Invoice

From tracking revenue to managing expenses, this document contains vital information that helps companies of all sizes stay financially healthy.

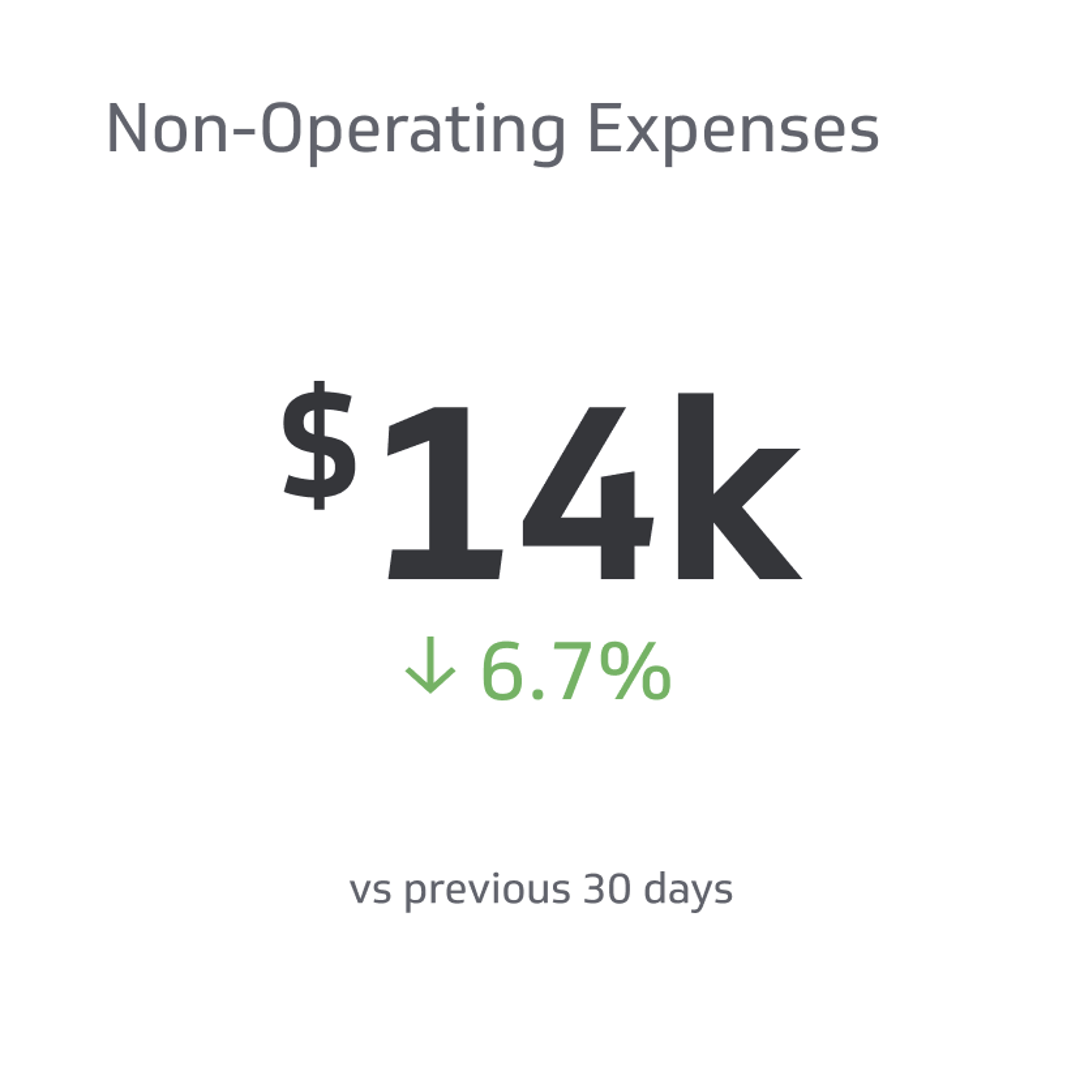

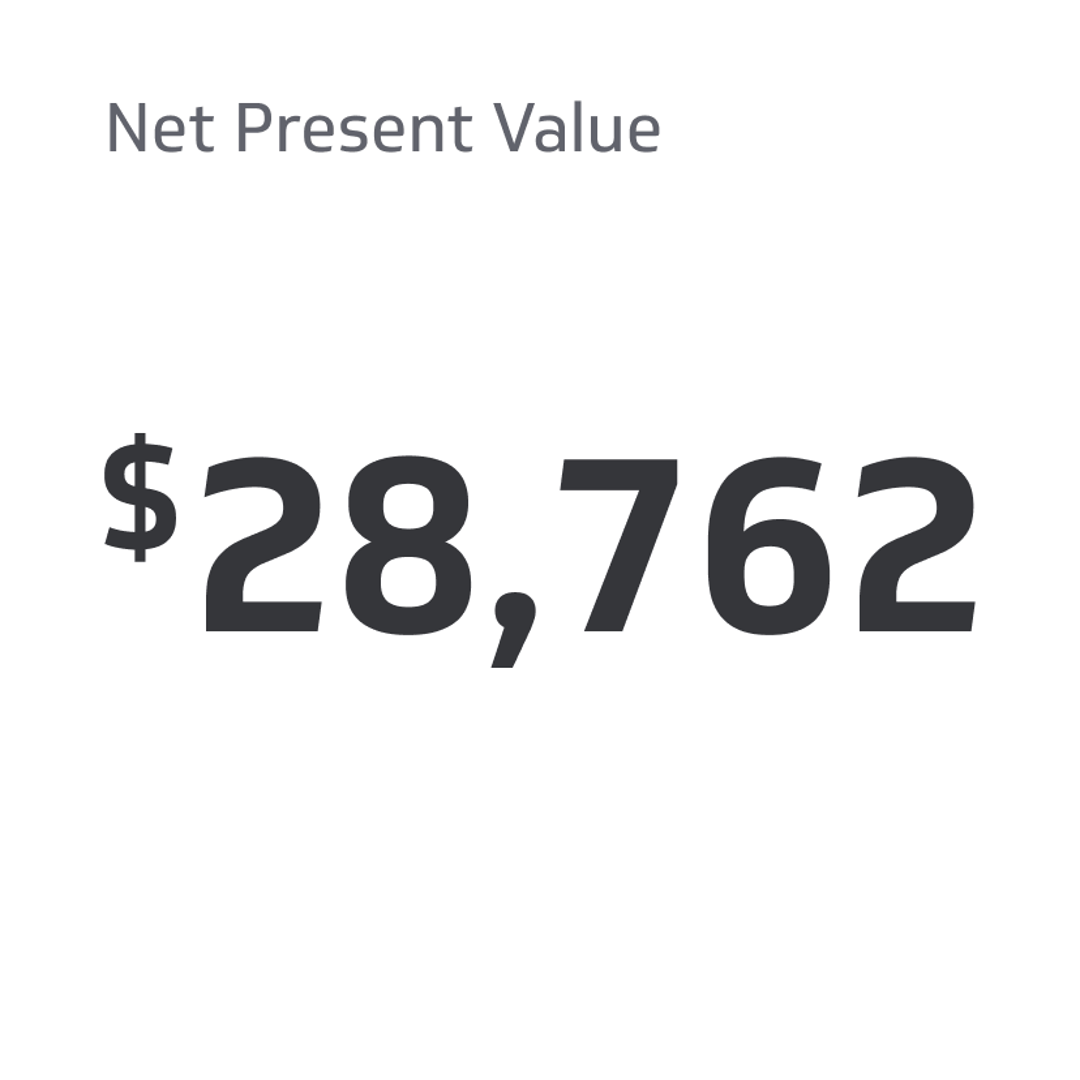

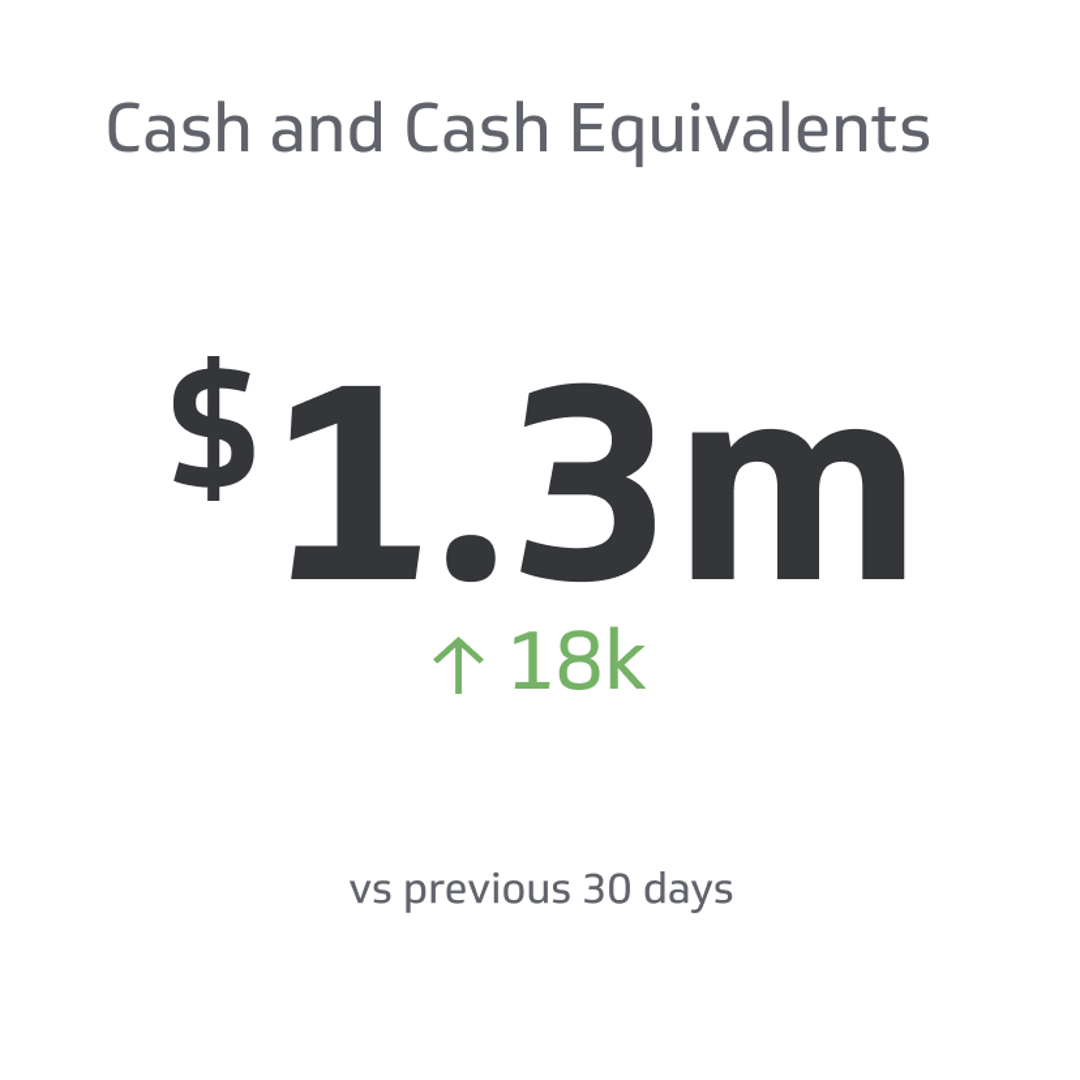

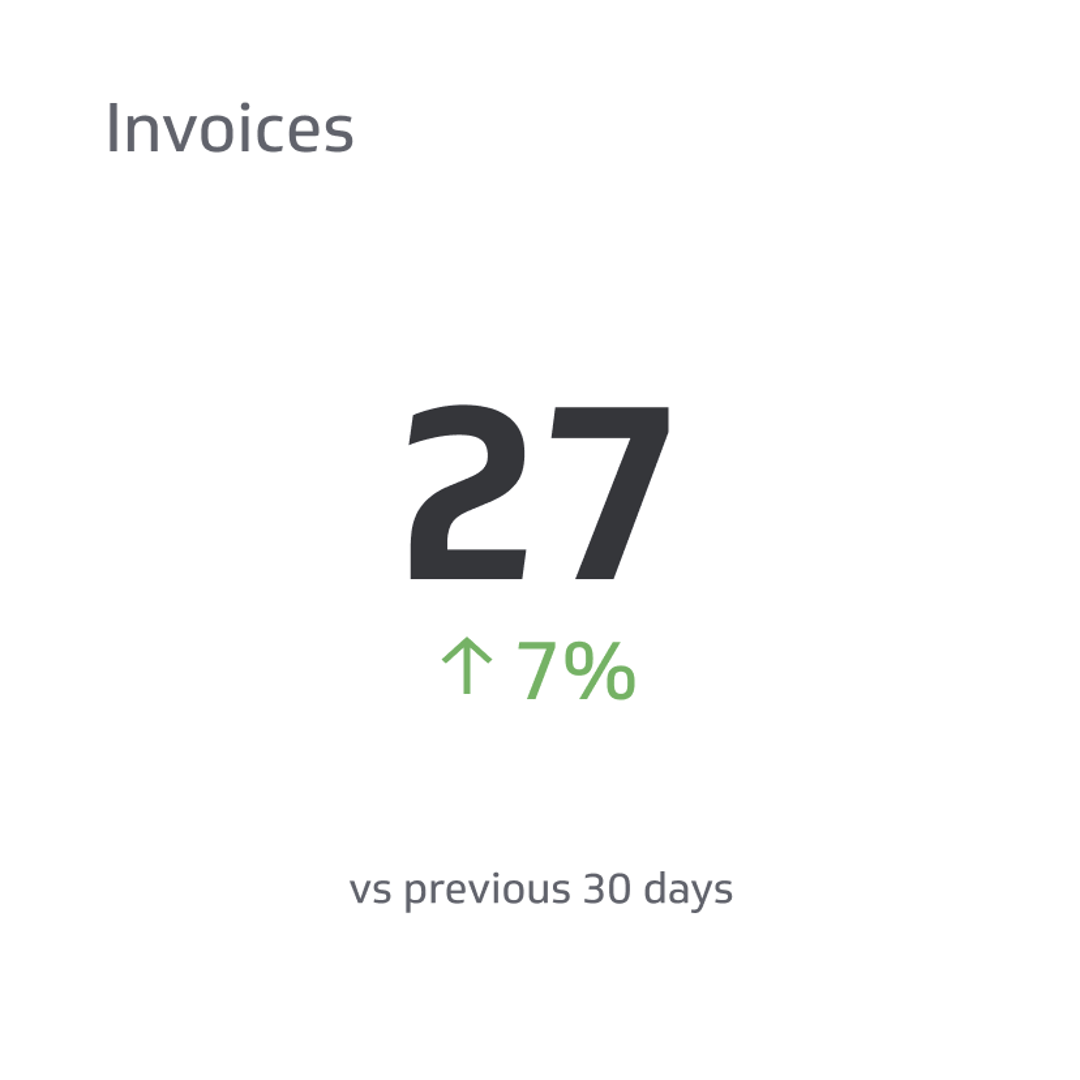

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In the world of business, invoices play a critical role in operations. From tracking revenue to managing expenses, this document contains vital information that helps companies of all sizes stay financially healthy.

As marketers strive to understand consumer behavior and modify their strategies accordingly, analyzing invoice data can offer insights into spending trends that inform marketing campaigns. Business operators can use invoice information to stay on top of cash flow, while analysts can use the data to make more informed decisions regarding inventory management and financial forecasting.

For SaaS teams, understanding invoices can help inform economic software development that streamlines billing processes. So whether you're a marketer, business operator, analyst, or SaaS team member, understanding the importance of invoices is crucial to stay ahead in today's market.

What Exactly Is an Invoice?

An invoice is an official document that states the details of transactions between buyers and sellers, including the products or services provided, the price, and any applicable taxes or discounts.

It serves as a request for payment and outlines the terms and conditions of the sale. Invoices are essential for maintaining accurate financial records, tracking sales and expenses, and managing cash flow.

Failure to issue or pay timely invoices can result in financial and legal consequences. As such, businesses must understand the official definition of an invoice and its purpose to avoid any misunderstandings or compliance issues.

What's An Invoice Made Of?

Although every company might have its idea of what's considered important information, most invoices contain the same information. An invoice's typical components include the header containing the seller's details and the buyer's information, such as name, address, and invoice number.

Other essential parts are the description and quantity of goods, their unit price, line item totals, taxes, and any applicable discounts or adjustments. Each component ensures that the buyer and seller can track the transaction, facilitate quick and accurate payment, and maintain correct records for tax or legal purposes.

Understanding the usual components of an invoice and their importance can help businesses avoid conflicts, reduce risks, and streamline their operations for growth and success. Here's some of the information you might commonly see on an invoice:

- Seller's name and address

- Buyer's name and address

- Invoice number

- Date of issue

- The due date for payment

- Terms of payment (e.g., net 30, etc.)

- Description of goods or services provided

- Unit prices for each item or service provided

- The total amount owed by the buyer before taxes or discounts

- The final total owed by the buyer

Different Types of Invoices

It's important to note that while most invoices share some characteristics, they're not all created equally. Different markets demand different types of invoices depending on their specific needs.

For instance, manufacturers may need a proforma invoice to detail the goods they produce, while service providers may use interim or progress invoices to bill clients as work progresses. Importers dealing with international markets may require an invoice that follows specific Customs regulations.

Understanding the different invoice types is essential for any business to bill and get paid on time accurately, and it helps establish good relationships and ensures compliance with local regulations. Here's a breakdown of the different types of invoices you might come across in business.

Proforma Invoice

A proforma invoice informs buyers about the cost of goods or services. It is a preliminary invoice usually sent ahead of the final invoice, including the actual prices of the goods or services provided.

A proforma invoice typically describes the products or services offered, their prices, quantities, and other relevant details. This type of invoicing can benefit businesses dealing with international clients, as it can help clarify pricing and avoid potential misunderstandings or disputes.

Proforma invoices also allow companies to provide their customers with a precise and accurate estimate of the overall cost of a project or purchase, which can help them budget and plan accordingly.

Interim Invoice

An interim invoice is a bill issued to a client by a business before the project or services are completed. It serves as a payment request for the work done so far. This type of invoice is common among companies that offer long-term or ongoing services, such as freelancers, contractors, and lawyers.

It helps the business to keep up with its cash flow needs by receiving payments during the project rather than waiting until the end. Additionally, it allows the client to keep track of the expenses and budget accordingly. An interim invoice can be a helpful tool for both parties to ensure that their financial needs are being met throughout the project.

Recurring Invoice

A recurring invoice is sent to customers on a regular, predetermined schedule, such as monthly or quarterly. It saves time and effort for both the business and the customer, eliminating the need to create and pay invoices manually each time.

Recurring invoices are commonly used by companies that provide ongoing services, such as subscription-based businesses or those offering maintenance and repair services. By setting up recurring invoices, companies can ensure prompt payment and focus on quality customer service rather than worrying about paperwork and payment follow-up.

Why Should Your Company Care About Invoices?

Invoices are often seen as a mundane task that handles payment transactions. However, there are other ways that invoices can be beneficial for businesses. In addition to facilitating payments, invoices can help companies to keep track of customer orders, monitor inventory levels, and improve customer retention rates.

Companies can enhance their accounting accuracy and financial management by including detailed and accurate information about a sale. An efficient invoice system can increase any business's operational efficiency and bottom-line profits. Therefore, companies should view invoices as more than just a payment tool but a vital component of overall business operations.

A well-designed and organized invoice can also enhance a business's professional image and brand identity. They allow the company to reinforce its brand image, establish credibility, and differentiate itself from competitors.

Invoices can include branding elements such as logos and taglines, and they can also have personalized messages tailored to the recipient. Businesses can achieve financial and branding benefits by adopting invoices and treating them as a strategic marketing tool.

How to Create and Send an Invoice

Creating and sending an invoice may seem daunting, but the process shouldn't be complicated. Start by gathering all the necessary information: the company name and logo, contact information, product or service description, pricing, and payment terms.

Next, choose a professional invoice template or create your own. Then, input all the information into the template and review it for accuracy. Finally, send the invoice to your client through email or mail. Here's a breakdown of these steps to ensure your business is paid promptly and efficiently.

1. Gather Customer Information

Collect the necessary details of your client, such as name, contact details, address, and any other relevant information.

2. Create the Invoice Template

Use a computer program or online invoicing service to create an invoice template with all the relevant fields for data entry (e.g., product or service description, quantity, rate per unit). Include your business’s logo and other branding elements to ensure your business is represented professionally.

3. Enter Itemized Goods or Services

Enter each item you charge for into the appropriate field in the invoice form and the quantity and rate per unit if applicable. Calculate subtotals accordingly and add taxes where applicable before reaching a total amount due figure at the bottom of your invoice document.

4. Add Payment Terms and Due Dates

Clearly state when payment is due on each invoice so there can be clarity about when payments should be made by them and received by you or your business.

5. Send the Invoice

Choose how best to send out invoices via email PDF attachment or printed paper copies to ensure they reach their intended recipient securely without delay.

Avoid These Common Invoicing Mistakes

Invoicing is essential to any business, and mistakes in this area could make things more difficult later on. One common mistake businesses make when creating invoices is not providing sufficient details. Invoices must be clear, outlining precisely what products or services are being charged for and any applicable taxes, fees, and discounts.

Another mistake is not sending invoices in a timely fashion. The longer it takes to send an invoice, the longer it will take to receive a payment. Additionally, businesses must ensure their invoices are accurate and free from typos, miscalculations, or incorrect billing information.

Addressing these common mistakes will help companies keep invoicing processes efficient and effective, improving their bottom line while maintaining positive client relationships.

What's the Best Way to Keep Invoices Organized?

Effective management of invoices is essential to maintaining the healthy financial state of any business. Invoices are your business's primary income source, and any errors or discrepancies in their management can cause financial loss.

A well-managed invoice system will track and maintain accurate financial records, streamlining taxes and audits. It can also boost overall productivity by reducing time on manual data entry and providing real-time visibility on cash flow.

With a comprehensive and robust invoice management system, businesses can improve financial health, reduce errors, and save vast amounts of time, allowing for more focus on core business operations. Here are some tips for effectively keeping invoices organized.

Automate your Invoicing Process

Streamline the entire invoicing process by automating it with software or online services. This will save time and money and reduce errors from manual data entry. Automated systems can also provide helpful analytics to help you better manage your finances and identify areas where you can improve your processes.

Keep Accurate Records of All Invoices

If your business manually manages invoices, it's a good idea to keep records of every invoice that is received and sent. Track each invoice you send out by creating a spreadsheet including details such as client information, the amount due, payment terms, and due dates.

This will help keep your business organized and make it easier to spot any discrepancies or irregularities in payments later on.

Ensure Accuracy in Invoice Creation

Double-check all calculations before sending out an invoice, eliminating any potential for errors that could cause confusion or delays in payments received.

Streamline Customer Communications

Utilize automated messages sent via email when necessary. This ensures clients receive important information while saving time spent manually communicating with each one individually.

The Final Word on Invoices

Invoices are an essential part of any business transaction, providing a record of the goods or services and the payment received. These documents are proof of purchase and a tool for maintaining accurate financial records.

By keeping your invoices organized, you can make it easier to track past transactions, monitor outstanding balances, and reconcile accounts. Making invoicing a priority in your business practices can help ensure timely payments, minimize errors, and promote healthy financial management.

Related Metrics & KPIs