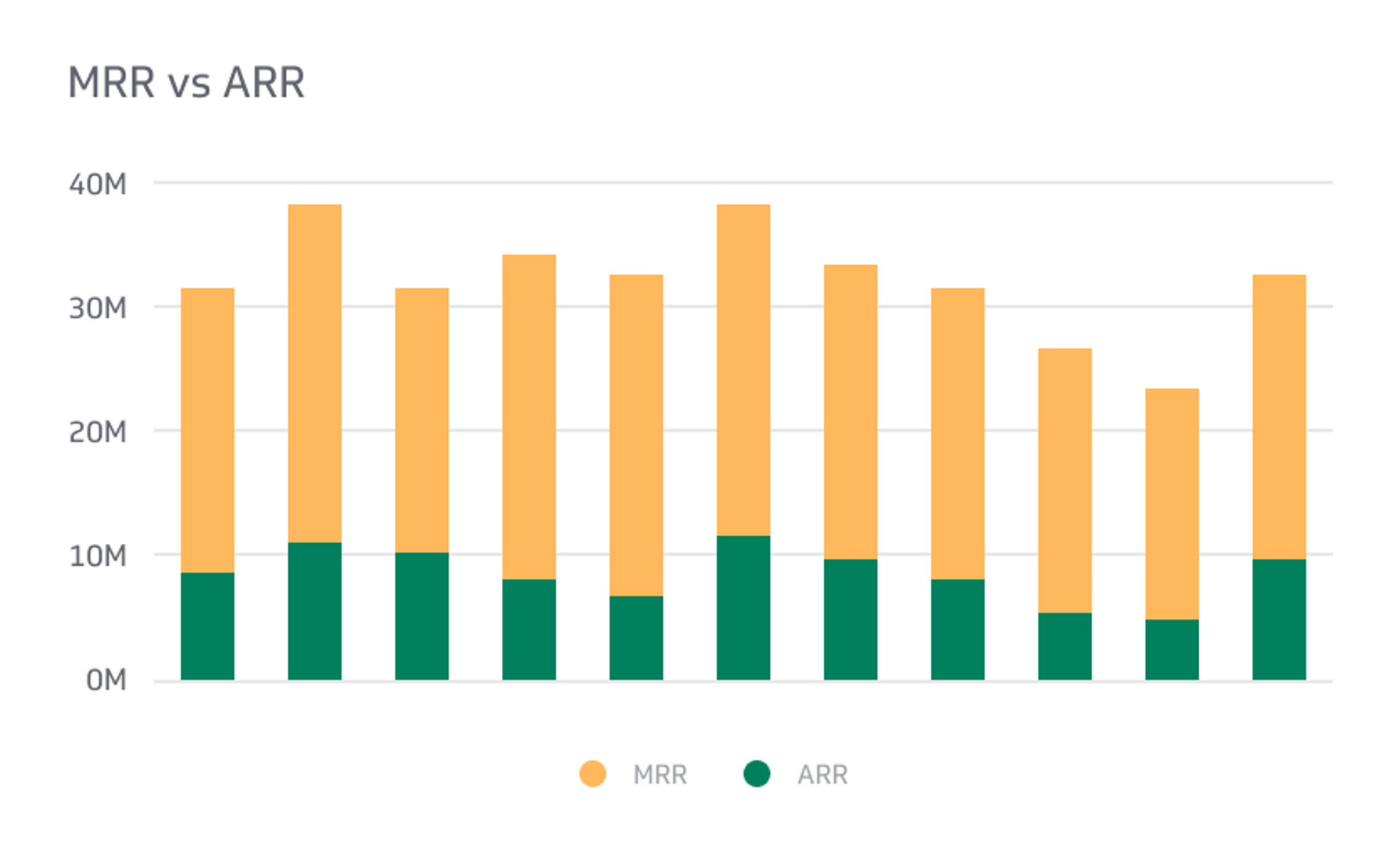

MRR vs ARR

These are key metrics used in the subscription business model to help measure revenue.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

ARR and MRR are key metrics used in the subscription business model to help measure revenue. For example, ARR provides visibility into the health and stability of a company's recurring revenue stream. It helps businesses plan its financials, make informed decisions about resource allocation, and set realistic growth targets.

Meanwhile, analyzing changes in MRR can identify which plans or packages are driving the most revenue and adjust them accordingly. Both are fundamental to assessing your company's financial performance.

Here’s everything you need to know about ARR and MRR, from what they are to KPIs you need to monitor.

What is Annual Recurring Revenue?

Annual Recurring Revenue (ARR) is a metric used by subscription-based businesses to measure the total revenue expected to be generated from recurring subscriptions, usually over a 12-month period. It provides a forward-looking view of your company's expected revenue based on the subscriptions at a given time.

Monitoring ARR and its trends over time can provide insights into your business' growth trajectory and financial performance. It is often used together with other metrics, such as customer acquisition cost (CAC), customer lifetime value (CLTV), and churn rate, to assess the overall health and success of your business.

ARR Formula

ARR is calculated by summing up the total value of all annual subscription contracts in effect without taking into account the start or end date of the subscription. It should also exclude one-time or non-recurring fees.

- ARR = Annual recurring revenue from existing customers + Annual recurring revenue from new customers

Compared to MRR, ARR provides a longer-term view of your company's revenue. You can use it for reporting, forecasting, valuation, and investor communication. It looks at the expected revenue generated over an entire year.

ARR evaluates the growth and scalability of your business. It helps owners understand their subscription business model's long-term revenue potential and stability.

What is Monthly Recurring Revenue?

Monthly Recurring Revenue (MRR) is used to measure the total revenue generated from recurring monthly subscriptions within a given month. It’s a dynamic metric that can change based on many factors, such as new sign-ups, subscription cancellations, upgrades, and downgrades.

You can use MRR for financial reporting, forecasting, benchmarking, and evaluating the effectiveness of your marketing and sales efforts. It can even be used to optimize pricing and packaging strategies, maximizing profits.

MRR Formula

MRR is calculated by summing up the monthly subscription revenue from all active customers during a particular month. It excludes one-time or non-recurring fees.

- MRR = Monthly recurring revenue from existing customers (or those who subscribed in the previous month) + Monthly recurring revenue from new customers

MRR provides insights into the health of your subscription business, as it reflects the recurring revenue that the company can expect to receive. It is a great indicator of your company's financial performance, growth, and stability.

What are the key differences between ARR and MRR?

There are many differences between ARR and MRR. Below are the important ones:

Timeframe

ARR measures revenue annually, while MRR measures revenue every month. ARR looks at the total revenue a subscription business expects to generate in a year, whereas MRR looks at the total revenue generated in a month.

Calculation

ARR is calculated by taking the sum of all subscription contracts for a year and excluding any one-time or non-recurring fees. Meanwhile, MRR is calculated by taking the sum of all subscription contracts for a month and excluding any one-time or non-recurring fees.

Granularity

ARR provides a higher-level view of your business’ financials, aggregating revenue from all subscriptions over a year. MRR is only calculated monthly, so it provides a more granular view of your company's revenue.

Flexibility

MRR is more flexible and responsive to changes in the subscription business, as it reflects monthly fluctuations in revenue. Since ARR is calculated annually, it captures revenue changes slower than MRR and may not be as responsive to changes in your business.

Comparability

ARR is commonly used for annual financial reporting, forecasting, and valuation purposes, as it provides a stable and predictable measure of your company's revenue. MRR, on the other hand, is used for operational and day-to-day management purposes. It provides a more dynamic and real-time measure of your profits.

What are the various ARR and MRR metric types?

ARR and MRR are widely used in software-as-a-service (SaaS) companies to assess subscription revenue and financial health. Below are ARR and MRR SaaS metrics you should be aware of:

Gross ARR/MRR

Gross ARR/MRR refers to the total annual or monthly recurring revenue generated from all active customers without considering any discounts, refunds, or cancellations. It represents the revenue a SaaS business expects to generate from recurring subscriptions before any adjustments.

Net ARR/MRR

Net ARR/MRR accounts for adjustments such as discounts, refunds, or cancellations. It represents the revenue that a SaaS business expects to recognize after accounting for these factors. It also provides a more accurate picture of the actual revenue that your business will realize, accounting for changes in customer subscriptions.

Expansion ARR/MRR

Expansion ARR/MRR measures the additional revenue generated from existing customers due to upsells, cross-sells, and upgrades. It reflects the growth in revenue from existing customers, indicating the success of your business in expanding its customer base and increasing customer value over time.

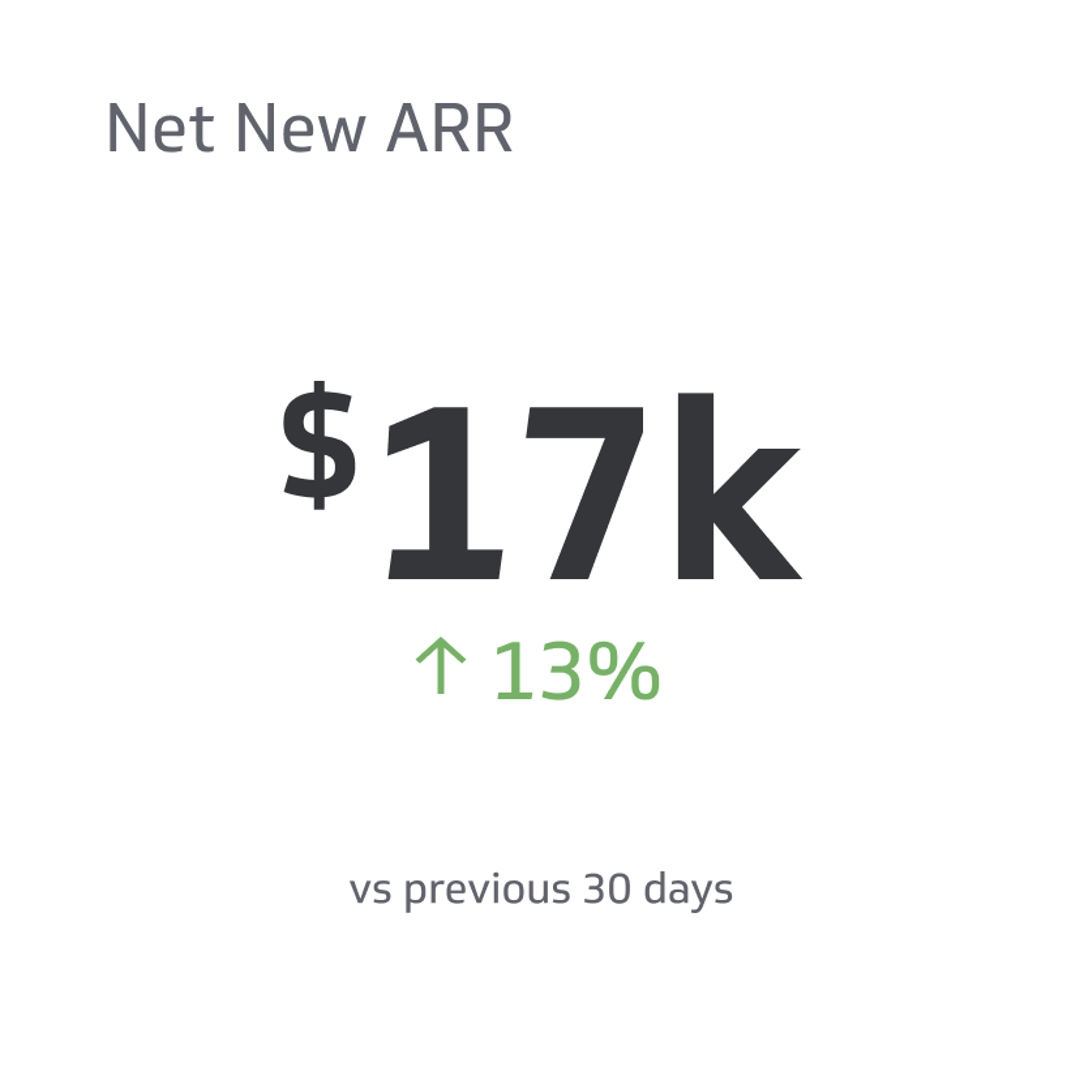

New ARR/MRR

New ARR/MRR represents the revenue generated from new customers who have recently subscribed to your SaaS product or service. It reflects the acquisition of new customers and the ability of your business to attract and convert new customers into paying subscribers.

Churn ARR/MRR

Churn ARR/MRR measures lost revenue caused by customer cancellations. Here, you will be looking at customer retention and loyalty.

Net Revenue Retention (NRR)

NRR is a comprehensive metric that combines ARR/MRR and churns ARR/MRR to provide a holistic view of revenue growth from existing customers. It measures the net change in recurring revenue from existing customers, accounting for both upsells and churn. NRR is often used as a key indicator of a SaaS business's overall revenue growth and customer retention.

Final Thoughts

In summary, ARR and MRR are essential metrics used to measure subscription revenue. They differ in their timeframe, calculation, flexibility, and comparability. ARR provides an annual view of revenue, while MRR provides a monthly view of revenue. Each has its strengths and limitations depending on the specific use case or business context.

Monitoring and analyzing these metrics can provide valuable insights for your SaaS business to make informed decisions and drive sustainable growth. To start, you can use them to optimize pricing and packaging strategies!

Related Metrics & KPIs