25 Days of Metrics: 2021 Year in Review

Published 2023-11-08

Summary - As the year draws to a close, it’s important to factor in some rest and relaxation to get a fresh perspective for the new year. Here’s some food for thought to go along with the delicious holiday treats you may have planned. If you’re looking for an easy way to catch up on a little last minute inspiration and productivity, look no further! Join me in a countdown to the

As the year draws to a close, it’s important to factor in some rest and relaxation to get a fresh perspective for the new year. Here’s some food for thought to go along with the delicious holiday treats you may have planned.

If you’re looking for an easy way to catch up on a little last-minute inspiration and productivity, look no further! Join me in a countdown to the holidays as I take you through the 25 metrics explored this year in the Metric Stack Newsletter.

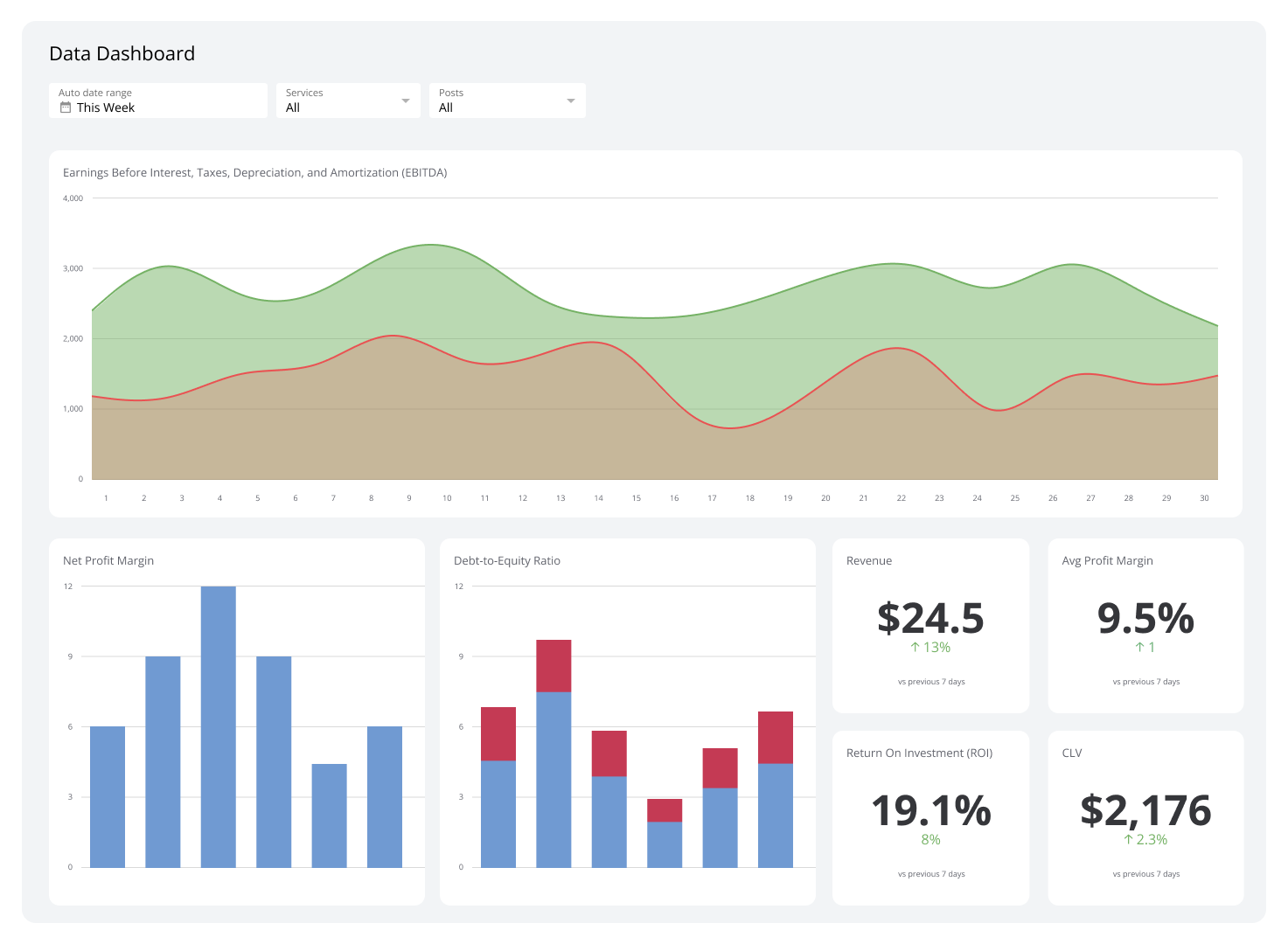

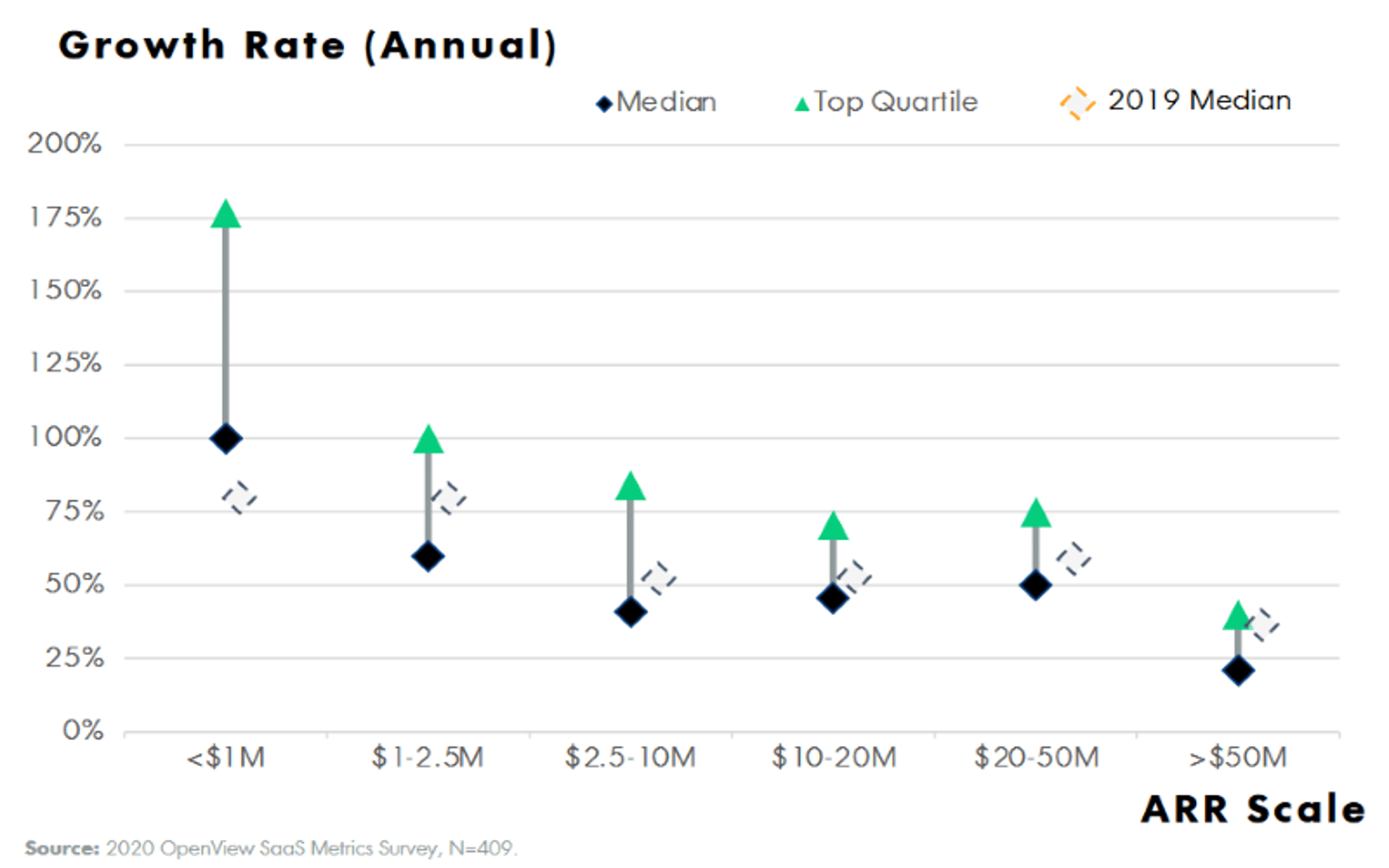

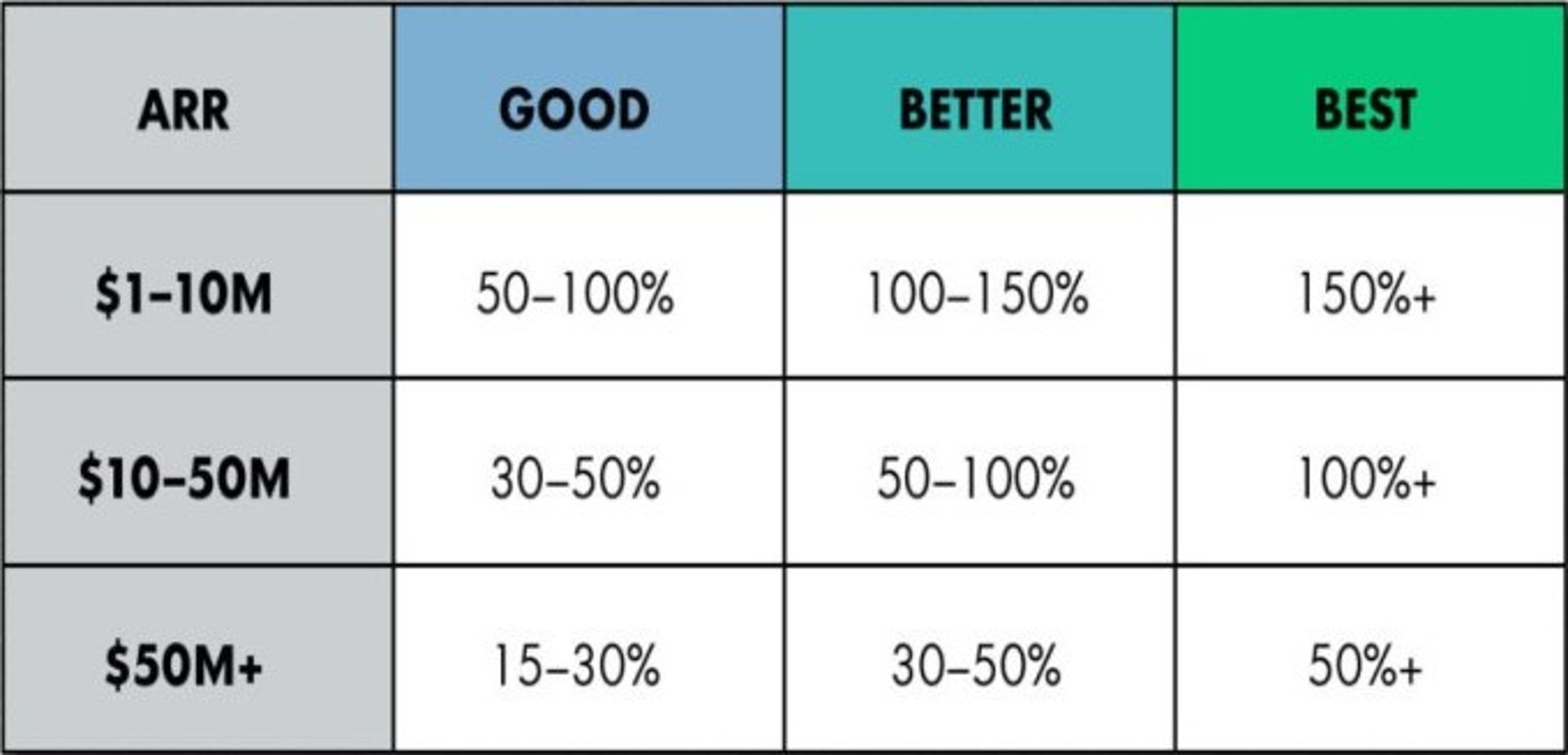

25. ARR Growth Rate

The first-ever metric covered in the Metric Stack newsletter packs a lot of information in a single number!

ARR Growth Rate measures the rate of growth of your Annual Recurring Revenue (ARR). Well, that’s obvious from the metric name.

But what it really tells you is how fast you’re growing, how good your product-market fit is, and how soon you can expect to go public. The average public SaaS company has a 61% year-over-year ARR Growth Rate in the few years prior to IPO.

And here’s a pretty graph of growth rate by ARR scale:

Read more about ARR Growth Rate in Edition 1 of the Metric Stack Newsletter.

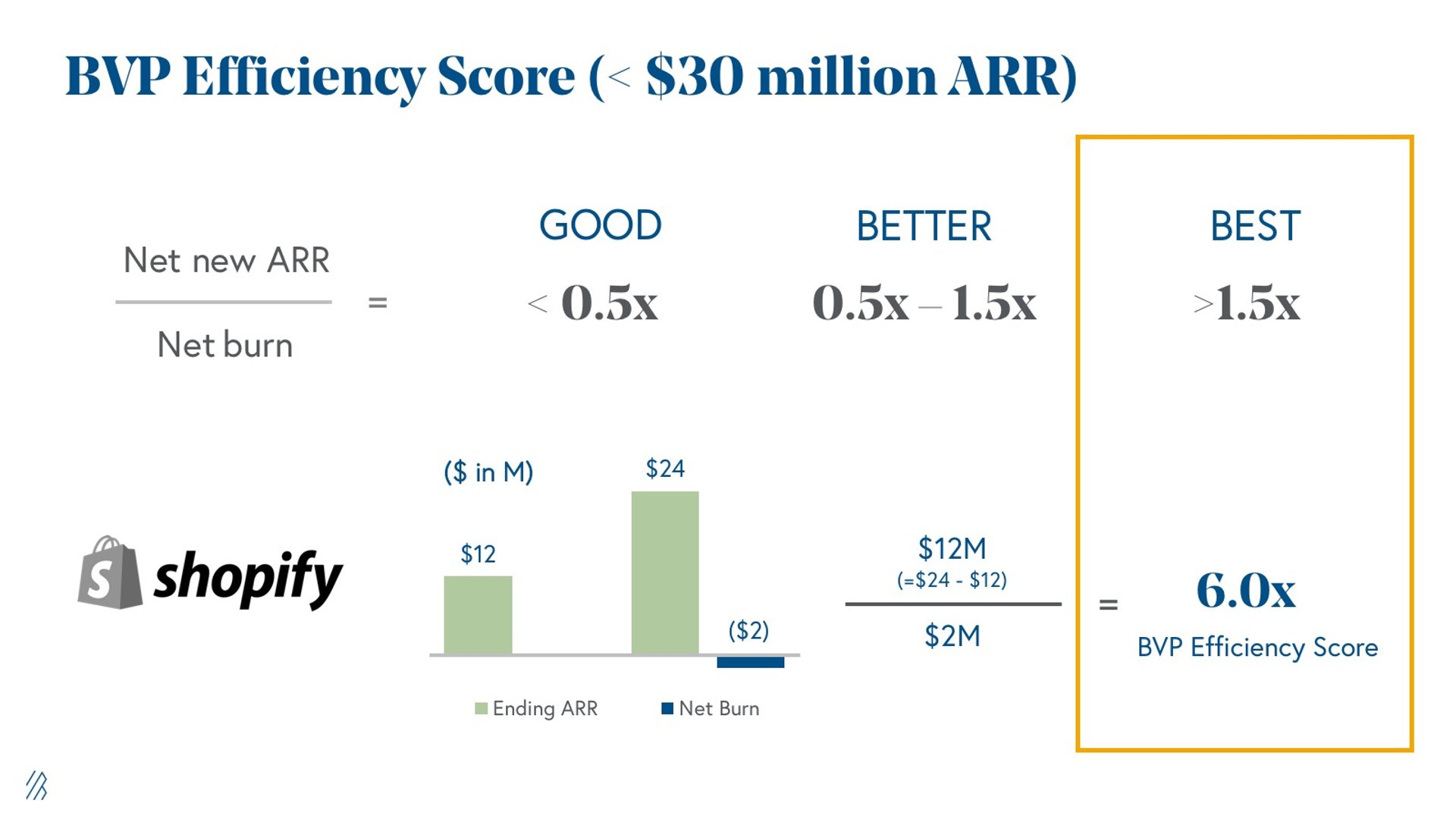

24. Bessemer Efficiency Score

I love this metric. No, really.

I was super lucky to witness Alexandra Sukin, Investor at Bessemer Venture Partners, run through the top SaaS metrics benchmarks at the 2021 SaaS North Conference in Ottawa - and you can bet she featured Bessemer Efficiency Score.

Bessemer Efficiency Score, or BVP Efficiency Score, is a multiple that measures the return on net burn in terms of net new ARR earned. A BVP Efficiency Score of 1 means you burned one dollar per dollar incremental revenue earned, so you want this number to be higher than one.

Bessemer states that a BVP Efficiency Score of 1.5 or higher can be categorized as “best” and indicates not just growth but resilient, sustainable growth.

Read more about Bessemer Efficiency Score in Edition 2 of the Metric Stack Newsletter.

23. Hype Factor

Are you generating revenue or just raising hype? If you’re a fan of asking yourself hard-hitting questions, Hype Factor is the metric for you.

Hype Factor is the ratio between raised capital and ARR. It is a capital efficiency metric just like Bessemer Efficiency Score, but measures something much less tangible: how much of the “hype” or buzz surrounding your business is fluff?

Coined by Dave Kellogg, investor, enterprise software startups expert, angel investor, and MetricHQ contributor, Hype Factor hypothesizes that if your capital isn’t converted to ARR, it’s spent with little or no ROI, aka hype. A Hype Factor between 1 - 2 is optimal.

Read more about Hype Factor in Edition 3 of the Metric Stack Newsletter.

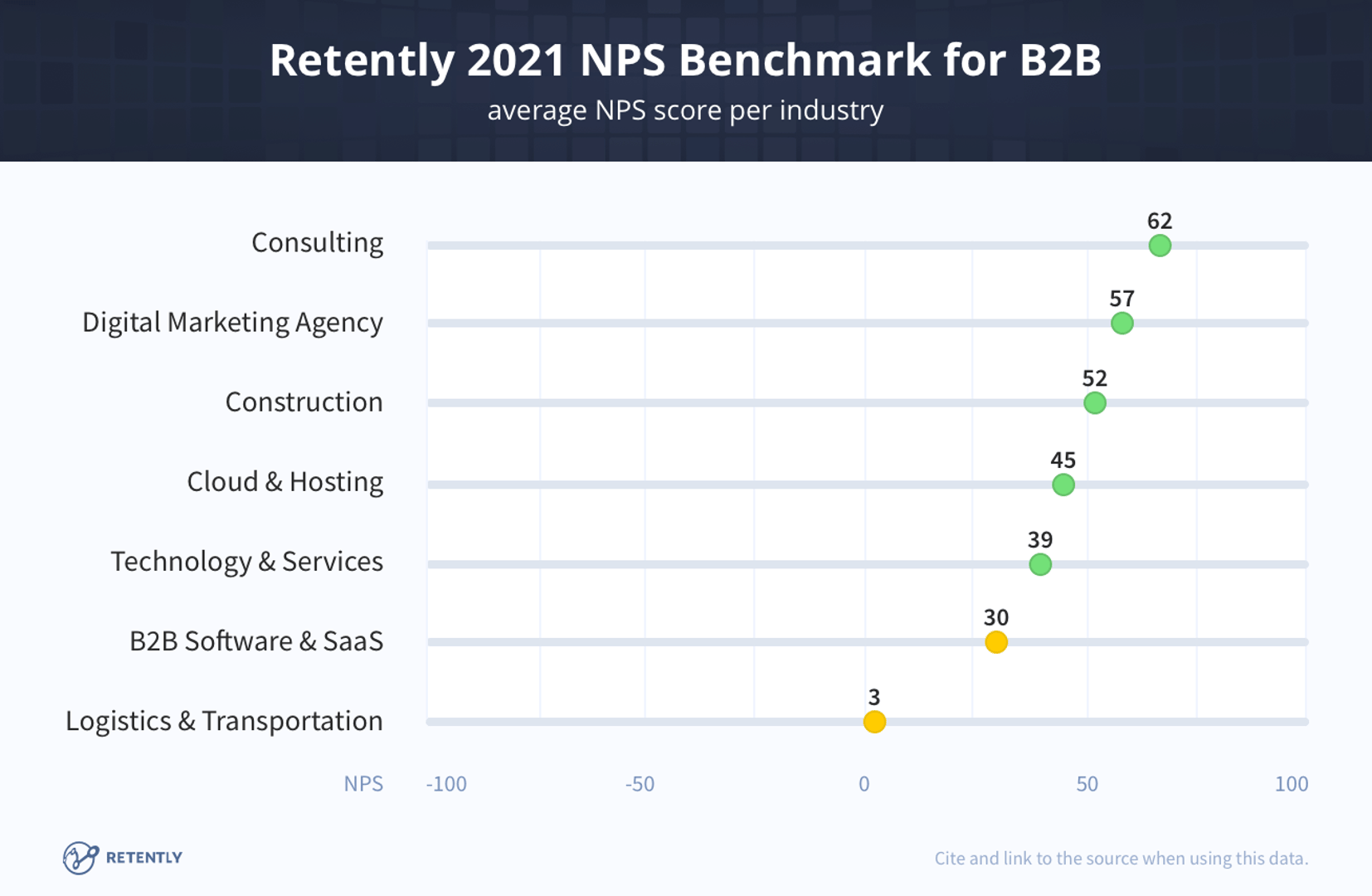

22. Net Promoter Score (NPS)

“I love this product, and I want to tell people about it!”

If you’re a founder or product owner, these are the words you want to hear from every customer. But in reality, there’s a much more practical way to capture customer feedback with the Net Promoter Score (NPS).

NPS is a customer feedback scoring system that groups customer reviews into Promoters, Neutrals, and Detractors. Those Neutrals are where your opportunity lies to discover what can improve and slowly convert lukewarm customers into super users.

Read more about Net Promoter Score in Edition 4 of the Metric Stack Newsletter.

21. Customer Acquisition Cost

Watch out for the startup killer!

In all seriousness, Customer Acquisition Cost (CAC) is widely known as one of the deterrents of survival as a startup.

Why?

CAC is increasing each year. It’s three times higher than it was last year. But more than, you invest so much sales and marketing in acquiring new customers, just for them to churn. And since it takes a year on average to recuperate CAC, you’re essentially losing money on each new customer you acquire!

Read more about Customer Acquisition Cost (and how to defeat the startup killer) in Edition 5 of the Metric Stack Newsletter.

20. LTV/CAC Ratio

The magic ratio. The lifeblood of SaaS. LTV/CAC Ratio has many impressive names that show how crucial it is to track. And with reason.

LTV/CAC Ratio pits Customer Lifetime Value (LTV) against Customer Acquisition Cost (CAC) to measure, essentially, your return on investing in new customer acquisition.

As we just saw, CAC can make or break your startup, and LTV/CAC is one way to determine which side you’re on. Remember that 3:1 is the magic number. You want three times the LTV as you spend on acquiring the average customer.

Why 3x? Answers here:

Read more about the LTV/CAC Ratio in Edition 6 of the Metric Stack Newsletter.

19. CAC Payback Period

You know that CAC is an important metric when you see me mention it three times in a row!

Bessemer states that CAC Payback Period is “the primary metric that we like to use to evaluate S&M [sales & marketing] efficiency” in their 2021 Scaling to $100 Million Benchmark Report.

CAC Payback Period puts your CAC and LTV/CAC into perspective with the one thing most founders lack: time. Use this metric to measure how long it will take to recuperate the average customer acquisition.

A good benchmark for CAC Payback Period lies between 8 to 12 months on average, slightly increasing in proportion to target customer size and ARR scale.

Read more about CAC Payback Period in Edition 7 of the Metric Stack Newsletter.

18. Burn Multiple

A common thread across many of the metrics here is the return on investment. Expenses tend to be endless and meaningless without results to justify them.

Burn Multiple, the ratio of net burn to net new ARR, acts as a warning sign when it gets too high. It indicates that you are burning cash with no incremental revenue, and no results to speak of.

Ideally, you have a burn multiple under 1x. However, especially if you are an early-stage startup, a reasonable burn multiple lies between 1x - 2x.

Read more about Burn Multiple in Edition 8 of the Metric Stack Newsletter.

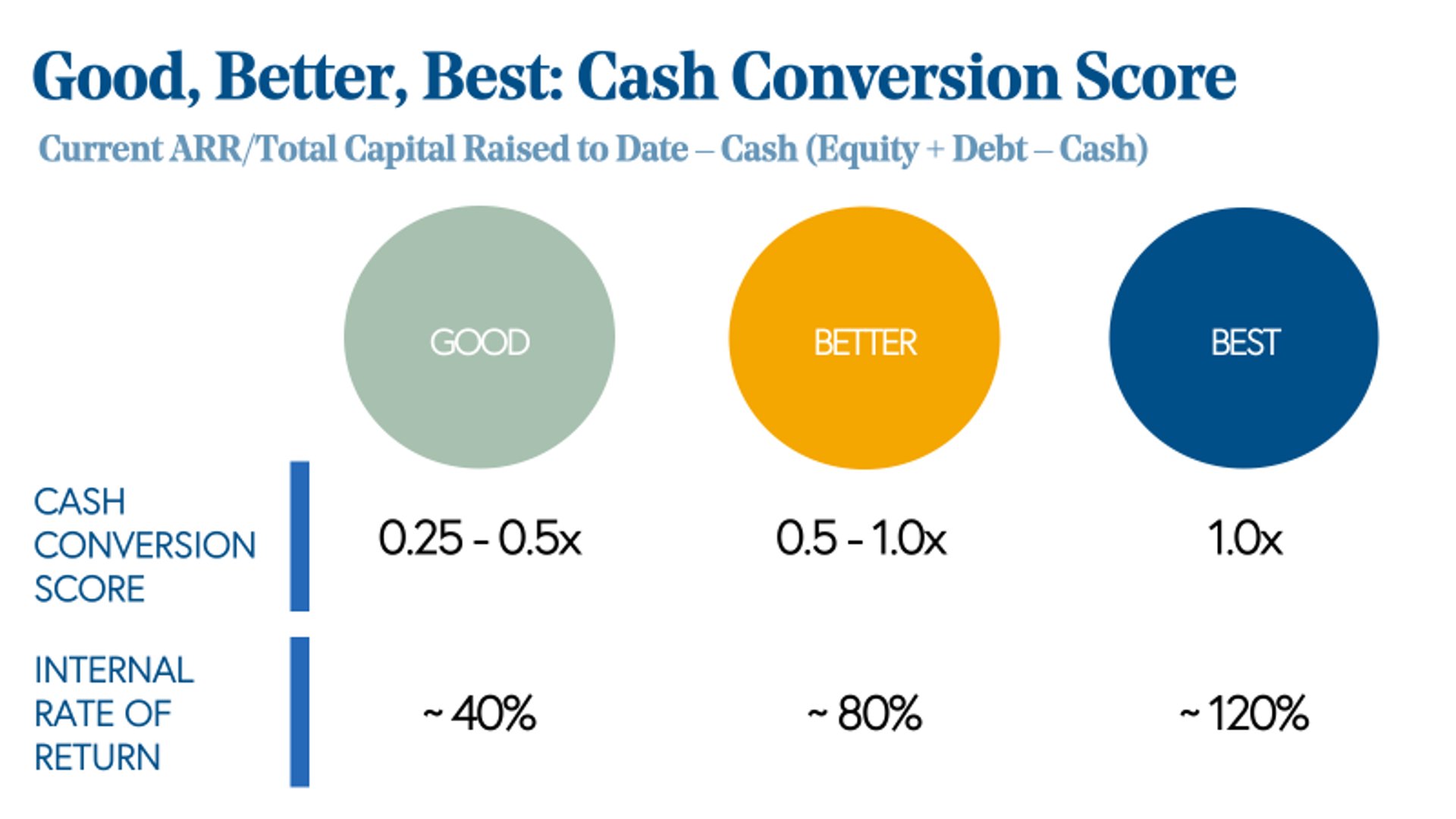

17. Cash Conversion Score (CCS)

With $19 Billion invested in 239 Canadian SaaS companies by 500+ investors, 2021 was a great year for SaaS.

And if you’re looking for a metric that investors love, Cash Conversion Score (CCS) is it.

CCS measures the ratio between ARR and invested capital. The converse of the Hype Factor, CCS tells investors how efficiently they spend capital and indicates that you’re in a position to grow further with additional funding.

Cash Conversion Score benchmarks will show that IRR (profitability and viability) increases with an increase in CCS:

Read more about Cash Conversion Score in Edition 9 of the Metric Stack Newsletter.

16. Net Revenue Retention Rate

Pop quiz! Which of the following statements are true:

- CAC has increased by 50% over the past 5 years

- Venture capital investment in fast-growing tech companies has doubled from 2020 to 2021

- It is 30-70% cheaper to retain an existing customer than to acquire a new customer

If you’ve watched Season One of The Office a thousand times as I have, you’ll at least know that statement 3 is right. But so are the other two.

And that’s why Net Revenue Retention Rate (NRR) is possibly the most important SaaS metric of 2021.

Calculate it by subtracting downgrades and cancels from net new + expansion revenue, dividing the result by recurring revenue for the period. Benchmark studies agree that your NRR should be between 100 - 120%.

Read more about the Net Revenue Retention Rate in Edition 10 of the Metric Stack Newsletter.

15. DAU/MAU Ratio

Let’s take a minute to appreciate the number of acronyms and ratios we’ve looked at so far. I counted 12. Can you find more? More urgently, can you tell me why SaaS (an acronym itself) is packed with acronyms?

In the midst of all these very useful acronyms and ratios, DAU/MAU Ratio is both an acronym and a ratio - an achievement that can only happen in SaaS!

DAU/MAU Ratio measures Daily Active Users (DAU) versus Monthly Active Users (MAU) to show the level of daily usage per month, or stickiness, of an app.

Now, take this metric with a pinch of salt because it was coined by Meta, aka Facebook, to measure the one metric they excel at daily active engagement.

Used correctly, DAU/MAU can be a good indicator of stickiness, but there are a few caveats.

Read more about the DAU/MAU Ratio in Edition 11 of the Metric Stack Newsletter.

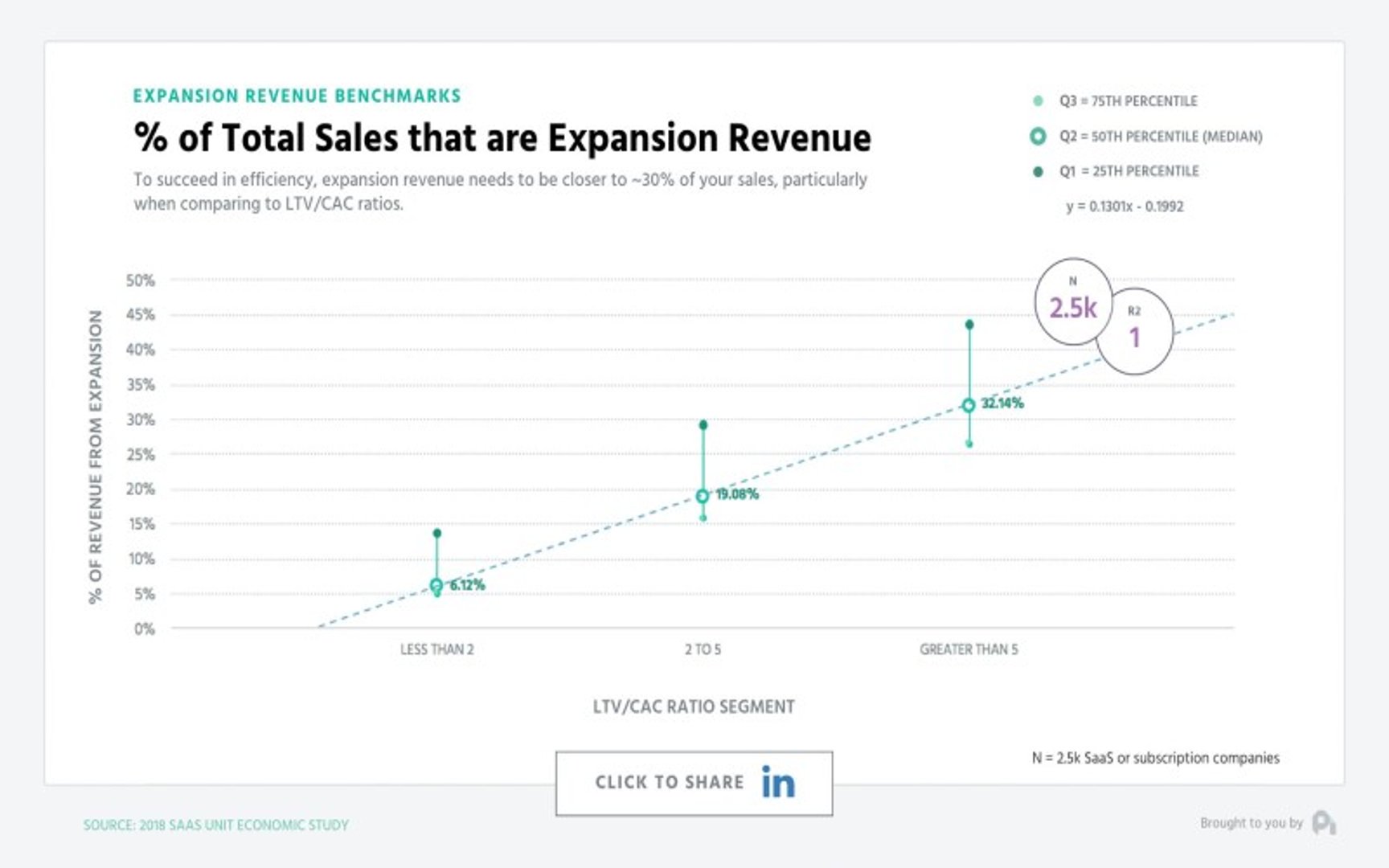

14. Expansion Revenue

Surprise! You get two metrics under one heading, mainly because I can’t decide which one is more important.

The first: Expansion Revenue as a Percentage of New Revenue, measures expansion revenue as a percentage of, you guessed it, new revenue.

What you should take away from this metric: expansion revenue is free from the perils of high CAC and therefore weighted more. You want to have a high percentage of your new revenue coming from expansion because you retain more of it.

The second: Expansion MRR Growth Rate is the percentage of total MRR at the beginning of the month that comes from expansion. Track this metric over time to see how successful your expansion strategy is, and watch your average LTV grow with it:

Read more about Expansion Revenue in Edition 12 of the Metric Stack Newsletter.

13. Natural Rate of Growth

It’s so exciting when new metrics are born out of industry trends! Here’s a metric that emerged with the onslaught of product-led growth:

Natural Rate of Growth measures the speed of your organic growth both through social media and external channels, as well as directly via your product. Think along the lines of conversions without sales involvement, high freemium-to-win rates, and virality.

Ideally, you want between 50% to 150% of your ARR growth to be organic:

Read more about the Natural Rate of Growth in Edition 13 of the Metric Stack Newsletter.

12. Burn Rate

Burn Rate is a great way to measure operating efficiency. This metric is calculated by subtracting gross profit from operating expenses, leaving you with the amount of money spent on operating expenses that did not result in profit.

By focusing on gross profit, you have a direct measurement of the costs related to your business and the return on those costs.

Depending on the stage of your business, it may be acceptable to have a higher burn rate. This holds true, especially for early-stage startups with very high R&D costs and lower entry prices.

Read more about Burn Rate in Edition 14 of the Metric Stack Newsletter.

11. Logo Churn

Moving on from Burn to Churn and moving on from my terrible attempt at SaaS poetry, Logo Churn is the percentage of unsubscribed customers in a given period.

On average SMBs see a 3% - 7% logo churn, and this number decreases to 1% - 2% for midmarket and enterprise companies.

There’s so much out there about how to reduce churn and why retention is cheaper and more rewarding than acquisition, but I’ll leave you with a unique perspective to consider:

Churn is a customer behavior pattern. The more data you collect related to churn and its dimensions, the easier it is to look into the mind of the customer. Here’s an example of how you can track customer churn.

Read more about Logo Churn in Edition 15 of the Metric Stack Newsletter.

10. Trial Conversion Rate

Free trials and freemium in SaaS have the benefit of reducing customer acquisition costs by encouraging self-serve exploration of the product before purchase.

Trial Conversion Rate, which calculates the percentage of free trials that result in wins, is a great metric to track how effectively you convert customers who have already experienced your product.

In other words, this is very real data on whether your product can provide enough value to convince users to part with their hard-earned money.

If you include retention as a criterion for a successful conversion, the average trial conversion rate lands at about 0.4%.

Read more about Trial Conversion Rate in Edition 16 of the Metric Stack Newsletter.

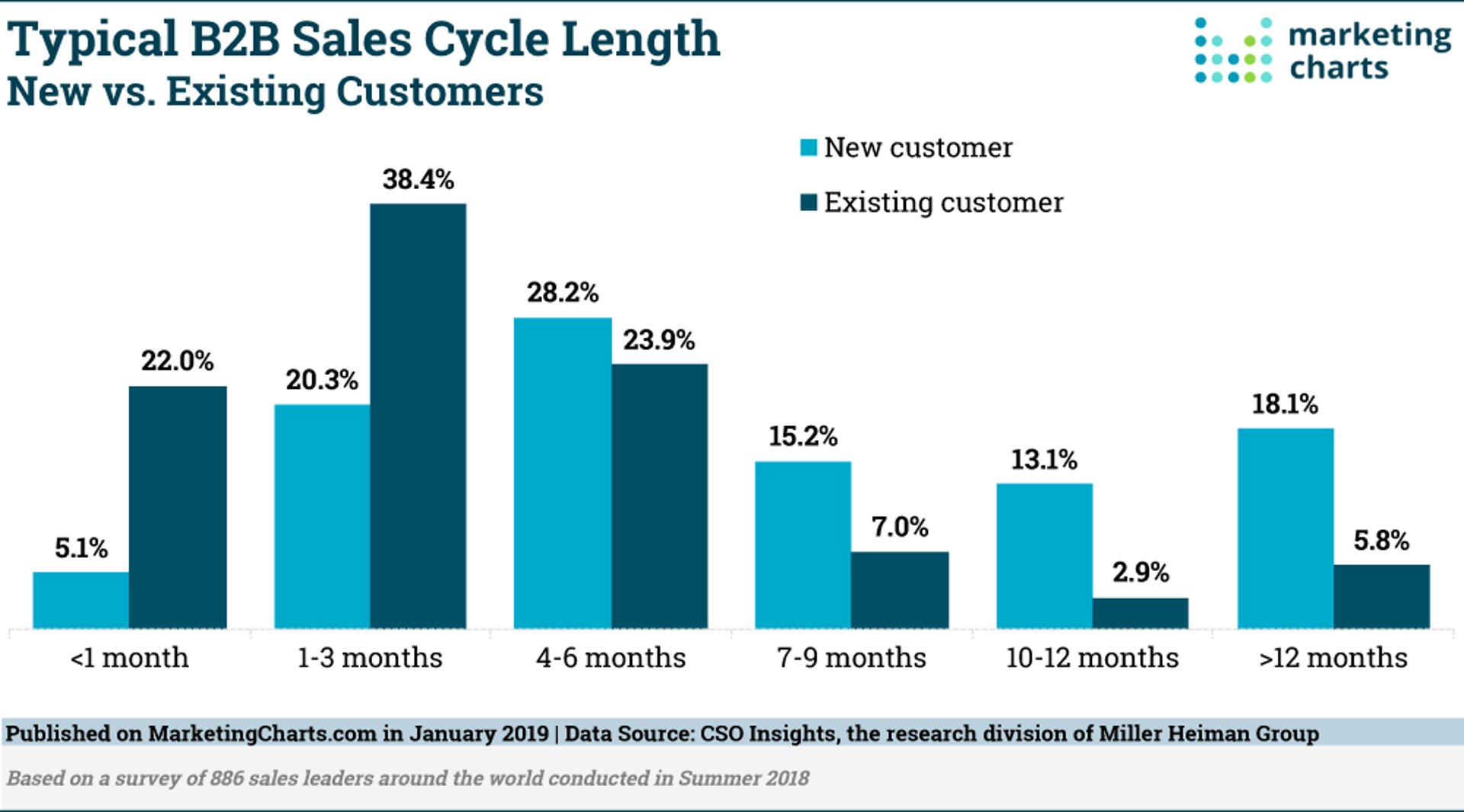

9. Sales Cycle Length

How short should your sales cycle be?

If you’re interested in increasing the efficiency of your sales cycle, start by tracking Sales Cycle Length.

Now, this is totally dependent on your sales model and might be irrelevant to you, especially if you follow a freemium or self-serve model. If so, skip to the next metric on the list.

But if not, compare your current average sales cycle length against some benchmarks:

Read more about Sales Cycle Length in Edition 17 of the Metric Stack Newsletter.

8. Total Addressable Market (TAM)

Have you been keeping track of the acronym count? We were at 12 the last time I checked. Well, I have three more for you.

Let’s begin with TAM. Total Addressable Market (TAM) is a massive number that shows the dollar value of your potential market. Although this is a broad category, you cannot simply qualify everyone within your reach as part of your market.

SAM (Serviceable Addressable Market) and SOM (Serviceable Obtainable Market) filter your TAM into more attainable numbers.

Here’s a great quote from Lauren Thibodeau, Metric Stack Podcast co-host, on the importance of market size analysis:

“TAM and market sizing are near the top of the list of metrics SaaS founders need to wrap their heads around at the product-market fit stage. Being able to back up your numbers from every angle will empower you with both credibility and confidence.”

Read more about Total Addressable Market in Edition 18 of the Metric Stack Newsletter.

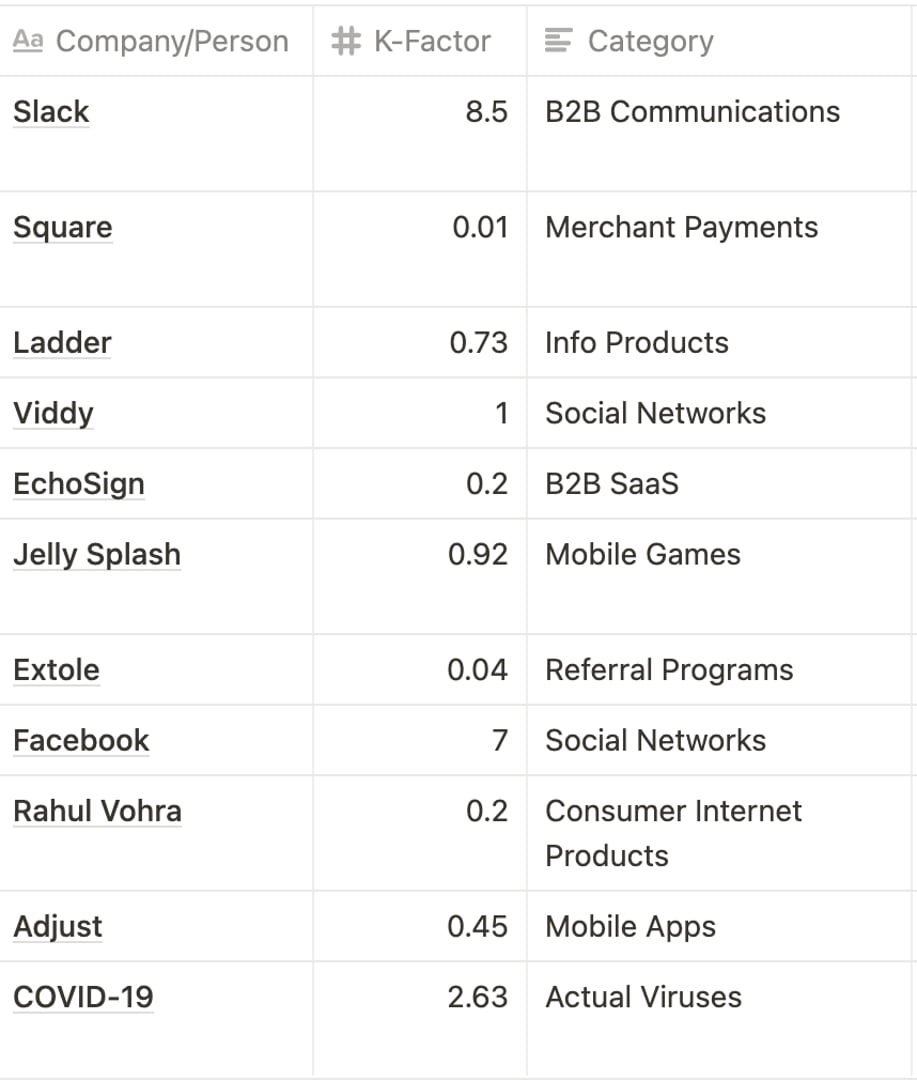

7. Viral Coefficient

What do Covid-19 and businesses have in common?

They can both go viral!

Viral Coefficient measures your business’ virality based on referrals and referral conversion rates. Essentially, if you find a large portion of your customers talking about and recommending your product to their network, and those referrals proceed to convert, you have a high viral coefficient.

Check out this incredible data on the virality (K-factor) of SaaS businesses, compiled by MetricHQ Contributor Jessie Summons:

Read more about Viral Coefficient in Edition 19 of the Metric Stack Newsletter.

6. Annual Contract Value (ACV)

Annual Contract Value is a metric largely used to communicate the size of the average deal a company wins. This metric calculates the total revenue brought by contract customers in a single year, divided by the number of customers.

If you have either a low-value ACV and a high customer count or a high-value ACV and a medium to high customer count, this is probably the best scenario. Low customer count combined with high-value ACV results in high customer concentration (spoiler warning for the next metric!), which increases the risk of not recovering from churn.

Read more about Annual Contract Value in Edition 20 of the Metric Stack Newsletter.

5. Customer Concentration

We’ve reached the last 5 metrics in our countdown to the holidays!

I warned you about the risks of high customer concentration, but let’s take a slightly deeper look:

Customer Concentration is the percentage of your total revenue that comes from your biggest customer or set of customers.

Did you know that a safe customer concentration can range between 10% and 1%?! Head of Finance at Rewind and MetricHQ Contributor Alamin Mollick cautions us:

“If your customer volume is high and mainly consists of SMB companies with low deal value, a more realistic customer concentration benchmark is 1% or less.”

Read more about Customer Concentration in Edition 21 of the Metric Stack Newsletter.

4. Sign Up Rate

Web-to-sign-up is a strong indicator of high-quality traffic visiting your website.

Sign Up Rate measures the percentage of website visitors who sign up for a trial, demo or start the freemium version of your product. Of course, it also counts if they directly sign up to be a paid customer.

Check out my blog post detailing Sign Up Rate benchmarks and tips to optimize your site for increased conversion.

Read more about Sign Up Rate in Edition 22 of the Metric Stack Newsletter.

3. Lead Conversion Rate

Here’s a great metric to measure top-of-the-funnel conversion:

Lead Conversion Rate is the percentage of website visitors that are captured as leads. Your aim is to eventually convert them, thereby increasing your Sign Up Rate, as we just saw.

So how do you optimize your website to make a great first impression? Speed, page load time, user-friendly design, and high-value, relevant content are some ideas to start with. Check out the link for more tips and examples:

Read more about Lead Conversion Rate in Edition 23 of the Metric Stack Newsletter.

2. Time to Value

Time is valuable. You do not want your customer to spend time unsatisfied with your product, and if they are, you want to learn about it and fix it.

Our second-to-last metric in the countdown to the holidays is Time to Value, which measures the duration of time that passes before your customer finds true value in your product.

Donna Weber, MetricHQ Contributor, and customer onboarding expert offers heartfelt advice on how to reduce time to value: listen to your customers, don’t use hope as a strategy, engage with people, and track TTV and other customer satisfaction metrics over time.

Read more about Time to Value in Edition 24 of the Metric Stack Newsletter.

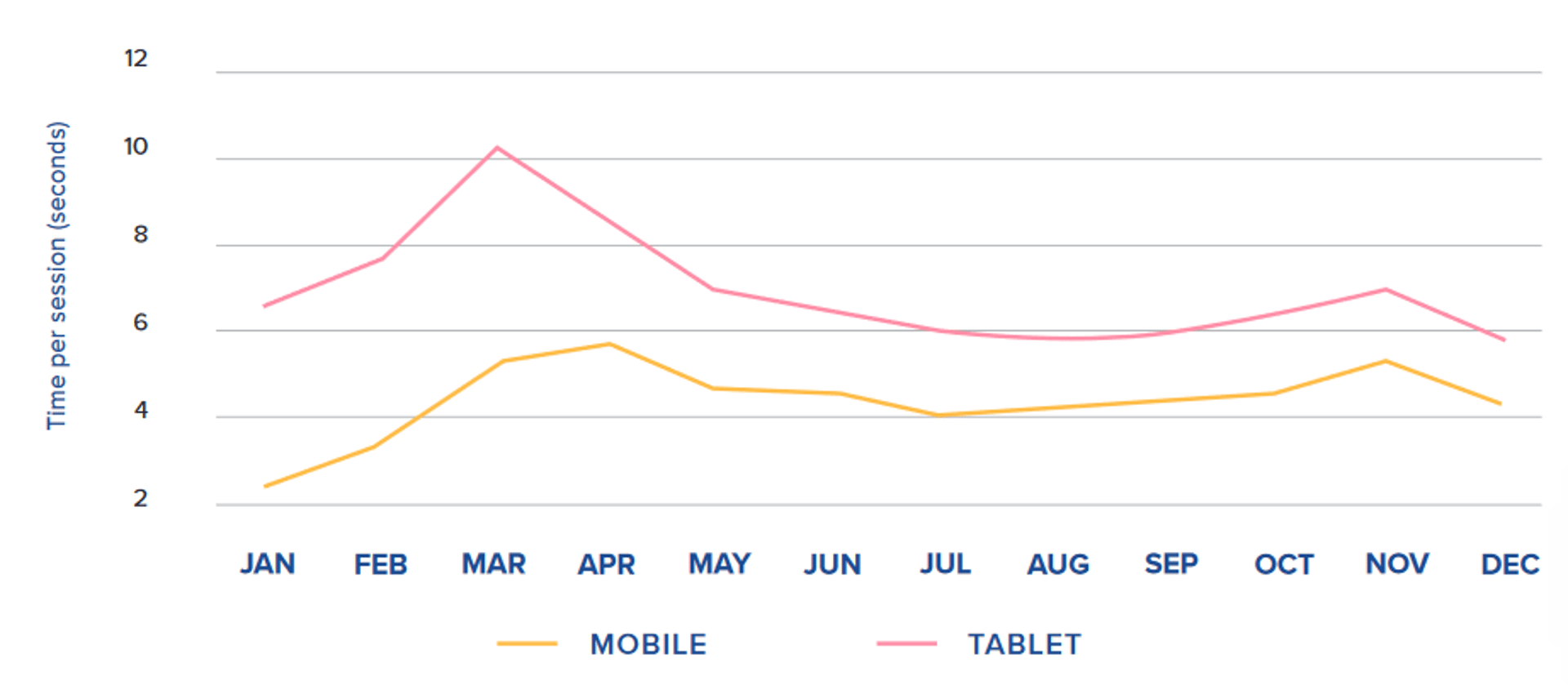

1. Average Session Duration

We made it to the final metric of our holiday countdown! Before you log out for the year and celebrate your achievements, read through one last metric definition to think about over the holiday season:

Average Session Duration continues our theme of the value of saving your customers’ time. This metric measures the average duration of time spent by your website visitors across the pages of your site.

Common sense indicates that this should be as high as possible, but in reality, Average Session Duration fluctuates between 2 to 4 minutes and can be significantly higher on certain devices:

Read more about Average Session Duration in Edition 25 of the Metric Stack Newsletter.

That's a wrap!

2021 has been a great year for SaaS, with the emergence of many new trends. Metrics are often the best way to translate big-picture ideas into smaller, actionable goals.

If you enjoyed reading through the 25 days of metrics, subscribe to the Metric Stack Newsletter for a new metric deep dive delivered to your inbox each Monday morning.

Wishing you and yours a happy holiday season from the Metric Stack newsletter!