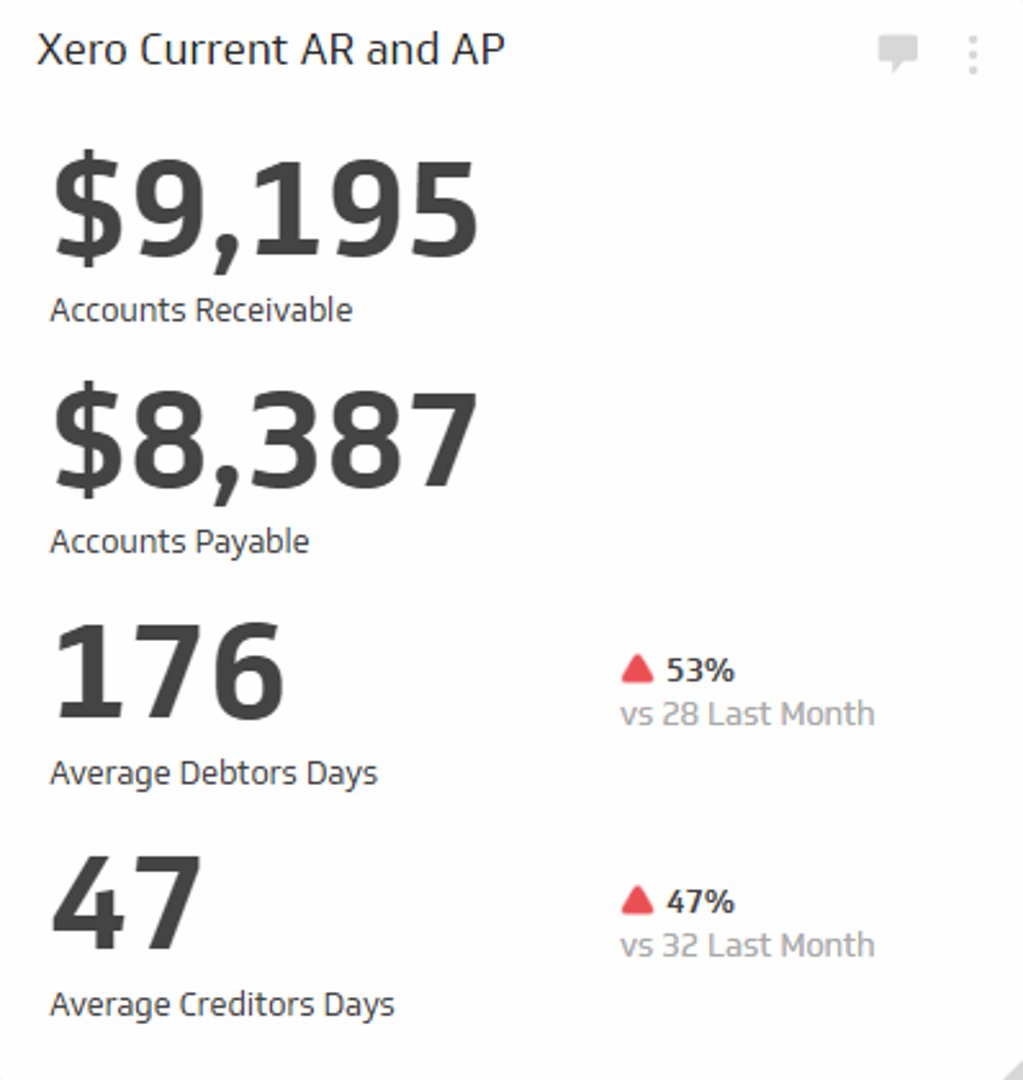

Accounts Payable vs Accounts Receivable

Easily track your accounts receivable and payable for the month

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Accounts Payable vs Accounts Receivable: What's The Difference?

Accounts Payable (AP) and Accounts Receivable (AR) are essential components of a company's financial management and accounting processes. Both terms refer to the money owed by or to a business, but they represent different aspects of the company's financial transactions.

What is Accounts Payable?

Accounts Payable refers to the money that a company owes to its suppliers, vendors, or other creditors for goods and services purchased on credit. AP represents a liability on the company's balance sheet, as it is an obligation that the business must fulfill by paying off its outstanding debts within a specified timeframe, usually according to the terms agreed upon with the supplier or creditor.

Managing Accounts Payable effectively is crucial for maintaining positive relationships with suppliers, ensuring timely payments, and avoiding late fees or penalties. To manage AP, businesses typically use software or tools to track, organize, and process payments, as well as to monitor cash flow, and maintain accurate financial records.

What is Accounts Receivable?

Accounts Receivable, on the other hand, refers to the money owed to a company by its customers for goods and services sold on credit. AR represents an asset on the company's balance sheet, as it is an amount that the business expects to receive from its customers within a specified timeframe, usually based on the agreed-upon payment terms.

Effectively managing Accounts Receivable is critical for maintaining a healthy cash flow, reducing the risk of bad debts, and ensuring that the company has sufficient funds to cover its operational expenses. To manage AR, businesses typically employ software or tools to track, organize, and process incoming payments, as well as monitor customer creditworthiness and maintain accurate financial records.

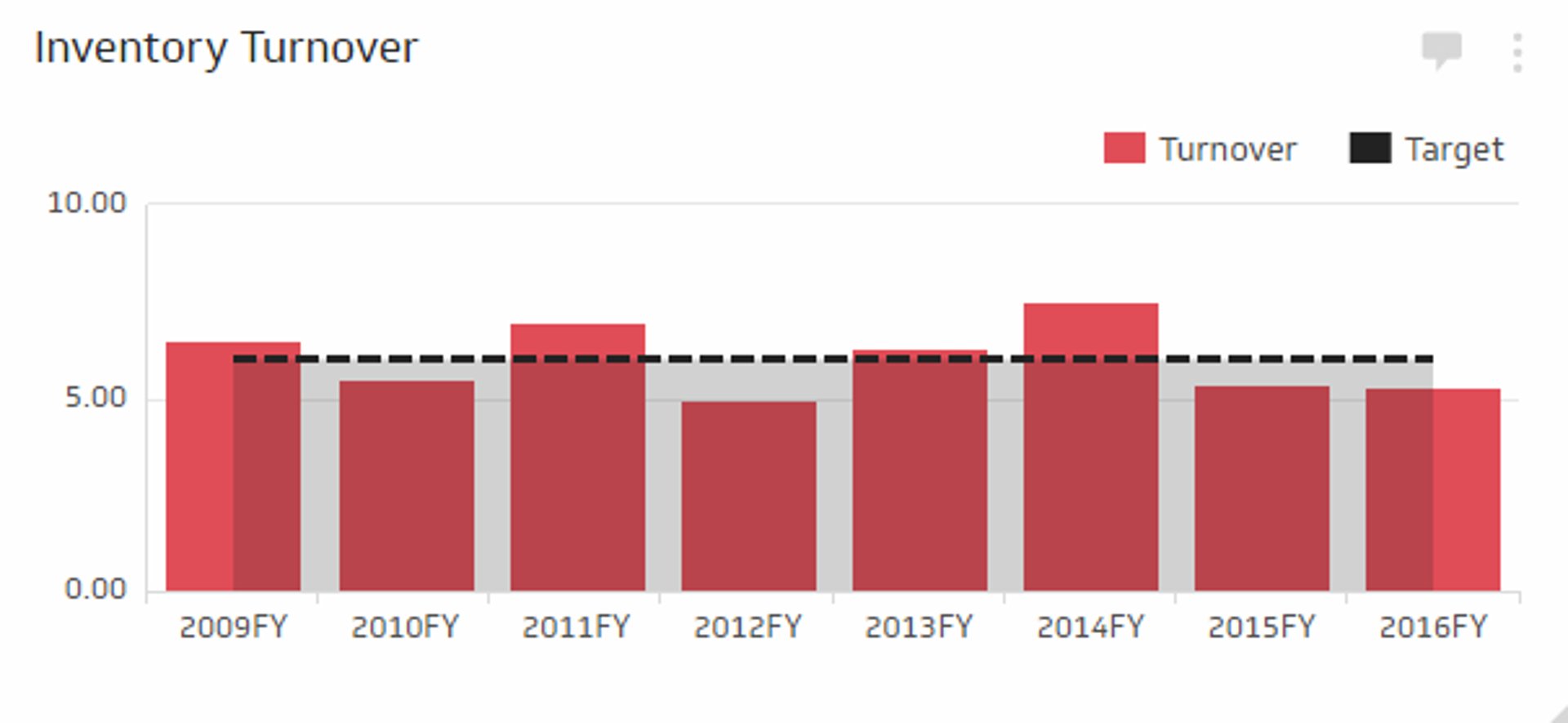

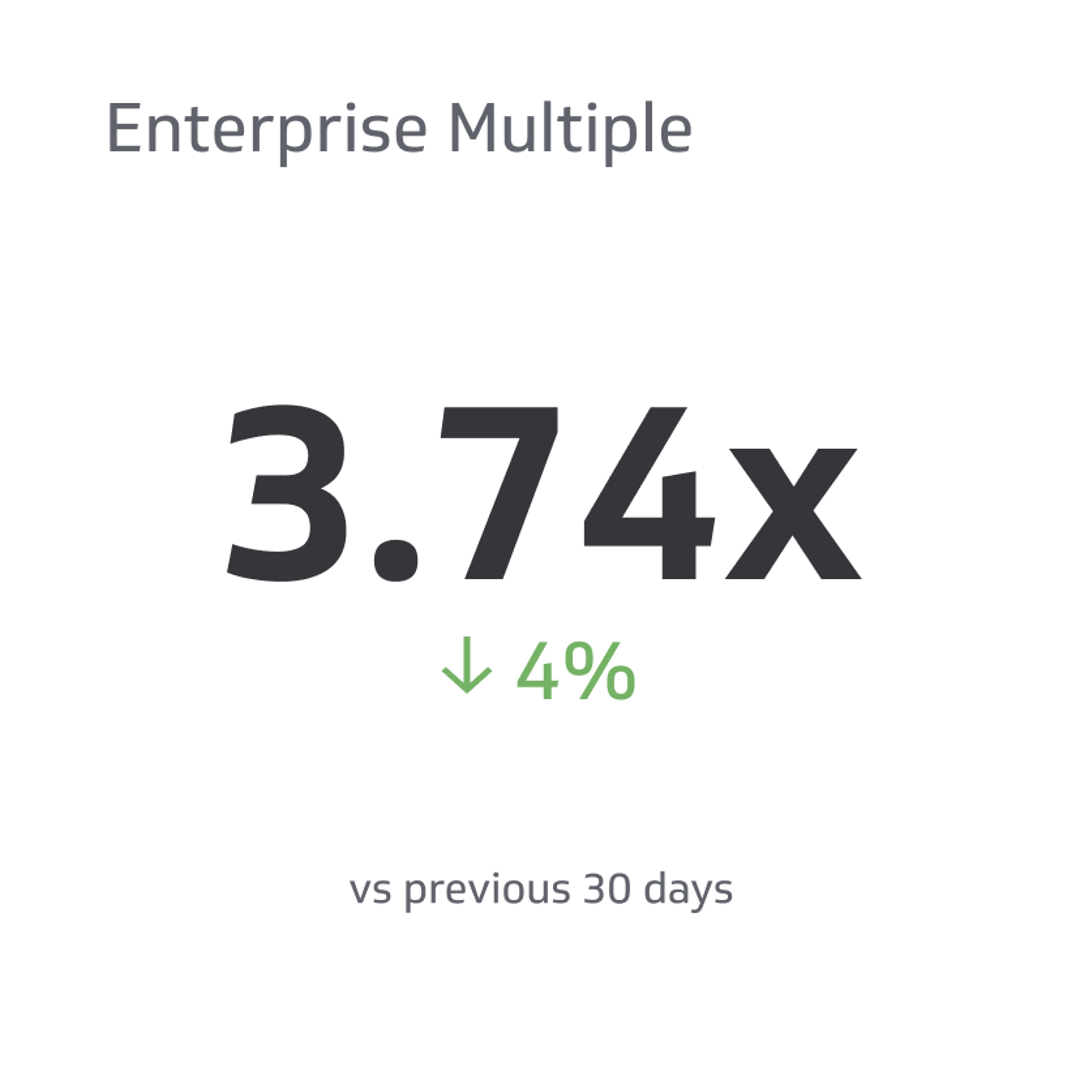

Monitoring Financial KPIs on a Dashboard

Once you have established benchmarks and targets for your Current Accounts Receivable and Accounts Payable, you’ll want to establish processes for monitoring this and other Financial KPIs. Dashboards can be critical in this regard. Read more

Related Metrics & KPIs