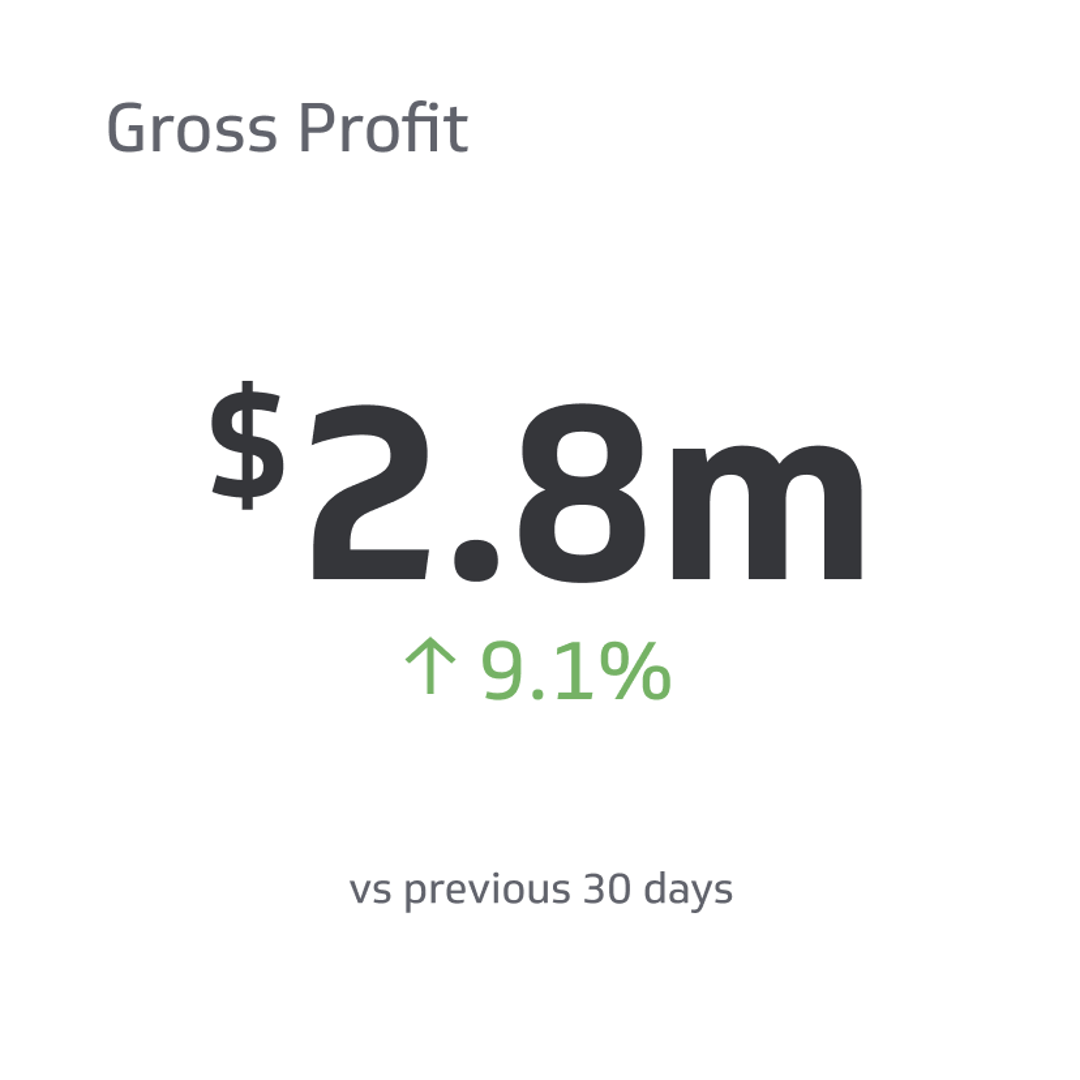

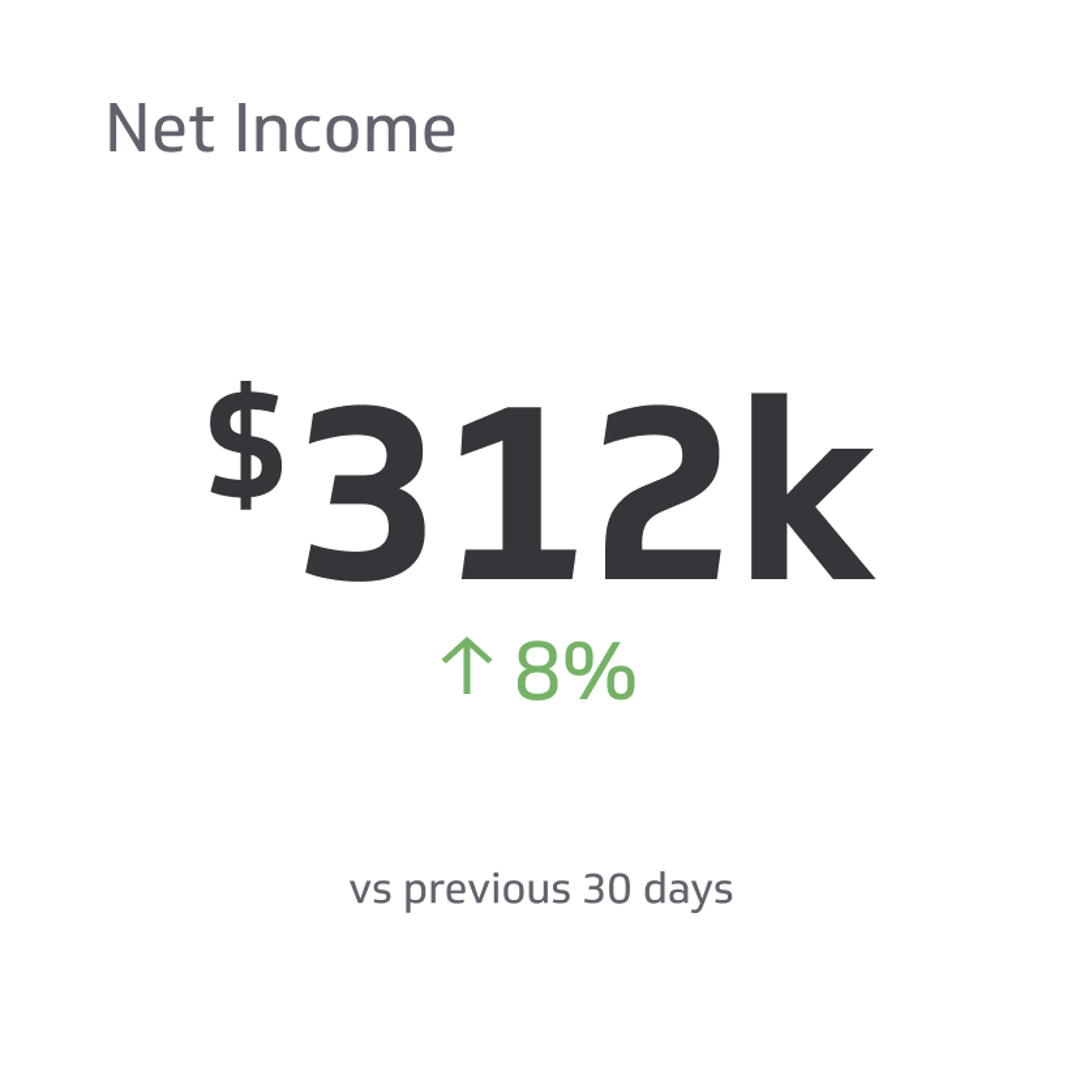

Net Income

Your net income refers to your gross earnings while considering your withholdings, deductions, and expenses.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In finance, understanding key terminologies forms the bedrock of sound decision-making. Whether you are a business owner examining your company's profitability, an investor assessing the viability of potential investments, or an individual keeping track of personal earnings, a solid grasp of financial concepts is indispensable.

Among the constellation of these financial terms, one that stands out in its importance and ubiquity is 'Net Income.'

This comprehensive article aims to provide a detailed exploration of this crucial financial metric. We will delve into its definition and the methodology for its calculation and elucidate its critical role in various economic contexts.

Join us as we demystify net income, enhancing your financial literacy and empowering you to make more informed financial decisions. Let's embark on this journey to financial comprehension together.

What is Net Income?

Your net income refers to your gross earnings while considering your withholdings, deductions, and expenses. You take all the money you earn while removing the deductions from your costs and keep track of your spending to calculate how much you make.

Some people refer to net income as profit and net earnings, so keep that in mind as you go through the definition. After you calculate your net income, it’ll let you know some crucial information to help your business succeed.

- Whether you made or lost money

- How much profit your business made

- How much you must reinvest

As you understand net income, you’ll notice that it shows you whether you made or lost money. If your business ends up with a positive net income, you made money, but if it’s negative, you lost money, which can lead to problems in a business.

Once you know if you made or lost money, you know how much your business has available. You can spend or save the money for future use, though this applies after you cover all your other expenses.

You should review the details to determine how much you must spend to keep your business running. If you know your total expenses, you can keep track of the necessary earnings to break even with your net income, so you’ll keep your business afloat and even lead it to success.

Understanding All Aspects of Net Income

Before you can calculate your net income, you must understand the different aspects of it. First, it comes down to your profits versus your expenses, so you should understand what counts toward each part to help you with the calculations.

Your profits will cover every way you make money, while your expenses will cover the purchases you must make alongside your obligations. Therefore, you’ll need to keep track of both totals and itemize them to help you understand the difference and calculate through them.

That means you’ll need to store these various details, put them together, and then you’ll be ready to calculate your net income using the straightforward equation. Ensure you collect the data beforehand to help you figure it once prepared.

How To Calculate Your Net Income?

Calculating your net income involves a simple formula you can easily use to determine how much money you made or lost. You must combine your various earnings, add up all your expenses, and minus your costs from your payments.

While the setup is simple, it becomes complicated when you consider multiple sources of income along with different expenses. In addition, you also have deductions, which impact your taxes while also affecting your total costs.

Calculating Your Profits

Regarding your profits, you have a few sources to get money: selling products, offering a service, and through investors. That means your business will provide specific products and services while receiving money from investors in exchange for stocks and shares.

For example, you have the money you receive from investors, so you can use that to cover your expenses and have a higher net income. Moreover, you should also calculate and include your various products sold, their cost, and passive income.

Keeping track of the various profits will make it easier to track your net income since you can combine it and minus your expenses from your earnings.

Calculating Your Expenses

As for your expenses, you have various aspects to consider. For example, you need to pay for business-related costs and cover tax payments, pay your employees, cover their health insurance, and certain similar expenses.

You’ll also need to pay federal and state taxes in the United States while covering social security and Medicare payments. These payments usually depend on a percentage of your income, though you should also consider your deductions to lower your income.

You must pay for business expenses, such as building expenses, gas payments, or any expense your business needs. Though they impact your net income, you can deduct various expenses from your taxes.

You should also cover other responsibilities, such as purchasing health insurance for your employees, paying their salaries, and everything else you need to run your business. Once you calculate all of them, you can combine and minus these additive costs from your profits.

Determining a Time Frame

You must work on your reporting period to keep track of your net income while seeing which periods matter to your business. That means going through the various options, seeing what your investors want to know, and considering the information your business needs.

For example, some businesses calculate the net income quarterly, bi-annually, or annually, depending on their situation. Usually, if you have investors, you’ll need to report to them regularly, so you’ll show them your profits in order to keep reinforcing their support for your business.

Keep your time frames consistent to make it easier to compare them as needed. You should also cover multiple time frames to see how you perform throughout the year and which quarters contribute the most to your profits.

How To Track Your Net Income?

You should use a worksheet to calculate your net income. A worksheet keeps the process simple by having you itemize your profits and expenses. For example, in the first column, you’ll enter all your earnings from various sources while doing the same with your costs.

You can itemize it further by splitting your profits by months. For example, you can put your passive income for January in one spot and your passive income for February in another and repeat it with all your money. That way, you can easily split it and move information as needed.

From there, you simply add all the money from each column and subtract the expenses from the profits to determine your net income.

If you use this approach, you must update your information regularly to stay up-to-date. Otherwise, you could update it all simultaneously and scramble to complete the calculations.

Why Does Your Net Income Matter?

Once you understand net income, you’ll question why it matters and why you should track it. That way, you’ll put effort toward your net income, keep track of the details, and prepare yourself financially to tackle different challenges.

Tracking Your Profitability

You’ll understand your profitability as you keep track of your net income. You must remain profitable to keep your business standing. For example, if you’re constantly losing money, you’ll reach a point where you must apply for bankruptcy and close the business.

While you should aim to make consistent money, you must note if your profitability starts to drop. Such changes can indicate issues within your business, product, and other aspects, so you must review your case to help your business survive.

Tracking your profitability can help you catch drops in your profit before it’s too late to make changes. Otherwise, your business could face problems before you realize you’re starting to run out of money, preventing you from fixing it.

Impress Your Investors

As you keep track of your income, you can show your investors how profitable your business is. Doing so will reassure them that your business performs well, so you’ll receive more money and support from them while getting additional investors.

If your business indicates signs of expansion and success, investors will rush to expand their investment. However, you can’t show that information if you don’t properly track your net income, so ensure you do that throughout the process.

You can hire accountants and data analysts to help you analyze various aspects of business and track your business’s net income. You can show off the details and attract different investors by showing off your company’s net income as a sign of success.

Tax Purposes

Every business must handle its taxes, so you should always track your net income for tax purposes. If you have everything you made and the documents to support these statements, you can submit them to the government and cover your taxes.

You can also find out if you must pay additional taxes or if the government owes you some of the money you spent. You can then use your net income from previous years to help you predict your taxes and avoid problems in the future.

You can submit your net income as proof of how much you made while paying what you owe. Otherwise, you could face a charge of tax fraud or similar charges, so do your best to track your taxes and make payments.

Prepare Your Estimated Payments

Speaking of taxes, you’ll want to prepare your estimated tax payments. These refer to payments you must make every quarter to cover how much money you make during the year. If you track your net income, you can use it to calculate your estimated tax payments.

This process allows you to mitigate and potentially prevent tax penalties. During the course of making your interim payments, it's essential to ensure that you remit at least 90 percent of the requisite charges to circumvent penalties, bearing in mind that any shortfall will need to be settled later.

Interestingly, your net income from the preceding fiscal year can be a helpful tool in managing these payments. By comparing your actual and projected earnings, you can adjust your quarterly payments accordingly, ensuring all tax obligations are adequately covered.

The Paramount Objective of Net Income Monitoring

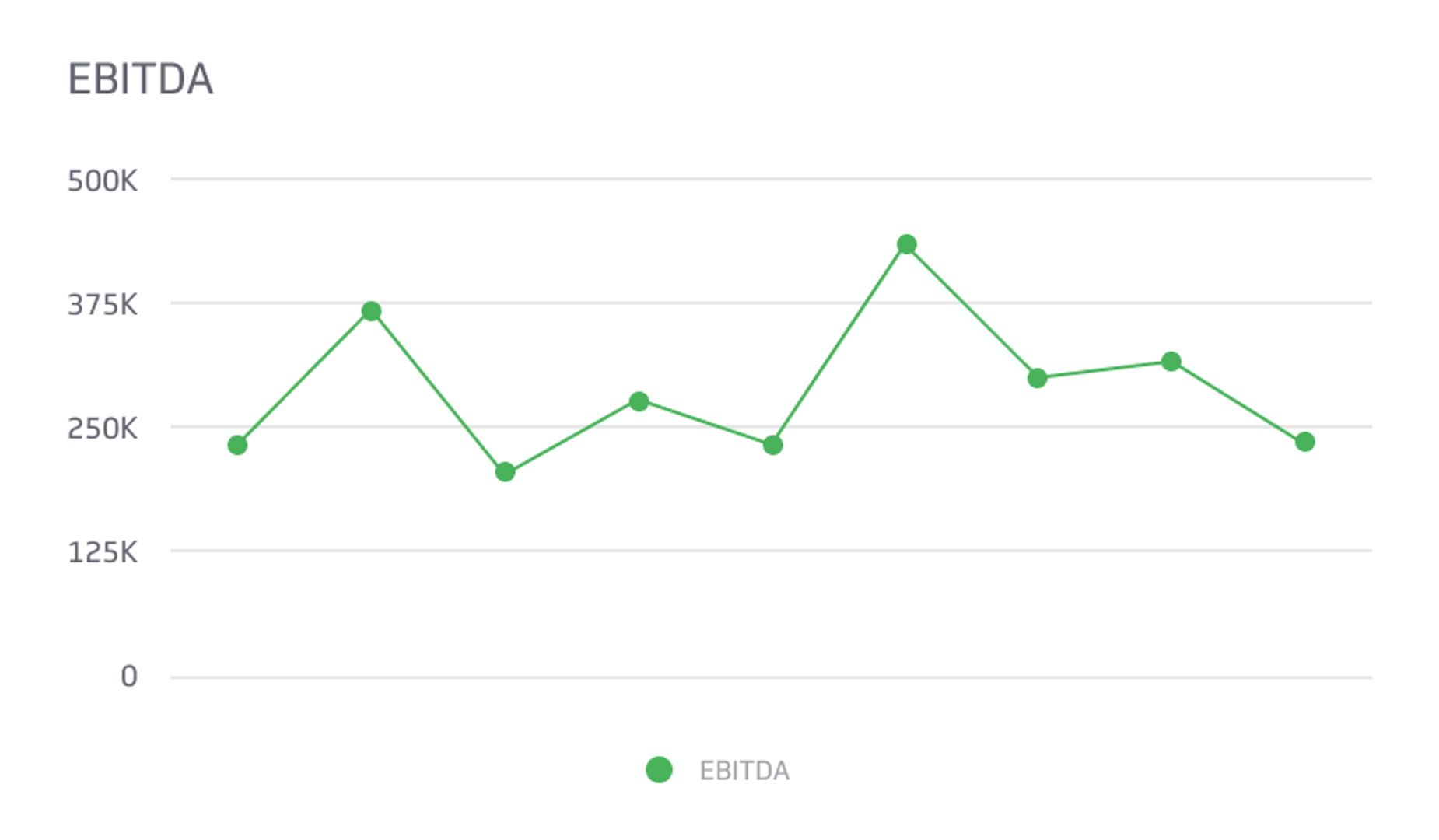

The primary purpose of tracking your net income is to gather vital financial data. The performance of your business can be gauged by the amount of net income generated within a specific period. An increase in net income indicates improved performance, whereas a decrease may signal the need for strategic adjustments.

By monitoring this information, you can make informed decisions to bolster your business's success. Maintaining a historical record of your data allows you to conduct retrospective analyses, enabling a deeper understanding of your business's financial status.

In essence, the process of tracking net income serves as a strategic tool for your business. While it may require a significant investment of time and effort, its benefits - including a clearer understanding of your business operations, better decision-making capabilities, and opportunities for future growth - make it an invaluable practice.

Conclusion

In conclusion, understanding and effectively managing your net income is a key tenet in navigating the financial landscape of your business. It is not merely a numeric representation of your earnings but a powerful tool that offers deep insights into the health and sustainability of your business operations. Regular net income tracking and analysis, coupled with strategic tax planning, can significantly reduce potential financial pitfalls and encourage sustainable growth.

Although the process might seem challenging initially, the returns, in the form of informed decision-making and a comprehensive understanding of your financial status, are unquestionably worth the investment. In the final analysis, your net income is more than a number—it's a compass guiding your business toward its future objectives and success.

Related Metrics & KPIs