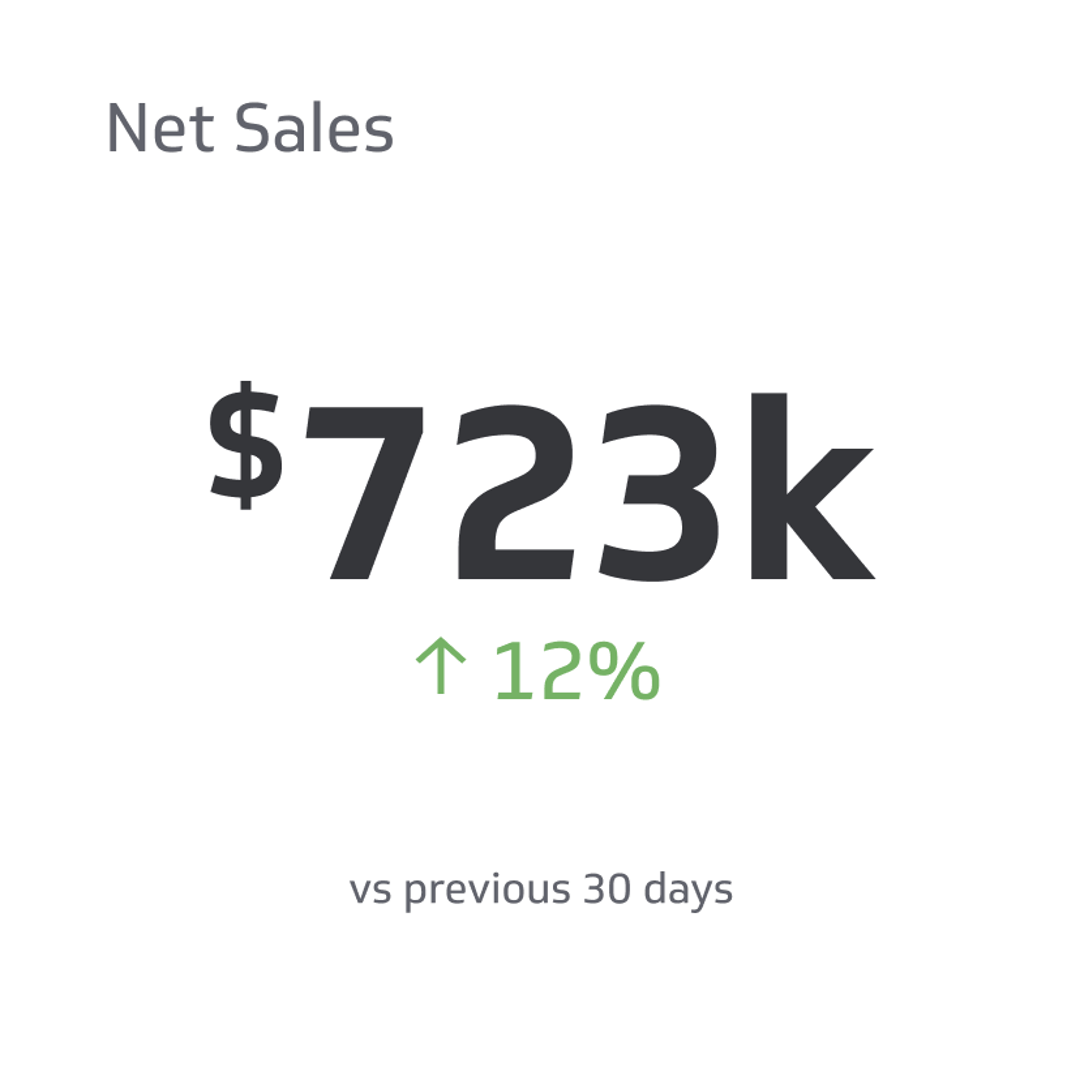

Net Sales

Net sales equate to how much money your business accumulates within a specified time frame after deductions are docked from the gross sales amount.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

As a budding business owner, there are certain terms that you must familiarize yourself with to sound professional when discussing funding with investors. Let’s start with net sales.

Net sales equate to how much money your business accumulates within a specified time frame after deductions are docked from the gross sales amount. We will discuss the types of deductions from business experiences and the equation used to calculate net sales on a monthly and yearly basis.

Why Is It Important To Know Monthly and Yearly Net Sales?

Being knowledgeable of your business's net sales on a monthly and yearly basis is important because:

- Helps you, employees, and investors to get a snapshot of the organization’s current financial standing.

- Gives you insight into what you can do to increase net sales over time.

- Enhances your understanding of business terms and financial metrics to become a better business owner.

- You can see which sales deductions are taking away from your net sales so you can find ways to reduce them accordingly.

What Are the Sales Deductions Docked From Gross Sales?

Sales deductions docked from gross sales to discover net sales include sales allowances, sales returns, and discounts. Understanding and tracking sales deductions is essential for discovering monthly net sales.

You can evaluate business performance based on how net sales rise and fall every month. From there, you can consider the possible influences of why sales were higher or lower for those four to five weeks. Hence, interpreting said effects will help you to get creative in enhancing ways to keep net sales high while minimizing sales deductions as much as possible.

Sales Allowances

Sales allowances do not happen as often as discounts or sales returns. However, they must still be factored into the overall sales deductions when figuring out net sales.

A business may decide to administer a sales allowance to increase customer satisfaction during a situation gone wrong. For example, the client may have received a shipped product that was different from their standards.

Whether damaged or an incorrect item, a business can issue some of the original value paid as a refund. This partial refund can act as compensation for the inconvenience the customer endured. The business can replace the item as they see fit based on whether the client still wants it or not.

Sales Returns

Sales returns are another business deduction that reduces gross sales to discover the net amount. A company that permits goods to be returned to their business within a 30 to 90-day period must reimburse the customer their full purchase amount.

The reimbursement can be issued in cash, a brand gift card, or a credit issued to a payment card. Your business is returning monetary funds to the customer in this situation as long as they are returning the goods within the specified mandates of your company's return policy.

Since money is deducted for customer reimbursement, this accounts receivable credit affects revenue. Hence, each sales return is a debit on your monthly income statement.

Discounts

Discounts take many forms. If you are in a service business, you may give your customers a small discount if they pay their bills in full before the due date. This could be anywhere between 1% to 5% off the due amount, depending on your company policies.

If you have a business that sells goods, discounts may entail offering customer coupons or promotions whereas clients can enjoy their purchase at a reduced price below the retail amount. For example, if you send out 20% off coupons to clients via email, you will lose 20% of the products’ retail price for every individual that redeems the coupon.

You may be running a 10% off promotion on one of your products without the need for a coupon. This means every person that purchases this 10% off product incurs a 10% loss in your monthly sales compared to each unit’s retail price.

How Are Net Sales Calculated?

Utilize a simple subtraction equation to calculate net sales. Here is a layout of the equation below showing how to calculate sales deductions before subtracting them from gross sales.

Net sales = Gross sales - (sales allowances + sales returns + discounts)

Net sales = Gross sales - sales deductions

The subtracted portion includes three numbers from the sales deductions discussed above. First, you must add the monetary amounts contributing to sales returns, discounts, and sales allowances. Adding these three values will determine total sales deductions for that month.

Review your sales records from the past month to discover your gross sales. Subtract the final sales deduction value from the gross sales number. Doing so will be your designated net sales for that month.

As long as you calculate net sales monthly, add the 12 values on December 31st to get a yearly net sales amount.

Example of Net Sales Scenario for a Clothing Store

Let’s lay out a net sales example so you are ready for when it is time to calculate the figure for your business. For this scenario, put yourself in a clothing store owner’s shoes.

The owner of a clothing store makes sales based on the number of clothing units they sell to clients. Upselling can occur when employees make outfit recommendations that go with a piece a client already picked out, so they can leave with new staples in their wardrobe.

Say that you grossed $52,000 in sales this past month. You evaluated your sales returns to find that they amounted to $3,000. Sales allowances were $2,500 while discounts equated to $5,000. We can discover net sales for this specific month as follows:

Net sales = Gross sales - (sales returns + sales allowances + discounts)

Net sales = $52,000 - ($3,000 + $2,500 + $5,000)

Net sales = $52,000 - $10,500

Net sales = $41,500

Hence, after $10,500 in sales deductions for the month, you have a net sales value of $41,500 if your gross sales were $52,000. Be mindful that each type of sales deduction can vary every month based on how many customers decide to make returns.

How often you permit sales allowances for clients determines profitability. In turn, the coupons and promotions you offer clients and how often they take advantage of them can directly affect your overall net sales turnout.

Tips for Keeping Careful Records of Sales and Deductions

With all of these values to track, it can be challenging to keep careful records of sales and deductions. However, you can follow these tips to track business income and losses accordingly so you are ready to generate your monthly income statement.

Utilize a Sales Tracking or Accounting Software

Sales tracking software is linked to the cash register’s computer that records every sale, the tender the customer used, and details of what they purchased. This tool also makes it seamless to track key performance indicators (KPIs) that drive overall success in your business.

Otherwise, you can keep all electronic records of every sale for that month. Then, with your chosen accounting software, you can input these sales records for the final gross sales calculation.

On the last day of the month, analyze your gross sales by viewing the detailed reports from either the sales tracking or accounting software. Make more time to handle other tasks within your business and experience less hassle with calculating net sales every month.

Keep All Sales Return Receipts

Even if sales returns are auto-recorded in sales tracking or accounting software, keep the business copies of all return receipts filed away for the month. Reconcile the paper copies against your electronic records to reassure you have the correct value for sales returns when calculating net sales.

Calculate Discounts Daily

Before closing up shop for each business day, review the electronic receipts of all sales transactions and calculate the total discounts. Note this value in a notebook and an Excel spreadsheet. At the end of the month, you can add all 28-31 values to finalize how many discounts you distributed during that period.

Track Sales Allowances in an End-of-Day Log

If you make a sales allowance when administering a customer return, note this in your end-of-day log. Note the sales allowance on pen and paper in a journal or a digital entry in an Excel or Word document for tracking purposes. Attach a business copy of the receipt showing the sales allowance for proper record tracking.

What Do Net Sales Not Include?

Some business costs are not designated as sales deductions when calculating net sales. Other expenses that are classified elsewhere on a business income statement include the following:

- Administrative costs.

- Cost of goods sold (COGS).

- General business expenses.

Administrative Costs

Administrative costs are expenses incurred that help you to run your business smoothly. Examples include the monthly rent payment on the business building and utility expenses. Think electricity, business insurance, employee salaries, and various supplies and equipment costs.

Cost of Goods Sold (COGS)

The cost of goods sold (COGS) refers to how much the company had to spend to make and distribute the product to customers. For example, it may cost $15 to make a blouse in your clothing store that you sell for $50. Hence, the profit for each blouse purchased without a discount would be $35, while the cost of goods sold would be $15.

General Business Expenses

Other general business expenses could be the cost of software, the upkeep of a company vehicle, and any bank fees incurred during sales and return transactions. Some general business expenses can also be listed as administrative costs. This depends on how you designate them on your income statement.

A Summary of Net Sales

Calculate net sales by subtracting three types of sales deductions from gross sales. Track your discounts throughout the month by keeping records of all promotions, coupons, or early bill payoff deductions.

Utilize sales tracking or accounting software to calculate gross sales. Always keep copies of all sales return records. Track sales allowances as they occur in a daily end-of-day log so it’s easier to calculate this portion of sales deductions at the end of the month.

Related Metrics & KPIs