Customer Acquisition Cost Metric

Measure Marketing and Sales Efficiency with the Customer Acquisition Cost (CAC) KPI

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

.png)

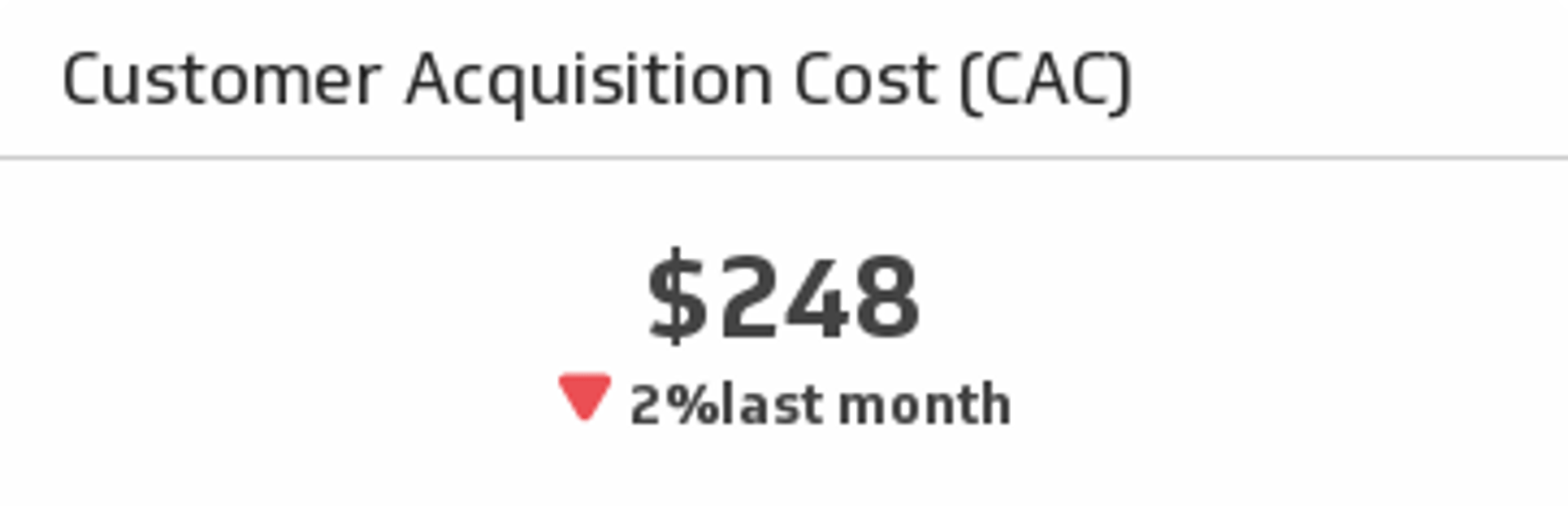

Customer acquisition cost (CAC) is a key metric that shows how much a company spends to gain each new customer. It’s a simple but powerful way to measure the efficiency of marketing and sales efforts. Knowing your CAC helps you understand whether your strategies are paying off or need adjustment.

For example, a high CAC might mean you’re overspending to acquire customers, while a low CAC can indicate efficient resource use.

Keeping CAC in check is crucial because it directly affects profitability and growth. By tracking and optimizing this metric, you can make smarter decisions about where to focus your efforts.

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) refers to your business' total expense to attract and convert a new customer. This metric combines costs from marketing, advertising, sales, and other customer-facing activities—offering a clear picture of what it takes to grow your customer base.

CAC is a vital measure for evaluating the efficiency and effectiveness of your growth strategies. It directly impacts profitability and returns on investment (ROI).

By understanding your CAC, you can identify areas to optimize spending and guarantee sustainable organizational growth.

CAC vs CPA

CAC and CPA (cost per acquisition) are both metrics that assess the efficiency of your customer acquisition strategies.

CAC represents the total cost of garnering a new customer, which includes all associated costs such as marketing, sales team salaries, software tools, and onboarding expenses. It provides a comprehensive look at the resources needed to plant a customer into your business ecosystem.

Meanwhile, CPA focuses on the cost of acquiring a specific action, which could be anything from a completed sale to a subscription or download. It evaluates the success of individual campaigns by measuring the cost of achieving the desired action.

What Does CAC Include?

An acquisition cost is any expense directly associated with gaining a new customer. These costs can vary depending on the industry, target audience, and acquisition strategies.

Below are some common examples of acquisition costs:

Marketing and advertising

Marketing and advertising are prime examples of customer acquisition costs since they include all the expenses of attracting and transforming potential customers into actual clientele. These expenditures include online and offline ad costs, such as pay-per-click (PPC) ads, social media promos, influencer partnerships, and content marketing.

Most companies spend 6% to 20% of their total earnings on marketing, and the competitive nature of digital advertising is the main reason costs are so high. This heavily impacts your business's general customer acquisition costs, especially during peak shopping periods when major industry players like Temu and Sheen increase the cost-per-click for smaller retailers.

Sales team salaries and commissions

The salaries and commissions paid to sales teams represent an ample portion of CAC. In the USA, the average salary of a sales representative is around $76,000 per year, with total compensation varying due to factors such as experience level, industry, job location, political affiliation, gender, and race.

Meanwhile, commissions, which are performance-based incentives, often range from 20% to 30% of sales revenue. This, too, varies depending on the company’s compensation structure.

Software and tools

Investments in software and tools are essential for the success of any business, and their costs are critical components of customer acquisition costs. These investments include expenditures for customer relationship management (CRM) software, automation platforms, analytics tools, and other digital marketing tools that streamline and enhance marketing and sales productivity.

Content creation

Content creation is an element of customer acquisition costs closely related to marketing and advertising. It includes your total expenses to produce materials such as blogs, infographics, videos, and social media content. These expenses can differ from a few hundred to several thousand dollars. For example, a nano-influencer may charge $10 to $100 per post, while a macro-influence might charge $5,000 to $10,000.

Promotions and discounts

Promotions and discounts affect your entire CAC since they reduce customers' initial purchase cost, driving conversion but lowering sales revenue. Promos like discounts or free trials attract new customers but directly impact your profit margins. As such, they must be factored into your CAC calculations so you can accurately evaluate the cost of obtaining new customers.

Event hosting

Event hosting is an often overlooked but significant component of CAC. Expenses related to this component include venue rental, promotional materials, catering, and staff salaries. These costs add up quickly, especially for large-scale events.

Additionally, event hosting can be unpredictable, with unexpected expenses arising from last-minute changes and additional promotional efforts required to maximize attendance.

Onboarding and training

The onboarding and training of your sales staff is a factor in customer acquisition costs. Costs associated with these involve the creation of training materials, conducting onboarding sessions, offering ongoing customer support, and compensating trainers.

How To Calculate Customer Acquisition Costs

To calculate customer acquisition cost (CAC), follow these steps: First, define the time period over which you want to calculate the CAC. From there, tally up all related marketing and sales expenses during that period. Finally, calculate the new customers you got within the same time frame.

The formula for CAC is as follows:

CAC = Total Marketing and Sales Costs / Number of New Customers Acquired

For example, if you spent $100,000 on marketing and sales in a quarter and acquired 500 new customers, the calculation would be:

CAC = $100,000 / 500 = $200 per customer

Is A Higher Or Lower CAC Better?

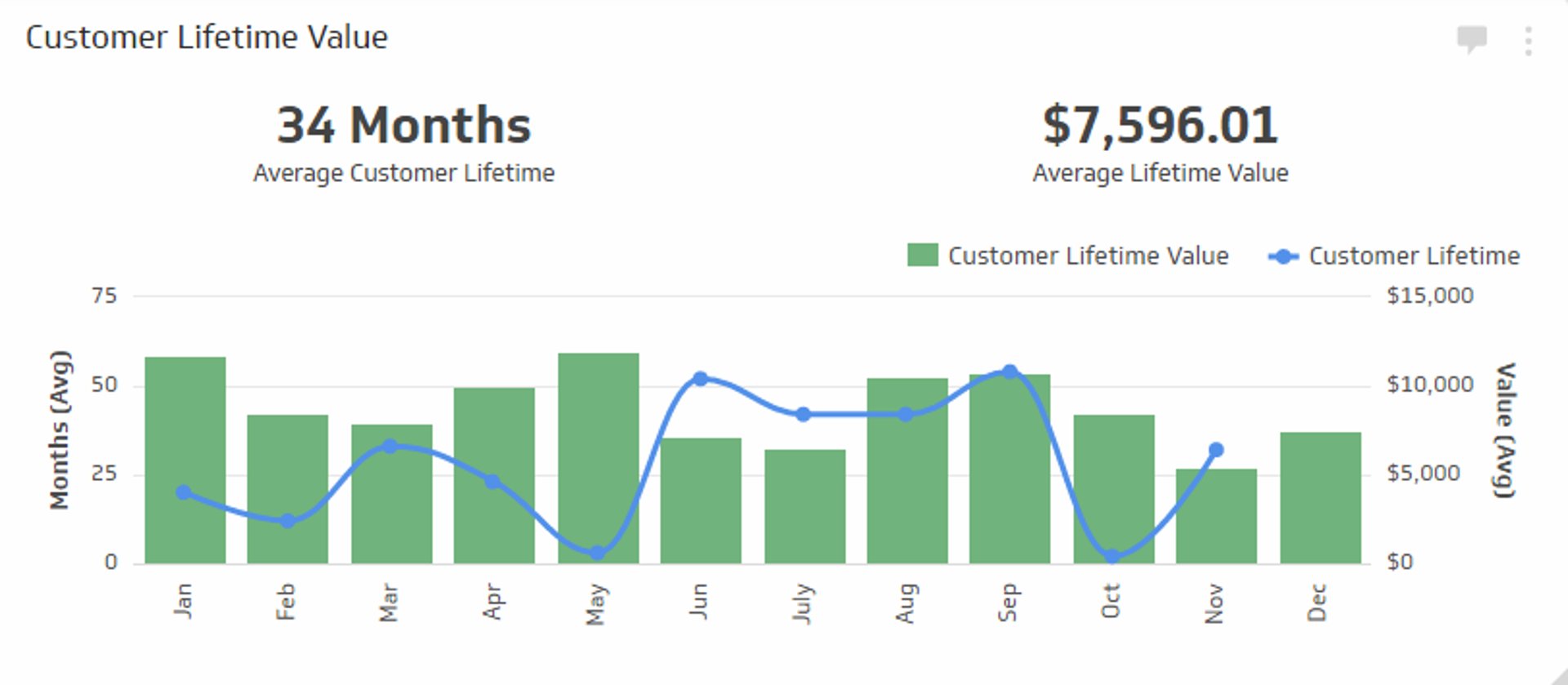

When analyzing Customer Acquisition Cost (CAC), a lower CAC is generally considered better because it signifies that a company is acquiring customers more efficiently and cost-effectively. However, the perfect CAC varies depending on your company’s business model, industry, and customer lifetime value (CLV).

The key to deciding whether your CAC is acceptable is to compare it with your CLV.

If you spend more on acquiring a customer than the customer is worth over their lifetime, your business model may be unsustainable. Conversely, if your CAC is significantly lower than your CLV, you're in a strong position to scale profitably.

Therefore, while a lower CAC is generally better, businesses should continually evaluate CAC in relation to CLV and long-term profitability to ensure that their customer acquisition efforts are viable and strategic.

When is a higher CAC justifiable?

A higher customer acquisition cost is justifiable if your CLV is significantly greater because the long-term revenue from each customer offsets the initial investment.

Companies with subscription-based business models or high-value repeat customers, such as luxury brands or SaaS providers, often employ this approach. Their willingness to spend more initially derives from their confidence that these customers will yield substantial profits over time.

In addition, high customer acquisition costs can be a strategic choice in businesses building brand awareness and growing their market position. New enterprises may allocate substantial resources to acquisition efforts to introduce their products or services, secure market share, and establish a good brand image.

Similarly, in highly competitive sectors, such as the tech industry, businesses may need to increase spending to set themselves apart and gain customers. While this will increase customer acquisition costs, it remains viable if the customer’s CLV is high enough.

Why Is Customer Acquisition Cost Important?

Customer acquisition cost is pivotal in your organization's financial health and informs growth, profitability, and long-term sustainability decisions.

Let’s explore why CAC is so important and how it can guide your company’s decisions:

1. Profitability and financial health

Excessive spending on acquiring customers and not yielding enough revenue leads to negative profit margins. By tracking CAC, you make sure that you’re spending the correct amount on gaining customers relative to the revenue you expect to generate. This helps you make informed decisions when planning your next marketing budget and sales strategies.

A high CAC without sufficient revenue generated from those customers can lead to a situation where you are essentially "buying" customers at a loss. For sustainable growth, you must balance your CAC with your customers' lifetime value as best as you possibly can.

2. Marketing and sales efficiency

CAC acts as a gauge for the efficiency of your marketing and sales operations.

A low CAC suggests that your marketing efforts are targeted, your messaging resonates with your audience, and your sales process is optimized. In contrast, a high CAC may indicate that marketing campaigns are not reaching the right audience or that there are inefficiencies in the sales funnel.

By analyzing customer acquisition costs, you can also identify areas of improvement.

For example, if your CAC is high due to weak advertising, you can reallocate your marketing budget to more cost-efficient channels or strategies. Similarly, a high CAC could signal sales process issues, such as long conversion times or inadequate lead nurturing.

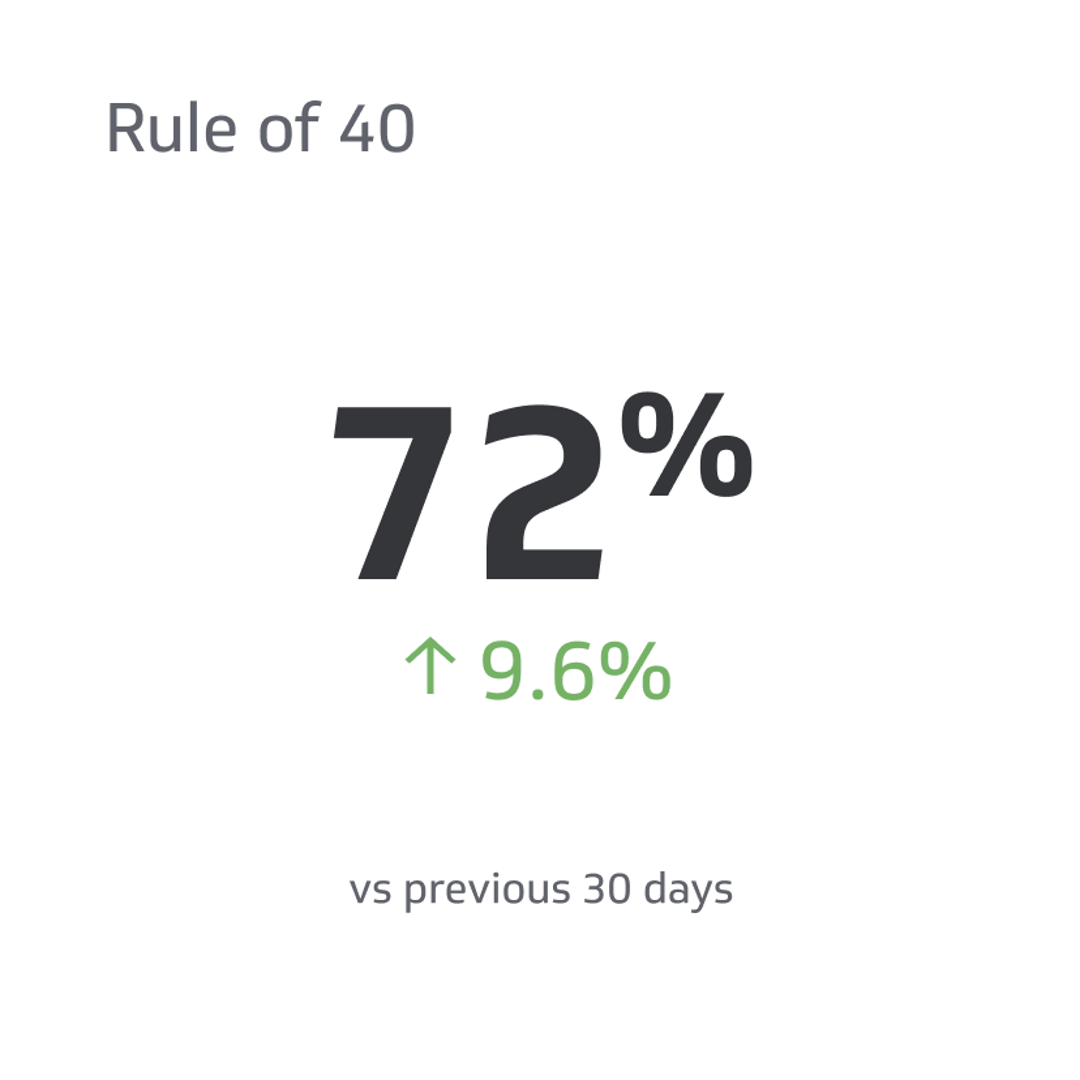

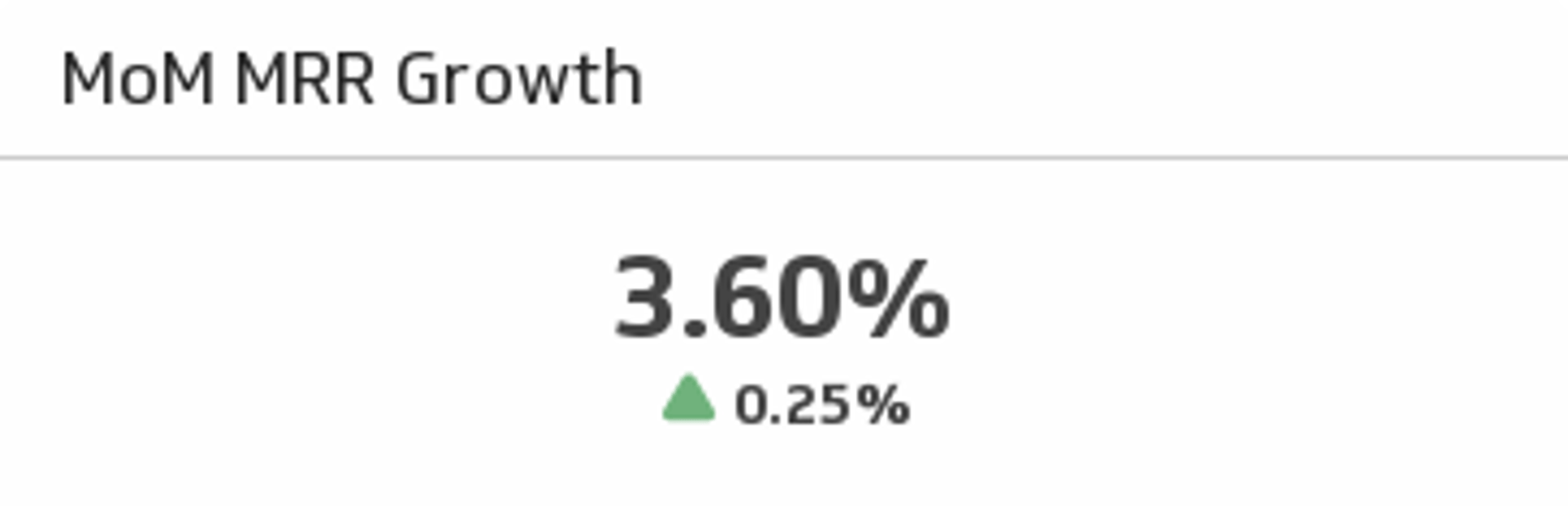

3. Scalability and growth

If you can acquire customers cheaply, you can reinvest your profits into further customer acquisition, driving exponential growth. However, if your CAC is too high, scaling becomes difficult as you must continually increase your marketing spending to acquire new customers.

With a low CAC, you can scale more quickly, as you don’t need to increase marketing budgets to attract more customers continually. If you have a high CAC, you must ensure that each new customer brings in enough revenue to justify the extra spending to guarantee that you scale up.

4. Customer retention and long-term sustainability

CAC is a metric critical for understanding the importance of customer retention.

The lower your CAC, the less pressure you have to gain new customers to sustain continuous growth. Focusing on retaining customers and increasing their lifetime value can significantly offset the expense of acquiring new ones by gaining increased value from existing ones.

High CAC combined with low retention can be unhealthy, as you’ll need to gain more and more customers just to stay afloat. In comparison, a low CAC coupled with high customer retention allows for more efficient expansion, eliminating the need for constant customer acquisition.

5. Competitor benchmarking and market positioning

Your CAC allows you to benchmark your business against market competitors, and a good CAC to CLV ratio will enable you to stand apart through better customer offerings. If your acquisition cost is lower than competitors, you’ll have a pricing advantage and the capacity to reinvest in enhancing the customer experience and brand positioning, providing a decisive market edge.

6. Informed decision-making for investment and funding

Investors often consider CAC a key indicator of a business’s capability to achieve profitability and growth.

A company with a high CAC relative to CLV may struggle to secure investment, as it signals inefficiencies in customer acquisition and potentially unsustainable growth strategies. On the other hand, a business with a low CAC showcases operational efficiency and the potential for future prosperity.

In addition, understanding your CAC also helps you communicate your value proposition more effectively to investors and secure better-term funding. With a low CAC, investors are more likely to view your business as a lower-risk opportunity with higher growth potential.

7. Resource allocation and budget planning

Assessing which channels, campaigns, and sales tactics are most effective at reducing acquisition costs can help you know where to allocate your resources more efficiently. This enables you to optimize spending and guarantee that marketing budgets are spent in areas with the highest ROI.

Inaccurate or insufficient tracking of CAC can lead to poor budget allocation, overspending on ineffective channels, and missed opportunities for cost-saving improvements. Hence, a clear look into acquisition costs ensures you maximize your resources to achieve the best possible results.

How to Reduce CAC

Reducing your customer acquisition cost (CAC) is essential for increasing profitability and achieving sustainable growth. Here are several strategies you can use to lower your CAC:

1. Refine targeting and messaging

Focusing on the right audience can make your marketing efforts more effective. Use data and insights to segment your audience and create tailored messaging that resonates with their needs. The more precise your targeting, the higher your conversion rates, which helps lower CAC.

2. Optimize your sales funnel

Review your sales process and identify bottlenecks causing inefficiencies, such as slow response times to leads, poor lead qualification, or clunky handoffs between marketing and sales. Streamlining the funnel, improving lead qualification, and enhancing follow-up processes can lead to quicker conversions and lower CAC.

3. Leverage content marketing

Investing in organic marketing efforts, such as blogs, videos, and social media, can attract customers at a much lower cost than paid ads. For example, organizations that consistently release blogs see 55% more website visitors and generate 67% more leads than those that don’t.

By concentrating on audience research to create consistent, valuable content, you can drive traffic and generate leads with minimal expense. Remember, understanding your audience's pain points and preferences confirms your content echoes and builds long-term engagement.

4. Increase customer retention

Retaining existing customers is a cost-effective way to boost revenue without constantly getting new ones. This can be done by offering exceptional customer service, creating loyalty programs, providing discounts, and personalizing the customer experience.

Keeping your existing customers and growing their lifetime value is often less expensive than acquiring new ones, and loyal customers tend to refer your business to others. Additionally, it builds trust in your brand, reducing churn rates over time.

5. Utilize referral programs

Unbeknownst to many, implementing referral programs can significantly reduce your customer acquisition costs.

A study by the Wharton School found that referred customers' CAC was $23.12 lower than that of non-referred customers. Referred customers also tend to have a 16% higher lifetime value and an 18% lower churn rate, which markedly enhances your organization’s overall profitability.

Moreover, referral marketing can offer a return on investment ranging from 18x up to 47x, depending on the industry. These factors collectively contribute to a lower CAC strategy via referrals.

6. Improve lead qualification

Improving lead qualification lowers CAC by making sure that your marketing and sales efforts are focused on prospects most likely to convert.

Furthermore, optimizing conversion funnels to increase conversion rates and cultivate more qualified leads can lower CAC. By implementing effective lead qualification strategies, your business can disburse resources more efficiently, which will lead to lessened acquisition costs.

7. Collaborate with influencers or partners

Leveraging influencers' audiences and trust can lower customer acquisition costs. A study by Aspire found that utilizing influencer-made content can reduce CPA by up to 30% compared to standard brand-produced content.

Partnership marketing can also be highly effective in lowering CAC. According to DataDab, a well-executed partnership campaign can lead to a 62% decrease in CPA compared to previous digital advertising campaigns.

Optimize Your Customer Acquisition Costs And Boost Customer Numbers

In conclusion, understanding and managing your customer acquisition cost (CAC) is essential for optimizing your business's growth and profitability. By carefully tracking your CAC, you can make more informed decisions on where to allocate resources, ensuring that your marketing and sales efforts are delivering the best possible returns.

To streamline this process, tools like Klipfolio can help you track and visualize your CAC in real time, making monitoring your marketing and sales performance easier. With Klipfolio, you can make data-driven decisions that enhance efficiency, reduce costs, and boost your bottom line.

Related Metrics & KPIs

.png)