SaaS Finance Metrics Cheat Sheet

Published 2023-09-15

Summary - For many finance leaders, it’s important to track everything from the money in your bank account to the traffic on your website. When you start looking at your full business funnel from a finance perspective, you start to see how your key metrics work together.

The scope of SaaS finance metrics goes beyond your traditional MRR. For many finance leaders, it’s important to track everything from the money in your bank account to the traffic on your website. It’s all intertwined when it comes to revenue. And a holistic look at full funnel business performance helps finance leaders see the full picture.

When you start looking at your full business funnel from a finance perspective, you start to see how your key metrics work together.

When you combine data from Salesforce, QuickBooks, and Stripe, you have the right processes in place to understand potential revenue growth. Tracking your metrics across different services lets you analyze your cash-in and cash-out of your bank account, track payment and subscription data, and your employee headcount so you can have a full view of your financial growth model.

Or analyze trends in your revenue with data from Google Analytics, HubSpot, and Stripe to drive full-funnel accountability. You can track the marketing dollars that bring in every new lead and forecast your sales revenue to see how your money flows across each channel.

Top metrics for full funnel financial reporting

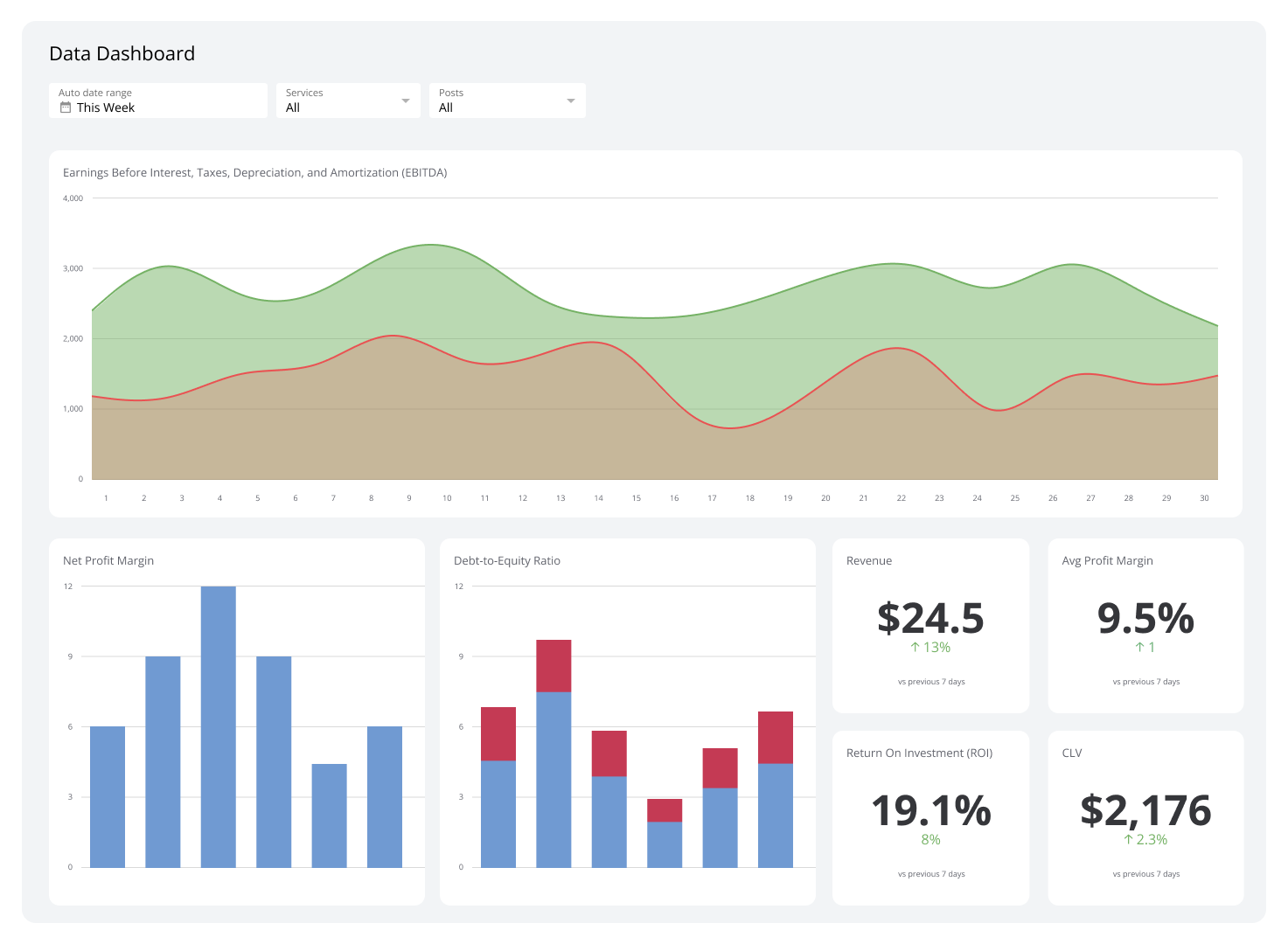

This cheat sheet will give you the top metrics to track for full funnel business reporting. I’ve also included the formula to calculate each metric, but tracking these metrics is even easier when you add them to a PowerMetrics dashboard.

For finance leaders and teams everywhere, each of these metrics is a key part of forecasting and analyzing revenue.

This is your SaaS finance metrics cheat sheet.

Here are the metrics I’ll cover in this article:

- Revenue

- Cash

- Payouts

- Payment Acceptance

- Charges

- Opportunities

- Return on Ad Spend

- Lead to Win Rate

- Goal Conversion Rate

- Full-Time Employees

Let’s jump in!

1. Revenue

Revenue, or the “top line”, and arguably the most important business metric, is the income generated through primary business operations. There are numerous ways to recognize revenue based on the account methods used by your business. Either way, tracking revenue gives you an idea of the amount of money generated across revenue streams which helps highlight high-growth areas or low performing areas of the business.

Calculate it:

ƒ Sum(Revenue)

2. Cash

Cash is a key indicator of the health of your business. Your cash, which you can track in QuickBooks or Xero, represents your business’ ability to meet operating obligations. The amount you have on hand is often referred to as runway. The way your cash moves within your business, whether it’s cash in or cash out, is known as your cash flow.

Calculate it:

ƒ Sum(Cash on Hand + Cash Equivalents)

3. Payouts

Payouts is the value of funds received from a payment processing platform, like Stripe, into your bank account based on your payout schedule (daily, weekly, monthly). Forecasting revenue based on your payout will help you track your cash flow, too!

Calculate it:

ƒ Sum(Payout Amount)

4. Payment Acceptance

Even if you have a stellar sign-up funnel, lead scoring, and subscription billing workflow, a low payment acceptance rate will dramatically decrease your revenue. Payment acceptance is the percentage of payments that are successful out of those attempted. Payment acceptance is a helpful metric to forecast revenue.

Calculate it:

ƒ Count (Successful Payments) / Count (Attempted Payments)

5. Charges

Charges is the total revenue you earn from payments after you deduct fees, refunds, transfers, and disputes. Charges is a view of your net earnings that you collect through a payment gateway like Stripe.

Calculate it:

ƒ Sum(Charges)

Stripe also tracks failed charges and disputed charges. Failed charges represent the dollar value of payments that failed including declined, blocked, or invalid payments. Disputed charges is the total value of charges that have been challenged and may be deduced from your net charges.

6. Opportunities

Opportunities represent a qualified lead with potential for closing a deal. You can track opportunities, also known as a sales lead or sales accepted lead, in your CRM software like HubSpot. Opportunities have a higher probability of closing, so this metric is a great indicator of potential revenue and will help with forecasting.

Calculate it:

ƒ Count(Opportunity)

7. Return on Ad Spend (ROAS)

When you’re spending money on advertising, it’s important to quantify how much revenue you’re generating from those efforts. While ROAS doesn’t have a “good” benchmark, since it’s influenced by your profit margins, operating expenses, and dependent on channel or tactic, the higher ROAS, the better.

Calculate it:

ƒ Sum(Revenue) / Sum(Advertising Spend)

8. Lead to Win Rate

Lead to win rate is the percentage of leads who entered the sales funnel and are considered “won”. Lead to win rate is a strong indication of product-market fit, pricing, and sales execution. Lead to win rate isn’t a metric that you can apply to your existing customer base, so it’s helpful for planning/forecasting.

Calculate it:

ƒ Count(Won Customers) / Count(Leads)

9. Goal Conversion Rate

If we’re talking about finance metrics, why are we tracking Google Analytics data? Your goal conversion rate tells you the percentage of user sessions that lead to a goal conversion. If you have set account trials as a goal in Google Analytics, tracking your goal conversion rate will help you understand your sales pipeline and potential revenue.

Calculate it:

ƒ Count(Goal Conversions) / Count(Sessions)

10. Full-Time Employees

You can track full-time employees in your accounting software like QuickBooks or Xero. Additionally, track your payroll expenses to understand the total cost with hiring and retaining employees on the payroll. Payroll is recorded against your revenue earned in the accrual form of accounting, where expenses are recorded when they are incurred.

Calculate it:

ƒ Count(Full-Time Employees)

Start tracking your SaaS finance metrics

The truth is, there are hundreds of business metrics to choose from. If you’re looking for inspiration, MetricHQ is a great place to start. If you’re ready to start tracking your performance metrics today, get started with PowerMetrics.

Related Articles

The Hidden Value of SaaS Sign Up Rate Benchmarks

By Priyaanka Arora — January 10th, 2026

17 KPIs Every Data-Driven Manager Needs to Lead Their Team

By Danielle Poleski — October 14th, 2025

The 9 Reddit KPIs You Should Be Tracking

By Mark Brownlee — September 17th, 2025