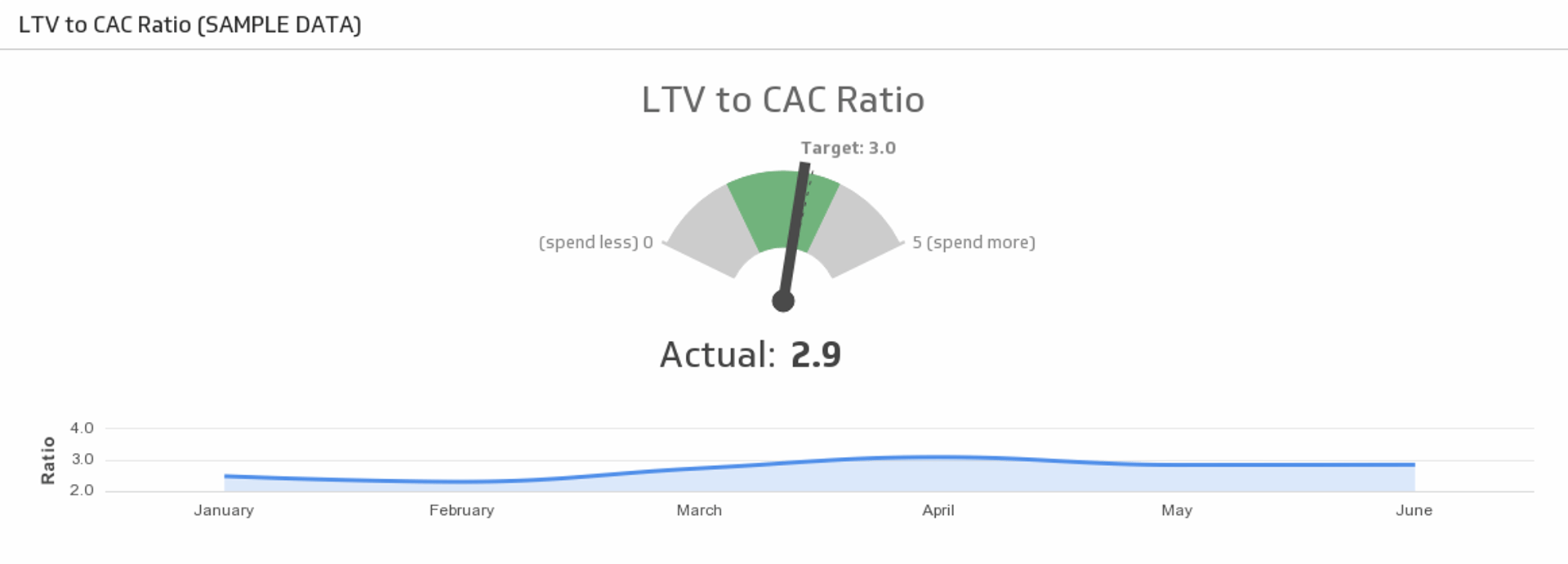

LTV:CAC Ratio

Measure marketing and sales efficiency with the LTV:CAC Ratio KPI

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

What is the LTV/CAC Ratio?

The Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC) Ratio measures the relationship between the lifetime value of a customer and the cost of acquiring that customer. The LTV:CAC ratio is calculated by dividing your LTV by CAC.

LTV:CAC is a signal of profitability. This metric tells you if the lifetime value of a customer is higher or lower than the marketing and sales costs to acquire that customer.

What is the formula for LTV:CAC Ratio?

(Customer Lifetime Value) / (Customer Acquisition Cost)

For instance, if obtaining a customer costs $100 and they generate $300 in revenue during their lifetime, the LTV/CAC ratio is 3:1. This shows the business earns three times the acquisition cost, which indicates a healthy return on investment. Therefore, a strong LTV/CAC ratio is essential to achieving sustainable growth, measuring profitability, and attracting investors.

Factors that affect LTV/CAC

The relationship between LTV and CAC is fundamental to understanding your business’s overall efficiency and profitability. These two metrics are closely intertwined, and achieving the right balance is essential for sustainable and possibly even exponential revenue growth.

The LTV/CAC ratio is influenced by various factors, which significantly shape your business's financial health and growth potential. Understanding these factors allows you to identify opportunities for improvement and maintain a sustainable balance between customer acquisition costs and lifetime value.

Let’s explore the key factors affecting both LTV and CAC in greater detail.

Factors that affect LTV (Lifetime Value)

1. Customer loyalty

Customer loyalty is a cornerstone of high LTV. Loyal customers are more likely to make repeat purchases, stick with a subscription service, and recommend your brand to others. Investing in retention strategies, such as loyal programs, personalized offers, and proactive support, can markedly enhance customer lifetime value.

2. Upselling and cross-selling opportunities

A business that effectively upsells higher-tier products or cross-sells complementary services can increase the revenue generated from each customer. For example, a SaaS company may offer additional features as part of a premium package, or an e-commerce store could suggest related products at the checkout stage.

3. Pricing strategies

The way you price your products or services directly impacts LTV.

Value-based pricing, tired subscription models, or bundles can encourage higher spending and long-term engagement. However, pricing must remain competitive and align with customer expectations to avoid losing potential customers and, by extension, potential revenue.

4. Customer experience and satisfaction

Happy customers are more likely to remain loyal and spend more over time. Factors like ease of use, quality of service, rapid issue resolution, and consistent communication all contribute to a positive customer experience, which in turn drives LTV.

Businesses that prioritize customer satisfaction often see increased referrals and stronger brand loyalty, further amplifying lifetime value.

5. Market trends and competition

External market factors, such as changing consumer behavior or the emergence of brand-new competitors, can significantly influence LTV. By quickly adapting to trends and consistently innovating, your business is more likely to maintain or grow its customer lifetime value.

Factors that affect CAC (Customer Acquisition Cost)

1. Marketing efficiency

The efficiency of your marketing campaigns is significant in determining CAC. Everything from targeted advertising, effective use of high-ROI channels, and precise audience segmentation reduces the cost of acquiring new customers while securing a higher conversion likelihood.

2. Sales process

A streamlined sales process that minimizes delays and maximizes lead conversion can lower acquisition costs. Optimizing communication workflows and leveraging tools like CRM systems help shorten sales cycles, improve efficiency, and pave a seamless journey for likely customers.

3. Customer segmentation

Not all customers are created equal.

Thus, focusing on high-value customer segments can yield better results. Tailoring acquisition strategies to attract customers with high lifetime potential ensures a better return on marketing and sales investments for your company.

4. Economies of scale

As your business scales, it can benefit from reduced CAC due to increased efficiency and better negotiation power with suppliers, partners, or platforms. For example, bulk purchasing ad space or the use of automation tools can drive down your costs.

5. External influences

Economic conditions, regulatory changes, and technological advancements can significantly impact CAC. Economic downturns often make acquiring new customers more challenging, increasing acquisition costs due to reduced public spending and heightened competition.

Conversely, adopting innovative marketing technologies can lower costs by improving targeting and automation. Shifts in consumer behavior or industry standards may also require strategy adjustments, further influencing acquisition costs.

How is LTV/CAC calculated?

The LTV/CAC ratio is a straightforward equation that compares the value a customer generates over their lifetime to the cost incurred in acquiring that customer. To properly understand and calculate this important ratio, it’s vital to break down both LTV’s and CAC’s components.

Formula for LTV/CAC ratio

To calculate the LTV/CAC ratio, you simply divide LTV by CAC; the formula looks like this: LTV/CAC = LTV ÷ CAC

Breakdown:

- LTV represents the total revenue your business expects to return from a customer throughout their relationship. It can be calculated using this formula: LTV = Average Revenue per User (ARPU) x Customer Lifespan

- The average revenue per user is a business's revenue from a single customer over a given period. Customer lifespan is how long, on average, a customer remains with the business.

- CAC represents the total cost incurred to acquire a new customer, including marketing expenses, sales team salaries, advertising, and promotional costs. The formula for CAC looks like this: CAC = Total Acquisition Costs ÷ Number of New Customers

By devising the LTV by CAC, you get the ratio that helps businesses determine whether the cost to acquire customers is justified by the revenue those customers will generate over time.

Example calculation

To illustrate, let’s consider an example with realistic numbers:

Assume a SaaS business generates $100 in ARPU per month, and the average customer stays for 24 months. So, the LTV is: LTV = $100 × 24 = $2,400

If the business spends $600 to acquire a customer, the CAC is: CAC = $600

Now, calculate the LTV/CAC ratio: LTV/CAC = $2,400 ÷ $600 = 4:1

This means the business earns four times the cost of acquiring a customer, indicating a solid return on its acquisition investment. A healthy ratio like this suggests the company effectively manages customer acquisition and retention.

Why is LTV/CAC important?

Knowing the LTV/CAC’s importance in evaluating business sustainability, growth potential, and operational efficiency, let’s examine the key reasons why this ratio is so important:

Financial health and business viability

Favorable LTV/CAC ratios indicate that your business can gain customers at a decent cost while generating a lot of revenue from each customer over time. This balance between cost and gains is essential for profitability since it allows your business to cover its acquisition and still make a profit.

A robust LTV/CAC ratio also enables reinvestment in customer acquisition strategies, allowing you to scale efficiently without compromising financial stability. Maintaining this ratio allows your business to expand its customer base, drive long-term value, and establish a sustainable growth trajectory.

Strategic resource allocation

The LTV/CAC ratio is a critical tool for strategic resource allocation, guiding where to invest in customer acquisition, marketing, and product development. Using this ratio, you can prioritize initiatives that yield the highest returns, guaranteeing your resources are deployed efficiently.

For example, a high LTV/CAC ratio may signal opportunities to enhance customer retention, as these customers provide substantial returns. Similarly, it can influence decisions to optimize marketing campaigns or explore acquisition channels that deliver high-value customers at a lower cost.

Competitive advantage

A high LTV/CAC ratio gives your business an evident edge by showcasing your ability to acquire customers efficiently while maximizing the earnings they generate over time. With this level of operational efficiency, you can reinvest gains into marketing and customer retention strategies, ensuring continually sustained growth and helping your business secure a larger market share.

When your business effectively manages acquisition costs and customer value, it becomes a lot easier to outpace your competitors. You can scale faster, maintain profitability, and solidify your market position. In addition, a well-managed LTV/CAC ratio signals to customers and investors that your business is created for long-term success.

Investor interest

A high LTV/CAC ratio signals that your company is acquiring customers at a low cost and generating long-term value from those customers. This makes your company highly attractive to investors seeking a strong return on investment.

With a good LTV/CAC ratio, your business demonstrates a scalable and profitable model capable of reinvesting profits into further customer acquisition and retention. This growth potential is a key consideration for investors looking for companies that can expand quickly while maintaining profitability.

What is a good LTV to CAC ratio?

Awareness of what constitutes a good LTV to CAC ratio requires considering general standards and the specific context of your business.

Here’s what makes up a good LTV/CAC ratio:

Typical standards

In many industries, an LTV to CAC ratio of 3:1 is often regarded as the benchmark for success. This means that for every dollar spent acquiring a customer, the business generates three dollars in revenue from that customer over time.

Ratios below this standard can imply inefficiencies, such as high acquisition costs or insufficient customer retention. Conversely, a ratio exceeding 3:1 might suggest underinvestment in customer acquisition, potentially limiting future opportunities for scalable growth.

Contextual variability

While 3:1 is a general guideline, the ideal ratio can vary depending on the industry, business model, and growth stage. For example, early-stage startups often have a lower ratio as they provide immediate customer acquisition and market penetration over immediate profitability.

Established businesses, however, are more likely to aim for a higher ratio, reflecting a balance between stable growth and efficient operations. Aside from that, industries with high customer acquisition costs, such as SaaS, often need a longer customer lifetime to achieve profitability, while low-cost acquisition models, like e-commerce stores, may target different benchmarks.

The ideal LTV to CAC ratio also varies widely across industries. For SaaS businesses, for example, a 3:1 ratio is typical, echoing the significance of long-term relationships in covering acquisition costs and ensuring profitability.

E-commerce companies may target a lower ratio, like 2:1, due to thinner margins and faster customer turnover. Meanwhile, subscription-based models, such as streaming services, often align with the 3:1 standard but must focus on managing churn rates to maintain profitability and steady growth.

How to increase your LTV/CAC

Improving your LTV/CAC ratio is a powerful way to enhance profitability and drive sustainable growth. Achieving this requires a dual focus: increasing your customers' LTV while lessening CAC.

Let’s explore actionable strategies to optimize both sides of this equation and maintain a healthy balance between the two.

Adjust pricing or subscription models

The most sustainable way to optimize your LTV/CAC ratio is by maintaining a balance between increasing LTV and reducing CAC. As such, revisiting your pricing structure can significantly impact both LTV and CAC.

Introducing value-packed subscription tiers, bundling products, or offering flexible payment options can make your offerings more attractive to potential customers while encouraging existing ones to spend more. A well-structured pricing strategy reduces barriers to entry and promotes loyalty, ensuring that customers continue to engage with your business over time.

Improve customer retention

Customer retention is one of the most effective ways to enhance LTV.

Improving customer retention is a key driver of increasing LTV), and data strongly supports the impact of loyalty and satisfaction on long-term profitability. According to a study by Bain & Company, increasing customer retention rates by just 5% can boost profits by 25% to 95%. Loyal customers are also 50% more likely to try new products and spend 31% more than new customers.

Upsell and cross-sell effectively

Encouraging customers to buy additional products or services is another way to increase their lifetime value. Offering complementary products through cross-selling or higher-value options through upselling not only increases revenue but also enhances the customer experience by meeting more of their needs.

For example, your business can use personalized recommendations based on past purchases or targeted promotions to inspire additional spending.

Enhance product or service value

Delivering consistent quality and value is essential to sustaining customer loyalty and driving higher LTV. Regularly updating your product or service to include new features, address evolving customer needs, or reflect the latest trends keeps customers engaged and invested in your brand.

Providing superior quality further solidifies their confidence, making them less likely to seek alternatives. Businesses prioritizing innovation and improvement signal to customers that their satisfaction and success are priorities, paving the way for long-term relationships that contribute to LTV growth.

Focus on high-ROI channels

Reducing customer acquisition costs starts with data-driven marketing strategies. By analyzing customer data, you can identify high-value audience segments and focus on the most effective channels, ensuring marketing budgets are used efficiently.

Not all marketing channels are equally effective, so it's essential to identify those that deliver the best return on investment, such as social media, email marketing, or SEO.

Concentrating efforts on cost-efficient platforms where your target audience is most active allows you to share resources strategically, minimize waste, and respond agilely to market changes or audience behavior.

Improve sales funnel efficiency

An efficient sales funnel plays a vital role in reducing acquisition costs by converting leads into customers more effectively. Streamlining each stage of the funnel—from initial lead generation to closing the sale—helps reduce drop-offs and increases overall conversion rates.

Tools like customer relationship management (CRM) software can automate repetitive tasks and optimize communication workflows, enabling sales teams to focus on high-value prospects. This lowers CAC and enhances the customer journey, creating a more seamless experience that encourages long-term loyalty.

Final thoughts

To drive sustainable growth, you need to balance customer retention and acquisition. Focus too much on acquiring customers, and you risk high churn rates and lower LTV. Prioritize retention without efficient acquisition, and costs can soar. Strategies like loyalty programs and personalized experiences that increase retention while encouraging referrals to reduce CAC.

Targeted campaigns lower acquisition costs, optimized sales processes increase conversions, and excellent customer service builds loyalty and trust.

When your teams align on shared goals, the synergy between LTV and CAC becomes a powerful competitive advantage. Monitoring your LTV/CAC ratio with Klipfolio helps you uncover actionable insights, make smarter decisions, and allocate resources where they matter most. With the proper data, you can create targeted campaigns that lower acquisition costs and optimize sales processes to increase conversions.

Related Metrics & KPIs