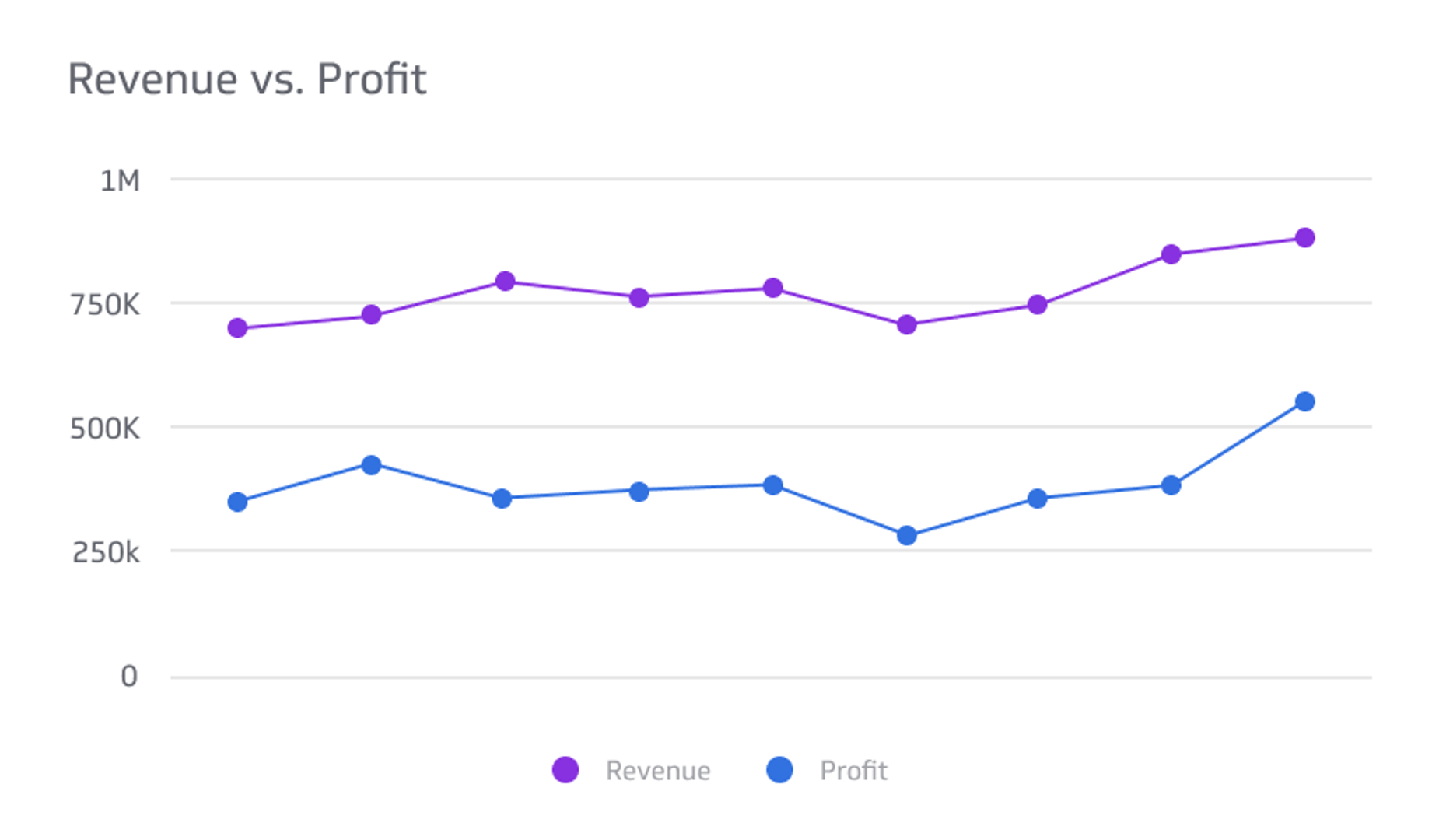

Revenue vs. Profit

Revenue and profit represent the top and bottom lines of a company’s income statement.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Whether you own an enterprise or plan to invest in one, understanding the fundamental concepts of business accounting enables you to analyze a for-profit organization’s performance and determine its overall financial health.

Revenue and profit are two key metrics telling the story of how a company is doing financially. These two terms have become part of the everyday vocabulary of modern society. Though they may be familiar to the average layperson, they are widely misunderstood and often used interchangeably.

Revenue and profit look at a company’s bottom line through different lenses. They are not the same thing. Understanding both principles and how they relate, you can discern whether a company is thriving or tanking.

Here's everything you need to know about revenue and profit and what makes them different.

What’s the Difference Between Revenue and Profit?

When analyzing how a company is doing, various metrics help provide clarity and bring the fiscal picture into focus. Chief among these is revenue and profit. On the surface, revenue and profit refer to the same thing, that is, how much money a company is making.

But while these two terms are intricately intertwined, each portrays an organization’s financial health from a different perspective and depicts differing sides of the story.

Think of revenue as a birdseye view of a company’s performance with a focus on the big picture. On the other hand, profit dives deeper into an enterprise's finances and helps shape strategic decision-making.

Here's a closer look at revenue and profit and how each is important to understand whether a business is overachieving, underperforming, or maintaining the status quo.

What Is Meant by Revenue?

Revenue is a sweeping term painting a company’s financial health with a broad brush. On an income statement or a balance sheet, revenue appears on the top line and is the first number seen by an owner, investor, or analyst.

Generally, revenue refers to an organization’s earnings during a specified period, such as a month, quarter, or year. Revenue is a straightforward value calculated by (1) taking the number of products or services sold by a company and (2) multiplying it by the selling price.

Put another way; revenue is a monetary measure of how much a company sells in the ordinary course of its business and what prices it commands for those goods or services. As a performance indicator, revenue highlights noteworthy trends relating to sales and marketing. For instance:

- Sustained revenue growth can be the result of increased sales volumes (i.e., more products or services sold)

- Rising revenues may also be the result of higher sales prices (with or without a correlating increase in the number of units sold)

- Conversely, declining revenue can be the result of shrinking sales volume, attributable to fewer units sold, lower sales prices, or a combination of both

- Plummeting revenue indicates dire financial straits for a company and foretells primary sales-boosting or drastic cost-cutting measures to keep the enterprise viable.

While revenue is not the end-all-be-all of financial analysis, it is a crucial analytical tool, and the data it represents provides invaluable insight into how a company is performing. From the standpoint of sales and growth, revenue is a strong indicator of whether things are trending in the right direction.

The Different Types of Revenue

Just like businesses run the gamut of types and sizes, revenue comes in different forms, each offering a unique perspective of a company’s financial health. Some revenue figures provide a cursory overview of an organization’s earnings, while others view income streams through a narrower lens.

These are the various ways that revenue is analyzed:

Gross Revenue

This value represents all the earnings of a company from the sources of income that make up its core business, as viewed in a vacuum without regard to operating expenses and costs

Net Revenue

Digging deeper into a company’s financial health, its net revenue accounts for operating expenses and costs and deducts these amounts from gross revenue

Operating Revenue

This form of revenue examines earnings derived from a company’s core or primary operations only (e.g., for a restaurant business, the operating revenue comprises the sale of food and beverages from its brick-and-mortar location)

Non-operating Revenue

Businesses can drive earnings through multiple sources, including non-traditional channels, and non-operating revenue accounts for these additional income streams (e.g., a popular restaurant with a devoted customer base may sell branded items like clothing and decals or sell prepaid gift cards)

Revenue appears as the top line in an income statement or balance sheet and is vital information for a business owner or an investor. But revenue does not tell the whole story of a company’s overall health; it indicates growth, scale, and activity and reveals whether a business is trending in the right or wrong direction.

But to see the complete picture of how a commercial enterprise is doing, other aspects of financial performance must be evaluated, including, most notably, profit figures.

What Is Meant by Profit?

Except for organizations like nonprofits and the like, most businesses exist to turn a profit. Although the basic premise of profit is simple, i.e., a company makes more money than it spends, understanding the complexities of profit requires understanding how enterprises go about their business.

Profit goes by several names, some of which are common and others a bit misleading. These include net revenue, net income, and net earnings.

What these terms all have in common is that they entail the subtraction of certain operating costs and expenses from a company’s revenue, or its gross earnings, to arrive at a figure that indicates how much money can be reinvested into the enterprise, put away and saved for a rainy day, or distributed as dividends to shareholders and investors.

Profit is often called the bottom line because it appears as the final entry (at the bottom of the page) on financial reports, like an income statement.

Profit is important because it represents a deeper dive into a company’s finances. It goes beyond how much a business earned selling its products or services and examines what it took (and how much it cost) to get those revenue streams to market.

How Do You Calculate Profit?

Unlike revenue, which is a snapshot of a company’s earnings at any given time or over a specified period, profit results from a calculation deducting various operating costs and expenses from revenue.

In theory, revenue will be zero at worst, meaning that a company failed to sell products or services. Profit, on the other hand, can be a negative value or an operating loss. This failure occurs when an enterprise spends more to produce its goods or provide its services than it takes in by selling them.

Typically, the types of costs and expenses that are deducted from revenue to yield a profit figure include things like:

- In the case of goods and products, the cost of raw materials, ingredients, parts, and other components used during the manufacturing process

- Labor and payroll costs directly attributable to production

- For services, the cost of providing them, such as hardware used in the field, software, and technology

- Sales and marketing expenditures like advertising and promotional activities are standard deductions in profit analysis

- The costs and expenses of doing business (such as making payroll and paying office rent) are also deducted from revenue to calculate profit.

Profit represents the amount, if any, remaining from revenue once operating costs and expenses have been deducted. Profit provides a more revealing look into a company’s financial health and its prospects for long-term growth.

What Are the Different Types of Profit?

Profit is a telling indicator of how well a company is performing. If an enterprise’s earnings enable it to meet its financial obligations with enough left over to reinvest into hiring additional personnel or acquiring more equipment, then its prospects for sustained growth are positive.

Conversely, suppose an income statement reveals that a business is operating at a loss (i.e., the company’s expenditures and overhead costs exceed the revenue it generates selling its goods or services). Companies must implement measures to increase revenue, slash costs, or both in that case.

Because a company’s profitability numbers dictate vital strategic and policy decisions, profit analysis is serious business (no pun intended). There are several ways to measure profit, but these three are the most common:

Gross Profit

The direct costs of producing goods (commonly referred to as COGS - the costs of goods sold) or providing services, such as raw materials, direct labor, and associated overhead, are subtracted from revenue to arrive at gross profit.

Operating Profit

By deducting ordinary operating expenses like salaries paid to administrative and support staff, office supplies, and R&D costs, you arrive at an operating profit figure.

Net Profit

The true bottom line of a business is its net profit, which is what is left from operating profit once non-operating expenses like interest paid on business loans and tax payments are taken out.

Revenue figures may create a buzz among investors and shareholders, but profit drives the decisions that shape a company’s future behind closed doors.

Why Do Revenue and Profit Matter to a Business?

Revenue and profit are vital financial metrics for a business and reveal two aspects of the same big picture: the health and vitality of a company and its prospects for long-term growth and sustainability.

Where revenue represents the headline-grabbing earnings that can send investors into a buying frenzy, profit depicts a more analytical (if not sobering) view of an organization’s financial condition.

From the standpoint of sales performance, revenue is an indicator of demand for a company’s products or services and its marketing reach. Upward trending numbers indicate growth, while diminishing or stagnating figures raise red flags.

Profit is a more nuanced metric than revenue because it reveals whether a commercial enterprise is net positive and sustainable as an ongoing concern or digging a financial hole from which it may not get out.

Final Thoughts

Analyzing the financial health of an enterprise can be a complex exercise. Two commonly used metrics are revenue and profit, representing the top and bottom lines of a company’s income statement.

Separately, revenue and profit only tell part of the story. Still, together, these factors reveal whether a company is meeting sales expectations and turning a profit or falling short and trending in the red.

Related Metrics & KPIs