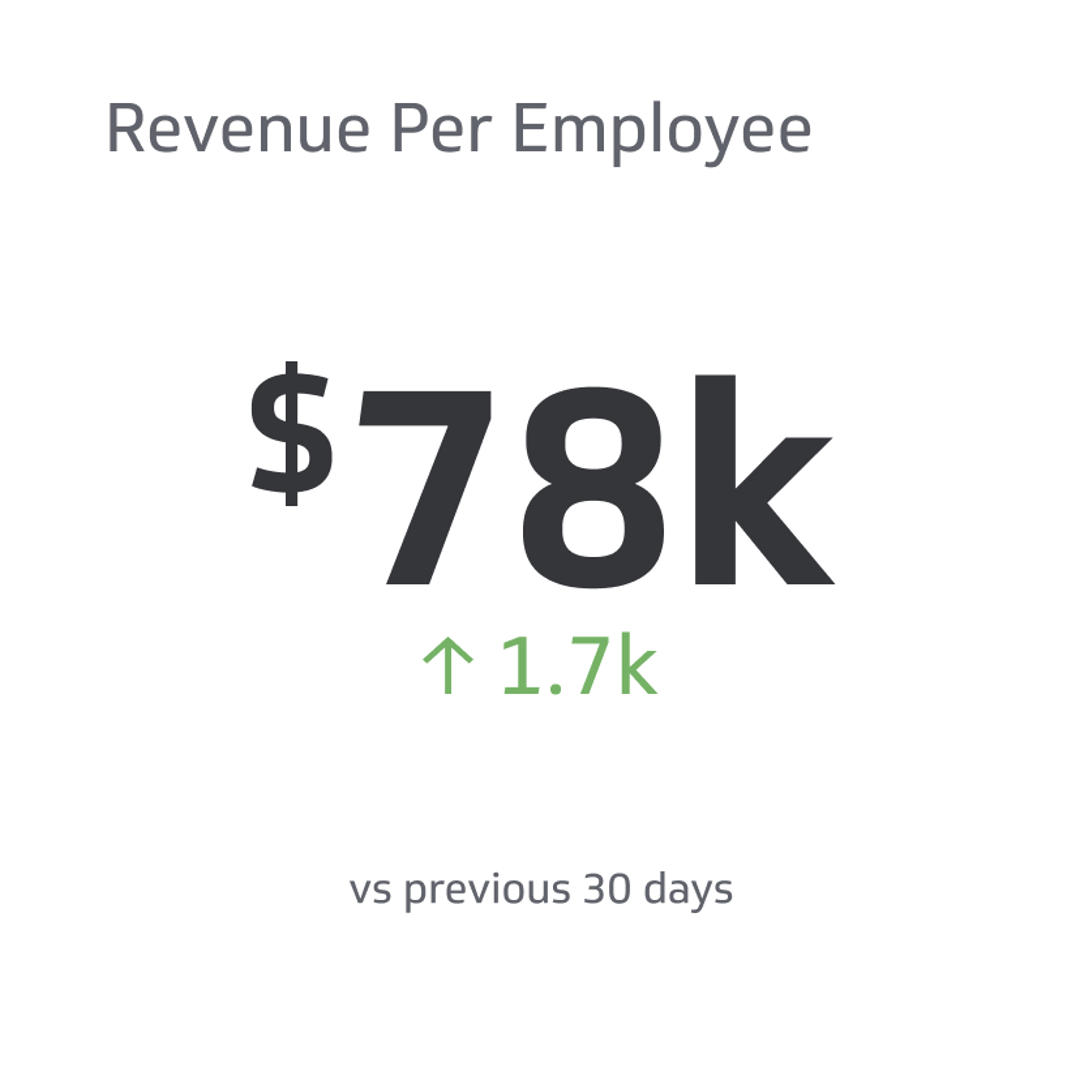

Revenue Per Employee

Revenue per employee is the average value an employee provides to your overall gross revenue.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

To this day, companies focus heavily on ROI, margins, and product pricing but don't seem to understand the importance of revenue per employee (RPE). Is the term new to you too? Hopefully, it isn't, but if it is, it's important to understand it and what it means for your business.

RPE stands as an important metric for every business that has employees. It gives a company insights into how much value they get from each employee, but that's not all. Revenue per employee drives important business decisions and helps gauge how well a business performs against competitors within its industry. Here's everything you need to know about RPE.

What Is Revenue Per Employee?

At the most basic level, revenue per employee is the average value an employee provides to your overall gross revenue. That means companies can reliably measure their employees' average contributions to revenue.

You may be wondering what effect that has on a business, but first; you must understand how to calculate your revenue per employee and why a company's RPE is important.

The Formula for Revenue Per Employee

Calculating your revenue per employee is relatively simple. First, you find to calculate your total revenue for any given period and then figure out your employee count for that same period. Once you have those two things, you divide your revenue by your employee count.

For example, if you made $2.5 in revenue for 2022 and have an employee count of 20. Your RPE is $125,000, which is pretty good. From there, you'll generally know whether you should hire more employees or consider downsizing or adjusting factors that affect your RPE.

What's the Purpose of Revenue Per Employee?

The main purpose of calculating and using revenue per employee is to get a general idea of how productive your employees are when comparing them to your total income. Unlike profit per employee (PPE), you get a general estimate that helps you find general problems to solve on the macro level of your business operations.

Why Is Revenue Per Employee Important?

RPE is important for businesses because it gives them an idea of the value they're getting from their talent. If RPE were low, a business would see that something is wrong and that the number of employees they have isn't contributing to the company's overall profitability.

Another, and more abstract reason, RPE is important is because it gives companies a real way to measure the intangible value their business gets from the talent of their employees.

Intangibles are extremely difficult to assess for most industries, but RPE allows for some way to measure them. For example, if businesses increase their RPE without changing factors other than employee training, they'll see direct value from efforts put into their employee's skill set.

How Does Revenue Per Employee Help Your Business?

Knowing your RPE helps your business make important macro-level decisions concerning employee involvement. Since companies want a higher RPE, they can compare their results to their competitors and see where they stand regarding the value they get from their employees.

For example, if the owner of a brick-and-mortar store sees that its competitor has a reasonably higher RPE than them, they can investigate and figure out why. Once they investigate, they notice that their competitor has an online store in conjunction with their physical store. Having an online store means more revenue with no extra human power necessary, raising their RPE.

What Factors Affect Revenue Per Employee?

When considering the factors that affect revenue per employee, you must remember that you're taking the average revenue your company earns and dividing it by your current employee count. Since it's an average, it doesn't account for outliers contributing more or less than the average.

Since that's the case, you want to look at factors on a macro level and not a micro one. These factors include employee count, company size, industry, and your product or service pricing. Here's more detail as to how each element contributes to your RPE.

- Company size: The first factor that affects your RPE is the size of your company. If your company is big and has few employees, you'll typically find your revenue per employee is higher than normal. For example, Air Lease has a revenue per employee of $2.4 million because they have only 87 employees.

- Company age: Believe it or not, a company's age may affect your RPE. For example, legacy companies will have more revenue which naturally increases their revenue per employee. However, start-ups with an average employee count still have less revenue than older companies, leading to a low RPE even with productive employees.

- Market and Industry: Depending on your industry or market, revenue may be high, and employee count may be low or vice versa. For example, an online eCommerce store has fewer employees but generates healthy revenue, while a traditional brick-and-mortar store needs more managers and employees to operate its stores.

- Employee turnover: A business may not have the workforce to generate more revenue because of high employee turnover. Low employee turnover means generally happy and stable employee contribution. For example, fast food industries and jobs with short-term positions typically find their RPE lower than others.

- Product/service pricing: Your revenue comes from your products and services, so if you're charging too little for your products, you may find that your RPE is lower than your competitors. Similarly, if you make plenty of money from your products, your RPE will be healthy.

How Do You Improve Your Revenue Per Employee?

Businesses get creative when improving their RPE, but generally speaking, there are some standardized and assured methods of improving your revenue per employee, assuming the issue relates to turnover rate, productivity, or employee count.

Improve Turnover Rate

The first thing you should look at when you see a low RPE is your employee turnover rate. Ask yourself, are employees quitting? And if they are quitting, why? Answering those questions will ensure you improve your overall turnover rate, which means spending less time and money on recruitment and more time on training and productivity.

Improve Employee Productivity

Employee productivity is the most common contributor to a low RPE. If your employees aren't using their time effectively, your organization won't see a big return in profit. Consider new training methods or incentivize your employees to do better.

Downsize

You may have too many employees for the amount of work available. When this happens, you'll find you're paying employees not to contribute to revenue. Instead, it would help if you found them work to do that will contribute to your business's revenue or downsize by letting some of them go.

Profit Per Employee vs. Revenue Per Employee

The main difference between profit and revenue per employee is the first word: profit and revenue. Profit per employee takes the overall contribution an employee has towards the profit of a business which means the net income after all expenses.

Revenue is the total income a company generates before deductions such as expenses. Meaning revenue per employee focuses on each employee's raw contribution on average before accounting for other factors.

It's a slight enough difference that you should understand the difference between the two, even though some companies use the terms interchangeably. For example, PPE is affected heavily by different factors such as labor costs and profit margins.

Frequently Asked Questions

You may still have some lingering questions if revenue per employee is a fresh concept. Here are some answers to common questions people have about RPE.

Is revenue per employee a good metric for small businesses?

Regardless of size, nearly all businesses utilize revenue per employee somehow. It's a measurement that provides insight into the value you get per employee, so if you're a business with more than one or two employees, it's a good metric.

What is the difference between revenue per employee and HCVA?

HCVA stands for human capital value-added or, in other words, profitability per employee. Instead of measuring the average overall revenue an employee contributes, it measures the average profitably per employee.

Who has the highest revenue per employee?

The leading company with the highest revenue per employee belongs to Apple. Their RPE is $2.4 million per employee.

What is a good revenue per employee for SaaS?

Most publicly traded SaaS companies average around $190k to $210k RPE annually. So, a good RPE for a SaaS-based business would be within that range, but you still have to consider company size and employee count.

Is low revenue per employee bad?

Low RPE typically means your business's productivity suffers in some way, whether that's too many employees, low productivity, or an extremely high turnover rate. It's best to examine why your company has a low RPE immediately.

How often should you check your revenue per employee?

Your best option is to calculate your RPE quarterly to stay on top of your business. While not necessary, it would still be wise. Even so, some businesses choose to calculate their RPE monthly or even annually,

Should human resources care about revenue per employee?

HR departments should certainly care about RPE. Since revenue per employee gives businesses a general idea of how their talent contributes to the overall business, it most certainly becomes an HR issue.

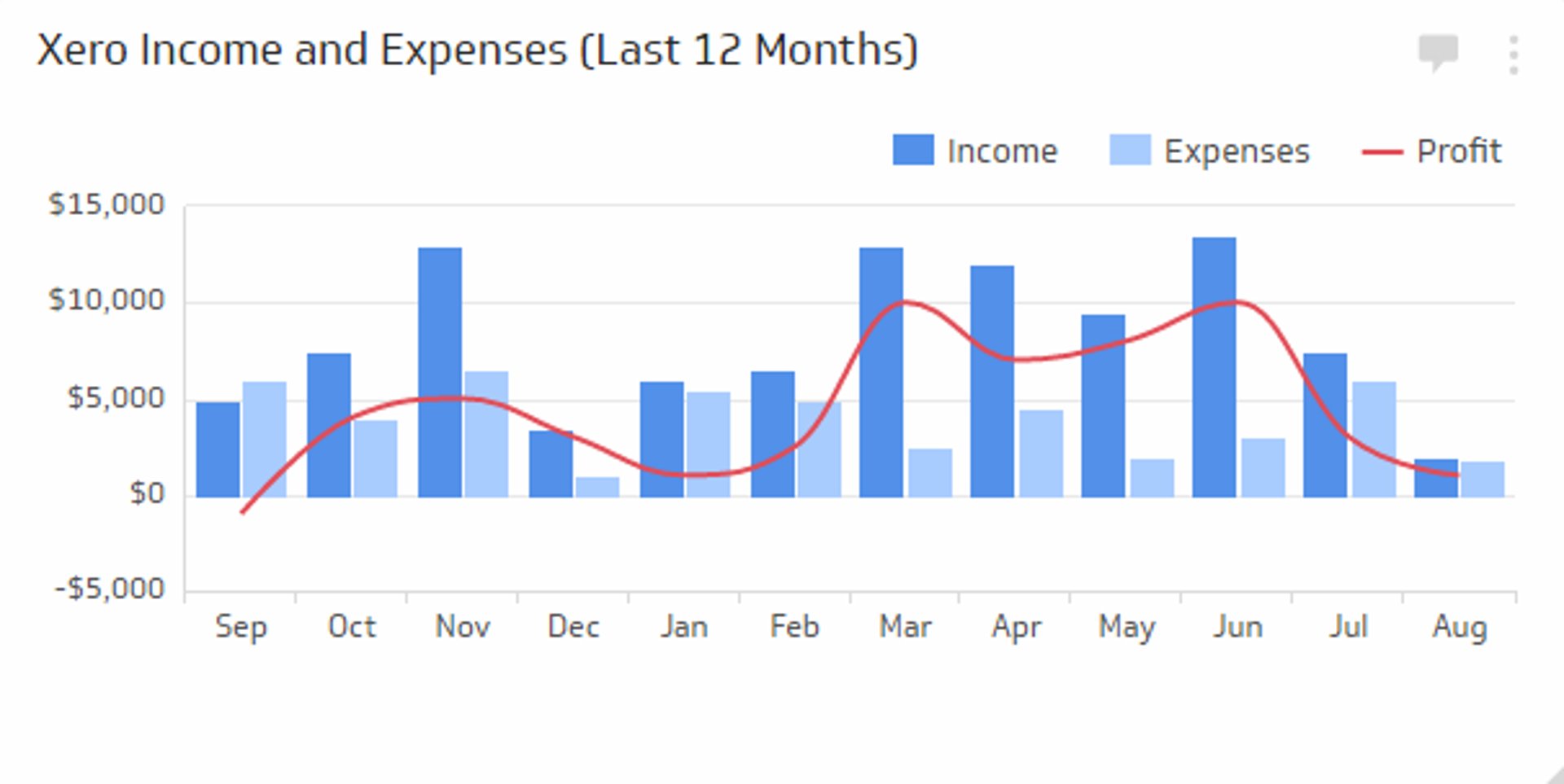

What's the best way to visualize revenue per employee?

If you're trying to show investors or shareholders your RPE, it's better to present it in a more consumable and easy-to-understand way. The best way to do this is via a bar chart. Bar charts are useful because it is easy to interpret and compare RPE to previous months or years.

Bottom Line

The only complex thing about revenue per employee is identifying which factors impact it and how to improve them. Company size, age, and turnover directly impact your RPE. And like any other financial metric, once you understand it, you can change it.

Remember, your RPE is the average of your employee's contribution to revenue. While you get a big picture of your employees' effectiveness, you still don't know which employees are the most effective. Even so, keep an eye on your RPE. You'll find it'll benefit you moving forward.

Related Metrics & KPIs