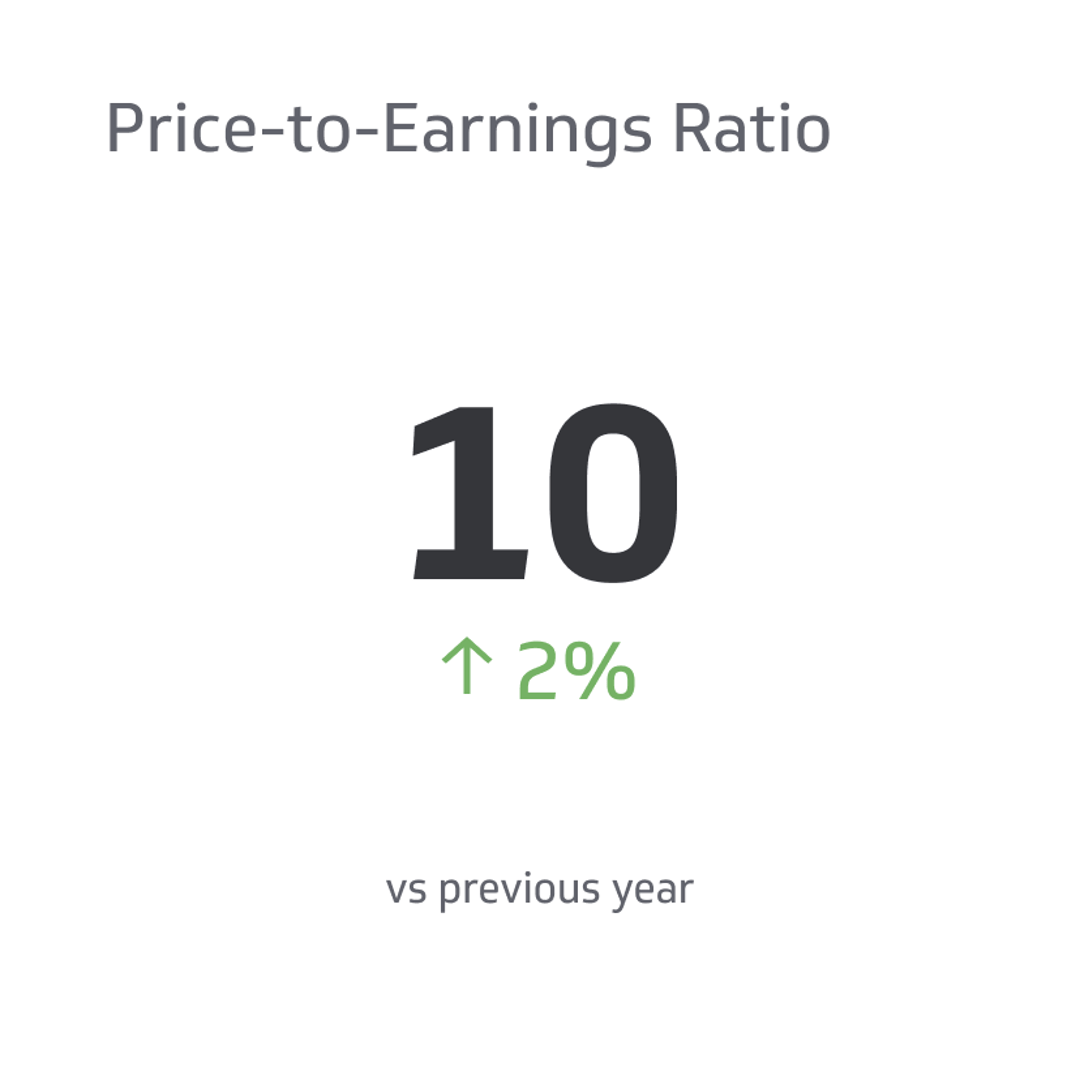

Price-to-Earnings Ratio

The price to earnings ratio is a metric that investors use to calculate which company shares are more profitable for investors.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

The stock market is a foreign concept to many, but those who participate try to find any means to evaluate and understand the profitability of stocks. Earnings reports, profit margins, ROA, and the Price-to-Earnings ratio help investors understand the value of a stock better.

Along with the many tools, the Price-to-Earnings ratio directly ties into whether or not stocks are over or undervalued. Understanding the P/E ratio will help you better understand how important it is for investors to evaluate stocks before committing to their investment.

What Is Price-to-Earnings Ratio?

The Price-to-Earnings ratio is a metric that investors use to calculate which company shares are more profitable for investors. The ratio is useful for comparing the performance of companies in that market against themselves and their past earnings.

To keep it simple, think about it this way. The higher the P/E ratio, the more the investor will pay per dollar. The lower the P/E, the less the investor will pay per dollar. Investors often use the P/E ratio to make investment decisions with other factors. The P/E ratio alone isn't enough for an investor to decide whether company stock is worth the investment.

Price-to-Earnings Ratio Formula

Calculating a company's P/E ratio may initially seem complex, but it's easy to understand once you understand a few fundamental concepts. At the most basic level, the P/E ratio formula is the stock price's market value divided by earnings per share.

To get your P/E ratio, you also need to understand how to get earnings per share. You can get a company's EPS by taking the company's total net profit and subtracting dividends. Then you divide that number by the company's outstanding shares. Once you have that EPS, you can use it in your P/E ratio formula.

For a better understanding, follow these three steps:

- Find the company's current stock price.

- Find the EPS (Net income - Dividends)/ Outstanding Shares.

- Divide the company's current stock price by its EPS (Current Stock Price/EPS).

Example

Here's an example of putting these steps into practice. Consider these two companies, Company A and Company B. Company A and Company B's stocks are both worth $30 per share, so the question becomes which one should you invest in?

Since both stocks have the same cost, you can use the P/E ratio to get more information before deciding which stock to buy. To do this, you must first figure out each company's EPS. Company A has an EPS of 5, and Company B has an EPS of 10.

Now that you have the value of the stock and EPS of both stocks, you can do your P/E ratio calculation, which is dividing the current stock of interest price by the EPS. Company A has a P/E ratio of 6 ($30/5), and Company B has a P/E ratio of 3 ($30/10).

If you buy stock from Company A, you'll pay $6 for every $1 of that company's earnings. With Company B, you'll pay $3 for every $1 of Company B's earnings. In this case, the most attractive option is Company B because you're paying less for the same dollar amount of earnings. Still, this is just an apple-to-apples comparison and isn't the only factor to consider.

What's The Purpose of The Price-to-Earnings Ratio

The main purpose of the P/E ratio is to help investors make informed purchasing decisions about a stock based on its current earnings. The information gives investors insight into which stocks to compare and purchase depending on that valuation. Depending on the value, some stocks may be over or undervalued.

Why Is The Price-to-Earnings Ratio Important?

The Price-to-Earnings ratio is vital for investors because it gives them another tool to determine whether or not they should invest in certain companies. Investing in anything without information is foolish and leads to trouble, but with these tools, investors can determine how much they have to gain from certain stocks and which ones to avoid.

How Does Understanding The Price-to-Earnings Ratio Formula Help Investors?

Direct insight into the value a business has based on its current profit. The P/E ratio provides investors with an accurate representation of the company's current standing when comparing it to its competitors.

Depending on the valuation, some companies have a higher Price-to-Earnings ratio, and others have a lower one. Understanding what that means and how you can use it to compare stocks to others gives you an edge in determining which stocks are the most profitable.

What Factors Affect The Price-to-Earnings Ratio?

While the P/E ratio formula is straightforward, plenty of factors go into the calculation and meaning behind the ratio. Since the P/E ratio is a financial metric that works parallel to other ratios and metrics, it's important to understand these contributing factors when calculating and using it.

- Earnings per share: The first factor to consider in the ratio is the company's EPS. A company's earnings per share greatly affect how high or low the P/E ratio is. It affects the Price-to-Earnings ratio because a company's EPS tells investors how much money it makes per stock share.

- Net income: A company's net income is important when calculating its P/E ratio. Remember, net income is different from total revenue. Net income is the company's profit after expenses and other deductions. Revenue is the total gross profit.

- Market conditions: Your P/E ratio isn't a definitive number that can tell you to purchase a stock because it's profitable. Market conditions greatly influence whether a P/E ratio is good or bad. A high or low P/E ratio will be good or bad, depending on the stock's performance in the market.

Is It Better To Have a High or Low Price-to-Earnings Ratio?

Whether a high or low P/E ratio is better or worse for a stock depends on multiple factors. With more information, you can tell if a company with a high or low P/E ratio is good or bad. Still, a higher P/E ratio may indicate that a stock's price is overvalued.

A low Price-to-Earnings ratio typically indicates an undervalued stock, but that doesn't always mean it's better for the investor. You must understand the contributing factors and context of that high or low P/E ratio.

No magic formula will predict whether a stock is profitable or will remain profitable. Ultimately, it's putting pieces together with your tools; in this case, an investor must investigate why a P/E ratio is low or high and add context to the valuation.

How Does a Company Improve Its Price-to-Earnings Ratio?

There are many ways a company can improve its P/E ratio. The first is to increase their revenue. How a company does this depends on the market and its business strategies.

Another way is to improve your growth potential. Investors love stocks with growth potential, and if a company shows above-average growth potential, investors will certainly take notice of that stock. Companies can improve their growth potential by breaking into new markets or improving their standings in their current market with new innovative technologies.

A company lowering its debt is another way to improve its P/E ratio since liabilities and equity play a big part in its performance and profitability. Companies with lower debt risk are extremely attractive to investors, so improving a company's debt-to-equity ratio is a viable strategy.

What Is Forward P/E and Trailing P/E?

Understanding the basics of the P/E ratio is important when discussing its other variants, trailing and forward P/E. Trailing and forward P/E ratios serve separate purposes, but depending on the kind of investor you are, you may prefer using one over the other. Here's more information.

Forward P/E

Also commonly known as the estimated P/E ratio, forward P/E is useful for investors who want to know what a company's future P/E ratio might look like. A company's forward P/E ratio uses current and historical data to guess how valuable a stock will be in the future.

It's important to note that while forward P/E does use data to back its projections, it doesn't mean it's reliable or accurate. Many factors and uncertainties go into future projections, so these estimates shouldn't accurately predict a company's profitability.

For example, companies and investors can underestimate their forward P/E to easily meet or surpass their projections, making their company and stock look more attractive to investors.

Additionally, they can overestimate their forward P/E to make their current stock price more attractive and get investors on board now instead of later. Plenty of situations can arise, but anytime you see an estimated P/E ratio, remember to keep your eyes open to other factors.

Trailing P/E

Also known as the trailing 12-month ratio, trailing P/E is useful for investors who only care about factual and historical data regarding a company's P/E ratio. Trailing P/E is the most popular of the two because of its solidity and factual basis, but it still comes with shortcomings.

First, past earnings don't equate to future or even current profit. A company's trailing P/E remains static and must account for worthwhile information already known. Additionally, the trailing P/E doesn't consider current factors and stock prices.

Even so, investors will always heavily prefer trailing P/E over forward P/E because of the uncertainty of a company's forward P/E ratio. What's important to understand about this ratio is how it improves upon the forward P/E ratio—more on that in the next section.

Which Should You Use, Forward P/E or Trailing P/E?

The answer is both. Even though investors prefer the trailing P/E ratio, smart investors use both in conjunction with each other to compensate for their natural faults. Now, it's time to understand how these two P/E ratios work in unison.

Once an investor has a company's forward P/E ratio, it can compare it to its trailing P/E ratio. Generally speaking, investors and analysts expect the company's earnings to decrease when its forward P/E ratio is higher than its trailing P/E ratio.

Conversely, if a company's forward P/E ratio is lower than its trailing P/E ratio, analysis and investors expect its earnings to increase. This observation isn't always accurate, but it's a good indicator for investors to consider or at least consider when doing their P/E calculations.

Frequently Asked Questions

All the information about ratios, metrics, and investing can be overwhelming, so here are some answers to common questions regarding the P/E ratio.

What is a good Price-to-Earnings ratio?

Unfortunately, there is no straightforward answer to what P/E ratio is considered good, but there are ways to help you determine whether or not a P/E ratio is good. Generally speaking, a P/E ratio under 20 is good, but depending on the market, a P/E lower than 20 may mean little.

Should you buy a stock based on its Price-to-Earnings ratio alone?

You should consider multiple factors before investing in a stock. More than a company's P/E ratio is needed to determine if a stock will be profitable to an investor. Instead, consider market factors, stock prices, future earnings, and company policies to understand stocks' value.

Can you have a negative Price-to-Earnings ratio?

Any company can have a negative P/E ratio; while low P/E ratios usually indicate undervalued stocks, negative P/E ratios indicate signs of financial struggle. Companies with negative P/E ratios run the risk of bankruptcy and financial troubles, so It's best to avoid them.

What is an unhealthy Price-to-Earnings ratio?

A negative or extremely high P/E ratio typically signals problems for a company's stock. Any major discrepancy, a large or small number, is never a good sign and usually falls under an unhealthy Price-to-Earnings ratio category. Invest in these stocks with extreme caution.

Should I avoid overvalued stocks?

For long-term investments, it's best if you avoid overvalued stocks. That's not to say you should always avoid overvalued stocks. Stocks with a higher P/E ratio have a good chance of earning you short-term profit, so only sometimes rule them out when investing your money.

What is the ideal P/E ratio?

Most investors believe anything under a 20 P/E is an ideal stock. Even so, you must consider market and growth factors. While ideally, you don't want to invest in an overvalued stock, depending on the market, it may be a smart investment regardless of its P/E ratio.

Bottom Line

Whether investing in the stock market or considering investing, always keep a company's P/E ratio and EPS in mind. Other metrics will help you determine the profitability of stocks but don't base your decision solely on ratios and mathematics.

Plenty of intangible factors play a role in the stock market, so keep your eye on how a company performs and always proceed cautiously. Still, you now have more tools to help you make informed investing decisions, so go out, take some risks, and earn some profit.

Related Metrics & KPIs