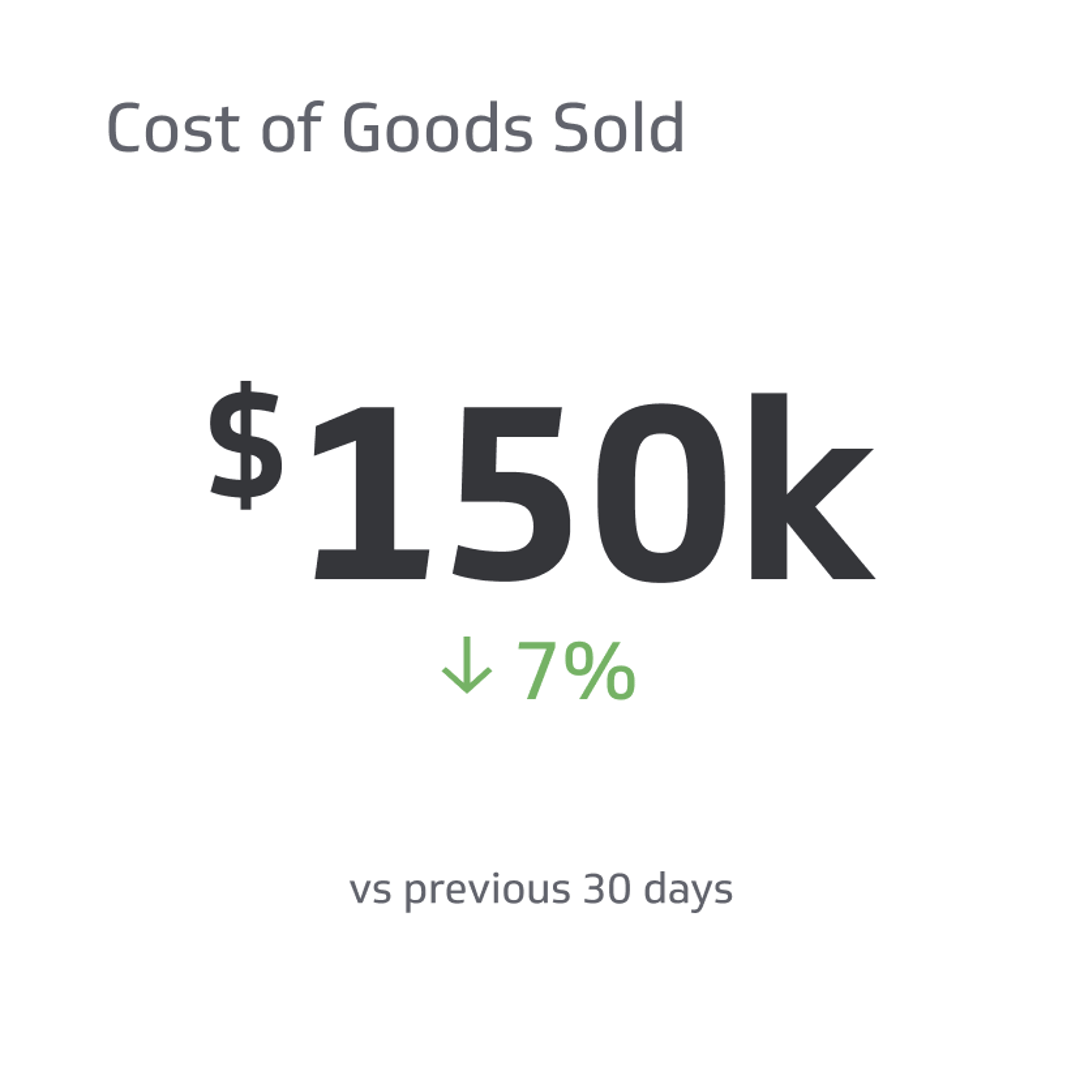

Cost of Goods Sold (COGS)

COGS calculates the direct costs of moving goods from production to consumption.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Meet the Cost of Goods Sold (COGS) is a metric that will help your business understand all the costs incurred when producing a particular good. This way, you can better understand your company’s performance and take the proper steps moving forward.

Though the process can be complicated, we’re here to break it down step by step. So, if you’d like to delve into the nature of COGS and learn how to calculate it like a pro, keep reading!

What is Cost of Goods Sold (COGS)?

Cost of goods sold (COGS) calculates the costs incurred by moving products, or services, from production to consumption. Bear in mind that it does not include indirect expenses such as marketing or distribution.

As every business knows, the production of any good involves various costs. Some of the main ones companies incur when producing their product are the following:

- Costs of raw materials

- Costs of new goods for sale if you’re a retailer

- Packaging costs

- Cost of labor

- Cost of storage

- Depreciation costs, depending on the nature of the product

The exact costs, of course, will differ based on the nature of your business. For instance, some businesses incur sales costs, such as commissions, when selling their products or services and thus have to include them in their calculation.

Remember that the costs will increase as the quantity of produced goods increases. So, naturally, the cost of goods sold may increase even if sales remain the same or do not rise.

How to Calculate COGS

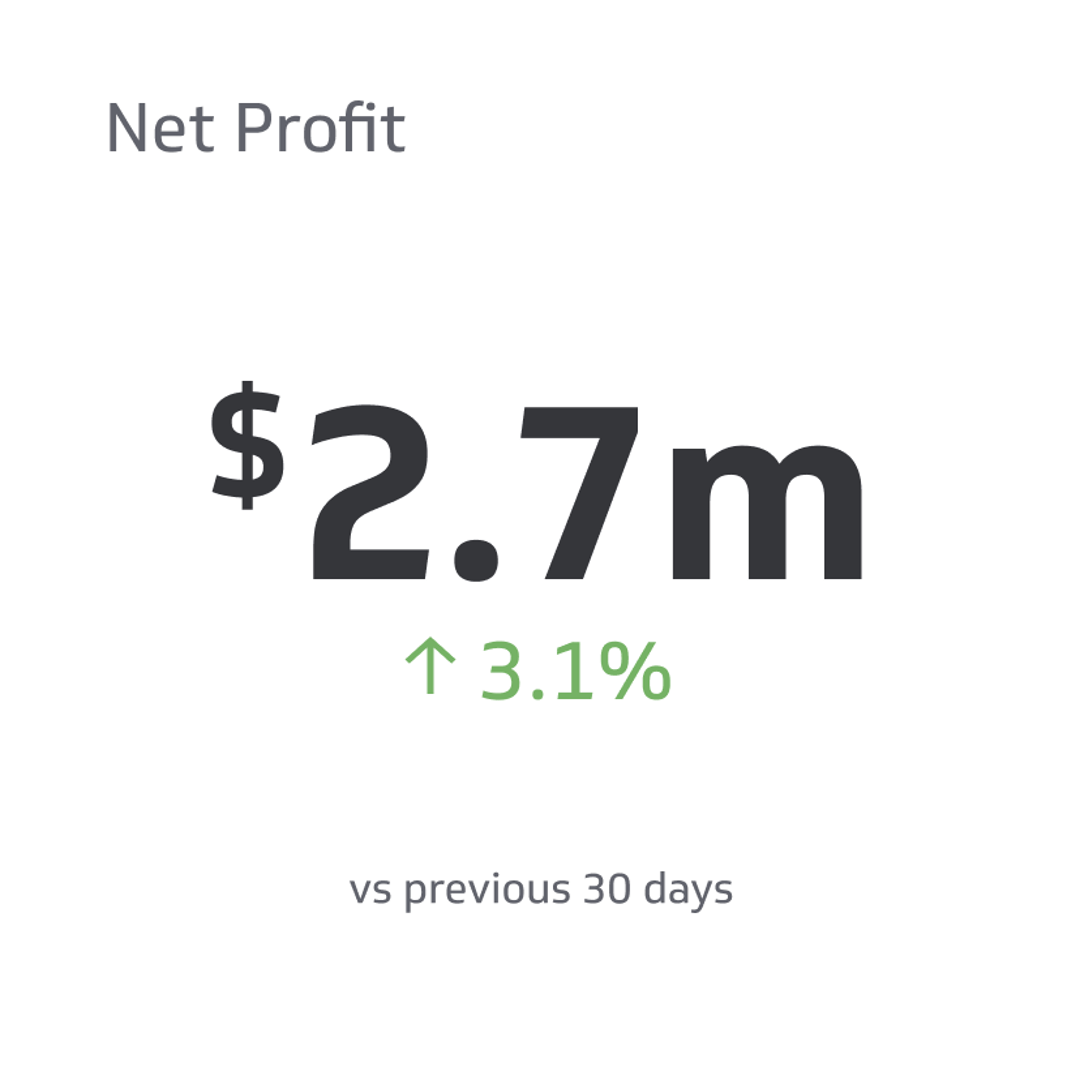

Located below the sales section, this metric is a crucial component of any business income statement. To determine your gross profit, you must subtract it from the total revenue. Essentially, the higher the cost of goods sold, the less your gross profit, which ultimately translates to a smaller net profit.

The basic formula for calculating cost of goods sold (COGS) is as follows:

Cost of goods sold / COGS = (Starting Inventory + Purchases Made During the Year) – Final Inventory

The closing inventory for every year becomes the starting inventory for the following year, and becomes the value of the products that were not sold. Therefore, you must use last year’s final inventory as the starting amount to calculate the current year’s COGS.

Calculating COGS can help your company understand the importance of keeping your production costs low. Simply put, this key performance indicator can help you realize how many costs the company incurs and how to reduce them.

For your convenience, here’s a step-by-step guide on how to calculate the cost of goods sold:

- Determine all costs incurred in the production

- Differentiate between direct and indirect costs

- Calculate the total of the direct costs

- Determine the number of purchases you made to increase inventory or buy raw materials

- Calculate the value of the final inventory

Once again, indirect costs incurred in marketing, insurance, rent, or utilities are not included in the calculation of COGS.

COGS examples

Lucky for you, calculating the cost of goods sold (COGS) is easy once you understand the basic formula above. The key to simplifying the process is having accurate figures for the direct costs involved in producing the goods. You also need figures for all the purchases made to increase your required stock of products or raw materials.

By the way, labor costs should strictly include payroll for employees directly involved in production. For example, a manufacturing plant does not need to add the salaries of its office labor when calculating COGS.

It is also important to note that products or services may sometimes get returned by the client. In such cases, the returned goods will get added to the final inventory valuation.

The formula for calculating the cost of goods sold in such a scenario would look like this:

Cost of goods sold / COGS = (Starting Inventory + Purchases Made) – (Final Inventory + Returned Goods)

Now, let’s actually get to calculating. An example of COGS computed using the formula with returned goods would be as follows:

- Inventory at the start of the year: $120,300

- Purchases made: $100,000

- Total: $220,300

- Inventory at the end of the year: $61,000

- Cost of returned goods: $2000

- Total: $63,000

- Cost of goods sold / COGS: $220,300 – $63,000 = $157,300

Next, let’s look at an example that uses the basic COGS formula:

- Inventory at the start of the year: $20,000

- Purchases made: $12,500

- Total: $32,500

- Inventory at the end of the year: $2,500

- Cost of goods sold / COGS: $32,500 – $2,500 = $30,000

On another note, it’s important to remember that transporting purchased goods is also a direct cost. So, if there were costs that the company in the examples above incurred when transporting goods, the formulas would change in the following ways:

- Cost of goods sold / COGS = (Starting Inventory + Purchases Made + Freight) – Final Inventory

- Cost of goods sold / COGS = (Starting Inventory + Purchases Made + Freight) – (Final Inventory + Returned Goods)

Different Cost Valuation Methods for COGS

The calculation of cost of goods sold (COGS) typically follows the simple formula shared above. However, the value of the final inventory at the end of the year may change based on the inventory method employed by the company.

The three main COGS accounting methods are as follows:

- Weighted Average Method

- First-In, First-Out Method

- Last-In, First-Out Method

Below, we’ll discuss what each of these mean.

Weighted Average Method

The weighted average method uses an average cost determined by calculating the cost of all goods available for sale during the financial year. Instead of prioritizing the period when the products or services were bought, this method presents an average cost per unit.

For instance, consider a company that made the following purchases of inventory during a particular financial year:

- 500 units of a product at $10 for four months

- 600 units of a product at $8 for four months

- 700 units of a product at $6 for four months

To start, the total inventory valuation is (500x10) + (600x8) + (700x6) = 14,000, and the total number of units bought during that year is (500+600+700) = 1800.

To calculate the average weighted cost of the goods, you must divide the total inventory valuation by the total number of units bought. The average cost per unit is then (14,000/1,800) = $7.78.

Remember: the COGS calculation will change as you use the average cost instead of the initial or final cost at the start or end of the year.

For example, if the number of units sold that financial year were 1,500, the weighted average cost method would use $7.78. The total direct purchase cost would then be (1500x7.78) = $11,670, while the final inventory would be (300x7.78) = $2,334, assuming the company had no products before the beginning of the year.

First-In, First-Out Method

The First-In, First-Out (FIFO) method involves a company selling off the products or services that were first produced or bought for reselling. Under this method, the company assumes that inflation will increase and that the goods produced first will be their least-expensive products.

The FIFO method is admittedly unpopular for some companies, considering it may increase the profit level. The COGS will naturally be lower if the products produced first are low-cost. Consequently, the products at the end of the year will have a higher cost valuation.

For instance, if a company produces or buys 200 units of a good in January at $10, the total will be $2,000. If you purchase additional units at an extra cost of about $12, the initial units produced will be sold first. As a result, the valuation for the final inventory will be higher as the price increases.

Last-In, First-Out Method

The Last-In, First-Out (LIFO) method is the inverse of the FIFO method. In this process, the goods sold first are those produced or bought last. Eventually, the price of the goods sold last is the amount used to calculate the COGS.

Under the LIFO method, the prices have already adjusted to inflation and are thus higher. Using this technique to account for inventory items may reduce the profit amount calculated from gross revenue in your income statement at the end of the year.

Benefits of Determining the Cost of Goods Sold

Calculating the cost of goods sold (COGS) is not an easy process, but it definitely has a plethora of benefits for your business.

Here some the perks that come with this financial metric:

- Cost valuation

- Inventory maintenance

- Identification of areas of improvement

- Tax compliance

- Improved profitability

To learn more about them, read ahead!

Cost Valuation

Calculating cost of goods sold helps the business get a clear picture of the costs associated with producing or selling their products. As you determine which direct expenses to include in your calculation, you can better understand which areas in your production are costing the business additional expenses.

Truth be told, accurate cost valuation is the key to identifying areas in production where the company can minimize wastage. For instance, a company might realize it is using excess labor to produce a product and then use this knowledge to decide which goods are worth producing, ultimately becoming more profitable.

Inventory Maintenance

COGS calculations can help your business understand how much of a product they sell over a certain period. Such information is crucial in determining the quantity of products the company must keep.

By thoroughly understanding these numbers, you can minimize storage costs for overstocked products that may not get sold at the right time. Additionally, the company can use the COGS to understand how much price decreases can affect the number of goods sold without adversely affecting net income.

Identification of Areas of Improvement

Like any key performance indicator, cost of goods sold can help an organization understand areas that it can improve in, primarily through comparison with competitors. Typically, the COGS among those in the same line of business is relatively similar.

By comparing their COGS to that of others, your business can successfully identify where they’re lagging. For instance, if a company is sourcing its products from the wrong suppliers, it could increase its direct costs and negatively affect performance. If such is the case, it’s essential for the business to then take the requisite steps to improve.

Tax Compliance

Regulatory agencies require businesses to calculate their cost of goods sold to avoid tax evasion by under-reporting their profits. If the company wants to avoid penalties and unnecessary audits by the IRS, it’s mandatory to meet regulations at all costs. So, in short, COGS is your new best friend.

Improved Profitability

Accurate calculation of the cost of goods sold can help a business improve its overall decision-making and business strategies. Simply put, companies with very high COGS will see increased expenses and reduced profit margins.

Understanding the reasons behind a high COGS valuation can help businesses make decisions that improve their profitability. For example, a company may choose to increase the pricing of its products, invest more in marketing, or adjust its production methods to boost growth.

Useful for both short-term and long-term purposes, this metric lets you keep track of your company’s financial health and consistently improves overall performance.

Remember: COGS is an expense, meaning it is neither an asset nor a liability. However, a company can increase its profitability by reducing its operating expenses.

Limitations of the Cost of Goods Sold

As with everything in this world, cost of goods sold (COGS) comes with its limitations. The main one is that it is possible to manipulate the figures used to increase or reduce a company’s profit margins.

This information can then be used to mislead shareholders or dupe them into believing a company is in good financial health even when it is not. So, needless to say, it remains crucial for accountants to maintain high ethical standards in their profession.

Use Cost Of Goods Sold (COGS) To Improve The Profitability Of Your Goods & Services

In business, it is pretty common to suffer losses, and perhaps one of the key reasons is the inability to account for the direct costs that go into production. That’s why it is essential to calculate the cost of goods sold (COGS) sold carefully.

Overall, knowing how to calculate COGS is vital to understanding what decisions you can make to improve the performance and profitability of your business. Such invaluable knowledge is the key to helping you stay in control of your company’s future.

Related Metrics & KPIs