Enterprise Value

Enterprise value is a measure of the total value of a company.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Are you interested in implementing Enterprise Value in your business? Check out this helpful article and learn all you need to know.

There are several reasons why someone might be interested in Enterprise Value. For example, investors may use Enterprise Value to compare the finances of different companies.

Companies may calculate Enterprise Value to track their value over time or to help them make strategic decisions. Or, analysts may use the measurement to determine the cost of a takeover or merger.

Enterprise Value is relevant to your work whether you're a business owner or professional. Read on for a detailed definition of Enterprise Value, why you should measure it, and how to implement it in your business.

What Is Enterprise Value?

Enterprise value is a measure of the total value of a company. Analysts can calculate it by adding the market capitalization of the company's equity to the value of its debt, less the value of its cash and cash equivalents.

The measure is ideal for tracking your company's value over time, setting financial goals, aiding decision-making, and assessing a new company before an acquisition.

Overall, Enterprise Value is a helpful tool for a variety of stakeholders. Investors, companies, and marketing or analyst professionals can all use the measurement to make informed decisions about investments and business changes.

Why Enterprise Value Is Important

More comprehensive measure than market capitalization

Market capitalization is simply the market value of a company's equity, which you calculate by multiplying the number of shares outstanding by the current share price.

However, market capitalization doesn't account for the company's debt or cash and cash equivalents. This fact can be a problem, as a company with a lot of debt may appear to have a high market capitalization, even if it's not profitable.

On the other hand, Enterprise Value accounts for a company's debt, cash, and cash equivalents. Enterprise Value is a more comprehensive measure of a company's value and reflects the company's financial situation in total.

As a result, the value is often used by investors and analysts to compare the worths of different companies or to calculate the cost of a takeover.

Compares Different Companies

Business personnel and analysts can use Enterprise Value to compare the value of different companies, even if they have diverse capital structures. It works because Enterprise Value accounts for all a company's assets and liabilities, while market capitalization only considers equity.

For example, a company with a lot of debt may have a lower market capitalization than a debtless company. However, the company with debt may have a higher Enterprise Value if its debt is less than the value of its assets.

Enterprise Value is a handy tool for investors and analysts to compare the value of different companies. You can use Enterprise Value to identify undervalued or overvalued companies or to make informed investment decisions.

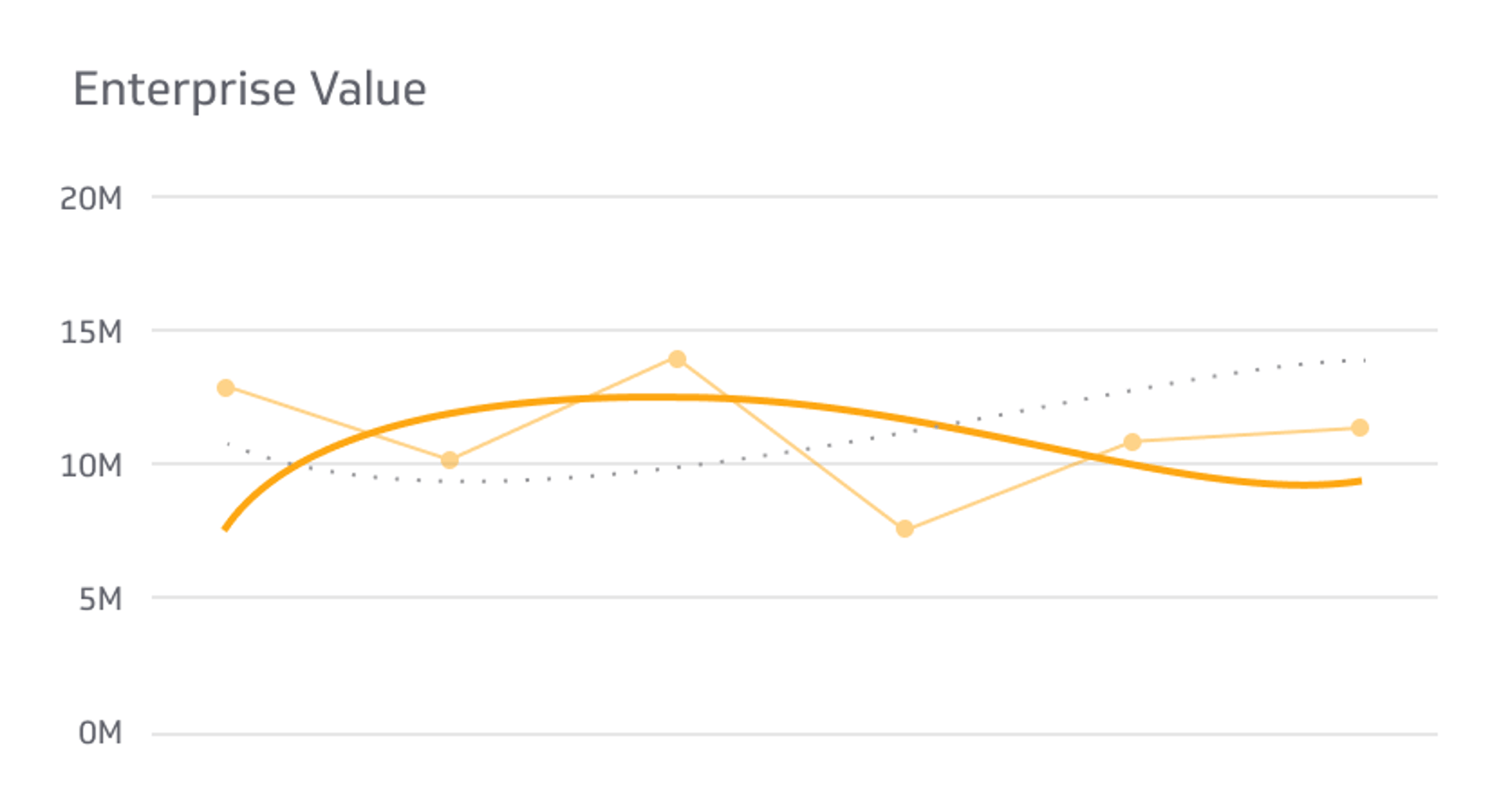

Tracks Value Over Time

Tracking Enterprise Value over time can be a helpful way to see how a company's value has changed in response to changes in the company's financial performance and the overall market environment.

For example, if a company's Enterprise Value is increasing, it may be a sign that it's performing well and that the market values it more highly.

Conversely, if a company's Enterprise Value decreases, it may indicate that the business is performing poorly.

Calculates Several Financial Ratios

Enterprise Value is also a helpful tool for calculating several financial ratios. For example, EV/EBITDA is a valuation metric that compares a company's Enterprise Value to its earnings before interest, taxes, depreciation, and amortization (EBITDA). EV/EBITDA can be used to compare the value of different companies, even if they have unique capital structures.

Another financial ratio that uses Enterprise Value is EV/Sales. EV/Sales measure a company's valuation relative to its revenue. You can use it to compare the value of different companies, even if they have different operating margins.

Useful for Mergers and Acquisitions

As discussed above, Enterprise Value is a handy tool for calculating several financial ratios. These ratios can compare the value of different companies, even if they have individual capital structures or operating margins.

Therefore, Enterprise Value is ideal for helping you analyze mergers and acquisitions (M&A). M&A deals are often large and complex, and the buyer needs to get a fair price for the company they are acquiring, so you'll want to calculate accurately.

Enterprise Value can also calculate the cost of a takeover. The cost is the total amount of money the buyer will need to pay to acquire the company, including the purchase price, the cost of financing the deal, and the cost of integration.

Can Help Set Financial Targets

Enterprise Value can help set financial targets by providing a more accurate measure of a company's value. Since it accounts for multiple factors, it gives a more holistic, accurate picture of the company's state.

By using Enterprise Value to set financial targets, companies can ensure that they set realistic and achievable goals.

For example, a company might want to increase its Enterprise Value by 10% yearly. The company would need to increase its revenue, profits, or both to achieve this target. By tracking its Enterprise Value over time, the company can see how it is progressing toward its target and make adjustments as needed.

Overall, Enterprise Value is a valuable tool that a business owner or financial analyst can use to set financial targets, track progress toward those targets, and make adjustments as needed.

Can Help With Risk Management

Enterprise Value is a helpful tool for risk management. Since it tracks value over time, Enterprise Value can help businesses assess the risk of an investment, acquisition, or merger.

Businesses can use Enterprise Value to quantify the risks associated with a business deal. For example, a company with a high debt-to-equity ratio is riskier than a business with a low debt-to-equity ratio.

You can also use Enterprise Value to predict potential risks to your business's value. For example, if the company's Enterprise Value falls sharply, it could mean that your company is facing some financial difficulties.

Aids in Strategic Decision Making

Measuring Enterprise Value can help with decision-making for your company.

For instance, Enterprise Value can help businesses allocate their capital. For example, a company might decide to invest in new projects, pay down debt, or repurchase shares of stock based on current Enterprise Value.

By comparing a company's Enterprise Value to its market capitalization, businesses can identify assets trading at a premium or discount to their value. Then you can use this info to decide whether to acquire or divest assets.

How To Calculate Enterprise Value

The traditional approach to calculating Enterprise Value is to add the market capitalization of the company's equity to debt value, less the value of its cash and cash equivalents. This approach is relatively straightforward to understand.

Computing Enterprise Value is simple with the following formula. You can input the values from your business and figure out your Enterprise Value in seconds.

Enterprise Value Formula

The Enterprise Value formula is as follows:

?EV = MC + TD − C

EV = Enterprise Value

MC = Market Capitalization. MC is your company's stock price multiplied by the numerical value of outstanding stock shares.

TD= Total Debt. This value is short-term and long-term debt added together.

C = Cash and cash equivalents. This value includes all your liquid assets but doesn't account for marketable securities.

How To Use Enterprise Value Formula

The Enterprise Value formula is easily applicable in real life.

For example, let's say that a company has 100 million shares outstanding, and its current share price is $10. The company also has $50 million in debt and $10 million in cash. You would calculate the company's enterprise value as follows:

EV = 100 million shares * $10/share + $50 million - $10 million = $1,400 million

Limitations of Enterprise Value

Like any measurement, Enterprise Value has some limitations. The measure is helpful in many scenarios but has shortcomings, which we'll discuss in depth below.

Not a Perfect Measure

Enterprise Value isn't a perfect measure. It's based on input values and is subject to human error.

Also, Enterprise Value only factors the market price of a company's shares. Aspects other than the company's underlying value affect the price, such as investor sentiment or market volatility.

Reflects Past Value

Enterprise Value has limitations because it only reflects past value. In other words, Enterprise Value doesn't consider the company's prospects, such as its growth potential or ability to generate cash flow.

For example, a company with a high Enterprise Value but low growth potential may not be as valuable as a company with a lower Enterprise Value but high growth potential. Similarly, a company with a high Enterprise Value but a history of poor cash flow may not be as valuable as a company with a lower Enterprise Value but a history of strong cash flow.

Therefore, it is often necessary to use Enterprise Value in conjunction with other valuation metrics, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-cash flow (P/CF) ratio, to get a complete picture of a company's value.

Difficult To Calculate Accurately

Enterprise Value can be difficult to calculate accurately for several reasons, firstly because it only accounts for company shares. It can be tricky to calculate accurately, as the market price of a company's shares may not always reflect its actual value.

Also, it can be hard to determine the other values in the formula. Larger companies, joint companies, and businesses with complex financial structures may struggle to define terms such as debt, cash, and market capitalization.

The formula for calculating Enterprise Value is simple, broad, and lacks nuance. Consider consulting a financial analyst to see if you can use other financial metrics along with Enterprise Value to get a more comprehensive view of your company's situation.

Enterprise Value Doesn't Take All Factors Into Account

Unfortunately, Enterprise Value doesn't take all factors into account. For instance, the Enterprise Value formula doesn't consider intangible assets. Intangible assets like brand value or intellectual property can be valuable to a company, but Enterprise Value doesn't reflect them.

Also, future growth potential isn't part of Enterprise Value. A company with excellent growth potential may be worth more than a company with similar financials but less growth potential. EV does not take future growth potential into account.

A company's liquidity or ability to convert its assets into cash can affect its value. Enterprise Value does not take liquidity into account.

Finally, though the measure can help assess risk, a company's risk profile or likelihood of defaulting on its debt isn't part of Enterprise Value. This fact can pose a problem, as the risk profile can affect its value.

Problems With Comparing Across Industries

Enterprise Value is helpful when assessing a single company or comparing two companies. However, things get tricky when you try to compare two different industries with the formula.

For one thing, different industries have different levels of risk and return. For example, the technology industry is typically riskier than the utility industry but has the potential for higher returns. As a result, a company in the technology industry with an Enterprise Value of $10 billion may not be as valuable as a company in the utility industry with an EV of $10 billion.

Different industries have different asset bases, which is another reason it can be tricky to compare diverse companies. A manufacturing company might have a lot of physical assets, while a software company of equal value may have fewer physical assets. Therefore, the manufacturing company may appear to have a higher Enterprise Value while the two companies are the same.

Conclusion

Enterprise Value measures a company's value and accounts for its debt and cash. It is a more comprehensive measure of value than market capitalization, which only reflects common equity. Businesses can also use Enterprise Value to compare companies with different capital structures and to value potential acquisitions.

However, Enterprise Value is not a perfect measure of value. It does not consider intangible assets, future growth potential, liquidity, or risk. Therefore, you might use Enterprise Value with other valuation metrics to get a complete picture of a company's value.

In conclusion, Enterprise Value helps measure a company's value and is a valuable tool for businesspeople and analysts.

Related Metrics & KPIs