Working Capital Metrics

Measure your organization's financial health by analyzing readily available assets.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Sign up with Google

or

Sign up with your emailFree for 14 days ● No credit card required

What is Working Capital?

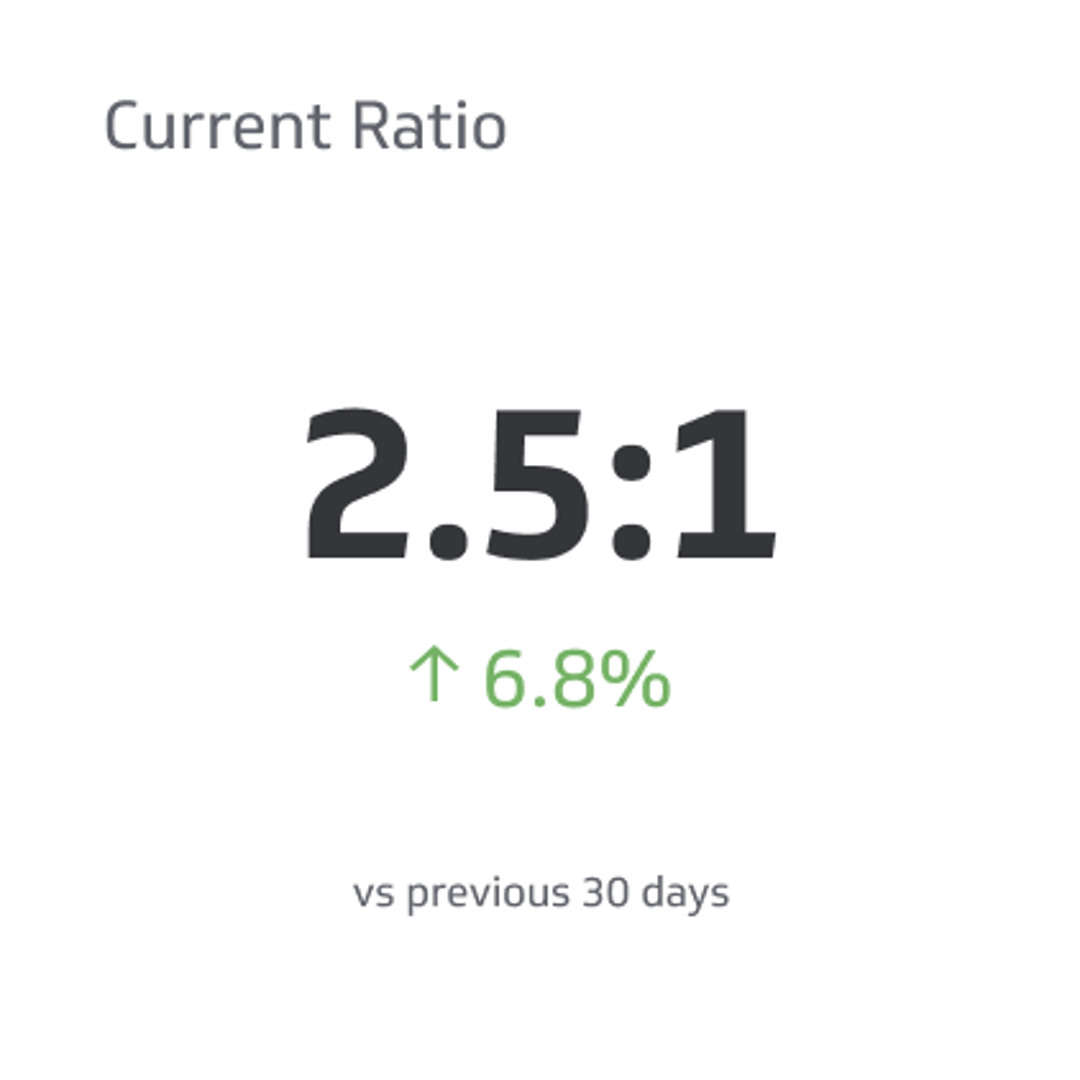

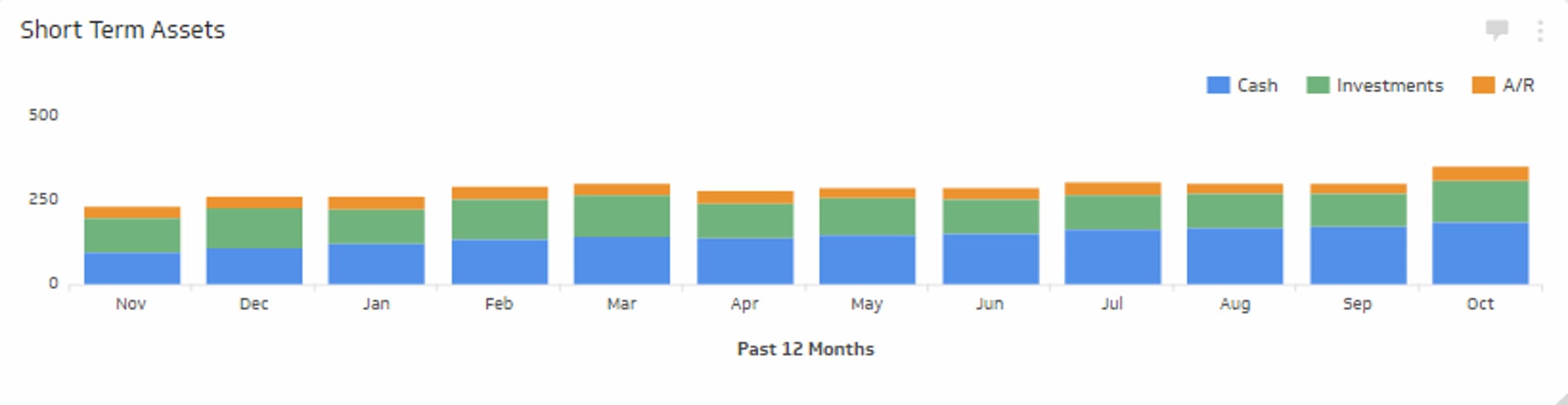

The Working Capital metric measures your organization's financial health by analyzing readily available assets that could be used to meet any short-term financial liabilities. Working capital includes assets such as on-hand cash, short-term investments, and accounts receivable to demonstrate the liquidity of the business (the ability to generate cash quickly). Working capital is calculated by subtracting current liabilities from current assets.

Key terms

- Assets: An economic resource that has a cash value.

- Liability: A financial obligation that stems from previous transactions, such as a purchase order.

Success indicators

- When expressed as a ratio, a working capital greater than 1 indicates that your company can cover its current liabilities.

See also

Related Metrics & KPIs