Net Burn Rate

Manage your SaaS startup’s runway with the Net Burn KPI

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Net Burn = Gross Burn - MRR

What is Net Burn Rate?

Net Burn Rate is a financial metric used by startups to track how quickly they spend their venture capital while considering the revenue generated by the business. This metric helps companies evaluate their financial health and forecast their runway.

For SaaS companies, Net Burn Rate and revenue are typically measured on a month-to-month basis. To calculate Net Burn Rate, you subtract the total expenses from the total revenue and divide the result by the number of months in the measurement period. This calculation takes into account any revenue generated, which can slow the gross burn rate.

Overall, understanding your Net Burn Rate can help you make informed decisions about your startup's financial future and can be a crucial factor in securing additional funding.

Net Burn Example

Consider a SaaS company that is spending $50,000 a month to finance overhead but generating $15,000 a month in recurring revenue. In this case:

Net Burn = $50,000 - $15,000

= $35,000

Net Burn Benchmarks

There are no hard and fast benchmarks for how fast a startup should be burning through invested cash. Venture Capitalists want to see that the money they’ve invested is being used to fund growth - they don’t expect it to sit in a bank account for long. At the same time, companies that spend cash too quickly risk running out of it, the result being that even a fast-growing company that appears to be approaching profitability could go under. Here’s some expert advice and rules of thumb:

Fred Wilson, Partner, Union Square Ventures

- “A good rule of thumb is to multiply the number of people on the team by $10k to get the monthly burn. That is not the number you pay an employee. That is the “fully burdened” cost of a person, including rent and other costs.”

Danielle Morill, CEO and Co-founder at Mattermark

- “Fred’s post (quoted above) is from 2011, and many believe startup costs have risen a lot since then due to higher cost of living fueled by low-interest rates.” Danielle reached out to her community in 2014 and asked: “what is the average fully burdened cost per employee at Series A startups over time?” and Marc Andreessen (General Partner at Andreessen Horowitz) suggested: $200,000 per year, and rising. This, Danielle noted, works out to $16,666 per month.

Mark Suster, Managing Partner, Upfront Ventures

- “Your value creation must be at least 3 times the amount of cash you’re burning, or you're wasting investor value...Money spent should add equity value or create IP that eventually will”.

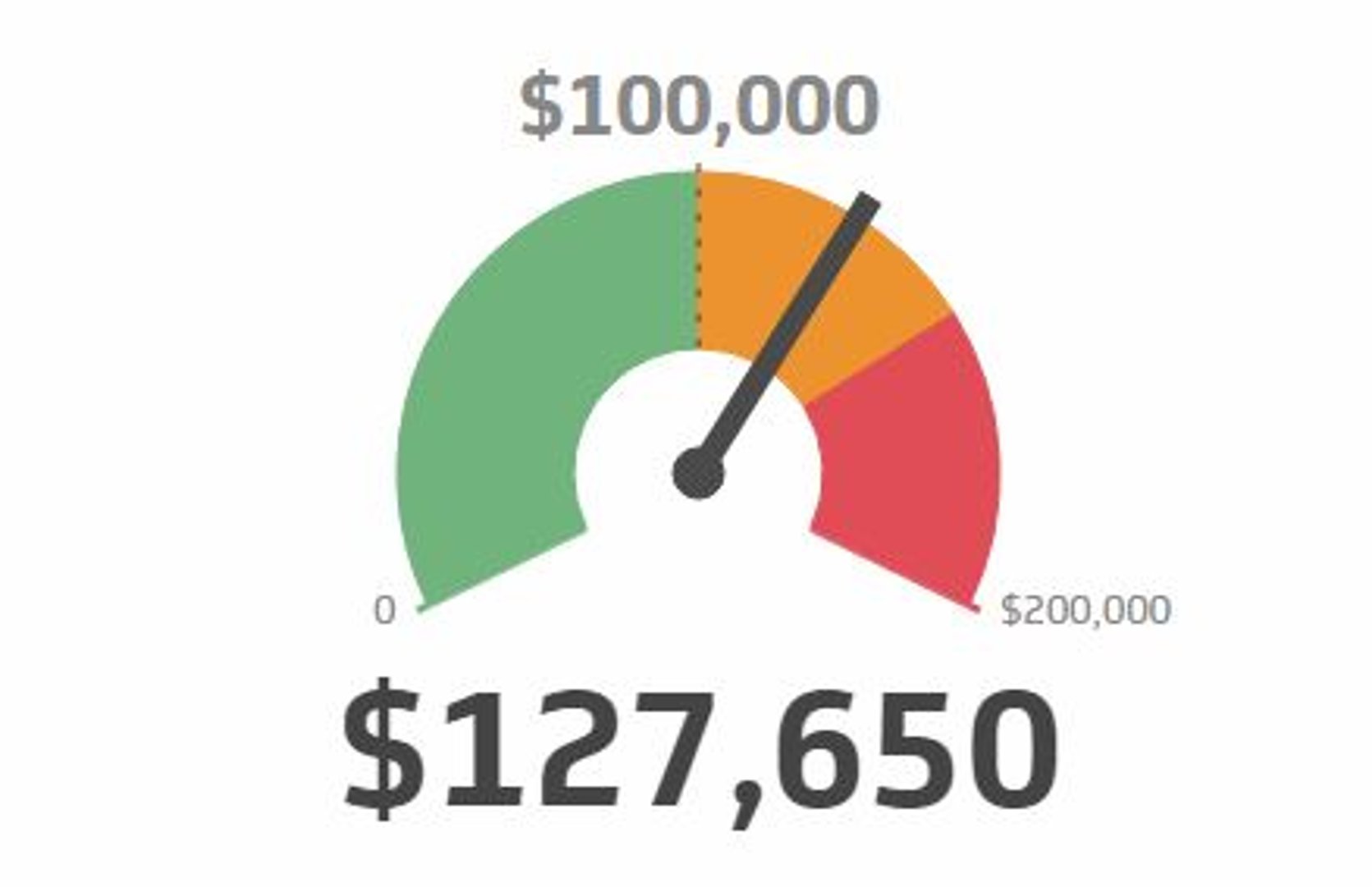

How to monitor Net Burn Rate in Real-time

Once you have established metrics for measuring Net Burn Rate, you’ll want to establish processes to monitor this and other SaaS KPIs on a continual basis. Dashboards can be critical in this regard.

Learn more about how to track your Net Burn Rate on a SaaS Dashboard.

Net Burn Best Practices

Danielle Morill, CEO and Co-founder at Mattermark

- Don’t aggressively increase your burn rate until you are confident you have found product/market fit.

- Try not to spend more than 5% of your budget on things outside of payroll, benefits, and rent.

- Try to avoid unnecessary scaling (hiring) early on.

Mark Suster, Managing Partner, Upfront Ventures

- Stay lean and only raise a big round of financing if you’re confident you’re on to product/market fit, “at which point you want to loosen the belt quickly (and raise capital)”

- Work hard to avoid dipping below six months of cash in the bank (“Take cash balance plus the net of your receivables and payables to get "net cash." Divide net cash by your monthly net burn rate as an approximation of how many months of cash you have”)

- Have a good reason to explain why you’re asking a VC for a lot of money if you’re Net Burn Rate is low.

- If you have a large amount of cash in the bank + an untapped credit line + a rapidly growing revenue line + large, supportive VCs + a reasonable valuation, then you may consider keeping the burn rate slightly higher than you might normally as a way of expanding your business while your competitors can't due to cash limitations.

Net Burn: Top Resources

What’s The Right Burn Rate For Your Company?, Mark Suster, Managing Partner, Upfront Ventures

Is my Startup Burn Rate Normal?, Danielle Morill, CEO and Co-founder at Mattermark

Burn Rates, How Much?, Fred Wilson

Why You Need to Ring the Frigging Cash Register, Mark Suster

Related Metrics & KPIs