Return on Incremental Invested Capital (ROIIC)

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In this economy, finding a return on investment is critical to continued well-being in the business world. One way that has emerged that allows individuals to understand the depths of their investment further is through a concept called return on incremental invested capital (ROIIC).

This new calculation allows organizations to better see the effectiveness of their decisions and determine what areas they can explore for improvements to their bottom line.

To help you better understand this concept, we highlight its various elements in the paragraphs below. Continue reading on to learn more about return on incremental invested capital and what the data can do for you and your business.

What Is Return on Incremental Invested Capital?

ROIIC is a financial metric that measures the efficiency and effectiveness of a company's capital allocation decisions for its investments. The formula itself provides insights into the return generated from additional capital that is deployed to generate extra revenue or profit effectively.

The premise of the ROIIC calculation is to increase operational efficiency and help identify growth initiatives that will help the company to expand.

While many people have heard of concepts and metrics like Return on Investment (ROI) and Return on Equity (ROE), ROIIC focuses more specifically on the capital that a business invests in projects or initiatives.

When it comes to these projects or initiatives, they generally include things like plans for expansion, research efforts, development work, marketing campaigns, acquisitions, and even investments in new technology.

How Do You Calculate Return on Incremental Invested Capital?

As you set forth to calculate your ROIIC, there are a few steps that you need to go through to get an accurate representation. It's crucial to note that you need to be explicitly clear in the numbers to get an objective picture of what to expect.

Determine Your Incremental Operating Income

To get this number, you must have the amount of operating income the company possesses before investments are considered. You then will need the company's operating income after investments are in place and subtract the before number from the after.

Calculate the Incremental Invested Capital

Once you have appropriately calculated your first number, you must determine the incremental invested capital. This number represents any additional capital that your business uses for the investments. You will often see these in expenditures, acquisitions, and other investments specific to incremental projects.

Determine the ROIIC

To get the official number of your ROIIC, you need to take the incremental operating income and divide it by the incremental invested capital. Your final result will be displayed as a ratio or percentage.

Formula for ROIIC

Ultimately, the formula for calculating your company's ROIIC is as follows:

Operating Income After Investments - Operating Income After Investments / Incremental Invested Capital = ROIIC

ROIIC Example

To better put into words how to calculate ROIIC and best review its findings, we can work through the situation in an example.

The company we will be addressing is Jones Automotive. As it pertains to this corporation, the following numbers are taken into consideration:

- Operating Income Before Investments: $5 million

- Operating Income After Investments: $7 million

- Capital Deployed for Incremental Investments: $20 million

For the first step, you will determine the incremental operating income by subtracting the before-investment amount from the after-investment operating income. In this case, the result is $2 million.

You will then calculate the incremental invested capital, which is also the capital deployed for incremental investments. For this example, the total is $20 million.

Finally, you will divide the incremental operating income by the incremental invested capital to receive the final result. Therefore, in the case of Jones Automotive, you will take $2 million and divide it by $20 million. Your ROIIC will then be .1 or 10%.

Being that Jones Automotive has a return on incremental invested capital of 10%, that means that for every dollar of deployed capital, the corporation earns ten cents. However, you can't gauge from that amount alone whether it's a good ROIIC or not due to not knowing what market trends and valuations Jones Automotive is currently subjected to.

How Do You Effectively Utilize Return on Incremental Invested Capital?

As a business, there are many ways that you can effectively utilize the information you receive from ROIIC. The key to using it in an optimal way is to leverage your findings to make informed decisions about how you allocate capital.

Other ways in which a business can effectively utilize ROIIC include the following:

- The ability to identify and evaluate incremental investment opportunities

- Optimization of resource allocation

- Assess and adjust capital allocation strategies

- Make informed investment decisions

- Continuously monitor and improve

- Incorporate findings into performance evaluation and incentive systems

Once you have the findings from the ROIIC formula, you can analyze the numbers and prioritize those with the highest potential for value and profitability. Business owners will be able to allocate capital where it needs to go to aid in growing the organization and levels of revenue.

It's not common for businesses to have endless resources to devote to the various projects and investments they run. Therefore, it's imperative to identify which will do the best and go the furthest with extra funding.

It's also crucial to continue to evaluate progress by repeating the ROIIC calculation throughout the year. Some businesses will do it quarterly, whereas others may do it at the end of the fiscal year. The more you perform the calculation, the more data you will have to compare when it comes to growth.

What Is a Good Return on Incremental Invested Capital?

When it comes to determining if the percentage or ratio you obtain after the calculations are complete is a positive result or a negative, the consensus will depend on various factors. Some of those include the following:

- The industry of the business

- Size of the company

- Findings of the company risk profile

- Current and past market conditions

As you can imagine, with the constantly changing market conditions and the ever-evolving elements that come with operating a business through periods of growth and change, the concept of what constitutes a good return is constantly changing. With that, you will find that what may seem to be positive one year may not be seen that way the following year.

Overall, when determining your current ROIIC status, you will want to have a higher percentage or ratio than the cost to operate. If a company consistently exceeds its cost of capital, it may be that they are creating value and generating returns that don't meet the expectations of its investors.

Tracking Return on Incremental Invested Capital

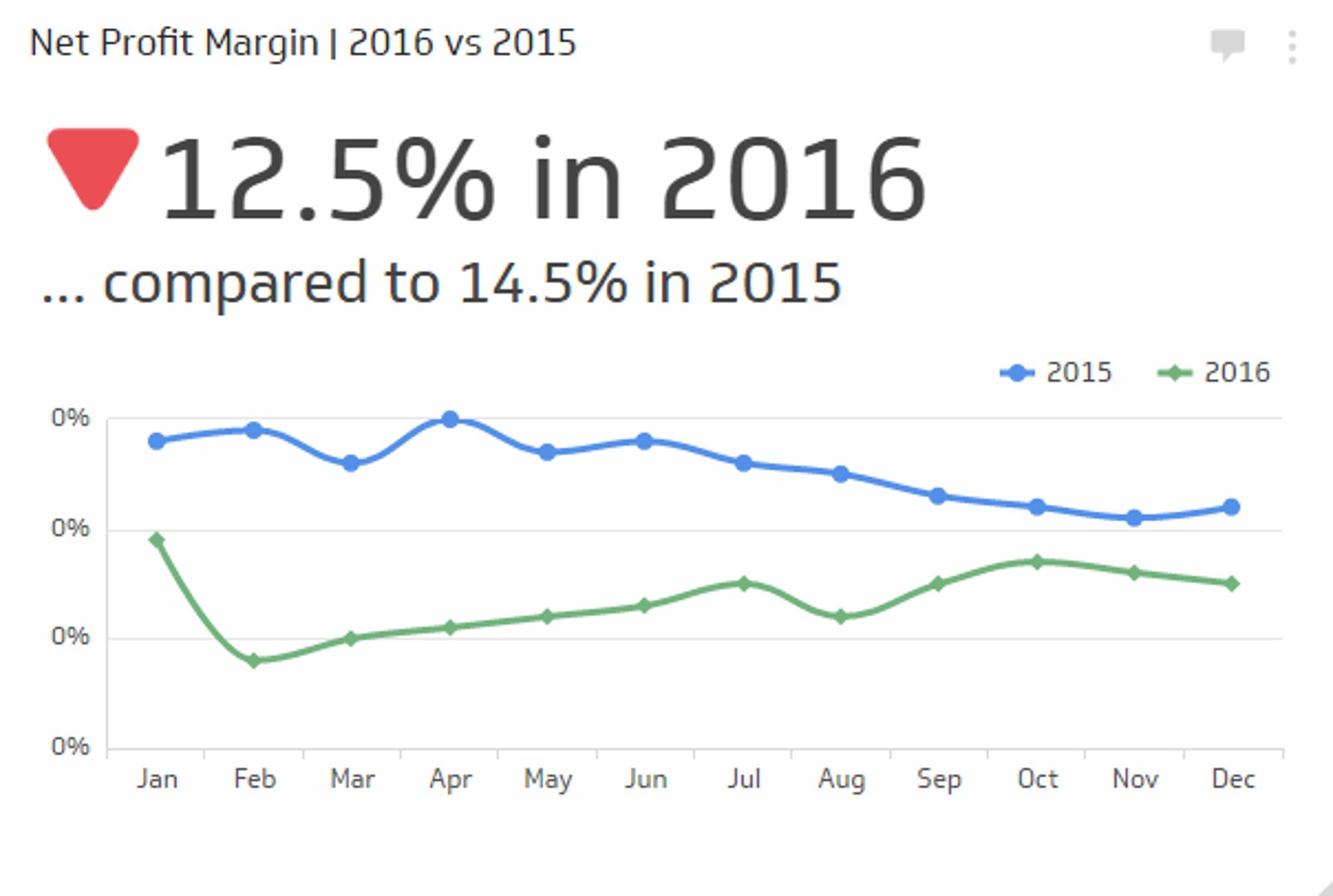

Throughout the years, you will inevitably gather much data as it pertains to your ROIIC. While you can peruse previous reports to gather insight into your company's growth and investments, many prefer to highlight the results visually to get a better read on the changes.

There are several ways in which a company can do this. The most popular method is using a line graph to lay out all the data from all previous calculations. This type of graph allows you to visually see where you experienced growth and where the loss occurred.

Another popular graphing option when it comes to visualizing your results is a bar graph. The illustration qualities allow you to see the percentage changes without reviewing a lot of information.

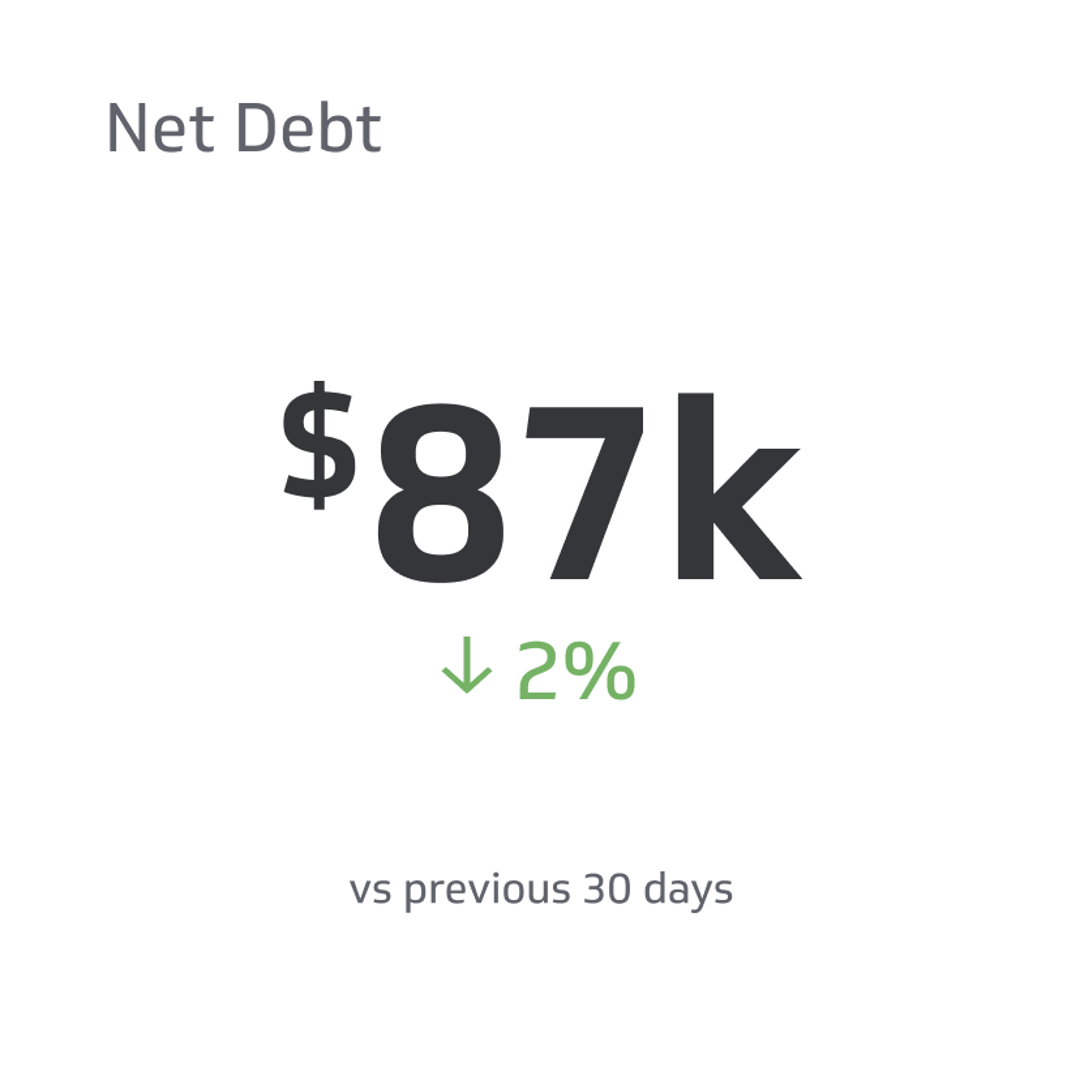

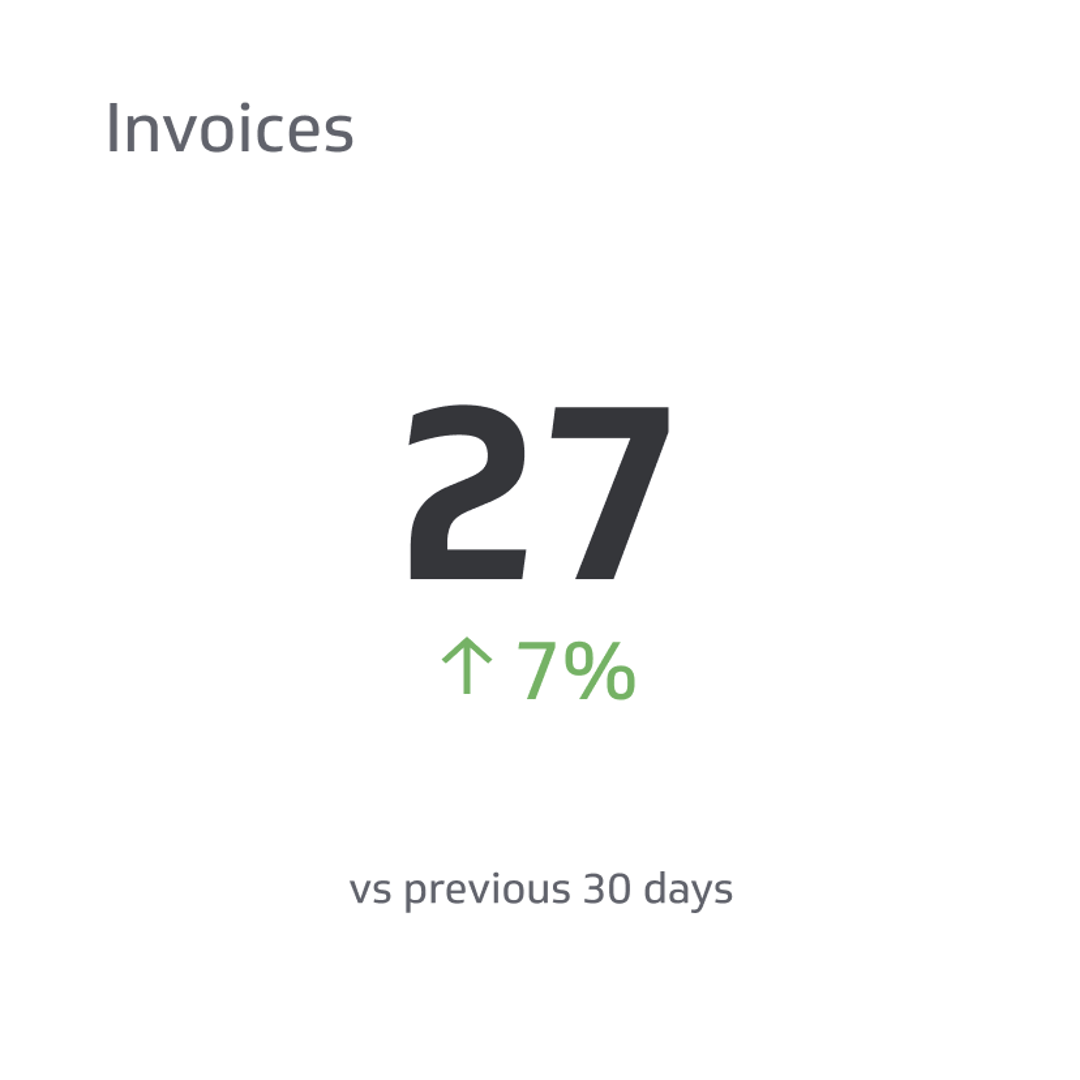

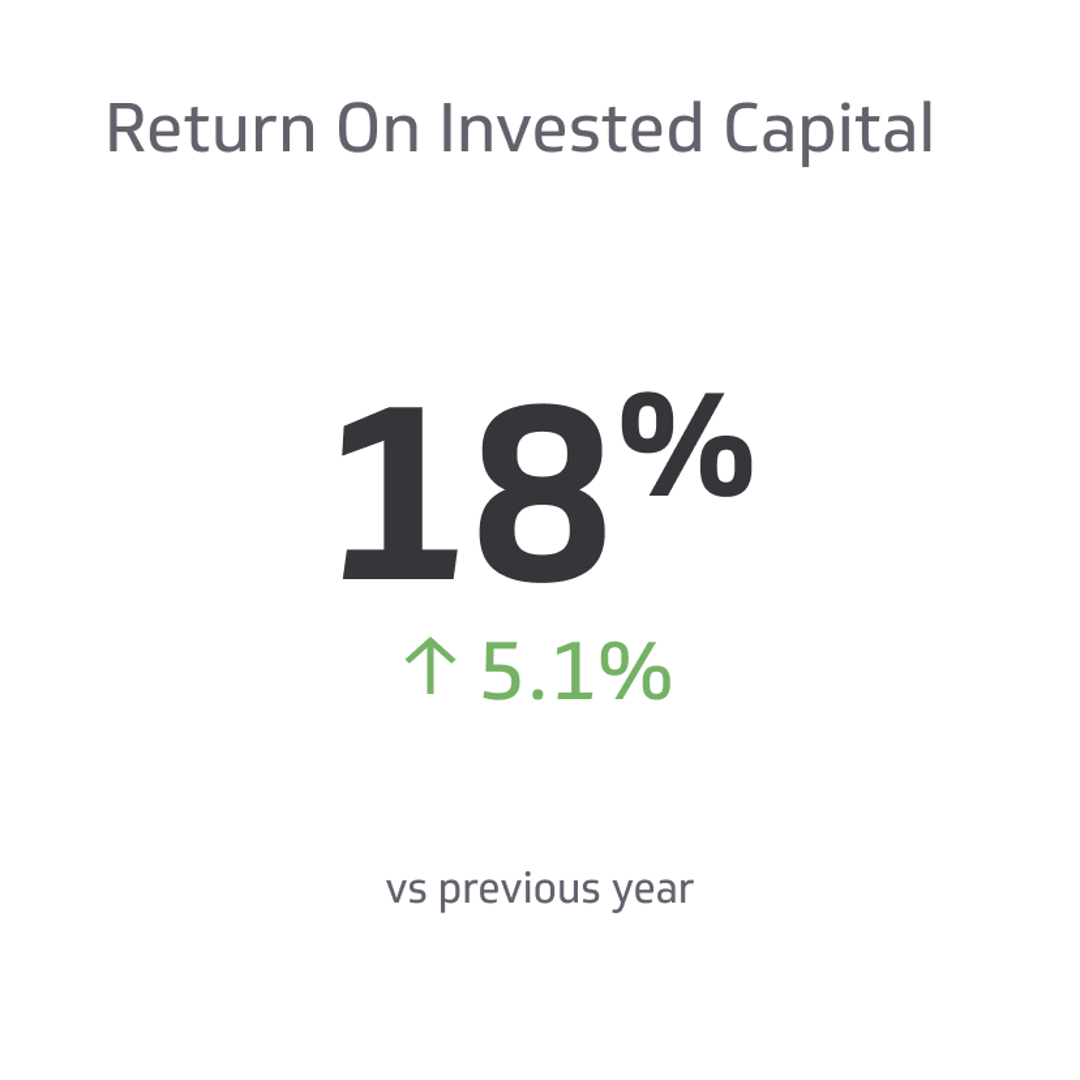

Creating or maintaining a dashboard can be helpful for those who are more technologically savvy. With this platform, you can access all the results in as little or as much detail as you wish, expanding certain areas as you go on or keeping information at a high level.

Another top option that is more technologically advanced is the use of interactive data visualization tools. For some, this is as simple as customizing an Excel spreadsheet. However, using a program like Tableau or Power BI is easier to manage for others. It allows more opportunities to analyze the data that you have collected throughout the years.

Final Thoughts

With all of the changes in the business world, it's vital to keep tabs on your various investments and whether or not they are providing the level of growth you desire. When it comes to business, you must keep in mind that what you do currently affects the future of the company as well as the employees and stakeholders.

Therefore, you want to ensure you are dialed into all the calculations and data you can obtain. Exposure to these concepts will allow you to make better decisions regarding investments, expansions, and changes to the corporate structure. With this data, you can also see where product, service, or employment changes can influence the bottom line.

While many have heard of ROI and ROE, not as many know about ROIIC. This formula allows you to see where your investments are going and what benefits they have to your company. With this information, you can better understand which direction to go and what changes to make within the company or the goods you offer.

Related Metrics & KPIs