The key business metrics from 8 SaaS startup pitch decks

Published 2025-10-18

Summary - There’s always something special about a successful pitch deck, especially because it’s often the one chance to concisely portray the company in a way that sways would-be investors. Even if “your company is your secret sauce,” your pitch deck must—through its presentation of key business metrics or otherwise—convey that.

When Mixpanel's co-founder, Suhail Doshi, made the bold move of open-sourcing the pitch deck that led to his company's $65M round and $865M valuation, he also shared the link to his post on Reddit.

Among the many comments, this one stood out to me:

“There’s nothing special about the pitch deck. The special sauce is the company....”

Sure, the secret sauce behind any round is the company—the scope of the problem the company’s product is solving, where that product fits into the market, and of course the team’s ability to execute.

But what about the pitch deck? There’s always something special about a successful pitch deck, especially because it’s often the one chance to concisely portray the company in a way that sways would-be investors. Even if “your company is your secret sauce,” your pitch deck must—through its presentation of key business metrics or otherwise—convey that.

As a seasoned marketer in the SaaS startup space, I’ve always been interested in uncovering patterns about pitch decks. In this piece, I dig into the metrics and KPIs these amazing and transparent startups have shared with the world. (My major takeaways are near the bottom of this blog post.)

UPDATE: Check out Front App's new Series B slide deck.

Below are what I took to be the most important slides from 8 different pitch decks (roughly in order from newest to oldest), along with my notes on the important metrics they included:

Front App ($10m, Series A, 2016) - frontapp.com

Slide 8: Consistent Organic Growth

The metrics

- # Companies

- $ MRR (MRR grew 5.4 times in the past 12 months)

Slide 9: Low Churn

The metrics

- % User Churn

- % MRR Churn

- % Net MRR Churn

Slide 12: Acquisition Channels

The metrics

- % leads from Organic Growth

- # qualified demos/month/SDR

- % post-demo conversion

- $ ARR added / month / AE

Slide 13: Land & Expand Strategy

The metric

- % of MRR retained relative to starting month

Slide 14: We’ve Been Capital Efficient

The metrics

- $ spend in last 18 months to reach current $ ARR

- $ Monthly Burn

- # Months expected until profitable

Slide 18: Projections

The metrics

- Expenses vs Revenue

- ARR

- Headcount

Pendo ($20m, Series B, 2016) - pendo.io

Slide 2: Overview

The metric

- Ending QTR $ ARR

Slide 9: User Engagement

The metric

- Usage by Role

Slide 15: Net New ARR Growth

The metric

- Net New ARR, Churn, Expansion over 2 year period

Slide 16: Sales Quota Capacity

The metric

- Sales vs Sales Capacity

Slide 17: Cohort Trending

The metrics

- Cohort Analysis

- ARR Cohort Build

Slide 18: New ASPs Trending Up

The metric

- Avg. Revenue per New Customer per qtr

Slide 19: Moving up Market to Serve Enterprise Customers

The metric

- Customers>$ per qtr

Mixpanel ($65m, Series B, 2014) - mixpanel.com

Slide 7: Monthly Recurring Revenue Over Time

The metric

- % Growth Rate for past 3 years

Slide 8: Sales KPIs

The metrics

- % YoY Growth, Revenue, # of Sales Reps

- Avg revenue per customer / month

- # Leads per month (% of new customers touched by sales)

- # new customer per month

- Avg Monthly revenue churn rate

- Sales payback rate in x months

Slide 9: Marketing KPIs

The metrics

- # leads

- Avg revenue per customer / month

- % customers that sign up will integrate

- % will become paid customers

Slide 10: Expansion Plan

The metrics

- They list the key objectives they hope to achieve next year

Mattermark ($6.5m, Series A, 2014) - mattermark.com

Slide 11

The metrics

- $ MRR

- % CAGR

Slide 12: 2015 Goal

The metric

- Projected growth rate: $MRR

Slide 13: Revenue By Use Case

The metric

- % from Different Customer Segments

Slide 14: ARR Growth Rate

The metric

- VC MRR Growth Rate vs Biz Dev MRR Growth Rate (highlighting fastest growing customer segment)

Slide 20: 500K+ Companies

The metric

- # of Companies Tracked by Mattermark

Slide 22: Pace

The metric

- # of future customer that can be tracked using a new way

Contently ($9m, Series B, 2014) - contently.com

Slide 8: By the Numbers

The metrics

- $ Gross Revenue and SaaS MRR

- $ Projected revenue run rate by end of year

Slide 9: Annualized value of customers closing in Q4

The metrics

- $ SaaS Revenue

- $ Marketplace Spend

- $ ACV

Intercom ($600k, Seed, 2012) - intercom.io

First pitch deck and did not include any key metrics! With family and friends at this stage it’s more about the idea than the company details.

Buffer ($500k, Seed, 2011) - buffer.com

Slide 5: Traction

The metrics

- # of Paying Users

- $ Annual Revenue run rate

- % Margins

- # of users, % month over month growth

- # of updates (a unique measure of their platform engagement)

Slide 6: Milestones

The metric

- Time series of data showcasing # of users ($ revenue) over a 2 year period

Slide 7: Business Model

The metrics

- % Churn

- LTV & CAC

- Projected Revenue at # of users

MOZ ($18m, Series B, 2009) - moz.com

This is my favourite pitchdeck. Moz provides the critical details and insights to give potential investors a sense that the company truly understands its business and knows precisely how to grow it with the investment dollar request.

Slide 3: 5-Year History Timeline

The metrics

- $ Software Revenue

- $ Consulting Revenue

- # Monthly Visits

Slide 20: Where are we today

The metrics

- $ Estimated Revenue:

- $ Current Revenue Run Rate

- # of Pro Subscribers

- # of New Free Trials / Day

- Av. Customer Lifetime Value

- Implied Customer Life

- Avg. Cost of Paid Acquisition

- Avg. Monthly Rev / Subscriber

Slide 21: Where are we today cont’d

- % of Free Trials Converting to Paid

- Churn Rate in 1st 2 Paid Months

- Monthly Visits

- Email Subscribers

- Gross Margins

- Estimated Net Profit

- Staffing Costs per month

- Crawling, Serving, Hosting + Processing Costs per month

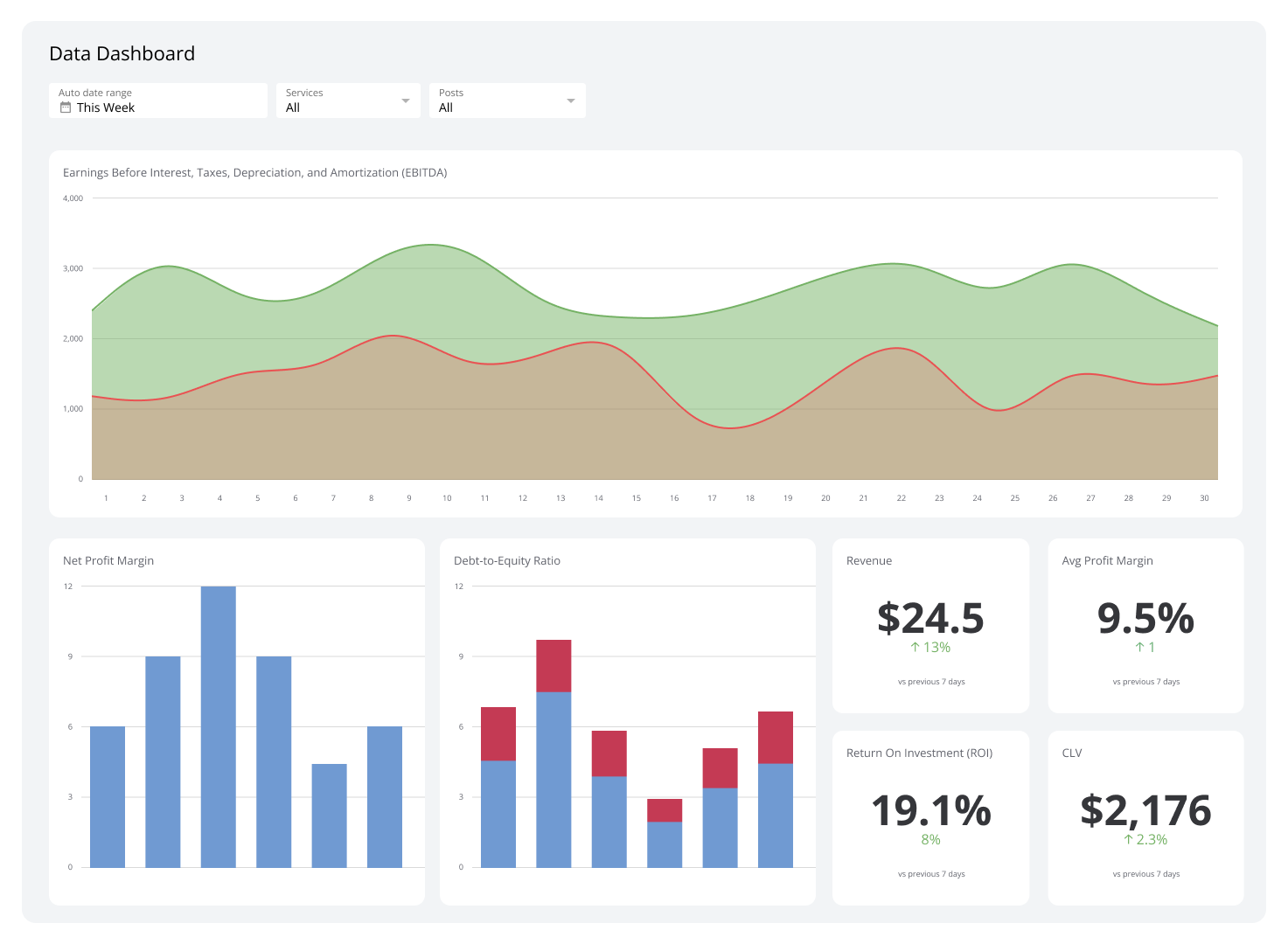

Major takeaways:

As a startup, take advantage of using your key internal business metrics and KPIs to help tell your story. The metrics you decide to include should help reinforce your unique market opportunity and why you are best positioned to take advantage of this opportunity.

Here are four key slides you should include in your SaaS startup pitch deck:

Traction

This is your opportunity to truly showcase what is a unique measure of success for you. Perhaps show that aha moment metric that is critical to conversion. The traction slide is all about showcasing how you are increasing your number of customers, increasing total revenue, increasing total revenue per customer, all while showing that your costs of attracting customers is going down.

This means you will include information about how the Lifetime Value (LTV) of your customer is greater than your Customer Acquisition Costs (CAC). At the end of the day, if you can’t get that business metric right it’s almost impossible to convince someone to invest in your startup.

Revenue Model

It seems obvious, but it's important to explain exactly how you make money. Showcase that you have figured out your pricing strategies and truly understand your growth measures when it comes to the dollars flowing into your organization.

Key metrics were: ARPU, Margins, Cohort Analysis, ARR, MRR, and % CAGR.

Sales/Marketing/Expense

This section tended to highlight how the founders have structured their teams, and it allows the company to highlight how the dollars they are asking for will go into a well-oiled machine that is ready to grow the company even faster. Highlighting your team in this way shows you understand the levers for your growth.

Take this opportunity to showcase your understanding around conversion rates, how long it takes you to acquire customers then convert and move to close. What are your costs to maintain and build recurring revenue? Can you penetrate your existing customers for additional growth? How can you increase LTV and reduce CAC?

Projections

From there, it's time to showcase your projected revenue forecast and demonstrate how this investment will help you to achieve your future success. You can also include what your monthly burn rate is now vs. after funding, as well as when you predict you'll become profitable.

Finally, a big shout out to Attach who collected all of these startup pitch decks into one area which I leveraged for this blog post. If you are interested in digging through non-SaaS startups, they also showcased Airbnb, Tinder, Wework, YouTube, LinkedIn, BuzzFeed and more….

Got other slide decks to share? We'd love to hear your thoughts!

***

Suggested reading:

From our co-founder: SaaS KPIs: Which to focus on at each stage of your company's growth