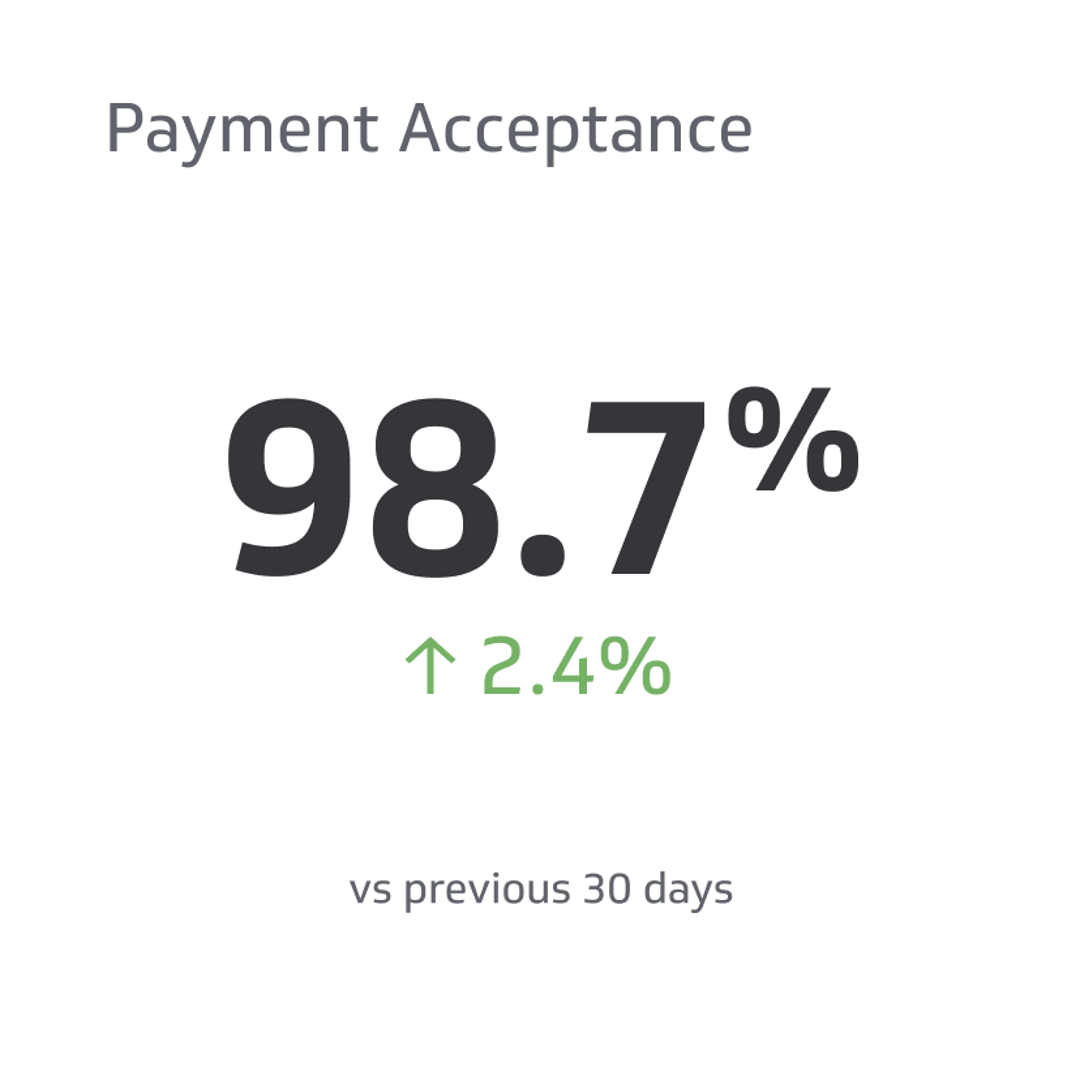

Payment Acceptance

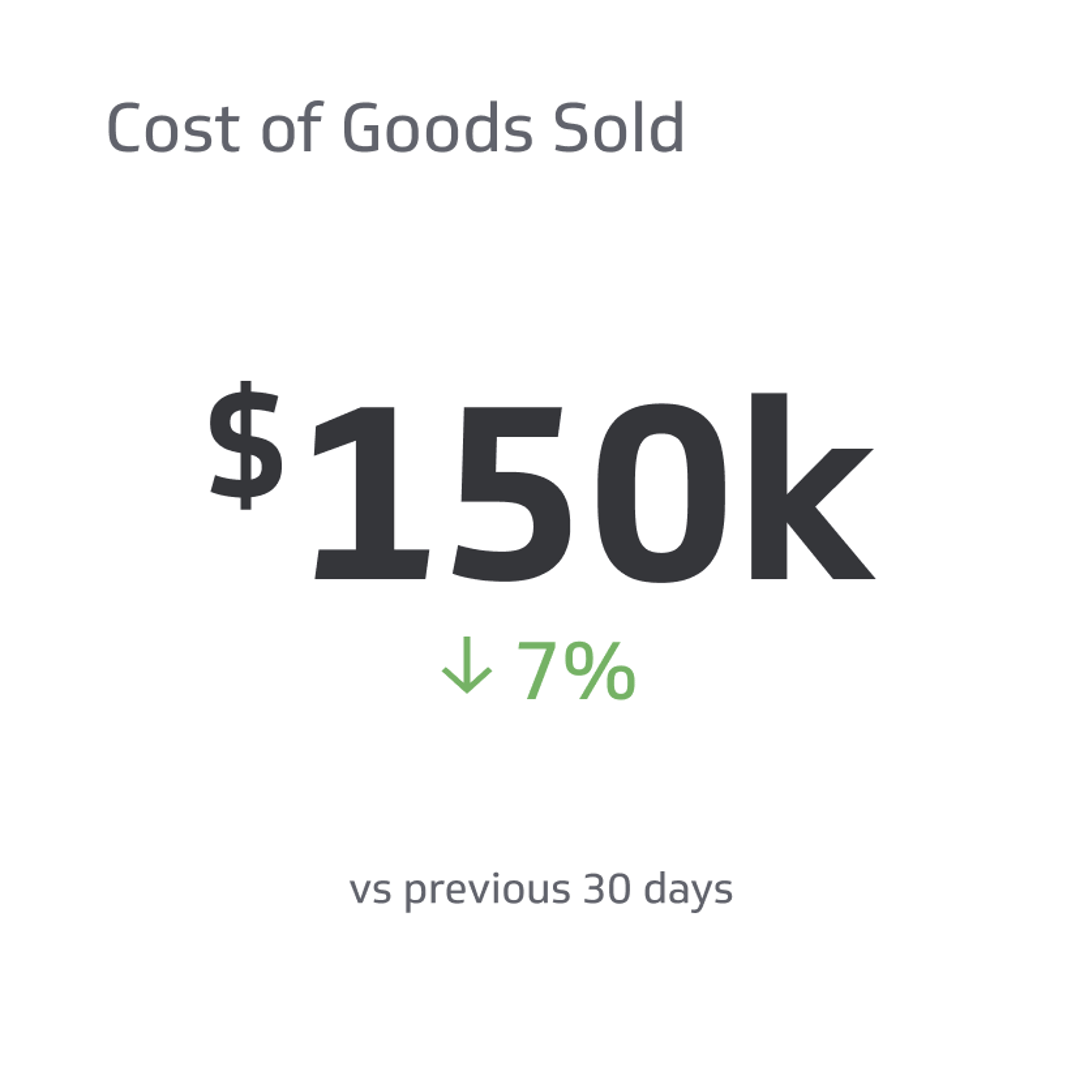

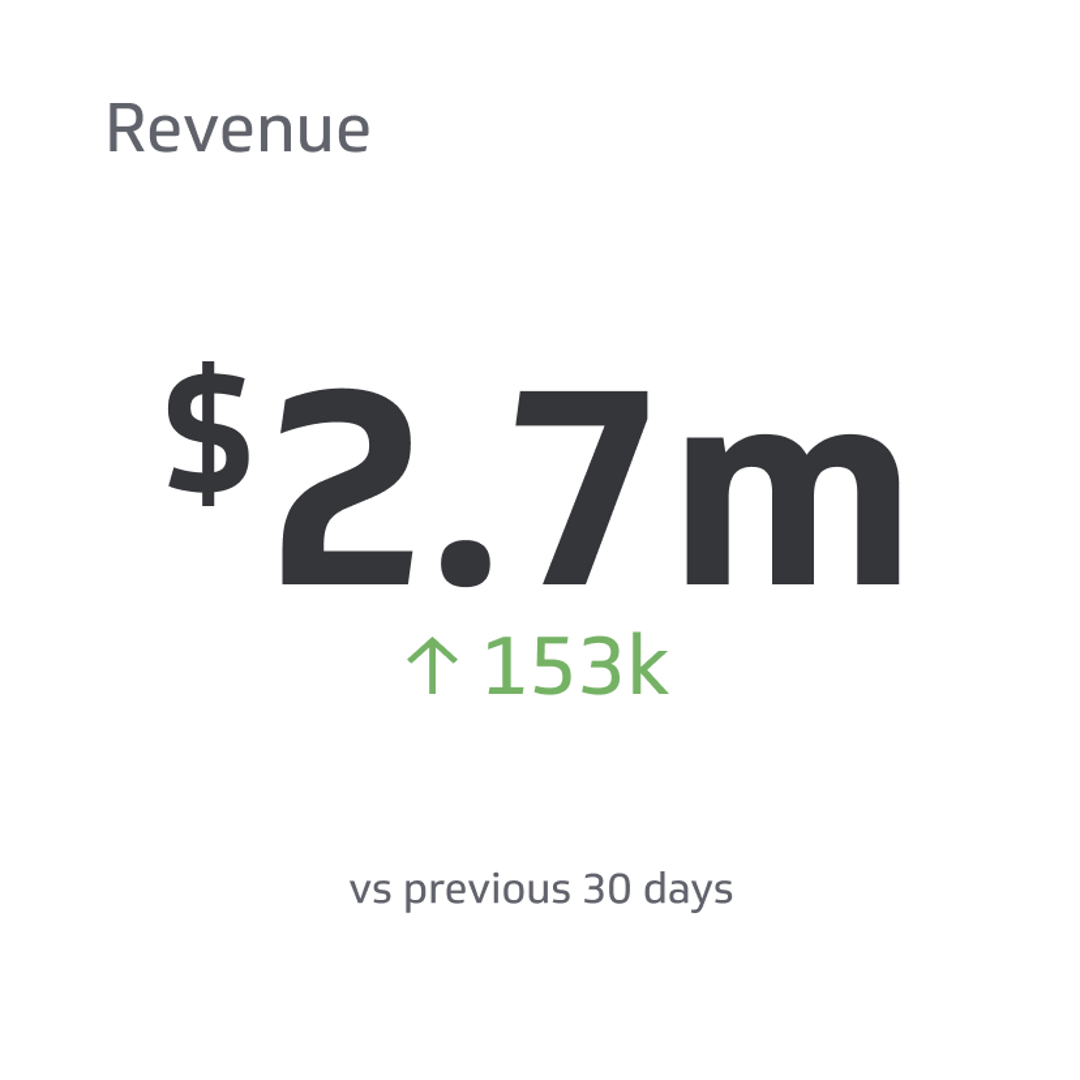

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

What Is Payment Acceptance?

Accepting payments is a crucial part of running a business. It speaks to a company's capacity to be paid by customers or clients for the products or services it offers.

Payment acceptance has grown even more crucial to business operations with the advent of digital transactions, especially for SaaS and e-commerce organizations.

A few factors that go into the process include the technology used to process payments. Tools include the types of payments received and the security precautions to safeguard the client and the business.

We'll explore each of these components in-depth and explain why payment acceptance is so crucial for businesses.

Technology Used for Payment Acceptance

In recent years, there has been a substantial advancement in the technology used to take payments. In the past, businesses would only accept payments in the form of cash or cheques.

Various technologies, including credit card terminals and mobile payments, are now available for businesses to collect payments owing to the rise of electronic payments.

Credit card machines are a popular option for businesses with a physical storefront. Another choice that has grown in popularity recently is mobile payments.

Customers can use mobile payments to make purchases using their cellphones by scanning a QR code or tapping the device on a payment terminal.

Online payment gateways are crucial for organizations that conduct their operations online. These gateways enable companies to receive payments from clients via credit cards or bank transfers even when they are not physically present.

Businesses can automate the payment process and minimize human data entry errors by integrating online payment gateways with e-commerce platforms.

Types of Payments Accepted

There are endless ways to pay for goods and services today. From cash and checks to credit cards, e-wallets, and mobile payments, the options can feel overwhelming.

But for businesses, the key to success is embracing this diversity and catering to the payment preferences of their customers.

Gone are the days when accepting only cash or checks would suffice. Customers now expect to be able to pay using their preferred method, whether it's a credit card, PayPal, or Apple Pay.

Providing multiple payment options allows businesses a seamless and convenient payment experience and avoids turning away potential customers.

But it's not just about accommodating the payment preferences of different age groups. It is also about embracing the global nature of business. Accepting international payments, for example, is crucial for companies that want to expand their reach and tap into new markets.

By accepting payment methods such as international wire transfers or cryptocurrencies, businesses can make it easier for customers worldwide to purchase their products or services.

Security Measures for Payment Acceptance

Security is one of the most important factors in accepting payments. Businesses that accept payments must take precautions against fraud and data breaches to safeguard both themselves and their clients.

Businesses must implement security measures like encryption, two-factor authentication, and fraud detection technologies.

Encryption is a vital safety precaution when accepting payments. It prevents illegal access by encrypting sensitive data, such as credit card details.

Another crucial security step is two-factor authentication, which requests two different pieces of identification from clients before they can proceed with a transaction.

Doing this helps prevent fraud by ensuring that only authorized users can make a payment.

Tools for detecting fraud also help companies that accept payments. These tools identify possible fraudulent transactions using machine learning algorithms and notify the company before the payment is made.

Businesses can safeguard themselves and their clients from fraudulent transactions.

Adherence to industry standards and rules is yet another step for payment acceptance. Businesses that accept payments are subject to severe rules and regulations to safeguard the privacy of their customers and avoid legal issues.

For instance, organizations that accept payments must uphold a secure network and safeguard cardholder data under the Payment Card Industry Data Security Standard (PCI DSS).

Such restrictions carry the risk of fines, legal repercussions, and reputational damage.

Importance of Payment Acceptance for Businesses

Payment acceptance is a convenience for customers and businesses to maintain their financial health and sustain growth. A lack of payment acceptance options can lead to lost sales, frustrated customers, and even reputational damage.

A critical aspect of payment acceptance is security. Customers want to know that their financial information is safe when making a purchase.

Security is especially important for businesses that handle sensitive data, such as medical or financial information. Implementing security measures, such as encryption and tokenization, can help protect the business and its customers from fraud and data breaches.

Moreover, a reliable payment processing system can help streamline business operations and improve efficiency.

By automating the payment process, businesses can free up time and resources to focus on other areas of their operations. Automated payment processes can lead to increased productivity, reduced administrative costs, and improved customer satisfaction.

For SaaS businesses, in particular, payment acceptance can ensure customer retention and growth. Recurring payments are the lifeblood of many SaaS companies, and any disruptions or delays in the payment process can lead to lost revenue and dissatisfied customers.

By implementing a robust and secure payment processing system, SaaS businesses can provide a seamless payment experience and build customer trust.

Wrapping Up

Payment acceptance may not be the most glamorous part of running a business, but it's certainly one of the most important.

It is a critical consideration for businesses, regardless of their size or industry, and makes the difference between a satisfied customer and one who takes their business elsewhere.

Payment acceptance is relevant for SaaS businesses, given their reliance on recurring payments. Ensuring that your business has a reliable and secure payment processing system will help you provide a seamless payment experience for your customers while also protecting your financial interests.

Related Metrics & KPIs