The Rule of 40

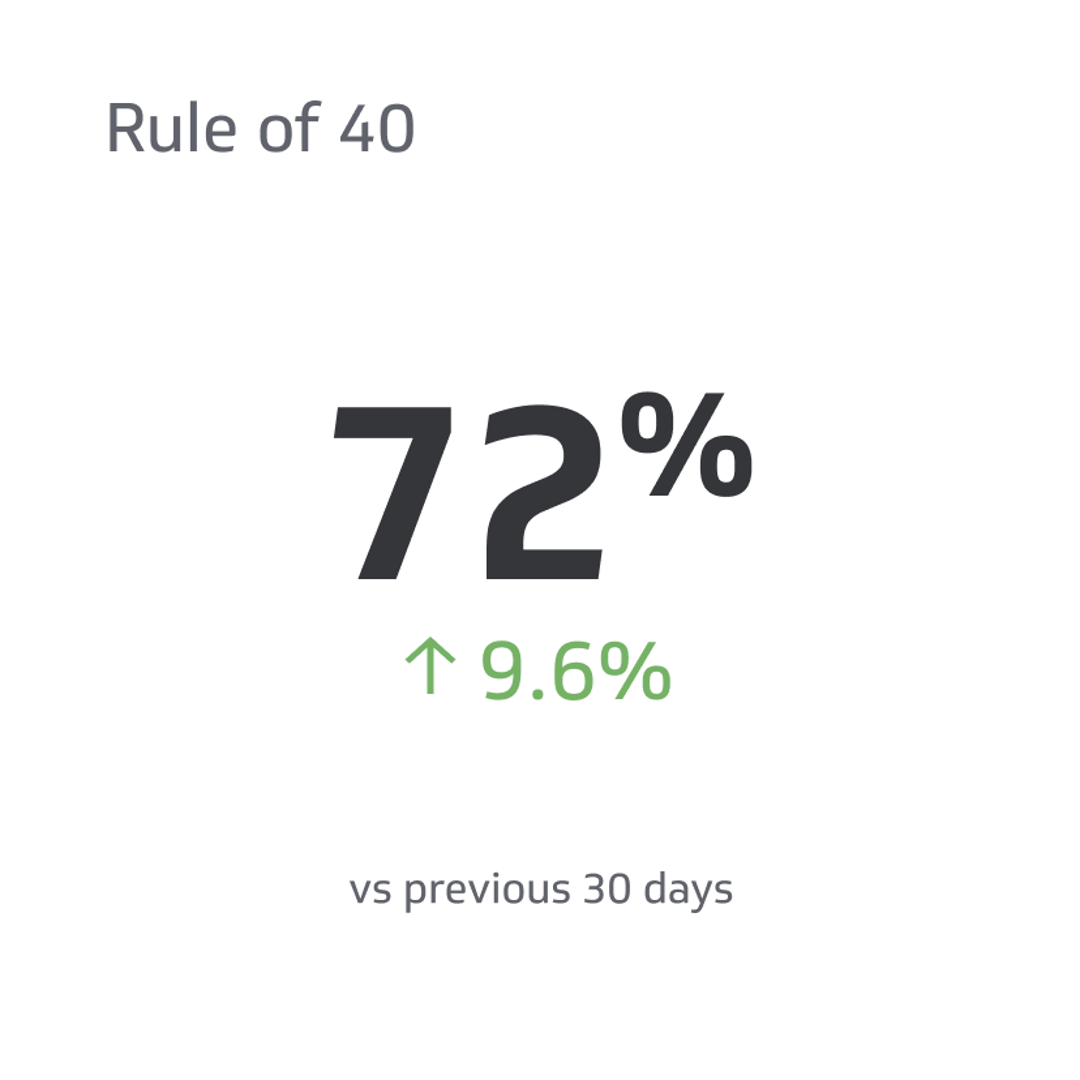

The Rule states that the sum of a SaaS company's annual revenue growth rate and profit margin should equal or exceed 40%.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

The Rule of 40 serves as a vital benchmark in the world of SaaS companies, offering a valuable perspective on their financial health and potential for growth.

This simple but powerful metric combines a company's annual revenue growth rate and profit margin to determine its investment attractiveness. But what makes the Rule of 40 so essential, and how do investors interpret its implications?

Join us as we explore the intricacies of this influential metric and learn how it shapes the SaaS industry's strategic landscape.

What Is The Rule of 40?

The Rule of 40 is a simple and widely used metric in the SaaS industry to assess a company's performance. The Rule states that the sum of a SaaS company's annual revenue growth rate and profit margin should equal or exceed 40%.

Calculating the Rule of 40 is straightforward, as it only requires adding the revenue growth rate and profit margin figures. This metric is a quick and easy way to gauge a SaaS company's financial health and growth potential.

It's worth noting that the Rule of 40 does not apply to companies outside the SaaS industry. Other industries have different performance metrics that reflect their respective profitability and growth standards.

The Investor Angle

The Rule of 40 is a helpful tool for investors seeking to evaluate the financial performance of software service companies. Such companies are known for having higher profit margins than many other industries, often exceeding 75% through margin alone.

This is because the cost of selling to 100,000 customers is not significantly higher than selling to 1000, especially if the system is automated and does not require active management. Additionally, partnering with the right hosting company easily facilitates purchasing additional server space.

Investors are often willing to overlook comparatively low-profit growth rates in software service companies if the profit margins are sufficiently high. Large profit margins give companies more flexibility to invest in further growth, which investors find appealing.

However, it's important to note that while SaaS companies can have high-profit margins, that's not always the case. In such cases, investors will look at the revenue growth rate, which broadly refers to how fast the software grows its user base or improves monetization for existing users.

Interestingly, even if a company's profit margins are small, sufficient growth can make it a more attractive investment opportunity. Investors often consider this because any software with a high growth rate likely has something inherently attractive to users. Therefore, both metrics - profit margins and revenue growth rate - appeal to investors, and it makes no sense to limit investment considerations to just one.

As a result, the Rule of 40 was created - a combined metric that looks at a company's overall profitability, regardless of whether it's coming from margin or growth. Essentially, if a company's growth rate and profit margin add up to 40 or more, it's considered a good investment opportunity.

Why You Should Use The Rule of 40

There are several reasons why you should consider using the Rule of 40 when evaluating SaaS companies.

Calculating Affordability

The Rule of 40 is a valuable SaaS metric for determining how much a company can invest in operations without making it less attractive to investors. When evaluating a SaaS company, the Rule of 40 considers both profit margins and revenue growth rate, offering a complete picture of its financial performance.

For instance, let's say you start with a 20% growth rate and a 20% profit margin. But then, you hire a skilled employee expected to improve its growth rate significantly. If the costs of hiring this employee bring down the profit margin from 20% to 10%, but the growth rate rises to 35%, the company still meets the Rule of 40.

However, if the employee underperforms and the growth rate is only 25%, the company no longer meets the Rule of 40, and it may be time to make some changes.

SaaS companies usually prioritize growth until they reach market saturation, at which point they shift their focus toward maximizing profit margins. They often use growth to increase the profit margin and then hire new employees or implement other strategies to improve growth further or raise the margin by more than the cost of hiring.

Once the software is fully developed, a SaaS company may run it in maintenance mode, reducing the need for developers and increasing the profit margin. This approach ensures that the company remains above the Rule of 40, even when growth is no longer feasible.

Decreasing Focus on Profit

If you're running a SaaS company, you may wonder whether it's wise to reduce your focus on profit. Although profit is usually the primary goal for most businesses, success in the SaaS industry typically requires getting the largest market share as quickly as possible to avoid losing customers to competitors.

Investors may be willing to accept negative profit if your company grows fast enough, as it's nearly impossible to fail at profiting from a sufficiently large user base. Therefore, spending two or three years building that base may be a sound investment before focusing on generating revenue.

To judge a SaaS company's success, both investors and company owners can use the Rule of 40, which looks beyond profit as the only metric. By solely focusing on profit, many SaaS companies may operate too conservatively to be successful.

Keep in mind that it can take around seven years for a SaaS company to reach profitability. Although it may earn revenue as early as the first year, realistically, it can take more than half a decade to hit an IPO. Early investors tolerate this timeline for companies with high growth and performance. So not needing to focus on profit allows a SaaS company to concentrate entirely on growth without worrying about expenses as long as investors find them reasonable.

Investment Quality Comparisons

Investors often like comparing opportunities, and the Rule of 40 serves as a valuable benchmark for investors to compare investment options.

One of the primary considerations when evaluating investments is value-creating growth. This term refers to a potential growth segment that exhibits a significant increase in both annual revenue and total shareholder return (TSR). Typically, investors are willing to accept a minimum of 2% growth in revenue and around 7% TSR.

However, if a company's TSR is closer to 20%, but its revenue growth is neutral or negative, then there's no actual growth occurring. Similarly, if a company's revenue growth is high, but its TSR is low or negative, then it's essentially value-destroying, and investors are understandably cautious. Ideally, investors prefer businesses with outstanding revenue growth and a high rate of return.

Nevertheless, most businesses fall somewhere in the middle of the growth and TSR spectrum, with moderate levels of around 15% in each. Profit margins can impact the payment of TSR, so a combined percentage exceeding 40% is usually desirable for investors.

However, remember that the Rule of 40 is not the only factor investors consider. Investors may still consider companies that fall below this benchmark, with around 30% being a hard cutoff for those attempting to minimize risk. While a 40% combined percentage is a goal worth striving for, it's not the end of the world for a company if it falls a little short for a time.

Changing Between Growth And Profitability

The Rule of 40 can make it easier to justify a high growth rate even with razor-thin profit margins. This is especially true if a company can easily shift from a growth-focused strategy to a profit-focused one whenever needed.

When it comes to investors, most are looking for a good return on their investment, but they can be patient if they believe the company is a safe place for their money. Therefore, if your company has a clear plan to increase profits whenever growth slows down, it can continue to grow until it reaches market saturation.

Even without having investors in the picture, though, this is an important consideration for companies. Infinite growth is not possible. At a certain point, you’ll reach every customer you realistically could, so pursuing growth makes no sense. So having the plan to step away from growth and become profitable without destroying your user base is always a good idea.

For instance, Meta (formerly known as Facebook) spent considerable time and resources on their Virtual Reality "Metaverse" concept, which ultimately turned out to be an unprofitable venture. They ultimately stepped away from that in early 2023.

Meta's VR system had several profit-driving elements, but the company did not focus enough on user growth to make these strategies effective. The key takeaway from Meta's experience is that focusing on profitability should only come when a company is ready for it.

When To Apply the Rule of 40

When starting a company, it may not be practical to apply the Rule of 40 right away. Realistically, you will have a lot of startup costs and minimal revenue until you can start getting your software out the door.

You’ll need exceptional growth, and you can’t expect that to happen before you have even a basic version of your software. It might be possible if you have enough high-profile investment in your basic idea, but most companies won’t.

Instead, you should start applying the Rule of 40 about the time you reach $1 million in annual recurring revenue. This is when most SaaS companies make enough revenue and growth to be serious contenders. A typical company can reach this in about five years, but some can achieve it sooner.

The Weighted Rule of 40

An alternative approach to the standard Rule of 40 is the weighted rule, which places greater emphasis on growth and less on profit margin. The calculation for the weighted rule is (1.33 x growth in revenue) x (0.67 x profit margin).

For instance, if a hypothetical company has a 12% growth in revenue and a 27% profit margin, it would have a score of 15.96 + 18.09 = 34.02% using the weighted rule. Although this is slightly below the score obtained through the standard Rule of 40, it is almost 6% lower when using the weighted calculation. As a result, the company may appear less attractive to investors.

Investors often prefer the weighted rule for smaller companies because it recognizes that growth is more important than profit margins at earlier stages. Additionally, the weighted rule encourages businesses to prioritize growth rather than treating it as equal to improvements in profit.

According to the Software Equity Group's analysis of the market in 2020, any company that performs well under the weighted rule has a significantly higher revenue multiple.

There’s also a reverse of the weighted rule, favoring profit margin over growth. Investors occasionally use this variant when focusing on mature companies. However, that’s rare because any well-established company has enough predictable returns that other calculations have minimal effect on investor decisions.

Frequently Asked Questions

Here are some other questions that people often have about the Rule of 40.

Where did the Rule of 40 come Can you be too far over the Rule of 40?

Yes, a company can be too far over the Rule of 40. In such cases, the company may need to consider changing its approach to increase its profits or explore investing in new projects.

While investors seek high returns, they also understand the importance of diversification in the SaaS industry. A company that solely relies on a single profitable software line may be vulnerable to market changes that could quickly make its software obsolete. A well-diversified company is considered more stable and, therefore, a better investment.

If a company has too much growth, some investors may demand it shift its focus to revenue. This does not mean abandoning growth altogether but instead finding a balance where the company has enough margin to operate without relying entirely on investor funds.

Should SaaS have higher growth or profit margin?

Whether a SaaS company should prioritize higher growth or profit margin largely depends on the stage of development.

In the initial years, prioritizing growth is generally more beneficial, even if it means operating at a negative profit. This approach can help acquire a larger user base, which sets the foundation for higher profits in the future.

However, it is better to focus on the profit margin for well-established companies with little or no room to grow with the same software. In such cases, the company can use some of its profits to support the growth of new software lines, if applicable.

When should a SaaS company stop focusing on growth?

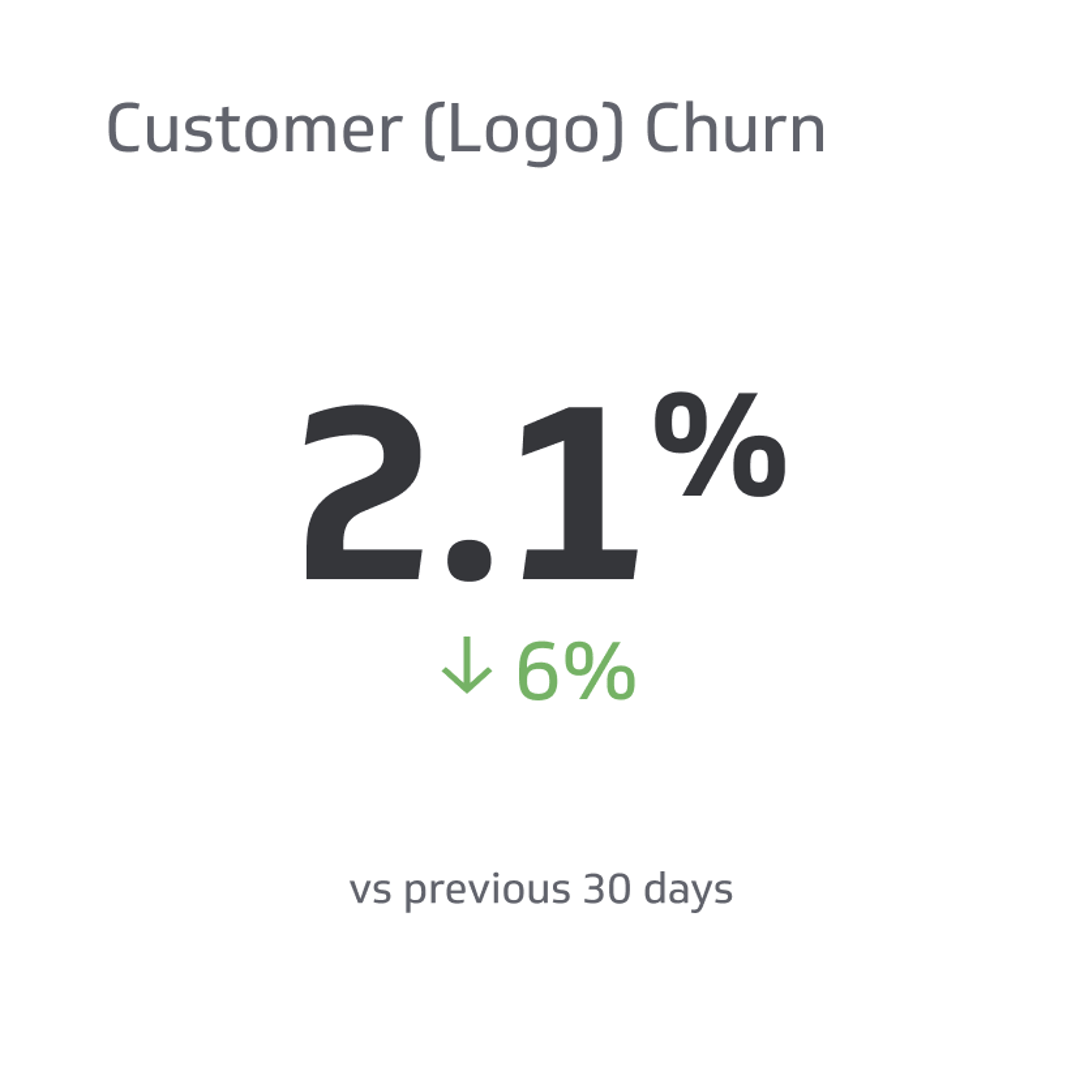

A SaaS company should shift its focus away from growth when it has reached a realistic market saturation point. It’s challenging to get every possible customer onto a platform, so a visible slowdown in growth is a clear indication to switch focus to revenue.

However, it's crucial to execute this transition in a manner that feels appropriate to the customers. If customers suddenly see their prices triple, that will push them away. However, if the company releases new features and services at a higher price point, many customers will accept that if they’re already invested in the software.

How many companies outperform the Rule of 40?

The number of SaaS companies that beat the Rule of 40 can vary significantly from year to year, depending on company strategies, investor demands, and market trends.

On average, around 40% of SaaS companies can achieve this goal in a given year, but less than half are likely to maintain this level of performance for more than three consecutive years.

Related Metrics & KPIs

.png)

Churn.png)