Net Operating Profit After Tax (NOPAT)

This financial metric considers the whole picture of a business, then eliminates tax costs to focus on profitability.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

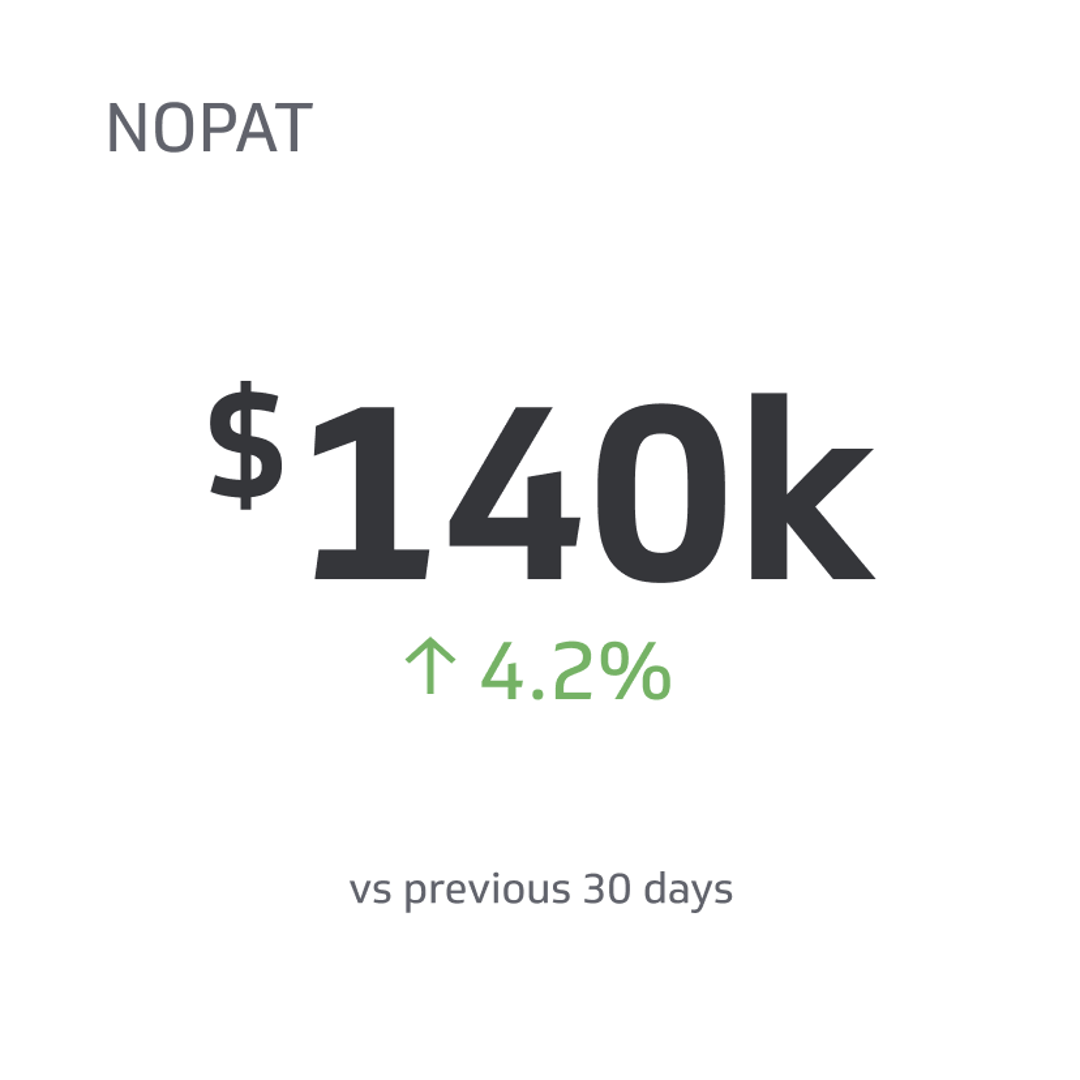

Assessing a company's true profitability can be challenging, as various factors, such as tax rates and financing structures, come into play. One essential financial metric that simplifies this process is Net Operating Profit After Tax (NOPAT). In this guide, we will delve into the concept of NOPAT, explore its practical applications, and equip you with the knowledge needed to effectively use this metric for informed decision-making and a clearer understanding of a company's financial health.

What Is Net Operating Profit After Tax?

NOPAT is one way a company can determine its profitability by calculating operating costs, taxes, and other financing issues. This financial metric considers the whole picture of a business, then eliminates tax costs to focus on profitability. Since taxes significantly impact a company's bottom line, taking them out of the equation makes for a clearer picture.

For the most accurate information, NOPAT assumes that the business doesn't get tax benefits from being in debt. The IRS allows businesses to deduct bad debts from their gross income to change their taxable income, which can lower their taxes due. NOPAT doesn't consider this amount, focusing only on the net operating profit and the business's tax rate.

How To Calculate NOPAT

Businesses calculate NOPAT by taking the Net Operating Profit (NOI) and subtracting the income tax expenses. The remaining amount will be the potential earnings if no other debt is considered.

To get the operating income, add the money the business makes from its core activities, products, or services. Subtract operating expenses from that revenue and then calculate the taxes due on that income level.

Each company has an effective tax rate or the percentage of income they must pay in taxes. If you need to verify the tax rate, calculate it by dividing the total company taxes paid by the overall revenue.

With those figures, you can calculate NOPAT by multiplying the operating income by one minus the tax rate. In this case, the active income refers to gross profits minus operating expenses.

This formula gives you the NOPAT for a business, which helps you get an overview of the profitability and efficiency of the company.

For example, say your business has an operating income of $200,000 and a tax rate of 30%.

NOPAT = $200,000 x (1-0.3) or 200,000 x 0.7, which is $140,000.

NOPAT isn't the most accurate figure because it doesn't include one-time expenses or losses, as those won't recur over the years and impact the business's earning potential. Similarly, any data relating to mergers or acquisitions won't factor into NOPAT. Those financial issues will affect the company's annual report, but they won't play into the operating expenses long-term.

Why Use NOPAT?

NOPAT gives a big-picture view of a company's performance. Analysts wanting to invest in a business need to see its historical earnings and potential for the future. While analysts can look at sales and get an idea of performance, that doesn't show the overall efficiency of a business.

Similarly, net income will include operating expenses but still has tax savings from debt in the equation. NOPAT eliminates all unnecessary funds and shows the most precise picture of a company's profitability.

Using NOPAT strips down the information to numbers only, which puts all businesses on a level playing field when it comes to investment and merger opportunities. There are different tax rates for various companies, so taking that money out of the equation allows investors and business owners to focus on the facts.

Taxes are a significant business expense, so the figure can inflate the company's well-being or make it look like they're struggling to turn a profit when that's not the truth. NOPAT gives a chance to see the after-tax profitability of a business and leads to better decision-making from investors.

Comparing the NOPAT of several companies will help you understand the financial stability of each because they can use different tax rates. For example, one business may seem profitable on the surface, but if it has a high tax rate, it'll pay a large portion of that money back to the IRS annually. This issue leaves much less money in the business's accounts as profit.

If you attempt to evaluate businesses based on revenue alone, you won't get the complete picture. The tax rates may make a company seem more or less profitable than they are in reality. This formula also helps you measure the business's efficiency. They could make a lot of revenue but spend it all on operating expenses, making it a risky investment.

However, you can't rely on NOPAT alone to understand a business's financial standing. When you compare several companies, this formula is an ideal way to level the playing field. But you'll still want to see other financial records to understand what the corporation spends on operations, salaries, and the backend compared to what it makes in revenue.

A benefit to using NOPAT is that it's more accurate than the net income alone and gives you an idea of profitability over time using historical data. However, it's not the best way to estimate the future success of a business because it pulls information from past financial reports.

NOPAT vs. UFCF

Many businesses use Unlevered Free Cash Flow (UFCF) to determine how much money they have available. This amount is in contrast to Free Cash Flow (FCF), which is the actual money left once the business pays for its operating expenses.

UFCF is a way to assess a company's financial status by factoring in the working capital and non-operating expenses and income. It's a bare-bones figure that proves how much a company can generate from its activities or services, with all other financial aspects taken out of the total.

The term "unlevered" comes into play because the UFCF doesn't include any debt or financial leverage. As previously mentioned, some businesses get tax breaks due to debt, and this amount doesn't factor into UFCF. This formula focuses more on the cash-generating abilities of a company without other aspects distorting the results.

You can calculate your business's UFCF by subtracting capital expenditures from the operating cash flow. Capital expenditures include money spent on property and equipment, costs that are typically one-off expenses. NOPAT doesn't consider these costs, which contributes to the difference in UFCF. The result is a dollar amount, also interpreted as a cash flow yield.

Cash flow yield is the amount of money a company can generate relative to its market value. You can calculate cash flow yield by dividing the cash flow by its enterprise value, which is the market value of equity, plus debt, minus cash on hand.

Many financial analysts use NOPAT and UFCF together to get a clearer picture of the economic FCF. They get this information by subtracting changes in working capital from NOPAT. Capital includes the following:

- Accounts payable

- Accounts receivable

- Amortization

- Inventory

- Depreciation

NOPAT doesn't show the changes in net working capital and excludes capital expenditures. However, it does include non-cash expenses, like amortization and depreciation. The purpose of NOPAT is to show a company's operating profitability.

UFCF represents a company's ability to create income from its business activities, which is more beneficial for long-term calculations. Regardless of taxes and operating expenses, the focus of UFCF is the potential to make money.

Final Notes on NOPAT

NOPAT is a valuable metric for evaluating a company's profitability. The figure takes taxes into account, which can significantly impact a business's bottom line. NOPAT is a simple metric to calculate and helps compare the profitability of different companies.

However, investors should be careful when comparing NOPAT across different industries, as some industries have higher tax rates. In that case, using complementary metrics like UFCF can help give a clear picture of profitability over the long term.

Overall, NOPAT is a helpful tool to evaluate profitability. If you use it in conjunction with other financial metrics to get a complete picture of a company's financial health, you'll understand the big picture of the business in question.

Related Metrics & KPIs