3 KPIs that carriers & shippers should be tracking

Published 2023-03-27

Summary - Here are 3 core KPIs for asset-driven service providers.

Every supply chain business is nuanced, striving toward different end goals at various points. However, there are a few broad KPIs that asset-heavy entities like carriers and shippers should monitor to effectively grow.

Especially within the supply chain industry, selecting the right KPIs, including supply chain metrics, can be convoluted and difficult. In some cases, managers negatively affect their company by saturating their internal operations with too many KPIs.

Ideally, you should only be tracking what is critical to your success. Too many KPIs will distract your team from your core goals. However, it’s still important to measure your performance against metrics that give you an accurate read on your team’s performance and offer your staff clarity in their work.

Experts say that have 6–8 KPIs in a single department can cause an overload or system failure by overanalysis.

This article will examine 3 core KPIs for asset-driven service providers and investigate their importance to your success. These should provide a fundamental direction for selecting additional KPIs that are more specific to your company in the future.

Top 3 KPIs for Shipping

You can measure delivery performance with these 3 KPIs for carriers and shippers.

1) Cash-to-Cash Cycle Time

Keeping active tabs on your cash-to-cash cycle time will aid you in monitoring your finances as cash flows in and out of your business.

The cash-to-cash cycle refers to the time between when a business pays its suppliers and when the business receives payment from its customers.

This KPI is financially important in your efforts to set expectations between a vendor and carrier, establishing a cadence of regular, predictable payments. In an asset-driven industry with products moving through your company quickly, keeping track of cash flows is a financial make or break for your business.

Aside from finances, cash-to-cash cycles can indicate changes in the health of your supply chain. Lower cycle times can symbolize a more profitable, lean business. Additionally, the metric can be a sign of how efficiently you’re using your assets and resources to deliver reliably.

Ideally, you should shoot for low cash-to-cash cycle times. However, your target number should result from a balanced consideration of supplier and customer needs.

Cycle times that are too low may leave you with insufficient inventory or with late payments to suppliers. Your target metric should reflect your aim to meet the needs of all parties involved.

Cash-to-cash cycle time monitorization will benefit both your asset management performance and financial tracking abilities.

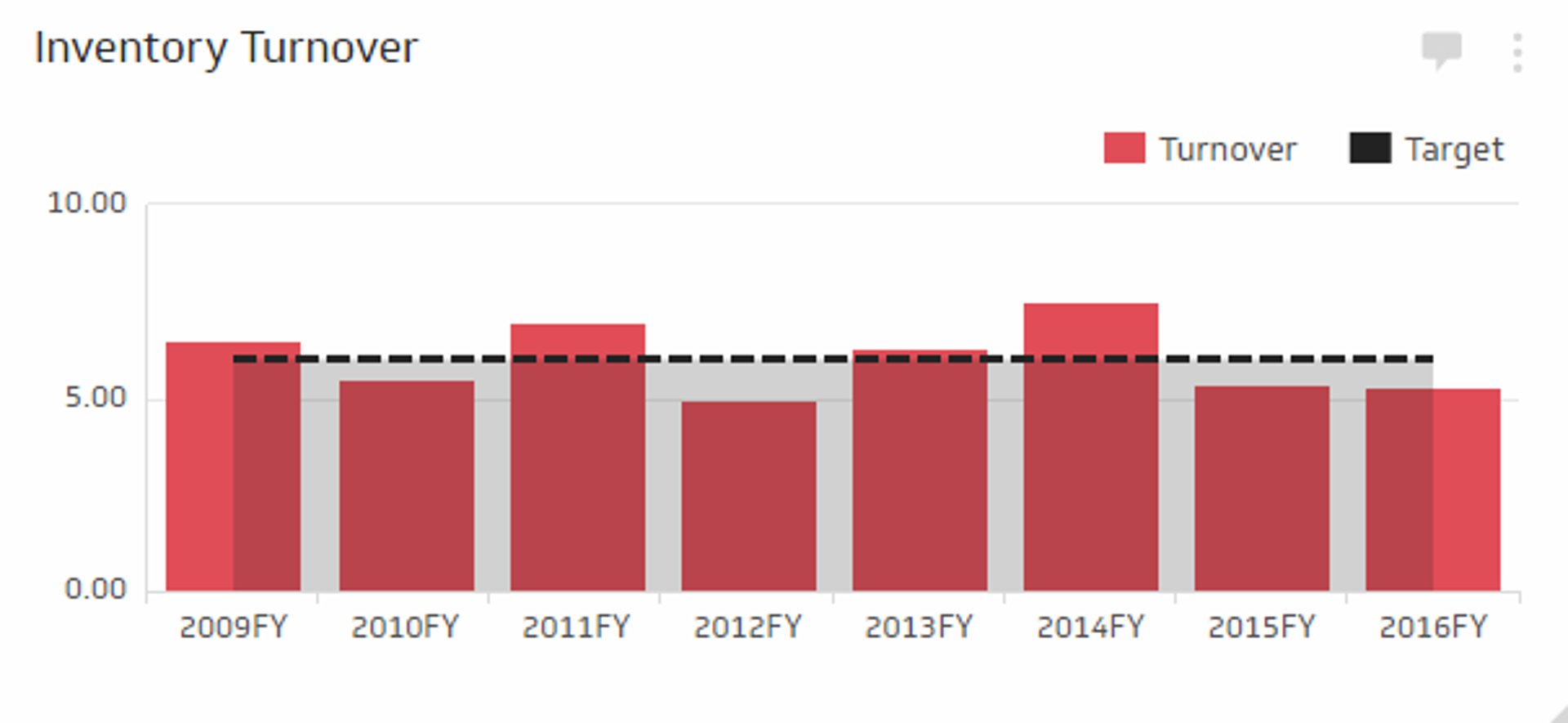

2) Inventory Turnover Rate

When concerning yourself with the constant flow of inventory in and out of your facilities, it’s important to be able to track its movement, avoiding large fluctuations.

Inventory turnover is the amount of time inventory stays within your organization before being passed on to the next link in the supply chain.

The numeral metric itself is equal to the number of times your business can move all of its inventory over the course of one year.

Tracking this information should help you determine the velocity and efficiency in which you’re able to move inventory.

Your average turnover rate can also assist you in gauging how in-demand certain products are to your end customers. If your inventory is turning over quickly, it’s safe to say there is a strong, active market for the products being sold.

Similarly to the cash-to-cash cycle time, you should aim for a low inventory turnover time. Financially, being able to turn over inventory quickly increases revenue and decreases the spend you need to devote to storing goods.

As you monitor this KPI over time, it has the potential to inform your business decisions. For instance, if you’re turning over inventory rapidly, you may be able to look into selling your products at a premium to account for its increased demand.

Additionally, you may be able to decrease or maintain your current ad spend on the product, because your current efforts are successfully connecting high levels of customers to your business.

Inventory turnover is an essential KPI to staying on top of your assets and guiding major company decisions.

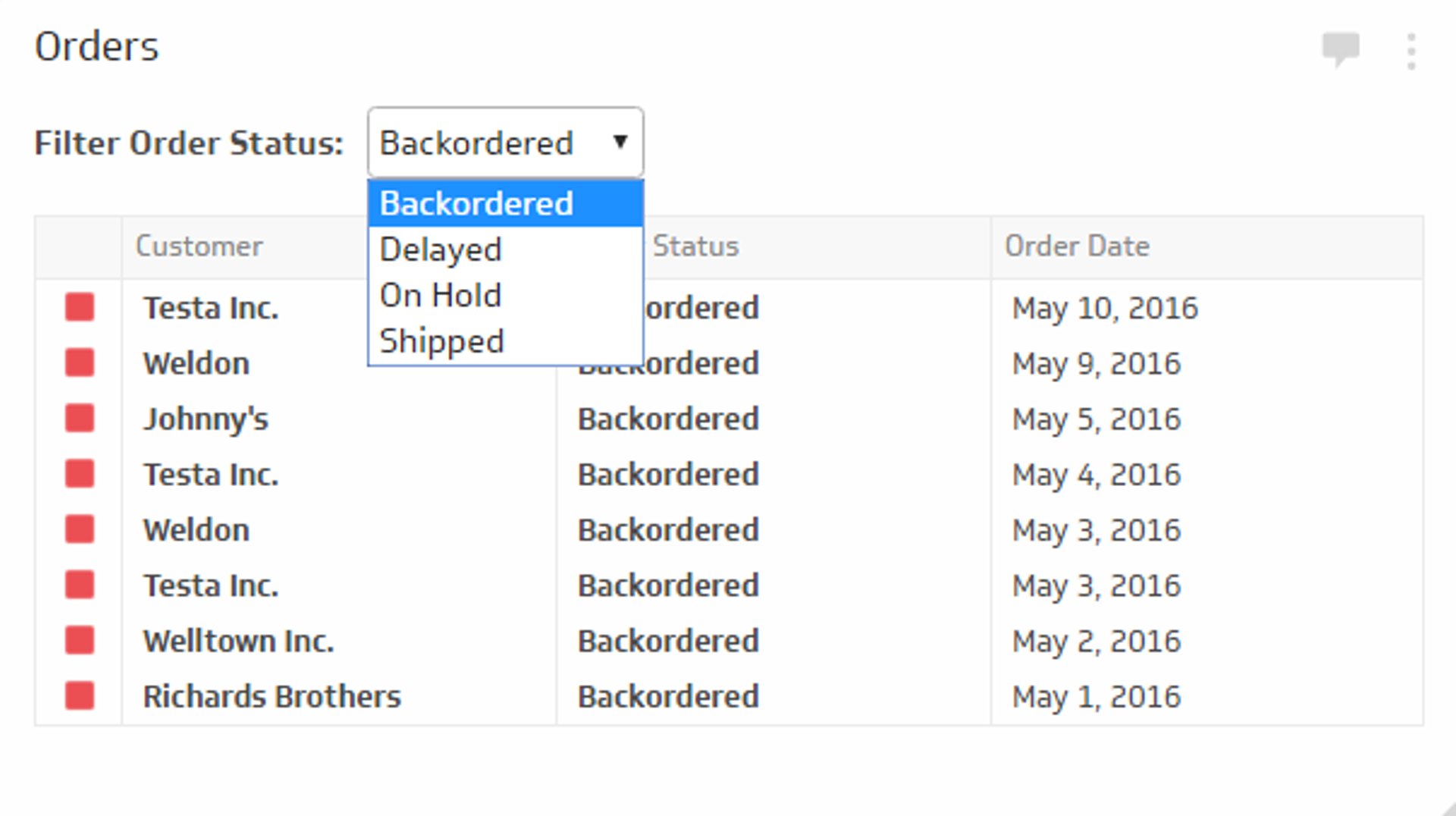

3) Customer Fill Rates

Tracking customer fill rates will provide you with more insight into your abilities to satisfy customers.

A fill rate is the percentage of orders that can be filled with your immediate stock availability. So, this gives you a proper check on your inventory levels, ensuring that you can consistently provide a reliable delivery service without frequent cases of backorders and delays.

In your aim to achieve high customer fill rates, you will be working to better forecast consumer needs and the respective inventory needed to meet them. The rate itself, because of this idea of customer satisfaction, is often referred to as On Time In Full (OTIF).

OTIF has relevant implications for both carriers and warehouses. For warehouses, your customer fill rate will be determined by inventory first and foremost.

However, you may also be deterred from meeting the desired metric due to staffing shortages and the time it takes a supplier to deliver to your facilities. Keeping your eyes on OTIF rates will allow you to spot these inefficiencies and address them.

For carriers, part of meeting OTIF standards is delivering the product to the customer without damaging it in transport. Damaged cargo or any other hold-ups in this stage of delivery are also accounted for in OTIF.

This allows issues to be addressed on a more holistic level, allowing suppliers, warehouses, and carriers to collaborate to yield a healthier supply chain.

In short, customer fill rate monitoring can attune you to inefficiencies at all points of supply and delivery, making it an effective metric for most inventory-driven businesses to track.

Work appropriate KPIs into your current operations

While overloading your team with KPIs can cause an operational paralysis and general confusion, carefully selecting a few sensible KPIs can aid in your effort to align your team and your partners. Shippers and carriers, as asset-heavy parts of the supply chain industry, should consider adopting KPIs that reflect that quality.

Start your business off by tracking OTIF rate, inventory turnover, and cash-to-cash cycle time. These three metrics will inform your financial choices, asset-related decisions, and openness in communications with your business partners.

About the author...

Sydney Wess leads Clutch’s supply chain research and content efforts. In her role as an Editorial Associate, she ensures content on Clutch’s platform is suited to ensure business buyers can vet and determine the best services and solutions providers for their needs.

Related Articles

The 5 most important SEO KPIs for digital marketing success

By Sanket Patel — February 24th, 2026

Anatomy of a great API

By Danielle Hodgson — January 21st, 2026

The Hidden Value of SaaS Sign Up Rate Benchmarks

By Priyaanka Arora — January 10th, 2026