Profit and Loss (P&L) Metrics

Track your income, cost of sales, and operating expenses to calculate net profit

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Sign up with Google

or

Sign up with your emailFree for 14 days ● No credit card required

What are the Profit and Loss (P&L) Metrics?

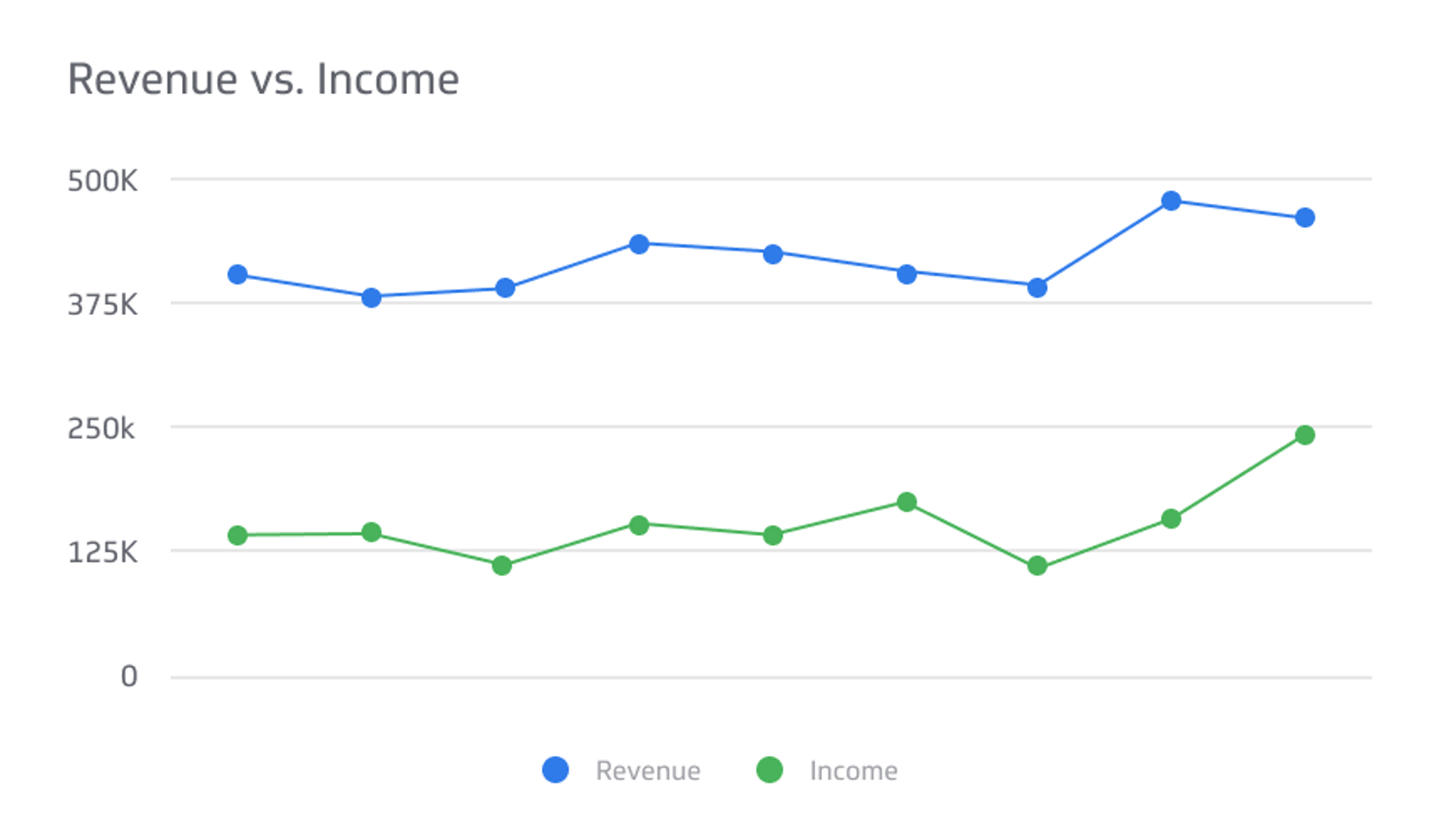

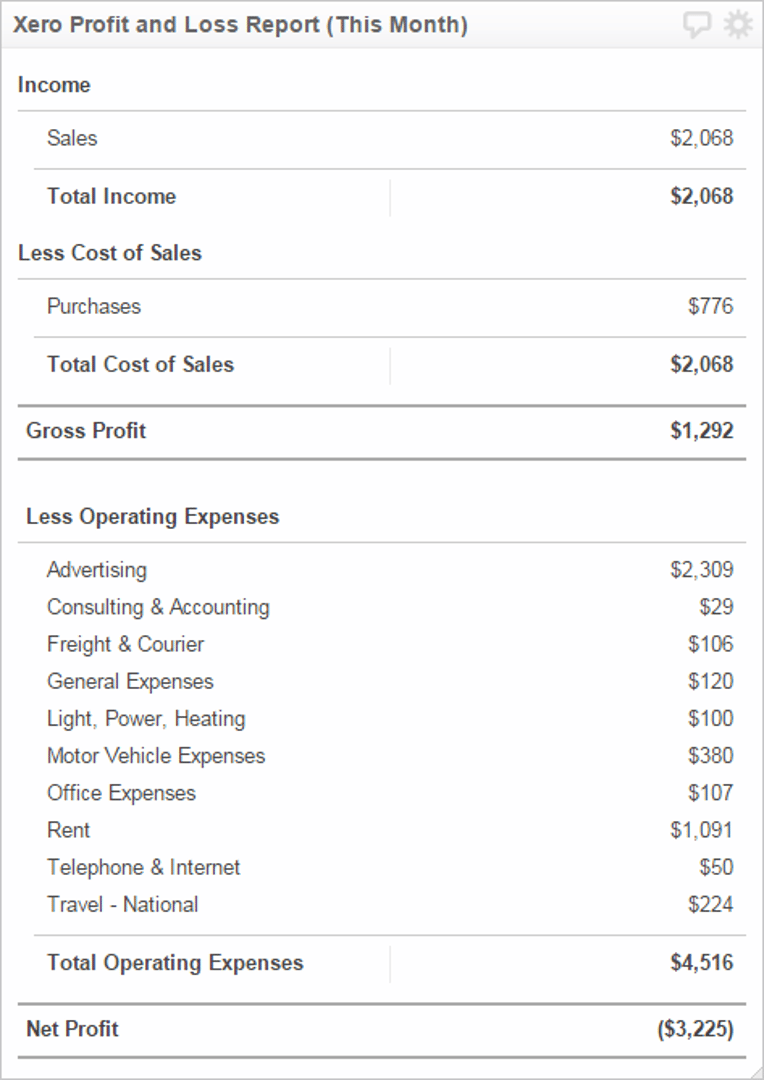

The Profit and Loss metric displays the business's income, cost of sales, and total expenses. This key accounting metric can help business owners, bookkeepers, and accountants easily calculate the business's net profit. The profit and loss metric will help determine whether or not a company's net profit is consistent month over month.

Key terms

- Income: The amount of money received by the business

- Expense: The cost required for running the business

- Net Profit: The amount of money the business makes after deducting the cost of sales and expenses from income

Success indicators

- Having more income than expenses and cost of sales, meaning a profit for the business

- Keeping expenses and cost of sales lower than overall income

Monitoring Financial KPIs on a Dashboard

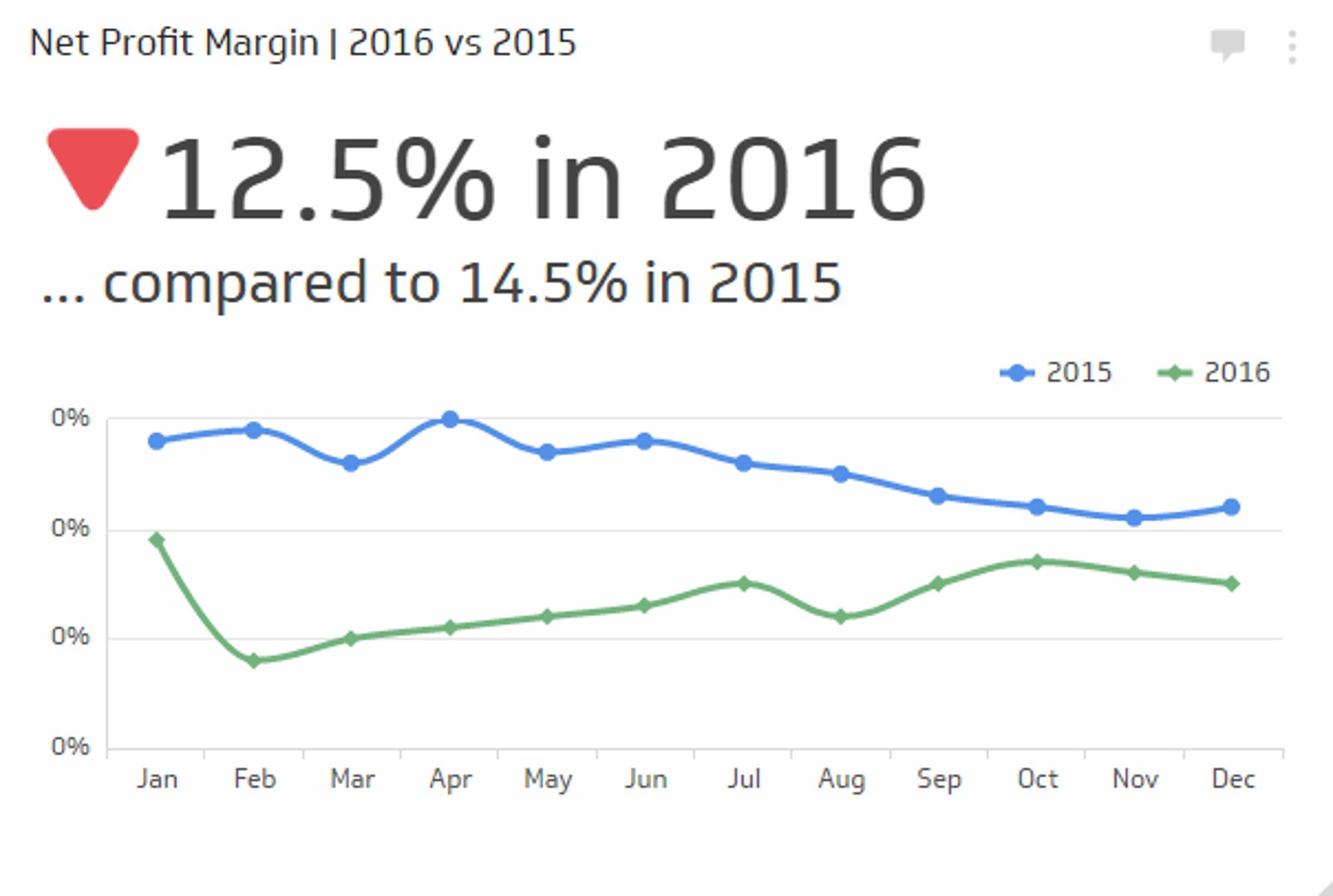

Once you have established benchmarks and targets for your Profit and Loss Report, you’ll want to establish processes for monitoring this and other financial KPIs. Dashboards can be critical in this regard.

Related Metrics & KPIs