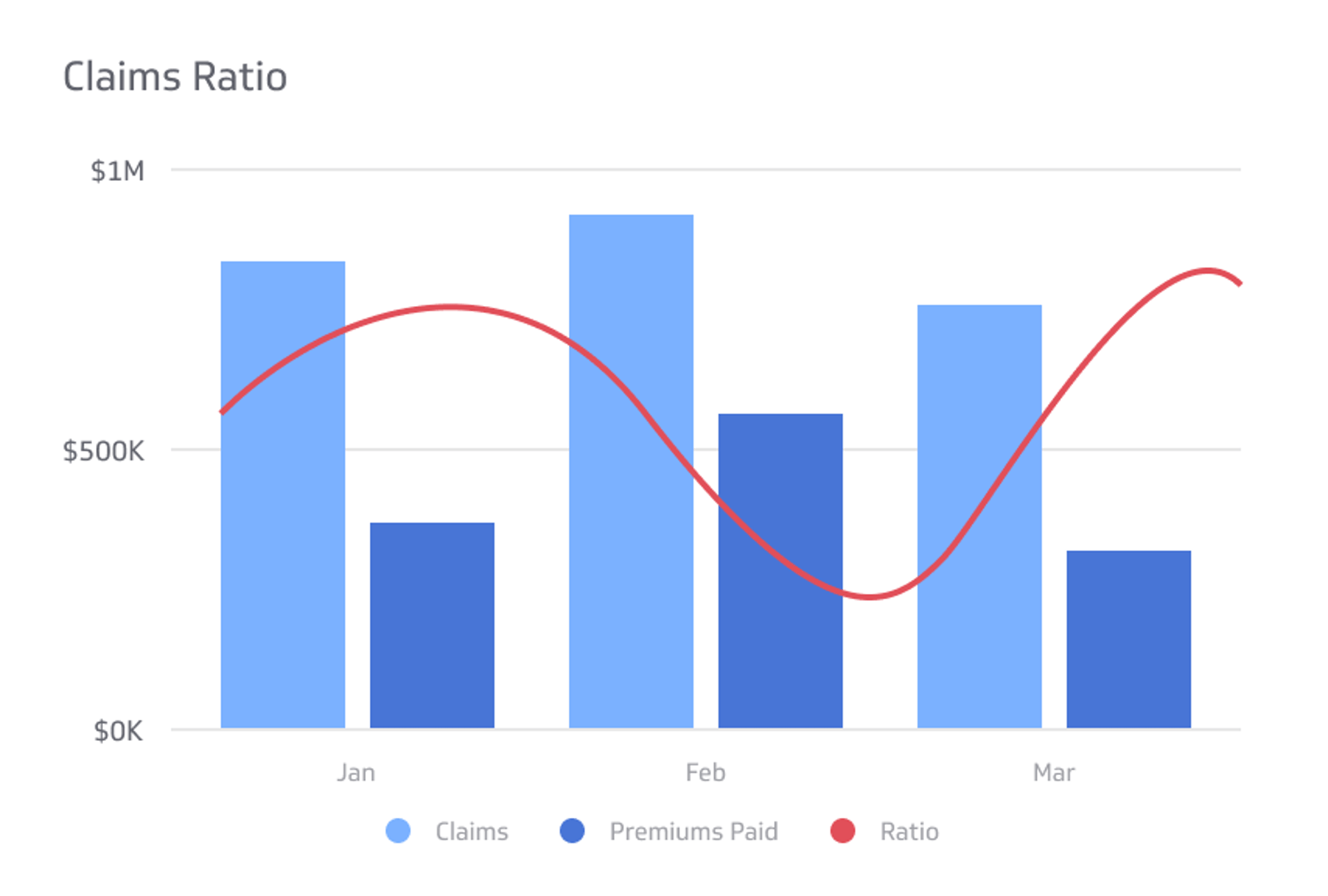

Claims Ratio Metric

Measures the number of claims in a period and divides that by the earned premium for the same period.

Track all your Insurance KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Sign up with Google

or

Sign up with your emailFree for 14 days ● No credit card required

The Claims Ratio KPI measures the number of claims in a period and divides that by the earned premium for the same period. It's important to note that insurance is the business of managing risks and, to do that well, the insurer needs a thorough understanding of the incurred claims ratio. If the value is higher than expected or established norms, then further investigation is required to figure out why that is (eg: fraud). If it is lower than expected, it could indicate irrelevant products or difficulties in claiming, possibly affecting customer satisfaction.

Related Metrics & KPIs