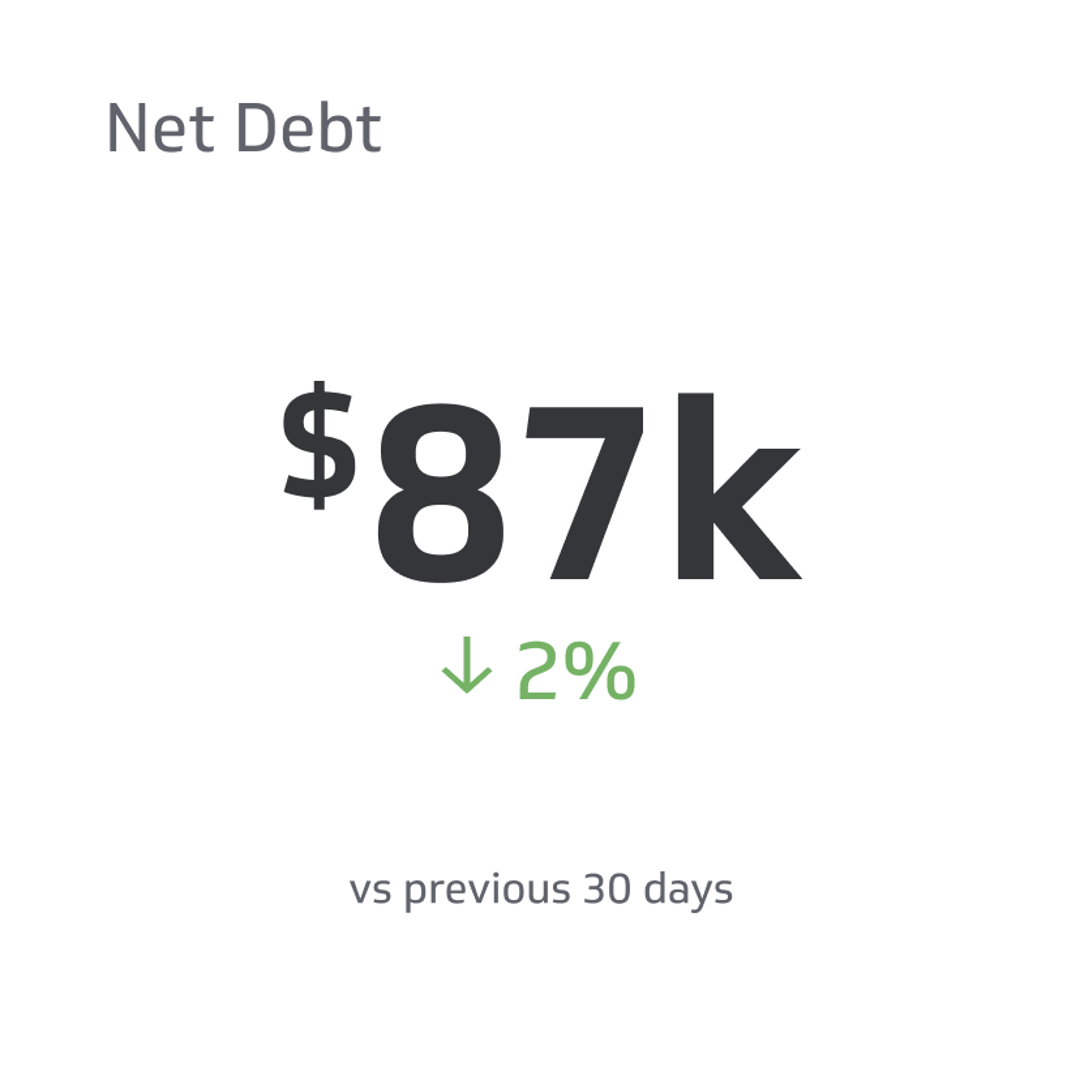

Net Debt

This is the metric that companies can use to evaluate their health.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Net financial debt is a metric that companies can use to evaluate their health. Here’s what you should know about net debt, including when to apply it.

What Is Net Financial Debt?

Net financial debt is the amount by which a company’s total debt (including short-term and long-term debt) exceeds its total liquid assets (cash and easily exchanged equivalents).

Depending on your calculation's purpose, you can express this amount as either a dollar figure or a percentage/ratio.

Why Use Net Debt?

Broadly, net debt is a good tool for indicating how much money a company could have if it wants to immediately settle all its debt obligations. For example, let's say that a potential buyer is looking at the company, and one of the terms of the sale may be paying off all existing debts. Looking at net debt makes it easier to see how much money would be left afterward.

In the real world, it’s not very common for a company to need to pay all its debts immediately. Removing all debt can occur in special situations like sales, but healthy businesses usually try to have payments spaced out over time.

Net Financial Debt Formula

The formula for calculating net debt is the short-term debt (due in less than 12 months) plus the long-term debt (anything due in more than 12 months) minus all cash and cash equivalents.

Net Debt = Gross Debt – Cash and Cash Equivalents

For this equation, cash equivalents include all cash and highly liquid investments which refer to short-term holdings such as marketable securities, money market funds, and commercial paper.

Examples

Let’s say a company has $500,000 in short-term debt, another $250,000 in long-term debt, and $2,000,000 in cash and liquid assets. Using our formula, we can calculate 500,000 + 250,000 - 2,000,000, giving us a net debt of -$1,250,000. As a percentage, this is about -166.66%.

(Percentages are helpful because they make understanding cash versus obligations at scale easier. A negative net debt of $5 million may sound great, but if it's for a multi-billion dollar company, that could be equivalent to barely having more cash than debt. Some companies prefer to express this as a ratio, such as 0.3, meaning debts are 30% of the cash.)

A negative net debt this far down shows that the company is financially stable. In fact, it’s probably too secure. If it has that much cash available, it should start investing it and look for new ways to expand.

Comparing Net Debts

One of the best ways of evaluating a company’s overall healthiness from net debt is by comparing it to other companies in the same industry.

Some market segments have much higher long-term, illiquid assets than others. As an example, a gas company usually has a lot of equipment, processing plants, refineries, trucks, and other materials necessary for their obligations. It doesn’t make sense to judge them the same way as a SaaS company with almost no physical hardware.

In other words, anyone evaluating a company by net debt should look for comparable figures from similar companies first, especially from businesses known to be healthy and in overall good standing. This provides a reliable basis for comparing the numbers. Cross-industry net debt comparisons are usually a bad idea.

Net Debt and Gross Debt

Another way to evaluate a company is by looking at the difference between its net debt and cross debt.

Gross debt is the total of all debts and obligations without applying any cash on hand to pay it down. A significant difference between net and gross debt is usually a sign that there’s a problem with the company.

The problem here is that a company usually doesn’t want to have too much cash balance alongside a bunch of debt. If it’s sitting on a big pile of money, it could be reducing its obligations or investing in growth.

It’s one thing to save money short-term for a project or investment, but businesses should try to avoid keeping a large pile of cash long-term.

Understanding Debt

Debt is not inherently bad for businesses. While there’s something to be said for not having much in the way of long-term obligations, that’s not realistic for most companies. Everything from property purchases to long-term projects can create debt, and paying things off over time has many advantages for companies.

Structured payment plans can smooth out cash flow issues, allowing companies to keep more for day-to-day operations and unexpected expenses. Rather than a feast-or-famine approach, debt allows companies to expand with predictable costs.

Many companies use debt financing options to help pay for things, as opposed to equity financing. Debt financing is especially popular with smaller businesses, where it can help them acquire the resources to encourage growth.

Notably, debt financing products have a higher priority for repayment than other debts. If a business goes bankrupt, these payments usually come before things like claims from shareholders, making them relatively safe.

Safety is always valuable when investing, and this helps ensure that taking on debt remains a practical and realistic option for businesses.

Debt and Investments

One of the things about having a low debt ratio is that it can discourage investors and shareholders from buying into the company. It often indicates that a company has minimal borrowing, so regular investors can’t expect to get much back.

How Much Debt Can A Company Have?

In most cases, a company’s debt shouldn’t exceed 60% (or a 0.6 ratio) long-term. Any company at this point usually has too much debt compared to its assets, suggesting that it’s struggling to find income and make payments.

Conversely, a company with less than 40% debt is usually in a good position. The lower the ratio from there, the better.

The debt ratio is important when looking for new sources of funding. If a company has a -0.2 debt ratio (much higher income than debt), then it can probably get a great deal when getting more money. A lender will think the loan is extremely low-risk, so they’re happy to lend at that point.

However, if a company is already struggling to repay, then, of course, lenders will hesitate to offer more. When they see signs of risk, prices go up, which makes it even harder to repay.

Modifiers

The information above applies to most companies at most times, but there are always cases where modifiers can change things.

An obvious example of this is an industry with consistently high debt ratios. Let’s say that an industry has a standard debt ratio of 0.8, meaning its debt is almost equal to its total assets. If that’s standard for the industry, being high won’t make investors or lenders shy away as long as the business is otherwise sound.

In short, don’t rely on net financial debt alone as an indicator of a company’s health. Always look at this number in the context of the company’s behaviors and applicable industry standards.

Final Thoughts

Net debt is an effective way to quickly understand a company's overall health and performance. While it's not the only factor you should look at, it provides a good starting point for comparing the company to similar businesses.

Related Metrics & KPIs