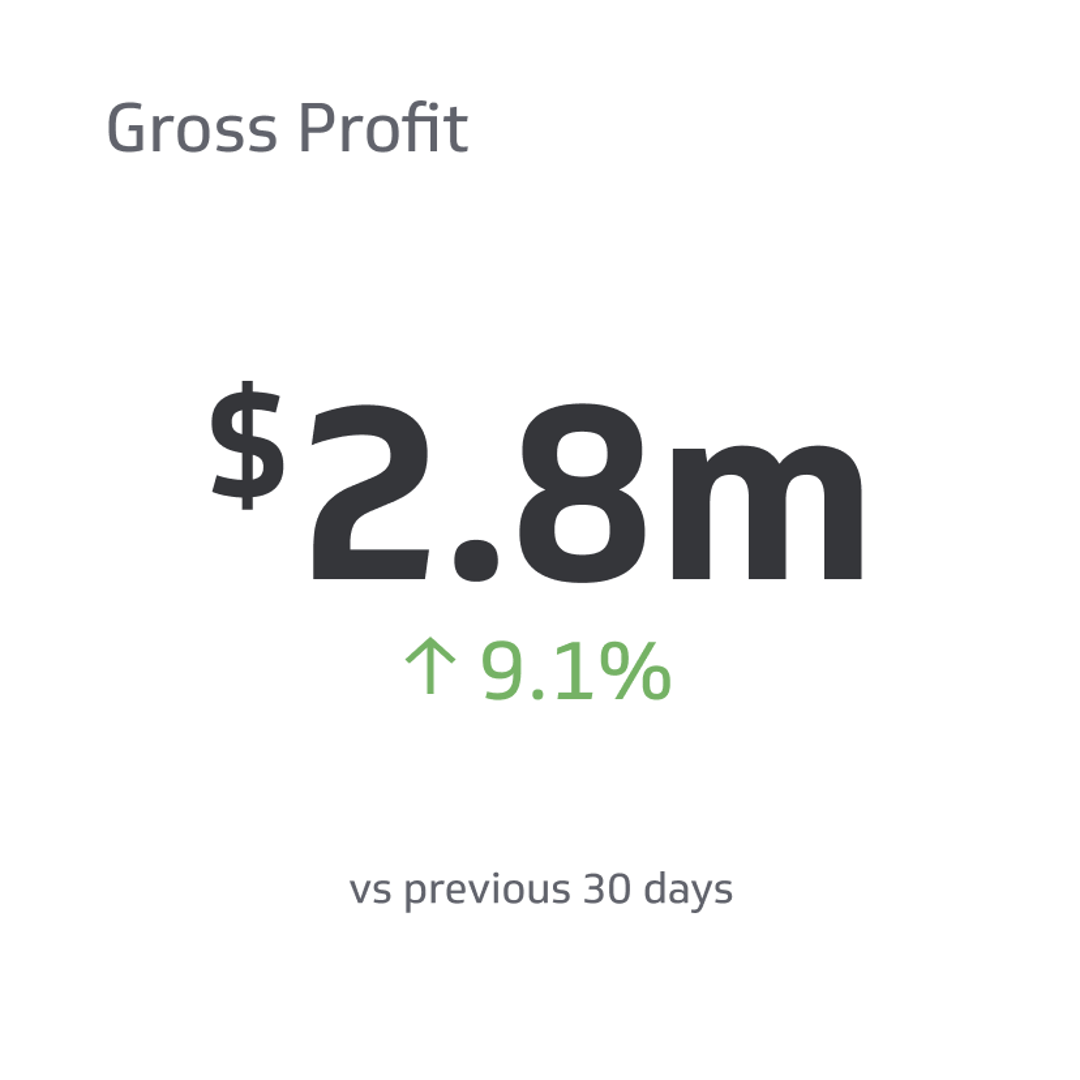

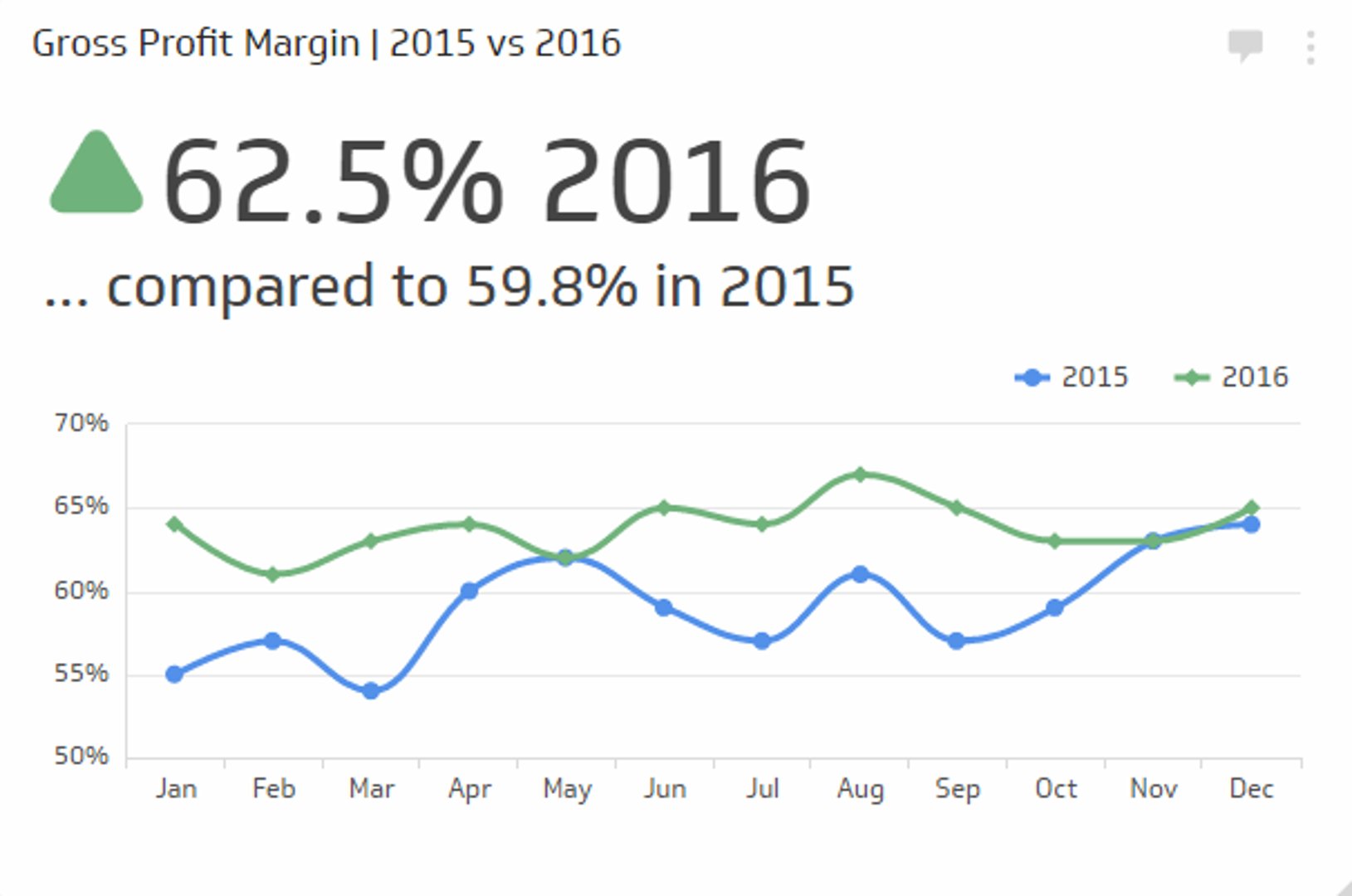

Gross profit margin is a financial metric that measures the profit a company generates from its revenue after accounting for the cost of all sales.

Return on Investments

Return on investment (ROI) is a financial metric measuring an investment's profitability relative to its costs. You can calculate it as a quotient of the profit generated by an investment and the cost of the investment.

These financial metrics provide a more comprehensive understanding of a company's financial performance. They can be even more efficient and accurate if used with EBITDA.

Conclusion

EBITDA margin is a valuable financial metric that evaluates a company's profitability and efficiency. It's vital in asset-intensive industries with high depreciation costs or early-stage technology companies with significant intangible assets.

While its simplicity and success in providing a snapshot of operational profitability make it a favored tool for many, the very same simplicity can be a double-edged sword. By excluding non-operational expenses, EBITDA does not give a reliable picture of a company's profitability.

Related Metrics & KPIs