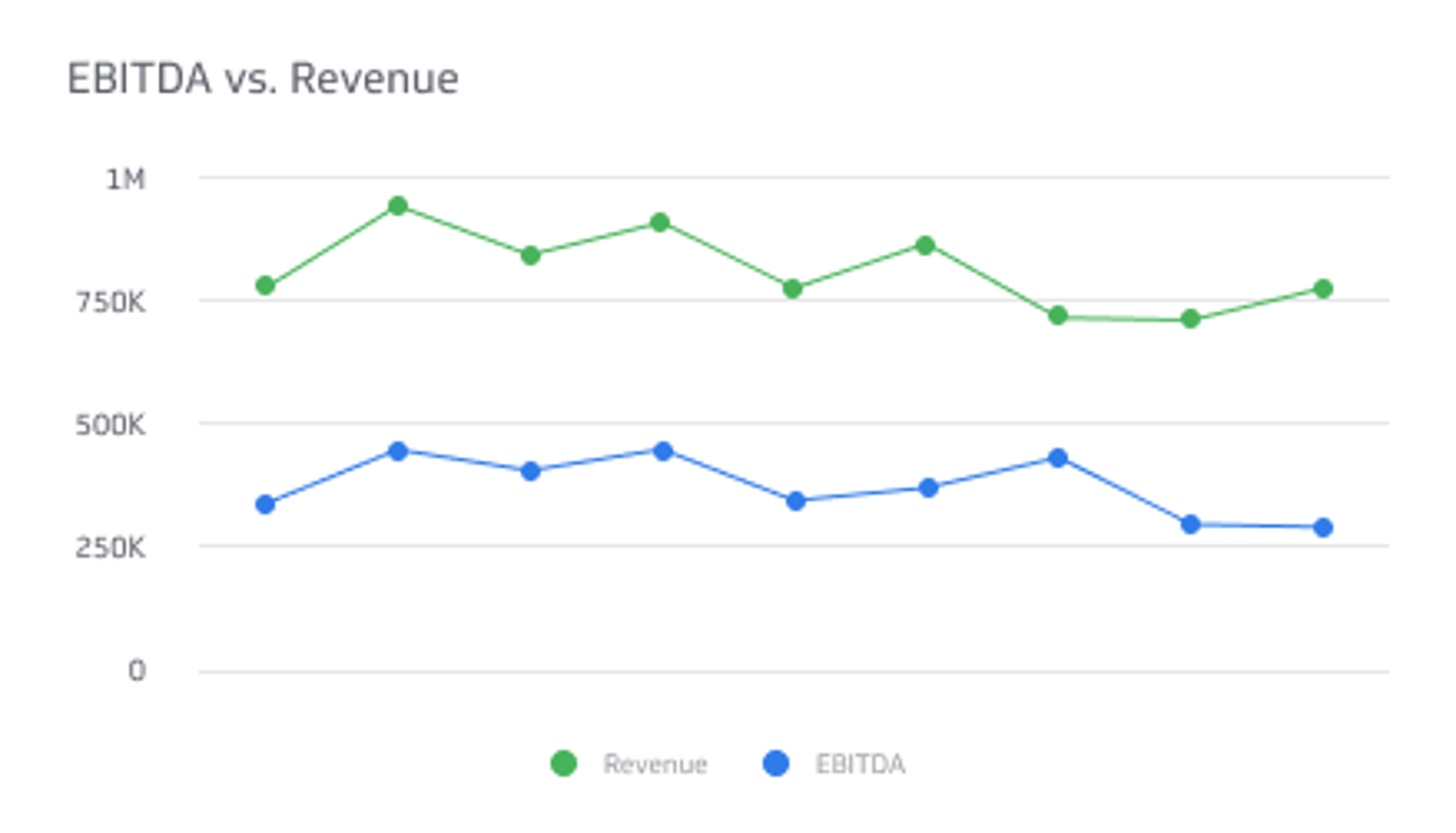

EBITDA vs. Revenue

Revenue serves as a comprehensive measure of overall income, while EBITDA offers a granular view of operational performance.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Profitability stands as the ultimate goal for enterprises across industries. It fuels growth, ensures sustainability, and lays the foundation for success.

To maximize their profits, companies must pay attention to the relationship between revenue and profitability metrics. Among these metrics, two significant indicators often come into focus: EBITDA and revenue.

In this article, we'll delve into the fundamental differences between the two and shed light on their definitions, calculations, and practical implications.

What is EBITDA?

EBITDA is a financial metric that assesses a company's profitability and overall financial performance. The acronym stands for earnings before interest, taxes, depreciation, and amortization.

It is commonly employed by investors, analysts, and business owners to assess operational efficiency and financial stability. By focusing on core business operations, EBITDA offers valuable insights into a company's capacity to generate cash flow.

Its usage in financial analysis facilitates a more comprehensive understanding of a company's financial health, assisting stakeholders in making informed decisions and strategic planning for the future.

What EBITDA Does

When evaluating a company's financial performance, EBITDA provides a more comprehensive perspective compared to revenue alone, which solely reflects the company's total income. This is because EBITDA considers operating expenses, which can significantly impact profitability.

EBITDA is useful for comparing the financial performance of companies in the same industry by neutralizing the impact of accounting practices and capital structure variations. This is especially valuable for assessing the financial health of businesses with different debt levels, allowing for an equitable comparison of operational effectiveness.

Furthermore, EBITDA helps isolate the influence of non-operational costs that may distort a company's true operational profitability. It highlights the cash a company generates before accounting for non-operational expenses.

EBITDA can also serve as a benchmark for comparing a company's performance against its industry rivals or peers, providing insights into operational effectiveness and profitability by examining its EBITDA margin.

While EBITDA is a helpful indicator, it should not be the sole metric used to assess a company's financial performance. In addition to EBITDA, it's crucial to consider other indicators like net income, cash flow, and revenue to get a fuller picture of a company's financial situation.

How To Calculate EBITDA

EBITDA is calculated by adding back interest, taxes, depreciation, and amortization to a company's net income. The formula for calculating EBITDA is as follows:

EBITDA = Net income + Interest + Taxes + Depreciation + Amortization

Note that EBITDA excludes other expenses, such as capital expenditures, working capital changes, and additional non-operating costs. As a result, EBITDA should not be used as the sole metric to evaluate a company's financial health.

What is Revenue?

A company's revenue represents the total income generated from the sale of its products or services. This financial metric encompasses all the money the company earns, whether through the sale of goods, provision of services, or a combination of both. It's significant since it enables investors and business owners to assess the organization's financial health.

What Revenue Does

The top line of a business is its revenue, which is the amount of money it makes before deducting charges like taxes, operational expenses, and interest payments.

Tracking revenue trends over time provides valuable insights into the company's sales performance, allowing for predictions about its future financial prospects and aiding investors in making informed decisions.

Examining a company's revenue also enables the assessment of its efficiency. Comparing revenue to expenses helps gauge profitability, as a company with high sales but significant expenses may be less profitable than one with lower revenue but lower expenses.

Moreover, revenue is a valuable tool for comparing the effectiveness of multiple businesses operating in the same industry. Analyzing revenue figures helps identify market leaders and emerging players, supporting investment decisions and identifying companies worth monitoring.

How To Calculate Revenue

Revenue is calculated by multiplying the price of a product or service by the number of units sold. The formula for calculating revenue is as follows:

Revenue = Price x Units Sold

For instance, if a company sells 1,000 units of a product for $100 each, the total revenue would amount to $100,000.

Alternatively, revenue can be computed by summing up the earnings from all sources of income within a company. For example, if a company generates $50,000 from product sales and $25,000 from rental income, the total revenue would be $75,000.

Comparing EBITDA vs. Revenue

Now, let's explore the differences and similarities between EBITDA and revenue, two essential factors in evaluating a business.

Similarities

EBITDA and revenue are key financial indicators for evaluating a company's performance. They provide insights into income generation and profitability, aiding analysts and investors in assessing the company's standing relative to its industry peers.

These metrics also facilitate meaningful comparisons of a company's performance over time. By examining EBITDA and revenue, stakeholders can gauge its progress and growth trajectory. Consistency in using these metrics allows for reliable performance comparisons across quarters or years.

However, it's crucial to acknowledge that EBITDA and revenue can be susceptible to manipulation. Companies may employ accounting techniques to inflate revenue or adjust EBITDA, complicating performance evaluations. This calls for careful analysis and consideration of other financial indicators to ensure a comprehensive assessment.

Differences

EBITDA is a more comprehensive financial term than revenue as it considers a company's operating expenses. Revenue, on the other hand, only indicates a company's total income. EBITDA is derived by adding back interest, taxes, depreciation, and amortization to net income.

EBITDA is particularly useful for comparing the financial performance of businesses with different capital structures, tax rates, or accounting standards. In contrast, revenue provides a straightforward measure of a company's overall income.

However, EBITDA has limitations that revenue does not. It does not account for changes in working capital, capital expenditures, and debt payments, which can impact a company's cash flow and long-term financial health. Revenue, on the other hand, provides insights into a company's sales performance and top-line growth.

EBITDA is often criticized for being a non-GAAP financial metric, meaning it can be calculated differently by different businesses, leading to inconsistencies when comparing EBITDA across industries. Revenue, on the other hand, is a GAAP metric that is standardized across organizations, facilitating comparisons across industries and companies.

Pros and Cons of EBITDA in Assessing Financial Performance

Understanding the advantages and disadvantages of EBITDA is essential for stakeholders who rely on this metric to make informed decisions. Let's delve into these aspects.

Advantages of EBITDA

As a financial metric, EBITDA provides several benefits that make it popular among analysts, investors, and businesses.

Facilitates Easy Comparison among Companies in the Same Industry

EBITDA is a commonly employed metric that facilitates easy comparisons among companies operating in the same industry.

EBITDA provides a more precise evaluation of a company's operational efficiency and profitability by excluding interest, taxes, depreciation, and amortization. This allows a more straightforward assessment of how a company stacks up against its competitors.

Assesses Debt Servicing Capacity and Future Expenditures

By excluding interest expenses from the calculation, EBITDA provides a measure of a company's operating performance without the impact of its debt structure. This enables stakeholders to gauge the company's financial capacity to handle its obligations and plan for future investments.

Indicates Cash Flow and Consideration of Operating Expenses

EBITDA's emphasis on earnings from core operations offers a more transparent view of a company's cash generation ability and capacity to meet financial obligations. This is especially valuable for evaluating liquidity and short-term financial stability.

This way, EBITDA allows stakeholders to assess the company's ability to generate cash flow from its primary business activities and determine its short-term financial resilience.

Limitations of EBITDA

While EBITDA is a valuable metric, it's essential to acknowledge its limitations when evaluating a company's financial performance. Being aware of these limitations is crucial to avoid potential pitfalls.

Exclusion of Non-Operating Costs, Potentially Distorting Financial Situation

One must be cautious when relying solely on EBITDA as it excludes non-operating costs like interest, taxes, and one-time charges. This exclusion could create an inflated perception of a company's financial situation.

Potential for Manipulation through Accounting Strategies

Certain businesses may manipulate their EBITDA by making adjustments that do not truly reflect their operational performance. Such practices can deceive stakeholders and create a distorted perception of a company's profitability.

Therefore, it is essential to carefully scrutinize the components and adjustments made when calculating EBITDA to ensure transparency and accuracy in financial evaluations.

Unreliable Predictor of Profitability for Companies with Significant Fixed Assets

For companies with significant fixed assets that depreciate over time, EBITDA may not be a dependable predictor of profitability.

The omission of depreciation in EBITDA calculations can lead to an inaccurate representation of a company's financial well-being, especially when its profitability relies on efficiently utilizing these assets. In such instances, it's essential to consider alternative metrics such as net or operating income alongside EBITDA to understand the company's profitability better.

The Bottomline

To sum up, it is crucial to emphasize the significance of comprehending the differences between EBITDA and revenue when evaluating a company's financial health. Revenue serves as a comprehensive measure of overall income, while EBITDA offers a granular view of operational performance.

Investors and analysts need to be mindful of the merits and limitations of EBITDA and should integrate it alongside other relevant financial metrics to make informed judgments. By holistically considering these factors, stakeholders can acquire a more thorough understanding of a company's financial situation and make well-grounded decisions based on comprehensive insights.

Related Metrics & KPIs