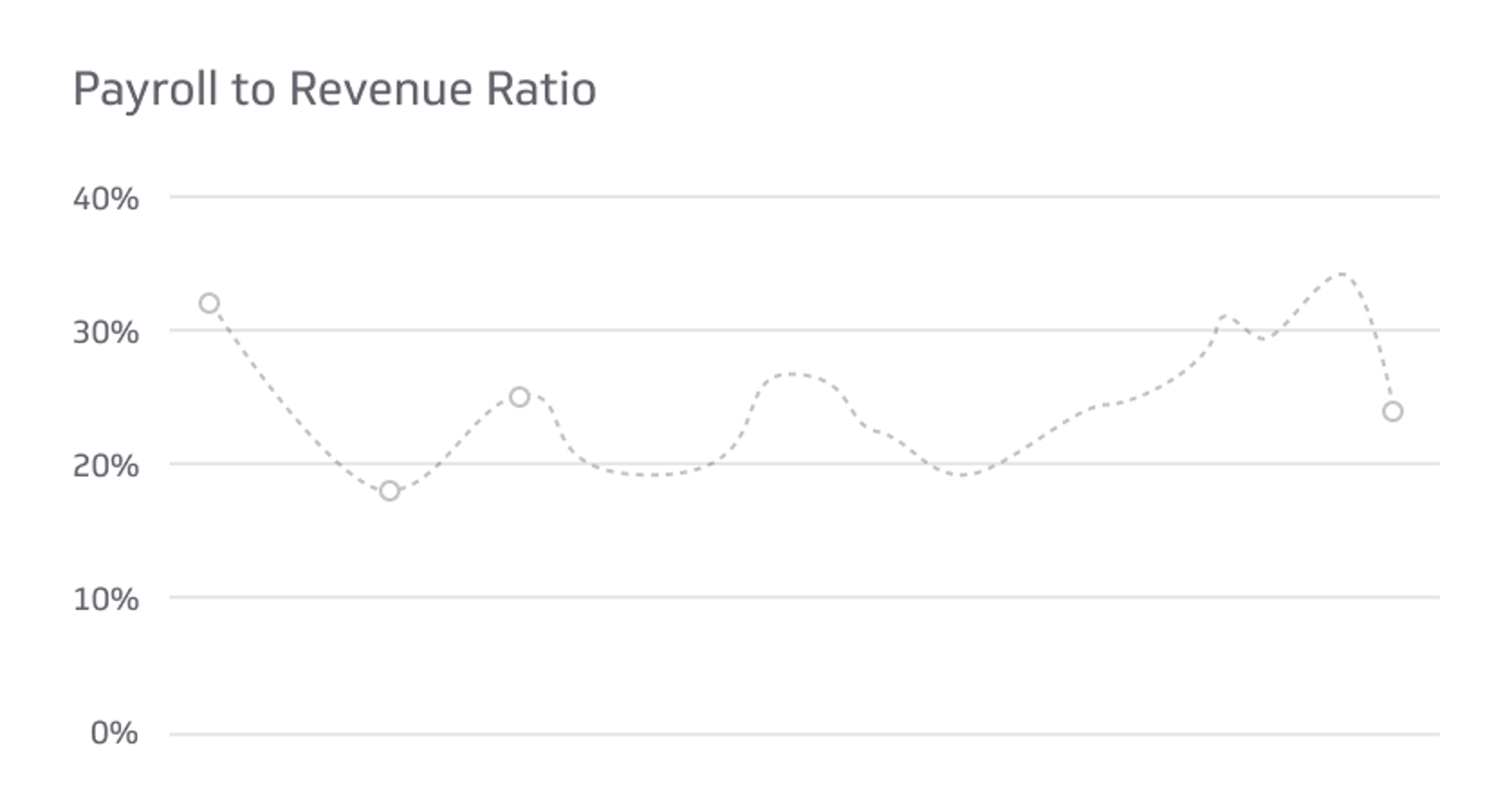

Payroll to Revenue Ratio

It is a financial metric measuring the proportion of a company's revenue allocated to employee wages and benefits.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

The Payroll to Revenue Ratio is a financial metric measuring the proportion of a company's revenue allocated to employee wages and benefits. The Payroll to Revenue Ratio is used by businesses and investors to assess labor costs and their impact on overall profitability. The ratio interpretation depends on the industry, company size, and specific business circumstances.

Below we highlight more details about this crucial accounting function and how it best serves others.

Requirements for Payroll to Revenue Ratio

The documentation requirements for calculating the Payroll to Revenue Ratio may vary depending on the specific needs of your organization or the jurisdiction you operate in. However, here are some common documents that are typically needed:

- Payroll Records: Maintain accurate records of employee wages, salaries, bonuses, commissions, benefits, and any other compensation-related expenses. This includes individual employee records and summaries of total payroll expenses.

- Revenue Records: Keep track of all sources of income, including sales revenue, service fees, and other operating revenues. This may include sales invoices, financial statements, bank statements, or other relevant documents that provide evidence of revenue generated.

- Payroll Tax Reports: Maintain records of payroll tax filings, such as Form 941 (Employer's Quarterly Federal Tax Return) in the United States or any other applicable payroll tax reports specific to your jurisdiction. These documents help verify the accuracy of payroll expenses.

- Employee Contracts and Agreements: Maintain copies of employment contracts, offer letters, and any other agreements related to employee compensation. These documents may contain details about salary, benefits, commissions, or other relevant information.

- Benefits and Deduction Records: Keep records of employee benefits, such as health insurance, retirement contributions, and other deductions from employee paychecks. These records help ensure accurate calculation of total payroll expenses.

- Timekeeping and Attendance Records: Maintain accurate timekeeping and attendance records to calculate employee working hours, overtime hours, and other relevant factors contributing to payroll expenses.

- General Ledger and Financial Statements: Keep track of financial statements, including the general ledger, income statement, and balance sheet. These documents provide an overview of your organization's financial performance and help validate revenue figures used in the calculation.

It's essential to consult with your organization's finance or accounting department and local regulatory authorities to ensure compliance with specific documentation requirements in your jurisdiction.

How Do You Calculate Payroll to Revenue Ratio?

When figuring out a business's Payroll to Revenue Ratio, you only need a few key elements before inputting them into a simple formula. The process can be completed in just a few moments as long as you have the correct documentation in line, as referenced above.

This particular calculation is done by dividing the total payroll expenses by the total revenue generated during a specific period and expressing it as a percentage. The formula for calculating the Payroll to Revenue Ratio is as follows:

Payroll to Revenue Ratio = (Total Payroll Expenses / Total Revenue) x 100

For example, if a company's total payroll expenses for a year amount to $1,000,000 and its total revenue for the same period is $5,000,000, the Payroll to Revenue Ratio would be:

($1,000,000 / $5,000,000) x 100 = 20%

This means 20% of the company's revenue is spent on payroll expenses.

What Can You Decipher From the Payroll to Revenue Ratio?

The Payroll to Revenue Ratio provides insights into the relationship between a company's payroll expenses and its revenue. Here are some key observations that can be made from the ratio:

Labor Cost Efficiency

The ratio helps evaluate how efficiently a company manages its labor costs. A lower ratio indicates that a smaller portion of revenue is allocated to payroll expenses, suggesting that the company is effectively controlling labor costs and potentially operating with higher profitability.

Labor Intensity

A higher Payroll to Revenue Ratio indicates that a more significant portion of revenue is spent on employee compensation. This could imply that the company has a labor-intensive business model where significant human resources are required to generate revenue. Industries such as healthcare, hospitality, and manufacturing tend to have higher labor intensity.

Profitability Impact

The ratio helps assess the impact of labor costs on profitability. A higher ratio suggests that a substantial portion of revenue is dedicated to payroll expenses, which can potentially reduce profitability. Conversely, a lower ratio indicates that the company is retaining a larger share of revenue after accounting for labor costs.

Cost Management

Monitoring changes in the Payroll to Revenue Ratio over time can provide insights into a company's cost management efforts. If the ratio increases, it may indicate rising labor costs or a decrease in revenue growth relative to payroll expenses. On the other hand, a decreasing ratio may suggest successful cost control measures or revenue growth outpacing labor costs.

Industry Comparison

Comparing the Payroll to Revenue Ratio with industry benchmarks can provide context for evaluating a company's performance. Different industries have varying labor cost structures, and comparing ratios within the same industry can help identify companies that may be more efficient in managing labor costs.

What Ratio Should Businesses Aim For?

While there is no universally defined percentage for a "good" Payroll to Revenue Ratio, a commonly cited guideline is that labor costs should ideally account for 15-30% of total revenue. This range provides a general framework for assessing the proportion of revenue allocated to payroll expenses.

A high Payroll to Revenue Ratio means that a significant proportion of a company's revenue is allocated to payroll expenses. This indicates that labor costs consume a substantial portion of the company's earnings.

A low Payroll to Revenue Ratio means a relatively small proportion of a company's revenue is allocated to payroll expenses. This indicates that the company is able to control labor costs effectively and retain a larger share of its revenue for other purposes.

Frequently Asked Questions

There are many questions surrounding a Payroll to Revenue Ratio. Below we highlight some of the most common.

What percentage of payroll should a company have?

The percentage of payroll a company should have can vary depending on various factors, including industry, company size, business model, and specific goals. However, many industries believe the maximum amount should hover around 30%. Others believe that payroll should be the bulk of outgoing resources.

What is the payroll ratio to employees?

The payroll ratio to employees refers to the amount of payroll expenses incurred by a company per employee. It is calculated by dividing the total payroll expenses by the number of employees. The payroll ratio to employees provides insights into the average labor cost for each company employee.

What is the employee vs. revenue ratio?

The employee vs. revenue ratio, also known as the revenue per employee ratio, is a financial metric formula that measures the revenue generated by a company per employee. This function provides insights into the productivity and efficiency of a company's workforce when it comes to generating revenue.

Final Thoughts

The Payroll to Revenue ratio and the Employee vs. Revenue ratio are two of the most important financial metrics that provide valuable insights into a company's financial performance and labor management.

While there are no universally defined thresholds or percentages for what constitutes a "good" ratio, it is essential for businesses to evaluate these ratios in the context of their industry, business model, and specific goals.

Related Metrics & KPIs