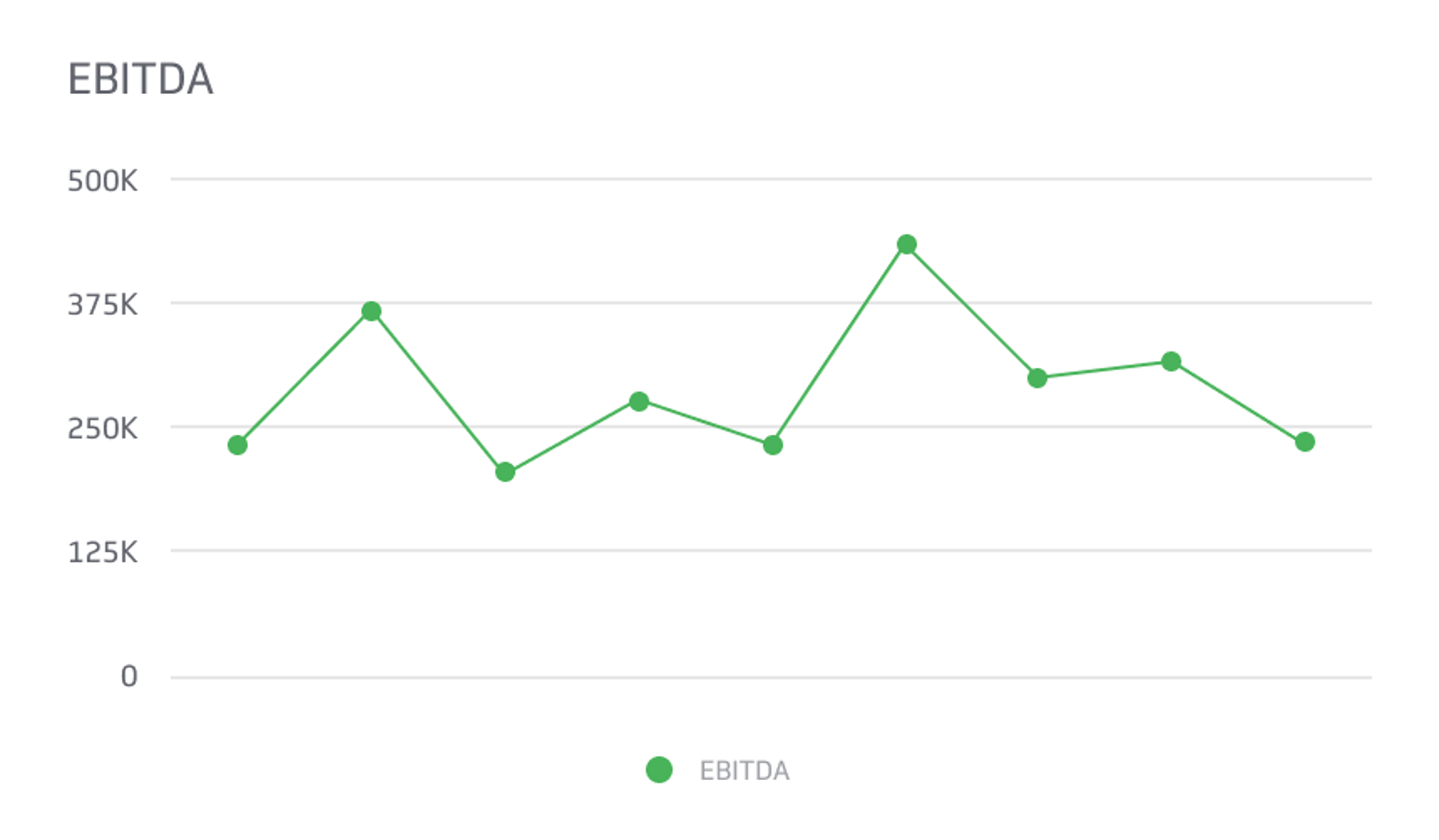

EBITDA

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Navigating the world of finance can be overwhelming, especially when it comes to the myriad of metrics and terms used to assess a company's financial health. One such metric, earnings before interest, taxes, depreciation, and amortization (EBITDA), often comes into play when evaluating a company's profitability.

This guide aims to unravel the complexities of EBITDA by providing an in-depth explanation of its definition, history, calculation methods, and advantages and limitations. By understanding EBITDA, you'll gain valuable insights into a company's profitability, whether you're a business owner seeking investors, an investor evaluating potential opportunities, or simply curious about this financial metric.

What is EBITDA?

EBITDA is considered an alternate metric of profitability for companies. It helps investors understand how profitable a company is once you remove all the expenses they make. By stripping the non-cash amortization and depreciation expenses, taxes, and other debts, it provides a complete picture of the business's revenue.

Even though the metric's name seems complicated, it's not very difficult to understand. Once you have the corresponding figures, finding the EBITDA only requires simple addition.

Unlike other metrics, the General Accepted Accounting Principles (GAAP) doesn't recognize EBITDA. While this isn't a huge deal, it has its limitations because of this. Many public companies report their EBITDA quarterly and adjust it accordingly as they see fit.

With more and more companies releasing their EBITDA in an attempt to get investors to join them, many companies have faced backlash for potentially exaggerating their earnings.

Due to the complaints, the US Securities and Exchange Commission (SEC) now requires companies that want to report their EBITDA to provide legitimate records showing how they calculated the EBITDA to ensure they're not overstating the final figure.

History of EBITDA

Liberty Media Chair John Malone is the inventor of EBITDA. The billionaire developed the metric back in the 70s to help sell investors and lenders on his business growth strategy. The business growth strategy would help deploy debit and reinvented profits to help reduce taxes.

With John Malone's strategy and metric, many investors and lenders who were a part of leveraged buyouts (LBOS) in the 80s thought that EBITDA was useful. It allowed them to estimate whether a company had the profitability to service the debt they would take on through the acquisition.

Typically, a buyout would cause a change in the capital structure and, therefore, the tax liabilities, so it made more sense to exclude tax and interest expenses from earnings. Since depreciation and amortization are non-cash expenses, they won't affect the company's ability to service debt.

Leveraged buyout buyers typically target companies with little to modest capital spending plans. Targeting companies this way allows them to secure financing through acquisitions and focusing on the EBITDA-to-interest ratio.

While many LBO buyers were using the metric in the 80s, EBITDA started gaining more popularity during the dot-com bubble because companies would use it to exaggerate their finances.

Formula for EBITDA

Most companies will report their EBITDA, but you can still calculate it yourself if they don't. You do so by looking at their financial statements. You can usually find their earnings, tax, and interest numbers on the income statement.

As for the depreciation and amortization numbers on the cash flow statement or in the notes on the operating profit, there's a shortcut for calculating EBITDA. It involves using operating profit (earnings before interest and taxes, or EBIT) and then adding back depreciation and amortization.

There are two formulas for calculating EBITDA. There's one based on operating income, and the other is on net income. The EBITDA formula for operating income is:

EBITDA = operating income + depreciation and amortization

The formula when using net income is:

EBITDA = net income + taxes + interest expense + depreciation and amortization

The Difference Between Operating Income and Net Income

If you're looking at the two formulas above, you're probably wondering what the difference between operating and net income is.

Operating income is a company's revenue less any of the operational expenses they incur. Net income is the company's revenue less any non-operational expenses. Non-operating expenses include taxes and interest. Both formulas should give you roughly the same final answer for the EBITDA.

How To Calculate EBITDA

Once you have the values you need, calculating a company's EBITDA is straightforward. You'll plug those values into the formula and end up with the EBITDA. Below you'll find an example and then the calculations.

Example of How To Calculate EBITDA

We can use the following example to give you a better idea of how to calculate EBITDA. Let's say a company makes $100 million in revenue annually and then incurs $40 million for things they sell and another $20 million for overhead costs.

Their depreciation and amortization expenses are $10 million, giving them a profit of $30 million. Their interest is $5 million, meaning their earnings before taxes would be $25 million.

At a 20% tax rate, their net income comes to $21 million after you subtract $4 million in taxes from their pretax earnings. If we add depreciation, amortization, interest, and taxes to the

company's net income, the EBITDA will reach $40 million. Here's how that looks in the formula:

EBITDA = $21 million + $4 million + $5 million + $10 million = $40 million

EBITDA Margin

On the other hand, the EBITDA margin is a financial performance ratio that measures a company's operating profitability as a percentage of its total revenue. In other words, it indicates how much of a company's revenue gets converted into EBITDA.

It can be used to compare the operational efficiency of different companies within the same industry or sector. A higher EBITDA margin indicates a more efficient company, as it shows that the company can generate a larger amount of earnings from its revenue while limiting operational expenses.

The formula to calculate EBITDA margin is:

EBITDA Margin = (EBITDA / Total Revenue) x 100%

For instance, if a company has an EBITDA of $50 million and total revenue of $100 million, the EBITDA margin would be 50%. This implies that half of the company's revenue is translated into operational earnings after deducting the cost of goods sold and overhead costs but before considering interest, tax, depreciation, and amortization expenses.

This ratio offers valuable insights to investors and analysts regarding a company's operational performance and efficiency. Knowing this, businesses commonly use it alongside other financial ratios and indicators to evaluate a company's financial health, operational efficiency, and profitability.

Issues With EBITDA

Even though many people prefer to use the metric EBITDA, it's not without issues. The first issue with this metric is that its calculation can vary from company to company. The variations in calculations are because it's not a GAAP measure.

Many companies will emphasize this over the net income to make themselves look better to investors, which is another issue on top of the calculation variations.

Another issue with EBITDA is that it ignores the costs of the company's assets. Since it doesn't showcase cash earnings, it can skew a lot of information that investors would typically want to know about a company before investing.

Some complaints about EBITDA are that it doesn't define the earnings specifically. While it might seem simple enough to think about a company's taxes, interest, depreciation, and amortization, some companies might use different figures for each part of EBITDA.

When there are different figures, it can skew the information and cause further problems. Essentially, this can make EBITDA an unreliable measure to use.

Lastly, many people have an issue with EBITDA because it can obscure the company's valuation. It can make the company look less expensive than it is, thanks to all the cost exclusions.

The Difference Between EBIT and EBITDA

If you've heard of EBITDA, you've heard of EBIT. The two terms have no massive difference, but EBIT stands for earnings before interest and taxes. People use EBIT to assess a company's profitability based on their core operations.

Since a company's net income excludes interest and tax, these deductions from net income are reversed when calculating EBIT. EBIT can include non-operating income too.

The main difference is that EBIT is earnings before interest and taxes, while EBITDA is earnings before interest, taxes, depreciation, and amortization.

The Difference Between EBITDA and Operating Cash Flow

Operating cash flow adds non-cash charges back to the company's net income. Non-cash costs include depreciation and amortization, while EBITDA doesn't add it back.

For this reason, most people would agree that operating cash flow is a better metric for understanding how much income a company generates.

It also factors in cash transactions in receivables, payables, working capital, and inventory. While you can use both to determine how well a company is doing, EBITDA can miss clues that operating cash flow doesn't include when calculating the business's income.

The Difference Between EBITDA and Free Cash Flow

EBITDA provides insight into a company's operational profitability by excluding non-operating expenses like interest and taxes and non-cash expenses like depreciation and amortization.

Meanwhile, Free Cash Flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. In simpler terms, it's the cash left over after a company pays for its operating expenses and capital expenditures.

While EBITDA and FCF may seem similar, they serve different purposes and convey different aspects of a company's financial health. Understanding when to use EBITDA or FCF will depend on what you're trying to measure.

For example, EBITDA is often used when comparing profitability between companies and industries, as it eliminates the effects of financing and accounting decisions, offering a rawer measure of profitability. It can also prove helpful in merger and acquisition situations to determine the actual profit potential of a target company.

On the other hand, FCF is a key indicator of a company's ability to generate cash, which is crucial for operations, expansion, and ultimately, for investors in the form of dividends. It can depict whether the company generates enough cash to satisfy debt obligations, pay for its expenses, and invest in new opportunities without relying on external financing.

What is a Good EBITDA?

What everyone will consider a reasonable EBITDA will depend on the person, but since EBITDA is a company's profitability, the higher the EBITDA, the better.

For an investor, a "good" EBITDA shows them additional perspectives on how the company is doing financially without forgetting that it doesn't include cash outlays for taxes and interest.

The larger the company, you'll want the higher your EBITDA. As for a smaller company, what some consider a good EBITDA for them won't be a good one for a company on a larger scale.

Importance of EBITDA to Investor Decision-Making

These are four reasons EBITDA is important to the decision-making process of investors:

Performance Evaluation

EBITDA is often used to compare the performance of different companies within the same industry. Since it removes the effects of various accounting and financing categories, it provides a more level playing field for comparison.

Valuation

EBITDA can give investors a good indication of a company's overall value, as it shows the core profitability of its operations. It can also be used in valuation multiples, which compare a company's value to its earnings.

Leverage and Solvency Analysis

EBITDA can be used to analyze a company's leverage and its ability to meet its debt obligations. A higher EBITDA means the company generates more earnings, which can be used to pay off debts - a vital aspect that investors monitor closely.

Cash Flow Analysis

Though EBITDA doesn't represent actual cash earnings, it can offer a rough idea of the company's cash flow status. Investors must consider it when evaluating a business's liquidity or overall fiscal health.

Evaluating EBITDA and Financial Health

Relying on EBITDA alone to gauge a company's financial health can be misleading. This metric doesn't factor in significant elements such as changes in working capital, capital expenditures, and tax payments. Therefore, it's essential to complement it with other financial indicators to create a comprehensive financial picture.

The Use of EBITDA Alongside Other Financial Indicators

When assessing a company's financial health, several financial indicators should be taken into account. These include free cash flow, net income, and tangible assets. By combining EBITDA with these metrics, you can accurately evaluate a company's comprehensive financial state.

The Role of EBITDA in Specific Financial Analyses

Despite some limitations, EBITDA continues to be a valuable tool for particular types of financial analyses. Its true value becomes evident when comparing performance across companies within the same industry or when assessing companies with extensive depreciation and amortization expenses.

EBITDA as a Starting Point

Investors and analysts frequently use EBITDA as a launch pad to calculate other pivotal financial metrics. For instance, the Enterprise Value to EBITDA ratio (EV/EBITDA) provides an instantaneous snapshot of a company's valuation compared to its earnings.

This ratio is applicable when benchmarking companies in the same sector. This is because it diminishes the distortions caused by discrepancies in capital structures, depreciation methods, and tax rates.

Frequently Asked Questions

When it comes to financial metrics, there's a lot to learn, and many of them feel very similar to one another. Here are some of the most frequently asked questions that others are asking regarding EBITDA.

Is EBITDA the same as gross profit?

Even though EBITDA and gross profit are a measure of a company's profitability that require removing certain expenses to get the final number, they are not the same. Gross profit requires subtracting the cost of making goods and providing services, while EBITDA removes the interest, taxes, depreciation, and amortization.

Though both metrics provide insight into a company's financial health, they focus on different aspects. Gross profit gives investors a snapshot of a company's efficiency in using resources in the production process, while EBITDA offers a wider view of overall operational profitability by taking into account operational costs and the impacts of financial and accounting decisions.

Does EBITDA include the company owner's salary?

No, the company's owner's salary isn't included when calculating EBITDA. SDE is a metric that will consist of the business owner's salary. Now, EBITDA does have all the wages of the other company employees, just not the company owner or owners.

Can a company have an EBITDA that's too high?

Yes. It all comes down to the opinion of the investor, but some investors might think that your EBITDA is too high for their liking. Even though this means you have a high number of sales, it can make your business look unattractive if you have a higher EBITDA than other companies of similar size and industry.

A very high EBITDA relative to the company's standing might be seen as a red flag for some investors. This discrepancy could indicate possible accounting manipulations or unsustainable business operations, triggering further scrutiny. While a high EBITDA is generally seen as a positive sign, an exceedingly high EBITDA may raise concerns about the company's financial practices and management efficiency.

Why would a company report its EBITDA?

When a company is trying to bring in more investors, it might report its EBITDA to give investors a better picture of its profitability. Another reason people have for reporting EBITDA is that it might look better to investors than their net income number.

Does a company legally have to report its EBITDA?

As of now, there is no legal requirement for a company to have to report its EBITDA. It is beneficial, but no one is forcing them to do so.

Final Thoughts

Earnings before interest, taxes, depreciation, and amortization (EBITDA) are a metric that many people use to understand corporate profitability better. It's relatively easy to calculate. All you have to do is add interest, tax, depreciation, and amortization to the company's net income, and you have the EBITDA.

It's an excellent tool for investors to understand better if a company is profitable enough for them to invest their money in. Many companies report their EBITDA automatically to assist with this. Despite its limitations, EBITDA is an excellent tool for companies and inventors to use.

Related Metrics & KPIs