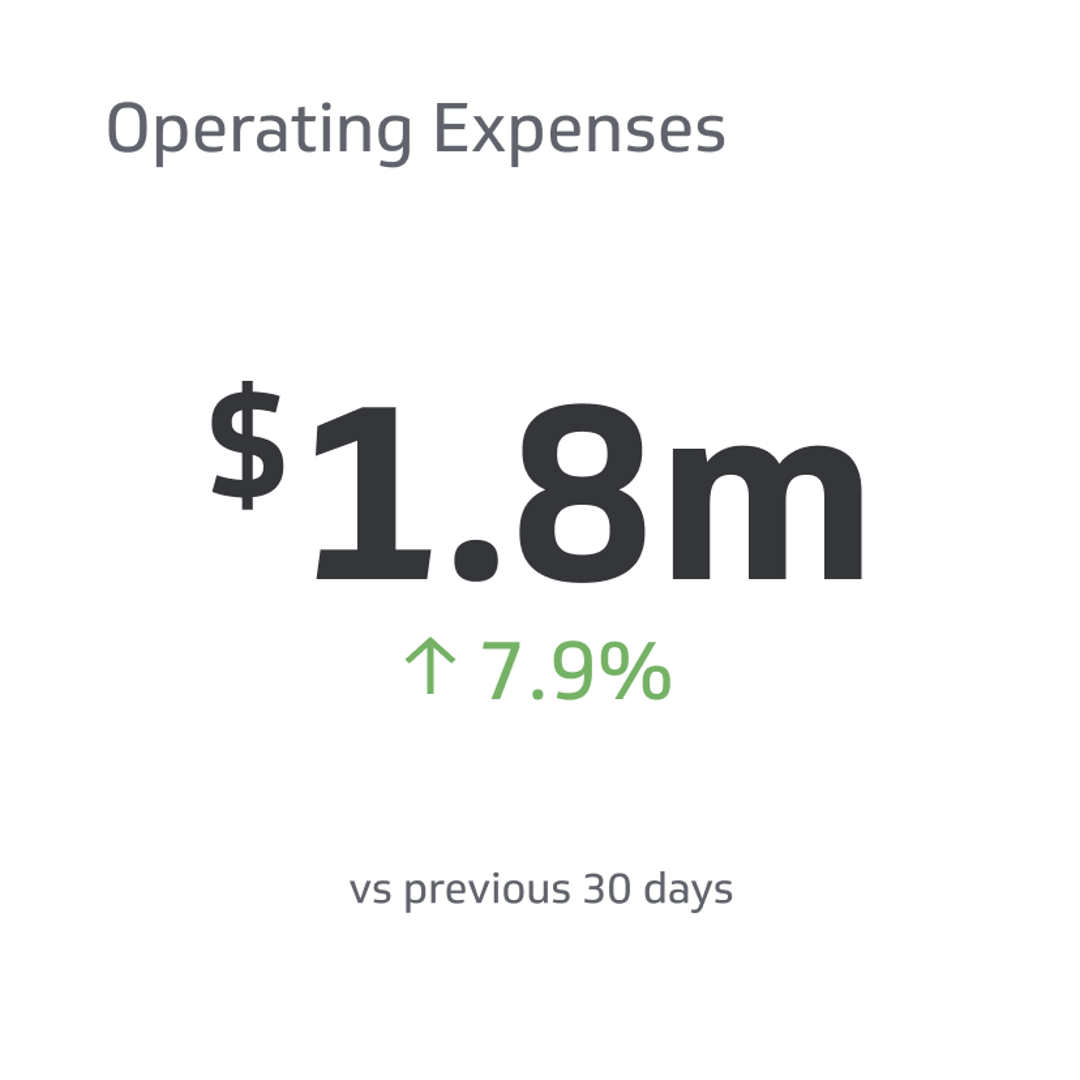

Operating Expenses (OPEX)

Operating expenses, or OPEX, are expenditures a business incurs as part of its normal day-to-day operations, such as rent, travel, utilities, salaries, office supplies, maintenance and repairs, property taxes, and depreciation.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In today's competitive business landscape, understanding and managing operating expenses is crucial for a company's financial success and sustainability. They are essential to the income statement, reflecting the costs incurred to sustain day-to-day operations and generate revenue.

In this article, we’ll explore the world of operating expenses—examining their definition, scope, and various examples that can impact your bottom line.

What Are Operating Expenses?

Operating expenses, or OPEX, are expenditures a business incurs as part of its normal day-to-day operations, such as rent, travel, utilities, salaries, office supplies, maintenance and repairs, property taxes, and depreciation.

These expenditures are necessary to maintain a company's functionality and ensure consistent performance over time.

Difference between Fixed, Variable, and Semi-Variable operating expenses

Operating expenses can be categorized into three main types: fixed, variable, and semi-variable.

Fixed operating expenses are consistent costs that don't change regardless of a company's production level or sales volume. Examples include rent payments for office space, property taxes, and insurance premiums.

On the other hand, variable operating expenses change in direct proportion to fluctuations in production or sales volume.

For example, as a company produces more goods or services, its utility bills or material costs will increase accordingly. Similarly, if the output goes down, these costs decrease.

Semi-variable operating expenses exhibit both fixed and variable expense characteristics—they remain constant up to certain production levels.

However, they may vary beyond that point due to factors such as overtime pay for employees who work beyond standard hours during peak seasons.

Importance of managing operating expenses

Effectively managing operating expenses is a critical component of maintaining strong financial health and ensuring the long-term success of any business.

Companies can optimize their resources by closely monitoring and controlling expenditures to generate greater profit margins and invest in growth opportunities.

Moreover, thorough tracking and analysis of operating expenses allow businesses to make data-driven decisions regarding staffing levels, marketing strategies, and budget allocations.

This proactive approach prevents unnecessary spending and creates a sharper focus on achieving strategic goals while remaining competitive within the market.

Examples of Operating Expenses

The following are a few examples of operating expenses that businesses commonly incur in their day-to-day operations.

Rent and lease payments

Rent and lease payments refer to the cost of renting or leasing office space, equipment, or other assets needed for business operations.

For instance, a business owner leasing an office space may have to pay $3,000 per month, irrespective of whether the business makes any profits during that time. Although this cost can be significant, it's necessary for normal business operations.

Wages and salaries

Wages and salaries include the compensation paid to employees, such as regular staff members, managers, and executives.

Employee salaries can be fixed or variable, depending on their roles and responsibilities within the company.

Aside from ensuring that employee pay aligns with industry standards and fair labor practices, companies must also ensure that payroll aligns with its budgetary constraints.

Utilities and maintenance costs

Utilities and maintenance costs include expenses associated with electricity, water, gas, and other essential services needed to operate a business daily.

Companies can reduce these expenses by implementing energy-efficient practices such as switching to LED light bulbs or addressing air leaks in windows and doors that contribute to unnecessary heating and cooling costs.

Marketing and advertising expenses

Marketing and advertising expenses can include online ads, social media campaigns, direct mailers, billboards, and other forms of promotion.

To manage these expenses effectively, businesses should focus on ROI (return on investment) by tracking the effectiveness of each campaign. They can do this using tools such as Google Analytics or hiring a digital marketing agency specializing in data analysis.

Office supplies and inventory

Office supplies and inventory are essential components of a company's operating expenses. These costs include paper, pens, printer ink, toner cartridges, file folders, staplers, and other office-related items that help keep the business running smoothly.

Consider implementing an inventory tracking system to monitor usage levels in real time and ensure that orders for new supplies are placed promptly before stocks run out.

This approach helps reduce waste while keeping operating expenses within budget limits without compromising quality or productivity in everyday business operations.

Managing Operating Expenses

Below are some tips for effectively managing operating expenses to optimize your business's financial resources and drive long-term profitability.

Conducting regular expense audits to identify cost-saving opportunities

One way to manage operating expenses is to conduct regular expense audits. By reviewing these expenses periodically, businesses can identify cost-saving opportunities and reduce unnecessary expenditures.

Businesses can start by analyzing costs such as rent, travel, utilities, salaries, office supplies, maintenance and repairs, property taxes, and depreciation.

It's important to understand where the money is being spent and how it impacts the business's bottom line.

For instance, a review of advertising or marketing expenses may reveal that social media advertising has a higher ROI than traditional print or television commercials.

This knowledge allows businesses to redirect funds towards more profitable areas while at the same time reducing wasteful spending.

Implementing cost-cutting measures without compromising quality

Companies should also implement cost-cutting measures without compromising quality. This involves identifying areas where expenses can be reduced without negatively impacting business operations or customer satisfaction.

Managing operating expenses requires a strategic approach that balances cost reduction with maintaining operational efficiency and quality standards.

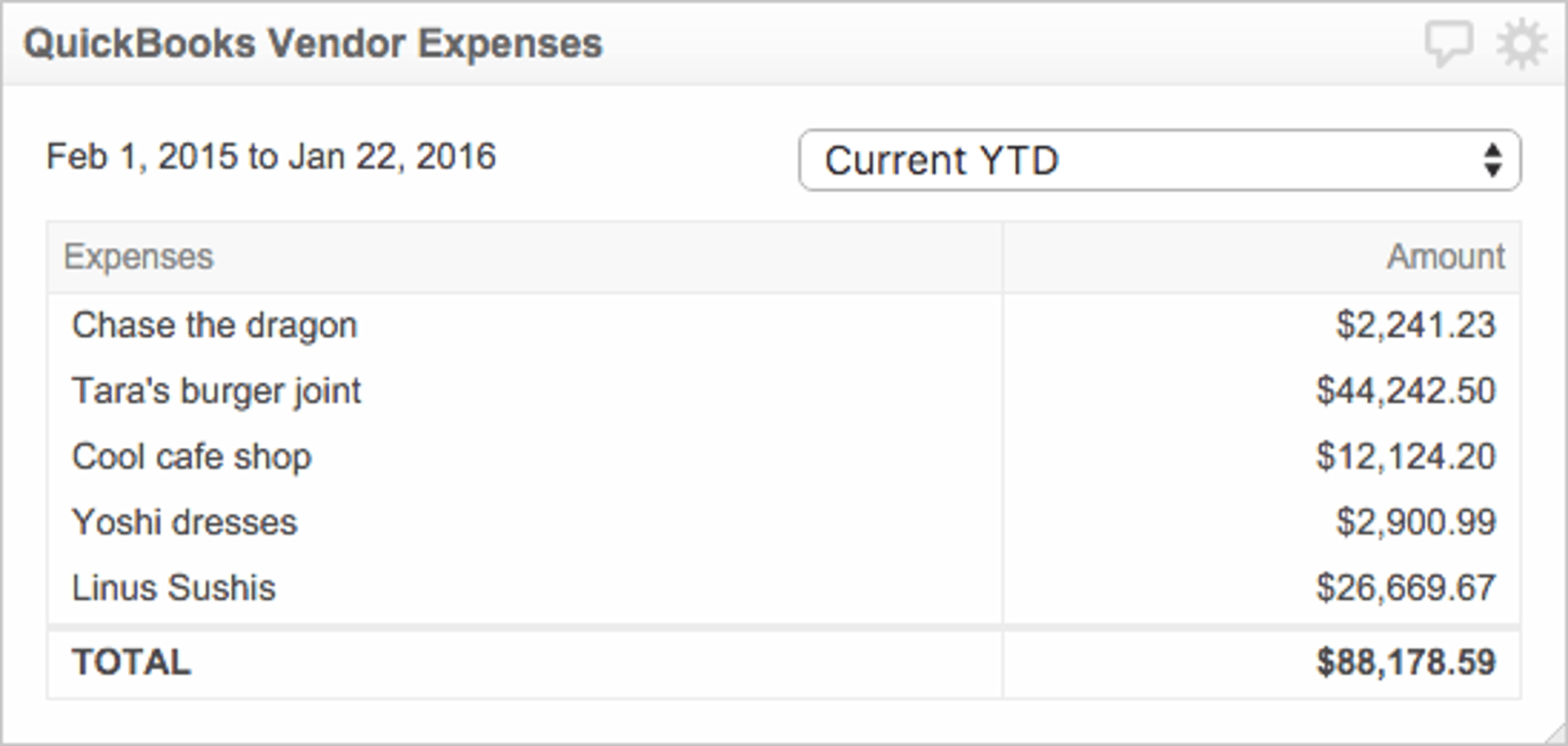

Renegotiating vendor contracts to get better deals and save money

Businesses rely heavily on suppliers for various goods and services, from raw materials to office supplies, so it's essential to negotiate the best possible terms.

When renegotiating vendor contracts, businesses can request discounts or bulk pricing based on their purchasing volume.

For example, if a company spends a significant amount on marketing and advertising expenses with an agency, it could negotiate lower rates by committing to a more extended contract period or agreeing to pay more overall for discounted prices.

Reducing energy consumption and environmental footprint

Reducing energy consumption and minimizing the environmental footprint saves money on utility bills and promotes a sustainable, eco-friendly brand image for the company.

Simple measures can make a significant impact over time. These measures include turning off lights and electronics when not in use, using energy-efficient appliances, and shifting to renewable energy sources such as solar power.

Additionally, companies can invest in green technologies that reduce waste generation or emissions, such as recycling programs or electric vehicles for transportation.

According to recent studies, implementing environmentally-conscious practices has become increasingly important for consumers willing to pay more for sustainable products and services.

In fact, around 70% of consumers say they consider a company's social and environmental involvements when making purchasing decisions.

Outsourcing certain tasks to third-party providers

Outsourcing specific tasks to third-party providers can be an effective way for businesses to manage their operating expenses. For example, a company may outsource its IT support or accounting functions to a specialized provider rather than hiring in-house staff.

This eliminates the need for additional resources, such as office space and equipment, which can result in cost savings.

While outsourcing has many benefits, businesses also need to consider potential downsides. They must ensure that service level agreements are clearly defined and met by third-party providers so that quality does not suffer.

Moreover, businesses should weigh the costs of using external services against the benefits of having those functions performed in-house before deciding to outsource certain tasks.

Conclusion

Managing operating expenses is critical for the success of any business. They are the essential costs that companies incur to sustain their daily operations and generate revenue.

Regular audits and cost-cutting measures can help reduce unnecessary spending without compromising on the essentials.

By understanding operating expenses and how to manage them effectively, businesses can maximize their profits while maintaining quality products and services.

Related Metrics & KPIs