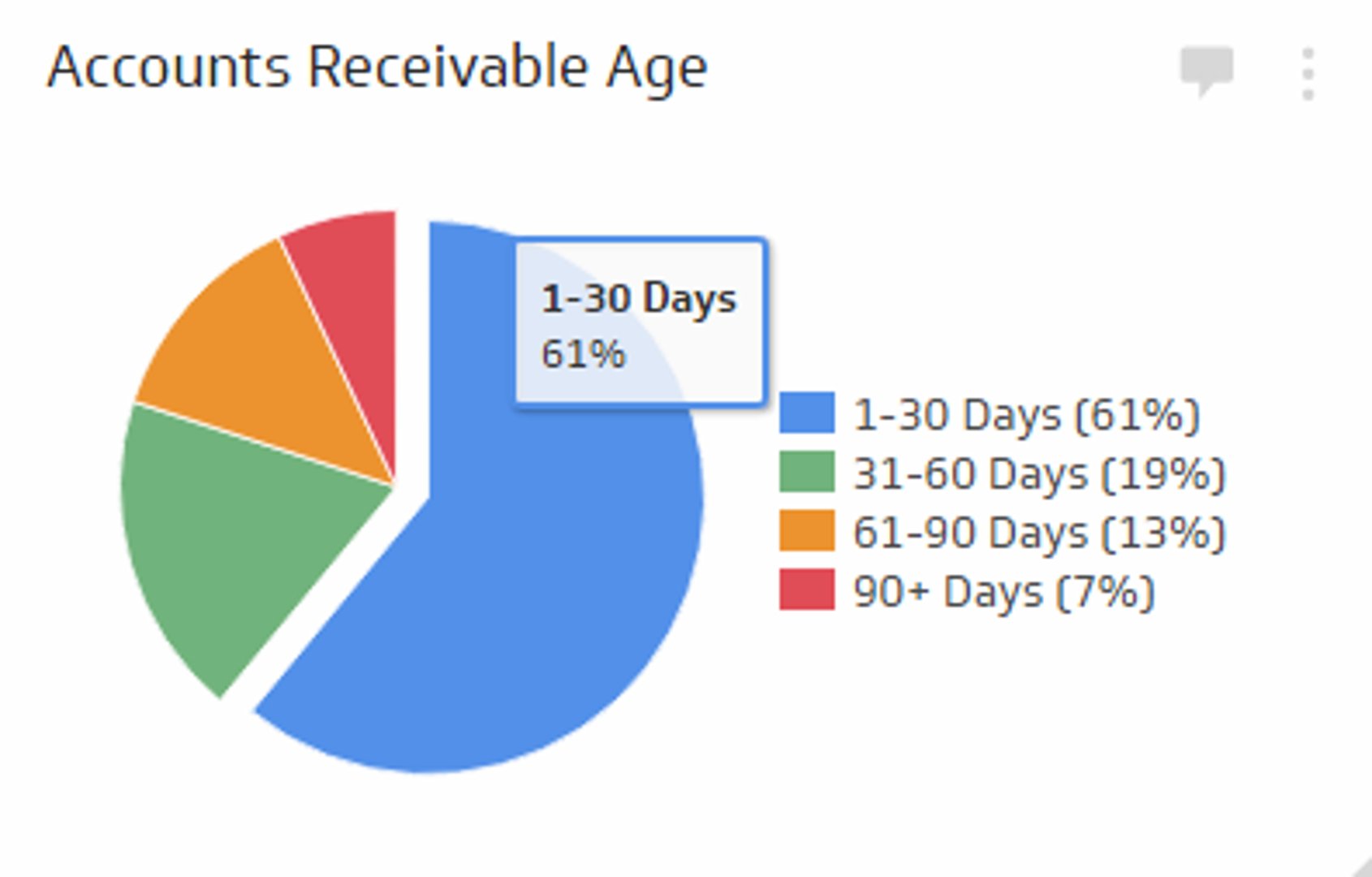

Accounts Receivable Turnover Ratio Metric

Measure how quickly your business turns credit sales into cash.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

What is Accounts Receivable Turnover?

Are you collecting payments from your customers efficiently? The Accounts Receivable Turnover ratio is a key performance indicator (KPI) that measures how effectively your company collects on its credit sales. In short, it shows you how many times you convert your accounts receivable into cash over a specific period.

Monitoring this metric is crucial for understanding the efficiency of your cash flow. A high turnover ratio suggests you have a healthy collections process and are extending credit to reliable customers who pay on time.

How to calculate Accounts Receivable Turnover

The formula for the Accounts Receivable Turnover ratio is straightforward.

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Here’s where to find those numbers:

- Net Credit Sales: This figure is found on your company's Income Statement.

- Average Accounts Receivable: This is calculated by adding the beginning and ending accounts receivable for the period and dividing by two. You can find the accounts receivable value on the Balance Sheet.

Example of Accounts Receivable Turnover

Let's make this real. Imagine your company generated $500,000 in net credit sales over the past year.

- Your starting Accounts Receivable was $40,000.

- Your ending Accounts Receivable was $60,000.

First, find the average accounts receivable:

($40,000 + $60,000) / 2 = $50,000

Now, calculate the turnover ratio:

$500,000 / $50,000 = 10

The result? Your Accounts Receivable Turnover ratio is 10. This means your company collected its average receivables 10 times during the year.

Why is tracking Accounts Receivable Turnover important?

Keeping a close eye on this KPI helps you make smarter decisions. It provides direct insight into several key areas of your business operations.

- Assess cash flow efficiency. A healthy turnover ratio is a strong indicator that your collections process is working well, ensuring a steady stream of cash to fund operations and growth.

- Evaluate credit policies. A low ratio might signal that your credit policies are too lenient, leading to delayed payments from customers who are poor credit risks.

- Identify collection issues. A declining ratio can be an early warning sign of problems in your collections department, allowing you to address issues before they impact your finances.

- Build financial credibility. Lenders and investors often look at this ratio to gauge your company's operational efficiency and financial stability.

Who should track Accounts Receivable Turnover?

While this metric is valuable for any business that extends credit, it's especially critical for certain company types and growth stages.

For business leaders in...

- Pro-Services Firms: For accountants, consultants, and law firms, timely payments are essential for maintaining healthy cash flow and managing payroll.

- Consumer Goods & Construction: Companies that deal with frequent, high-volume invoices need to monitor collections closely to manage inventory and operational costs.

- SaaS & Subscription Companies: Even with automated billing, tracking collection efficiency helps identify failed payments and potential churn risks early.

For companies that are...

- Scaling Up: As your customer base grows, manual tracking becomes difficult. Monitoring this KPI helps you maintain financial control during rapid expansion.

- Refining Processes: If you're experiencing cash flow problems, this metric helps you pinpoint whether the issue lies with your credit policies or collections effectiveness.

Ready to track your Accounts Receivable Turnover? Get all your team's data in one place, up-to-date, and beautifully presented with Klipfolio Klips. Build a dashboard today.

Related Metrics & KPIs