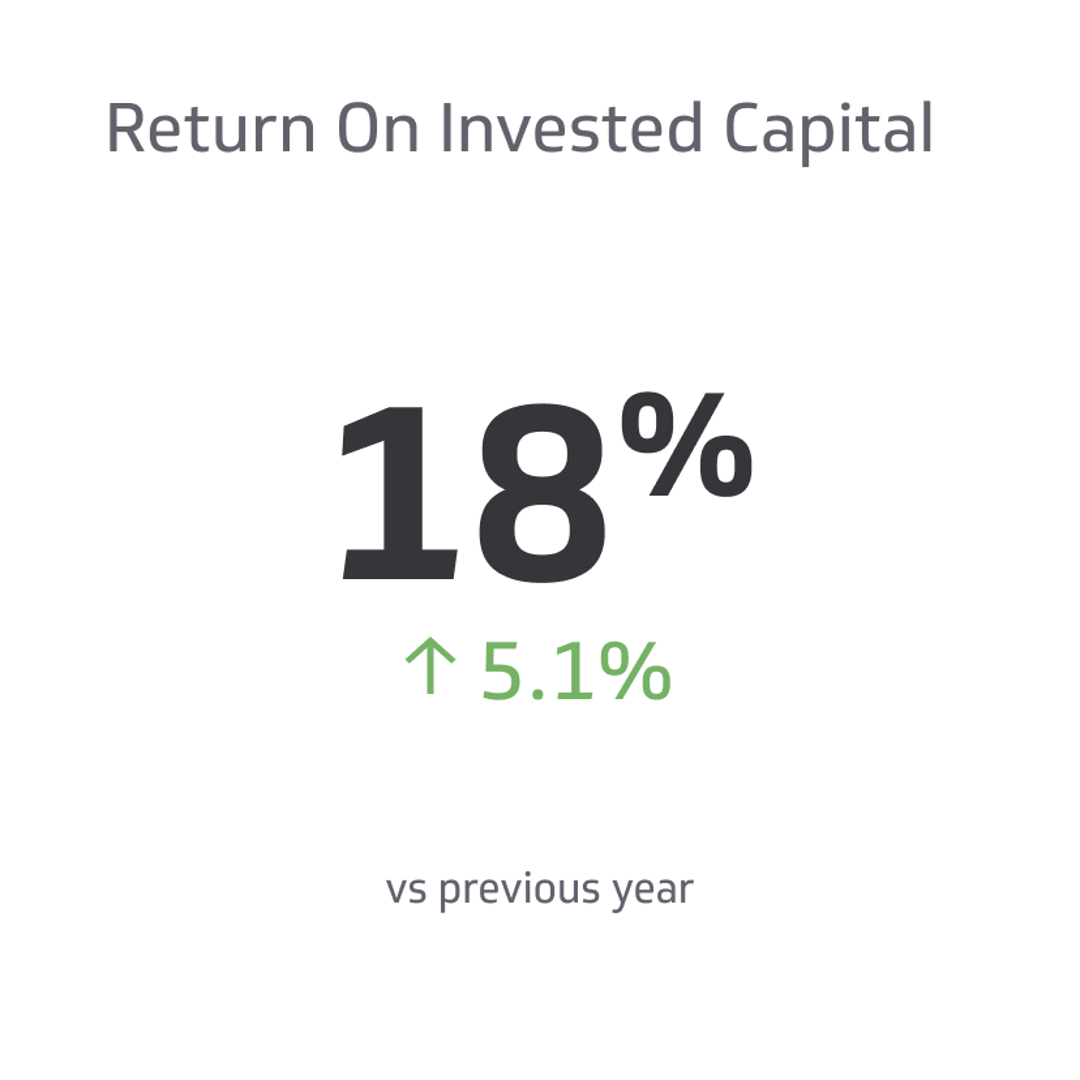

Return On Invested Capital (ROIC)

Return on invested capital refers to how much money a business makes compared to how much it receives from investors.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Return on invested capital (ROIC) is a formula that lets you see what assists you as you work with investors. To remain efficient and see what you can make, you must understand the formula, look into examples, and learn how to calculate it.

You’ll enjoy multiple benefits that make a return on invested capital worthwhile if you understand how it works. That way, you can effectively track what you make and see what you can adjust regarding your business to keep your investors happy or to help you succeed if you invest.

Defining Return On Invested Capital

To keep it simple, return on invested capital refers to how much money a business makes compared to how much it receives from investors. Either the companies themselves can calculate it and show investors, or investors can compare it to the money they receive back.

The calculation gives them an idea of how much value they get from the capital since the ROIC gives them a ratio. So, for example, if it comes back as a two, they earn two dollars for every dollar they spend on the company, which can be an incredible return for others.

Return on invested capital remains vital on both ends since it keeps both parties informed while reassuring them of the business relationship. However, they must consider multiple steps to effectively calculate ROIC and understand what it means for both sides of the business relationship.

The ROIC Formula

You’ll need to follow multiple formulas to calculate your ROIC since you must perform other calculations before determining it.

- After-tax income is one minus the tax rate multiplied by operating revenue.

- Invested capital is liabilities minus short-term debt, then total assets minus liabilities.

- ROIC is after-tax income divided by invested capital.

How To Calculate ROIC

To calculate ROIC, you must use the above formulas in that order. First, you must calculate the after-tax income to know how much a business makes. You then find out the invested capital to see how much money the investor put into the business.

At this point, you can divide the after-tax income by the invested capital to determine the ratio. If you prefer percentages, you can multiply the ratio by 100, letting you know how much of a return you got from your investment.

For example, if you get a two as your ROIC and multiply it by 100, you’ll realize you made 200 percent of the money you invested into the company.

So with those steps in mind, you must calculate the after-tax income, then the invested capital, and you can use those two points to calculate the ROIC.

If you want a long-form version of the calculation to have in one spot, you can use the following formula:

ROIC = [operating income x (1 - tax rate)] / [total assets - (liabilities - short-term loans)]

Examples of ROIC

Now that you understand how to calculate ROIC, you can see an example to learn how to go through the process. You can look into instances of companies using the information to make investment decisions while also seeing how businesses can gain investments through ROIC.

Calculation Example

For the after-tax income, you may have 100,000 as your operating income and a tax rate of 10 percent, or 0.1. You’d minus the one from the 0.1 and get 0.9. So you should multiply 100,000 by 0.9 to get an after-tax income of 90,000.

You must calculate invested capital to have 60,000 total assets, 11,000 current liabilities, and 1,000 short-term debt. You should minus the 1,000 from the 11,000 to get 10,000, and then minus the 10,000 from the 60,000 to get 50,000 invested capital.

At this point, you must finish the equation by dividing 90,000 by 50,000, equaling 1.8. This formula gives you a 1.8-to-1 ratio, meaning the company made one dollar and 80 cents for every dollar it spent from the invested capital, or a 180 percent return.

While it may not be the highest ROIC ratio, it does reassure the company that the business makes money, so the amount earned depends on the scenario and situation.

A Positive Experience

With that in mind, you may run a software development company, so you need investors to give you money to help you create it. One investor gives you two million dollars to cover the costs. You spend the money developing the software, marketing, and selling it.

Once you finish everything and discover how much you made, you learn that you made four million dollars, meaning you made double what the investor gave you with a two-to-one ratio. This technique allows you and the investor to profit from the software, making it ideal for everyone.

On top of that, you had a ratio of 1.5-to-1 in the past, so the investor sees that you improved the model and made more money. This incentive encourages them to keep working with you, so you can both profit and grow.

A Negative Experience

However, only some investments go well. For example, you may be an investor and put one million dollars into a shoe company. Once the company covers the costs and production and sells the shoes, they make about 500,000 dollars.

This fact puts you in a rough position since you don’t make back the money spent. Since you have a 0.5 ratio, you only got 50 percent of what you put into the company. To worsen the situation, you had a 0.75 ratio the previous year.

After you review the reports, you determine that the company doesn’t make enough money to make the investments worth it. You can use this information to understand that you can’t keep working with this company since you don’t get enough value from the investment.

While it may close one door, you know that you can find other companies needing investors and attempt to create a business relationship with those investors.

An Improving Experience

You can find yourself in another situation where you worked with a company with an ROIC of one-to-one, meaning the investor broke even. They may feel weary about working with your movie streaming company, but you talk with them and convince them to reinvest.

At this point, they cut down on the investment, giving you 500,000 this time instead of 750,000 since they don’t want to take unnecessary risks. So you take the money, use it to secure more rights, advertise your company, and find more subscribers.

As the months go on, you end up with an after-tax income of 750,000. That means the ROIC comes out to a 1.5-to-1 ratio, meaning you went from breaking even to a dollar and 50 cents for every dollar spent.

At this point, the investor sees you performing well and realizes your brand is growing and becoming more popular, so they invest more into your business.

Why ROIC Matters

As you understand ROIC and how it impacts your business, you’ll know why you should track it. You can also understand its importance if you work with a firm that invests in companies, so you’ll avoid losing money and can help everyone succeed.

It Measures Success for Both Sides

Whether you plan to invest or run a business, you can use ROIC to keep track of your success. For example, you can review the data and learn how your company performs, allowing you to make choices while using the information you receive.

As for the business side, you can show how you use the investor’s money wisely and make more money, reassuring the investors that they can work with you. It works well because it can show if the business succeeds while allowing the investor to see the data.

It works as a way to protect and reassure both parties, so investors know if they should stick with the company or work with someone else. The calculation allows both sides to see the success and maintain their business relationships with minimal concerns.

Identifying the Best Investment Options

If you use ROIC to track information, you can find the best investment options to help you find the diamonds among the bunch. In addition, many companies will want your attention and money, so you can use ROIC to help you go through them and see their previous results.

For example, you could request details about their previous earnings and similar information to see what they say. You can then review the pros and cons to determine if you should invest money into their business based on whether you think you’ll make money.

You must show why your business stands out from other options to receive money. Show your success and the projected earnings alongside similar data to demonstrate your business’ capabilities and secure a deal with an investor.

Making Better Decisions

An investment firm makes its money by investing, so it must seek companies that can make returns and show promise. That means they’ll want to identify red flags to avoid businesses that won’t give them the needed returns.

For example, if a business has a history of low ROIC, you know to only work with them if they give you a low-risk offer. On the other hand, a high ROIC can indicate that you should work with that business and see what they offer.

ROIC also matters since you can get a feel for how much they ask and the potential returns. You may remain open to assisting a smaller company with a lower ROIC if they don’t ask you for as much money, so keep these points in mind.

Conclusion

Now that you understand the return on invested capital, you can make better decisions regarding your business. Since you’ll see how you perform and keep track of the total money you make with the help of your investors, you can look into trends and make better decisions.

Working with investors comes down to understanding the market and identifying the best ways to make money.

As you remember those points and do your best to work with return on invested capital and track your information, you’ll minimize losses while maximizing your profits.

Related Metrics & KPIs