Cost Of Goods Sold (COGS) Vs. Operating Expenses

Understanding the distinction between the Cost of Goods Sold (COGS) and Operating Expenses (OpEx) is essential for business owners and professionals.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In the business world, having a firm grasp on your financials is crucial for informed decision-making and sustained profitability. A critical aspect of this knowledge is the distinction between the Cost of Goods Sold (COGS) and Operating Expenses (OPEX).

While both expenses impact a company's performance and profit margins, they have distinct roles in evaluating business operations. In this article, we will delve into the difference between COGS and OPEX and how they affect a company's financial health. So let's get started!

COGS Vs OPEX: Understanding The Key Differences

Let's delve into the details of two fundamental categories in business finance: Cost of Goods Sold (COGS) and Operating Expenses (OPEX).

COGS: Direct Costs Of Producing Goods and Services

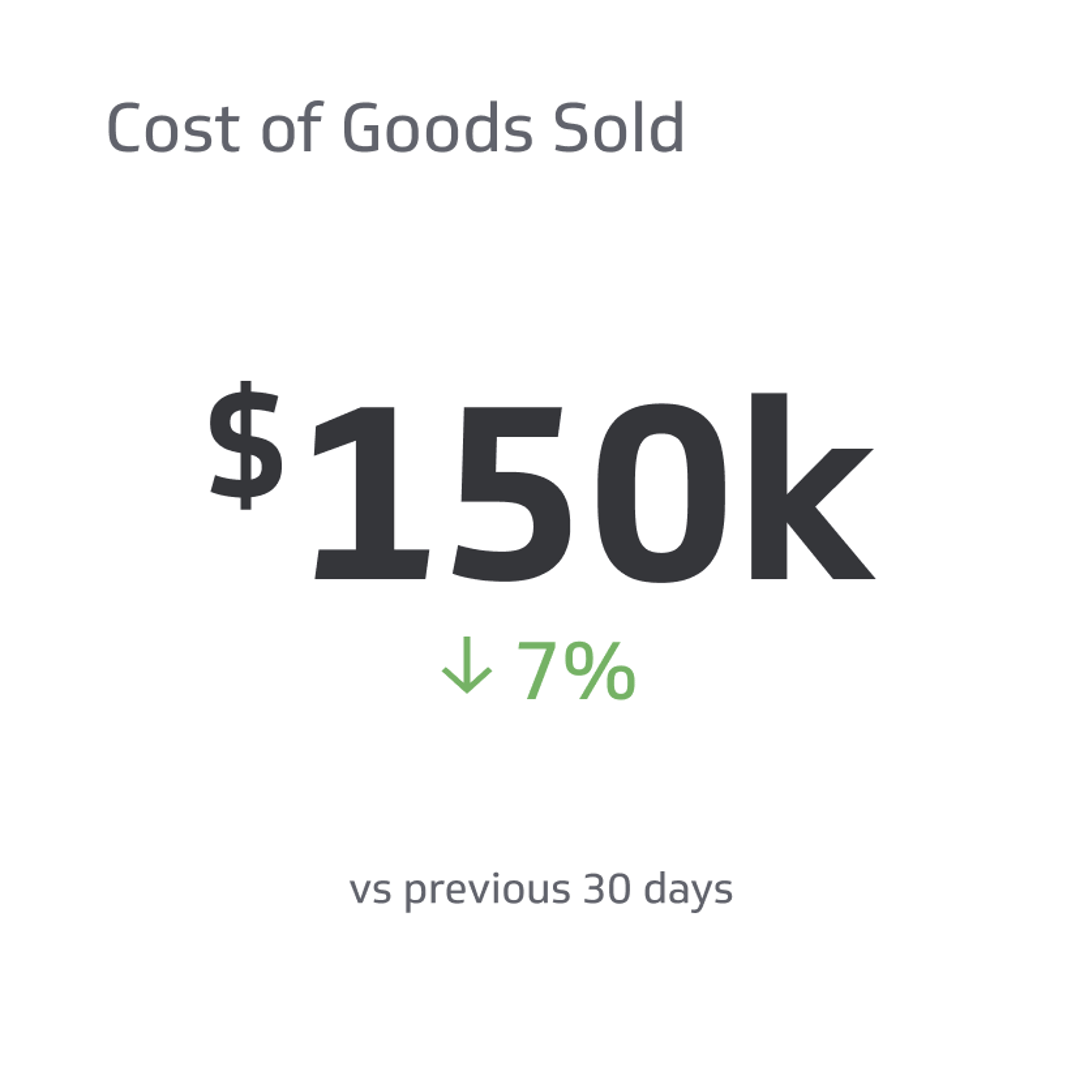

Cost of Goods Sold (COGS) is an integral factor in determining the direct expenses associated with producing goods or providing services. These costs arise directly from the manufacturing process and encompass materials, labor, and other relevant overheads such as factory utilities or machinery maintenance.

Accurate comprehension and calculation of COGS hold significant importance for businesses as they directly influence profitability. A lower COGS signifies that a company can generate higher gross profits from its revenue by maintaining efficient production operations.

To improve profitability, businesses should always try to reduce their direct costs. They can do this by optimizing processes, minimizing waste, and finding better deals on raw materials. However, it's essential to do all of this without compromising the quality of the products or services.

OPEX: Indirect Costs Of Running A Business

Operating expenses (OPEX) encompass the indirect costs involved in the day-to-day functioning of a business. These costs are not directly linked to producing or selling goods and services but are essential for sustaining operations.

For instance, in a small retail store, rental fees and staff compensation might be the main components of OPEX. Conversely, a large corporation may have substantial OPEX attributed to research and development (R&D) investments or legal expenses.

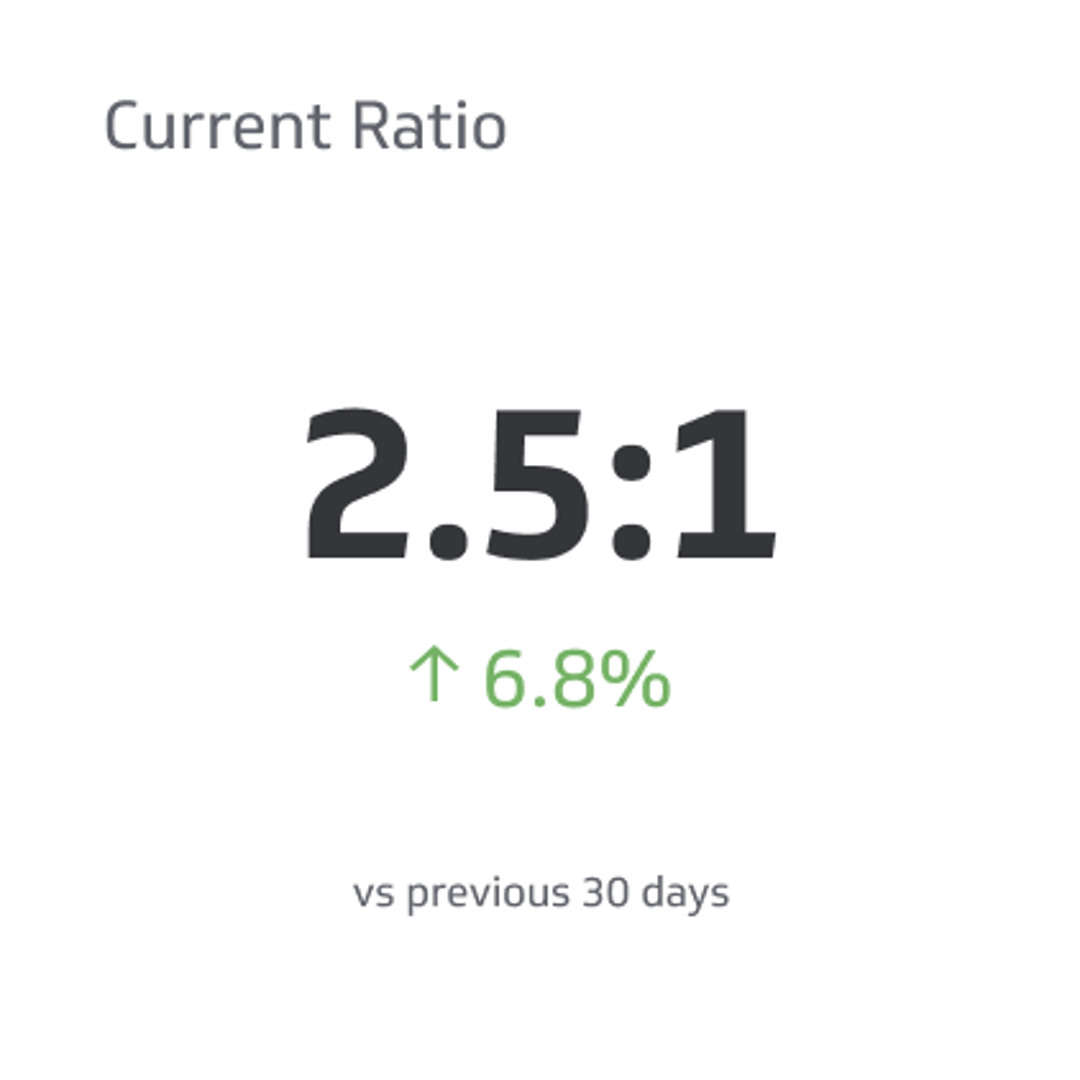

Irrespective of a business's type or size, monitoring OPEX is crucial for effectively managing budget allocations and ensuring prudent utilization of resources.

Why Tracking COGS And OPEX Is Important

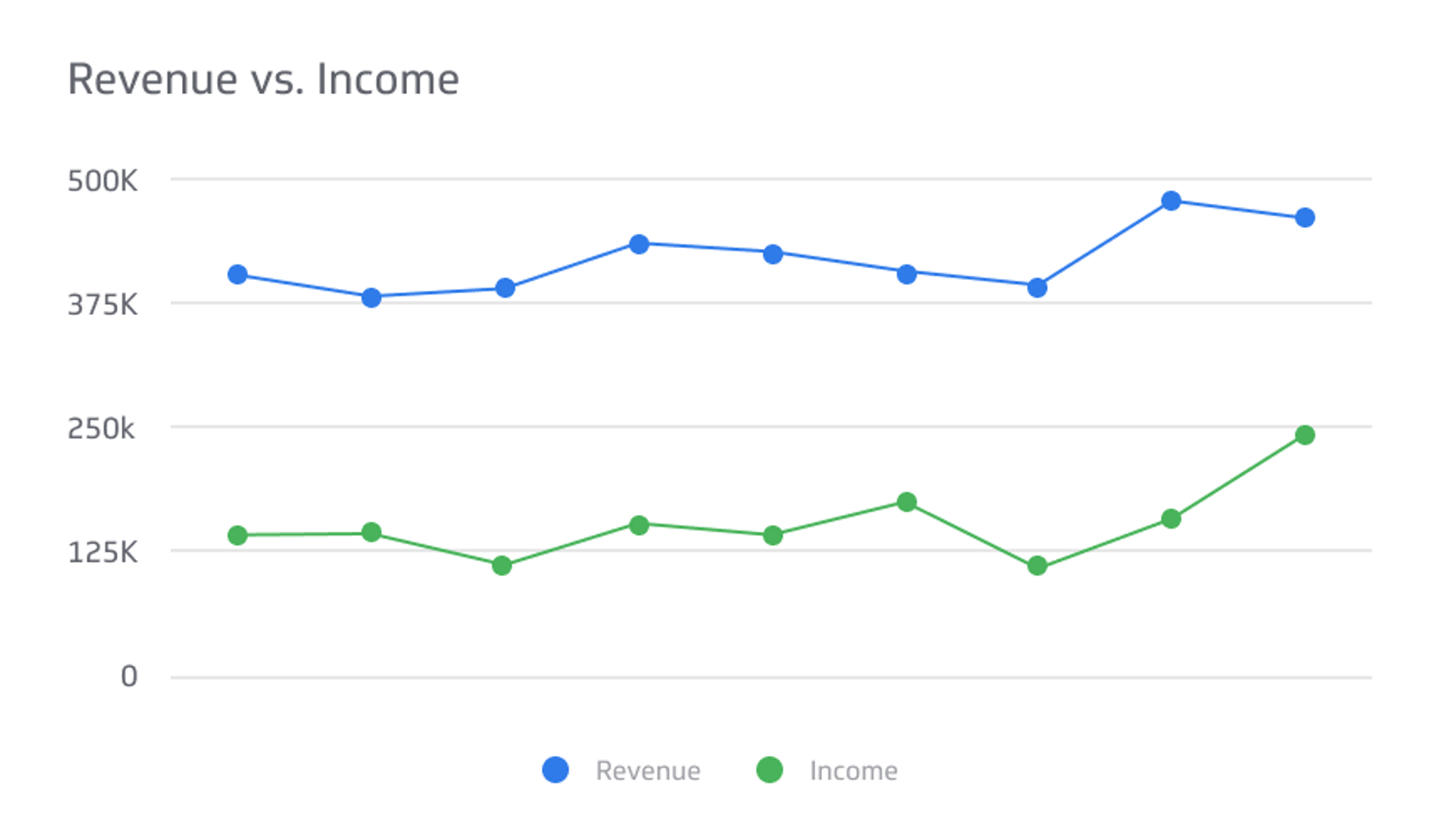

Tracking the cost of goods sold and operating expenses is essential for businesses to gauge profitability, identify cost reduction opportunities, and make informed decisions on pricing, production, and revenue.

Accurately Calculating Profits

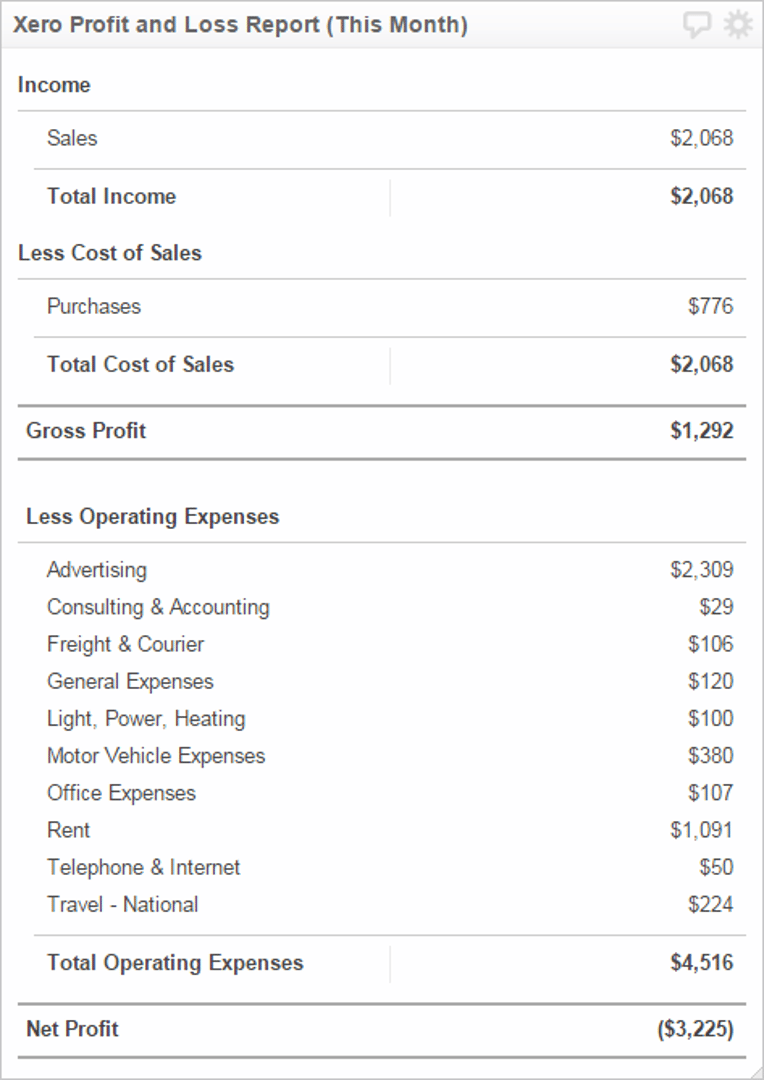

Accurately assessing profits is vital for the success of any business, regardless of its size. Whether a small start-up or a large corporation, understanding the Cost of Goods Sold (COGS) and Operating Expenses (OPEX) is crucial in evaluating the company's financial performance.

COGS and OPEX play distinct roles in profit calculation. While COGS represents the direct costs associated with producing or delivering a product, OPEX includes indirect expenses necessary for day-to-day operations.

These expenses include rent, employee salaries, insurance, marketing efforts targeting sales leads, and other essential expenditures that contribute to revenue generation but are not directly tied to specific product sales.

Identifying Areas For Cost Reduction

Tracking COGS and OPEX offers a valuable advantage by enabling businesses to identify opportunities for cost reduction. By comprehending the direct costs associated with production or delivery (COGS) and the indirect expenses involved in daily operations (OPEX), companies can make informed decisions regarding pricing, production, and overall profitability.

For instance, if a company notices an increase in COGS due to escalating material costs, it may consider adjusting its pricing strategy or exploring alternative suppliers to maintain profitability. Similarly, if operating expenses have consistently remained high because of factors like rent or insurance, finding methods to reduce these costs could lead to significant long-term savings.

Influence of COGS and OPEX on Pricing Strategy

COGS and OPEX knowledge are crucial not only for cost control and profit calculation but also for developing an effective pricing strategy. It provides valuable insights into a company's cost structure, directly impacting how it prices its products or services.

A company with low COGS can offer competitive pricing while maintaining a healthy profit margin. This can give it a significant advantage in price-sensitive markets, where affordability is a key factor.

Conversely, if a business has high operating expenses due to investments in customer service, premium locations, or advanced technology, it may need to adopt a premium pricing strategy. In such cases, the higher price can be justified by the added value provided by these operational investments, creating a brand image associated with quality and service excellence.

Remember, pricing strategy goes beyond covering costs and ensuring profit margins. It is a powerful tool for positioning your brand in the marketplace. With a deep understanding of COGS and OPEX, you can develop a pricing strategy that aligns with your overall business goals.

Calculating COGS And OPEX

Calculating COGS (Cost of Goods Sold) and OPEX (Operating Expenses) involves several steps to determine the financial figures accurately. Here's a detailed breakdown of the calculation process for both:

COGS: Beginning Inventory + Purchases & Expenses - Ending Inventory

Calculating the cost of goods sold (COGS) is crucial in assessing a company's profitability. The formula for COGS is relatively straightforward: it involves adding the beginning inventory to the purchases and expenses and subtracting the ending inventory value.

The calculation of COGS encompasses all the direct costs associated with producing or delivering a product or service. These costs typically include expenses such as raw materials, labor costs, and shipping expenses.

To illustrate this, let's consider the example of Company A, which specializes in selling handmade candles. At the start of the month, Company A had $10,000 worth of wax and other supplies used in candle-making as their beginning inventory. Throughout the month, they purchased an additional $5,000 worth of supplies and incurred $2,500 in labor costs to create 1,000 candles. These candles are sold for $25 each.

By the end of the month, after selling 800 candles (resulting in $20,000 in revenue), Company A is left with an ending inventory value of $7,500 worth of supplies that were not utilized in production.

To calculate COGS for Company A:

- Beginning inventory: $10,000

- Purchases and expenses: $5,000 + $2,500 = $7,500

- Total cost of goods available for sale: $10,000 + $7,500 = $17,500

- Ending inventory: $7,500

- COGS: $17,500 - $7,500 = $10,000

In this example, the cost of goods sold (COGS) for Company A during the month amounts to $10,000. This figure represents the direct costs associated with producing the candles that were sold, including the raw materials and labor expenses.

OPEX: Total Expenses - COGS

Operating expenses (OPEX) are indirect costs incurred while running a business normally. They encompass various expenditures, such as rent, salaries, utilities, insurance, marketing, administrative, and other overhead expenses. Calculating OPEX involves subtracting the cost of goods sold (COGS) from the total expenses listed on the income statement.

Let's consider an example to illustrate the calculation of OPEX. Suppose a company's total yearly expenses amount to $100,000, and its COGS is $40,000. To find the OPEX, we subtract the COGS from the total expenses: $100,000 - $40,000 = $60,000.

In this scenario, the OPEX for the company would be $60,000. This figure represents the indirect costs associated with operating the business, excluding the expenses directly related to producing or delivering the goods or services.

Conclusion

In conclusion, understanding the distinction between the Cost of Goods Sold (COGS) and Operating Expenses (OpEx) is essential for business owners and professionals. COGS encompasses the direct costs associated with production, while OpEx covers the indirect expenses necessary for day-to-day business operations.

Businesses can make informed decisions regarding pricing strategies, production optimization, and overall profitability by effectively tracking and analyzing these two expense categories. Calculating COGS and OpEx enables businesses to identify areas where cost reduction measures can be implemented, leading to increased net income and improved financial well-being.

Related Metrics & KPIs