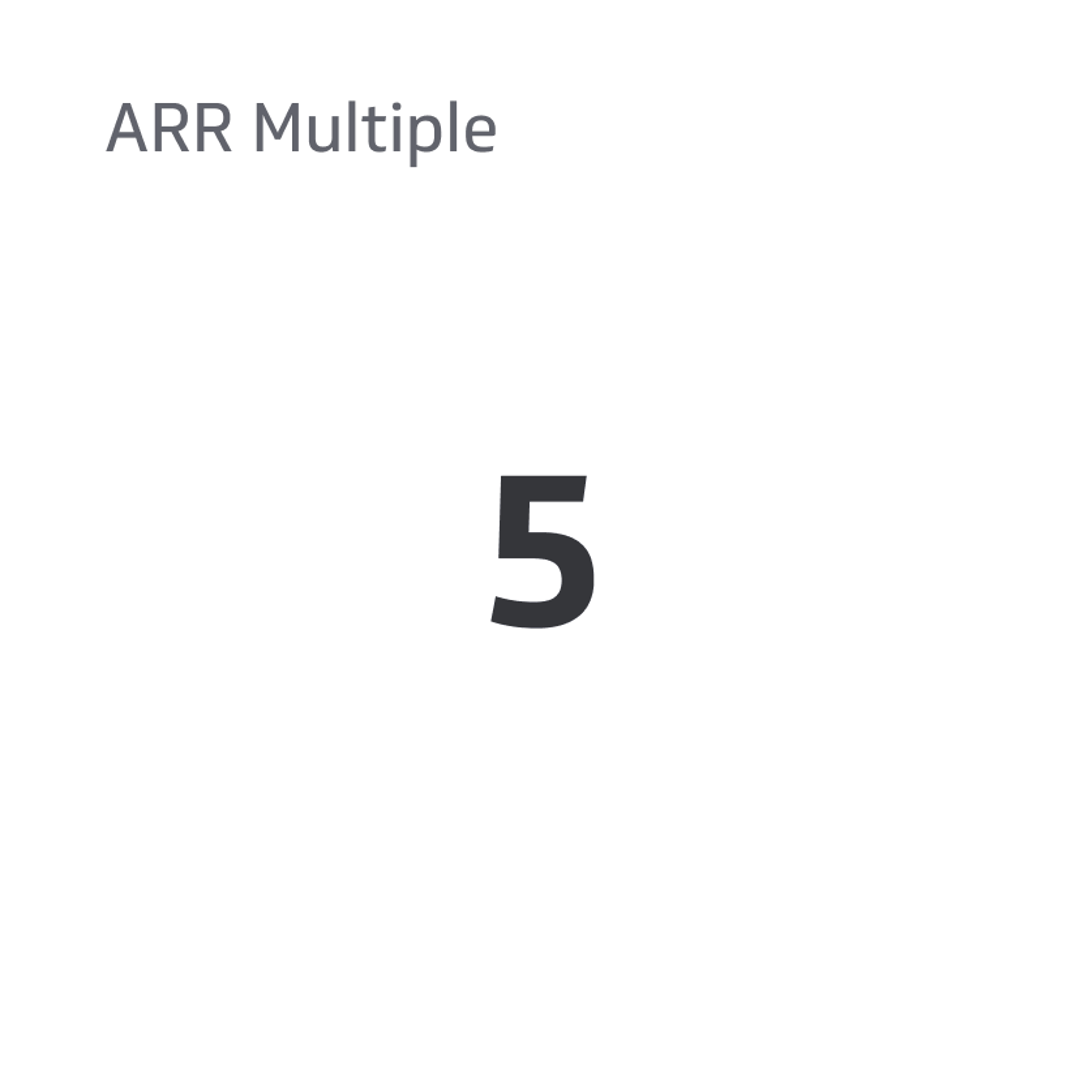

ARR Multiple

The ARR Multiple gauges the ratio between a company’s valuation and its Annual Recurring Revenue (ARR).

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

The ARR Multiple is one of the most important metrics for every SaaS company aiming to go public. Tech investors use it to calculate a SaaS company’s approximate value quickly.

Since SaaS companies sell intangible software as their primary service, it can be difficult to appraise them like a company selling a physical product. That’s where the ARR Multiple comes in.

In this article, you’ll learn all you need to know about calculating the ARR Multiple and how to increase it in a SaaS company.

What Is The ARR Multiple?

The ARR Multiple gauges the ratio between a company’s valuation and its Annual Recurring Revenue (ARR). Tech investors will also consider other metrics, such as the SDE-based valuation, growth rate, NRR, gross margin, and revenue retention, but the ARR Multiple is the easiest to calculate.

How To Calculate The ARR Multiple?

You can use the following formula:

ARR Multiple = Company Valuation / Annual Recurring Revenue (ARR).

Let’s use a more concrete example to describe this:

A SaaS company with an Annual Recurring Revenue (ARR) of $5 million and a market valuation of $50 million.

To calculate the ARR Multiple, divide the market valuation by the ARR:

- ARR Multiple = Market Valuation / ARR

- ARR Multiple = $50 million / $5 million

- ARR Multiple = 10

So the ARR Multiple for this SaaS company is 10.

This means that investors are willing to pay ten times the company's current ARR to own a share of the company. In other words, the company's valuation is ten times its annual recurring revenue.

What Does A High ARR Multiple Mean For an Investor?

A high ARR may suggest that a SaaS company has a large and loyal customer base.

If the SaaS product is useful, and customers find it valuable, they’ll continue paying for it recurrently. This will, in turn, increase the company's ARR growth.

A high ARR Multiple means the SaaS company is a potentially attractive option for investment from other tech firms, private investors, and venture capitalists.

More importantly, SaaS business owners will strive to increase their ARR Multiple if they intend to take the company public. However, for a SaaS company to achieve a valuation based on ARR, they’d need to have an ARR greater than $2 million.

On top of that, the ARR Multiple is an easy-to-understand metric. It’s easy to calculate and easy to compare with other companies, and its concept can be explained swiftly to investors outside of the SaaS industry.

Precisely because of its simplicity, it’s also the most popular metric for valuing a SaaS company, but not the only one.

Other Financial Metrics

There are other financial metrics, such as the Gross Profit Margin and the Net Income, which are much more difficult to grasp at a glance.

Other non-revenue-based SaaS valuations include SDE-based and EBITDA-based valuations.

The former stands for Seller Discretionary Earnings (SDE) and represents the remaining value after the owner has paid all business expenses. This method has its formula to calculate, and other SaaS valuables are at play here.

The EBITDA-based valuation stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, and it’s even more complicated to calculate.

While all three of these valuation methods can be used for the same purpose of appraising a SaaS company, it’s evident that investors will prefer the easiest, fastest, and most easily comparable method to do so, at least at first. That’s why the ARR Multiple is preferred.

While a high ARR Multiple is undoubtedly a great asset for any SaaS company, it’s not the only metric for success.

Why Do SaaS Companies Have Higher ARR Multiples?

You might have noticed that SaaS companies enjoy higher valuations than other tech companies.

That’s because SaaS companies generate recurring revenue through subscription-based models. These are more predictable and stable than companies that rely on direct product sales.

For example, Slack sells its enterprising messaging software. They have different plans tailored for each of their clients.

As part of their software analytics, they keep track of how many customers are subscribed to their product and can predict how many will remain subscribed throughout the year.

An accurate estimate of how many customers will remain allows them to command a higher valuation, knowing that this revenue is mostly secure in the long term.

This also gives tech investors higher confidence in investing on these SaaS companies, thus increasing the ARR Multiple more so in SaaS than in other industries.

What Is a Good ARR Multiple?

This depends on the SaaS company’s sub-niche, but some general industry benchmarks exist to determine a decent ARR Multiple. In Q1 2023, the multiple for U.S SaaS companies is 6.7x. That means the multiple could be from 3x to 15x of annual revenue. This is a stark contrast for the 18 to 19x of 2021.

Metrics such as customer churn rate, customer acquisition rate, and the company’s level of scalability also play an essential role.

That’s without considering external factors like SaaS competition, market saturation, and year-over-year (YoY) growth rate.

Regardless, the ARR Multiple and the MRR remain the most important metrics for SaaS valuation.

How Can A SaaS Company Increase Its ARR Multiple?

ARR investors pay multiples of ARR. The value of predictable recurring revenue cannot be understated, which is why most SaaS companies do everything they can to increase their ARR Multiple.

Increasing the companies' annual revenue is the most obvious way to do so. Other metrics mentioned in the article include improved customer acquisition, retention rates, and increased product offerings.

Customer Acquisition Cost

The Customer Acquisition Cost (CAC) is the cost of acquiring a new customer. Depending on the SaaS product, a customer could mean different things, but it almost invariably involves a paid subscriber.

Most SaaS startups fail, let alone go public, because their CAC is just too high to be sustainable.

SaaS startups will spend money on marketing, PPC, loyalty programs, and other advertising, increasing the Customer Acquisition Cost.

Free trials and freemium programs also increase the company’s CAC due to the support needed to onboard free users and the conversion into paying customers to boot. That’s also why reduced customer acquisition costs are a straightforward way of increasing the ARR Multiple.

Increased Retention Rates

A good retention rate usually translates into a higher ARR.

If the company recurrently keeps its customers hooked on its software, offers incentives for long-term subscriptions, and keep customers engaged through product updates, then they’ll renew their subscription.

Most importantly, the pricing and value of the SaaS company directly correlate to a good retention rate. If the product provides value that exceeds its cost, customers are more likely to renew their subscriptions.

Multiple Product Offerings

When a SaaS company markets its product, they probably have a specific customer avatar in mind. While many SaaS companies only offer one product with a couple of different tiers, others offer a more diverse product offering for different customer avatars.

While diversifying the product offering can be expensive for some companies, it can massively increase the company’s ARR if done right. It can help SaaS companies differentiate themselves from competitors and better target their audience’s pain points.

Conclusion

The RR multiple is one of the essential metrics in the business world, and it works wonders for businesses in todays world. A high ARR usually means that a company has a huge and loyal customer base which is quite attractive to investors.

Companies can increase their ARRs by reducing customer acquisition costs, increasing retention rates, and diversifying product ranges. We hope this guide helped you understand this concept better and use this metric for your business.

ARR Multiple FAQs

Here are some FAQs related to ARR Multiple

What Is The ARR Multiple?

The ARR Multiple compares a SaaS company's market valuation to its Annual Recurring Revenue (ARR). It’s the essential metric for calculating SaaS company valuation.

How Do You Calculate ARR Multiple?

Divide the company’s market valuation by its Annual Recurring Revenue (ARR). If the company brings in $1 million yearly, it has an ARR of $1 million. If its market valuation is $10 million, you must divide 10 between 1. The resulting ARR Multiple would be 10.

How Can a SaaS Company Increase Its ARR Multiple?

A SaaS company can increase its ARR Multiple by growing its ARR through increasing customer acquisition, improving retention rates, and expanding its product offerings. Additionally, a company can work to reduce costs and increase efficiency to improve its profitability.

Related Metrics & KPIs