22 expert informed metrics for SaaS Head of Finance

Published 2025-11-13

Summary - Metrics demonstrate the milestones in your business’ story. The challenge, however, is knowing what metrics to measure and make sense for your business. That’s where MetricHQ comes in.

SaaS growth targets are ambitious: new markets, funding rounds, bell?ringing moments. Hitting those goals takes disciplined execution grounded in clear, reliable metrics.

If you lead finance at a SaaS company, you translate strategy into numbers that stand up to scrutiny. Without a tight grip on fundamentals and the right metrics, investor conversations stall and planning wobbles.

Metrics mark the milestones in your company’s story. The challenge is knowing which ones matter for your stage and model, then tracking them consistently.

This expert?informed list highlights the most important financial metrics to monitor. Klipfolio PowerMetrics is a business intelligence and analytics platform that helps you centralize these metrics and share trustworthy dashboards across the team.

- Annual Contract Value (ACV)

- Burn Multiple

- Customer Acquisition Cost (CAC)

- Customer Acquisition Cost Ratio (CAC Ratio)

- Customer Concentration

- Customer Lifetime Value (LTV)

- Deviation from Target Churn Rate

- Gross MRR Churn Rate

- Gross Revenue Retention Rate (GRR)

- Hype Factor

- Lifetime Value to Cost of Acquisition Ratio (LTV/CAC)

- Logo Churn

- MRR Growth Rate

- Net Annual Recurring Revenue Added (Net ARR Added)

- Payment Acceptance

- Propensity to Renew

- Reactivation MRR

- SaaS Magic Number

- SaaS Quick Ratio

- The Rule of 40

- Total Addressable Market (TAM)

- Weighted ACV (WACV)

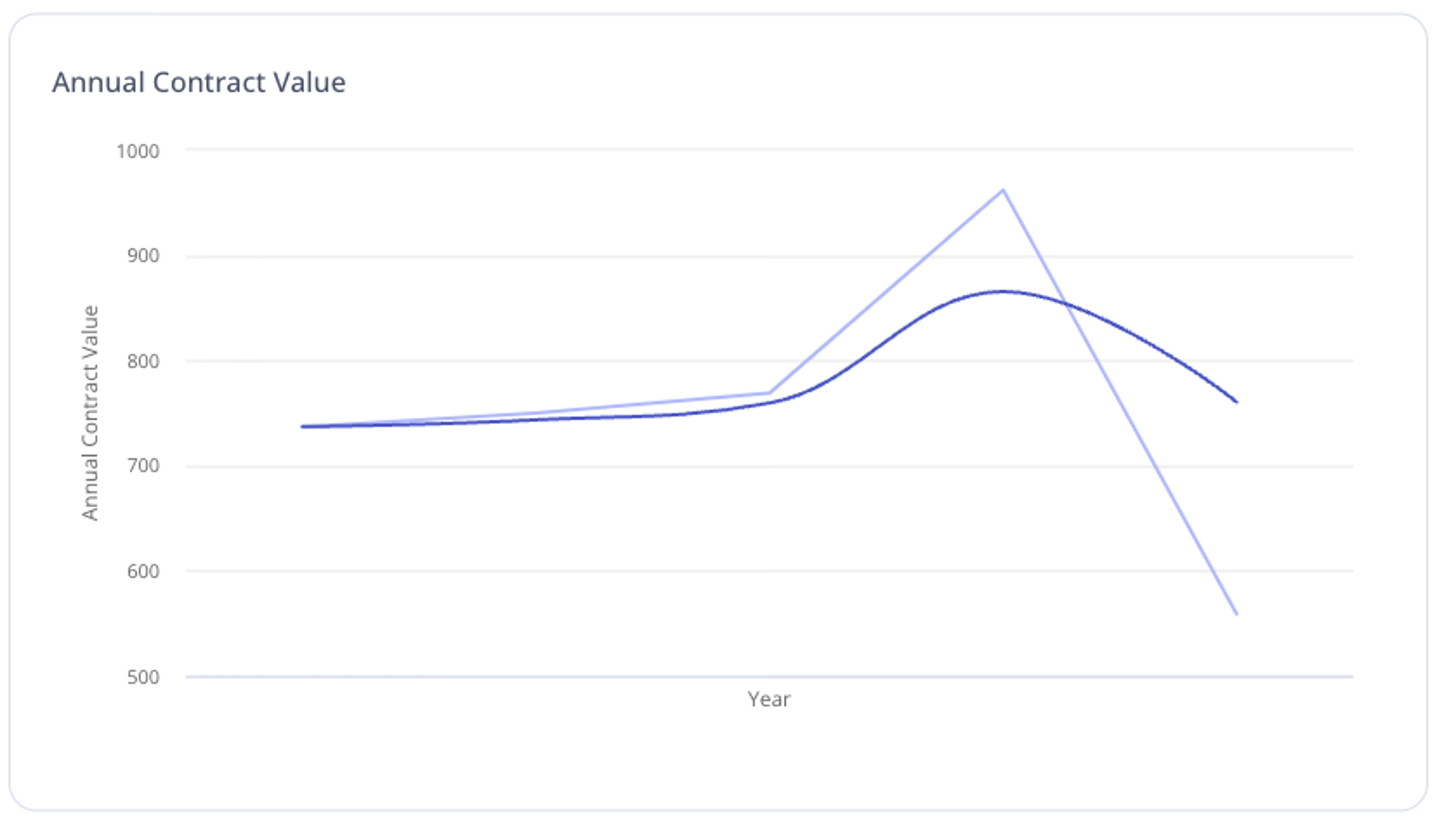

Annual Contract Value (ACV)

Expert contributor: Lauren Thibodeau

Annual Contract Value (ACV) is the dollar amount an average customer contract is worth to your company in one year. Definitions vary. Some teams include one?time fees like setup or training in ACV; others don’t. Track ACV the same way each period and use a SaaS dashboard to align understanding across teams.

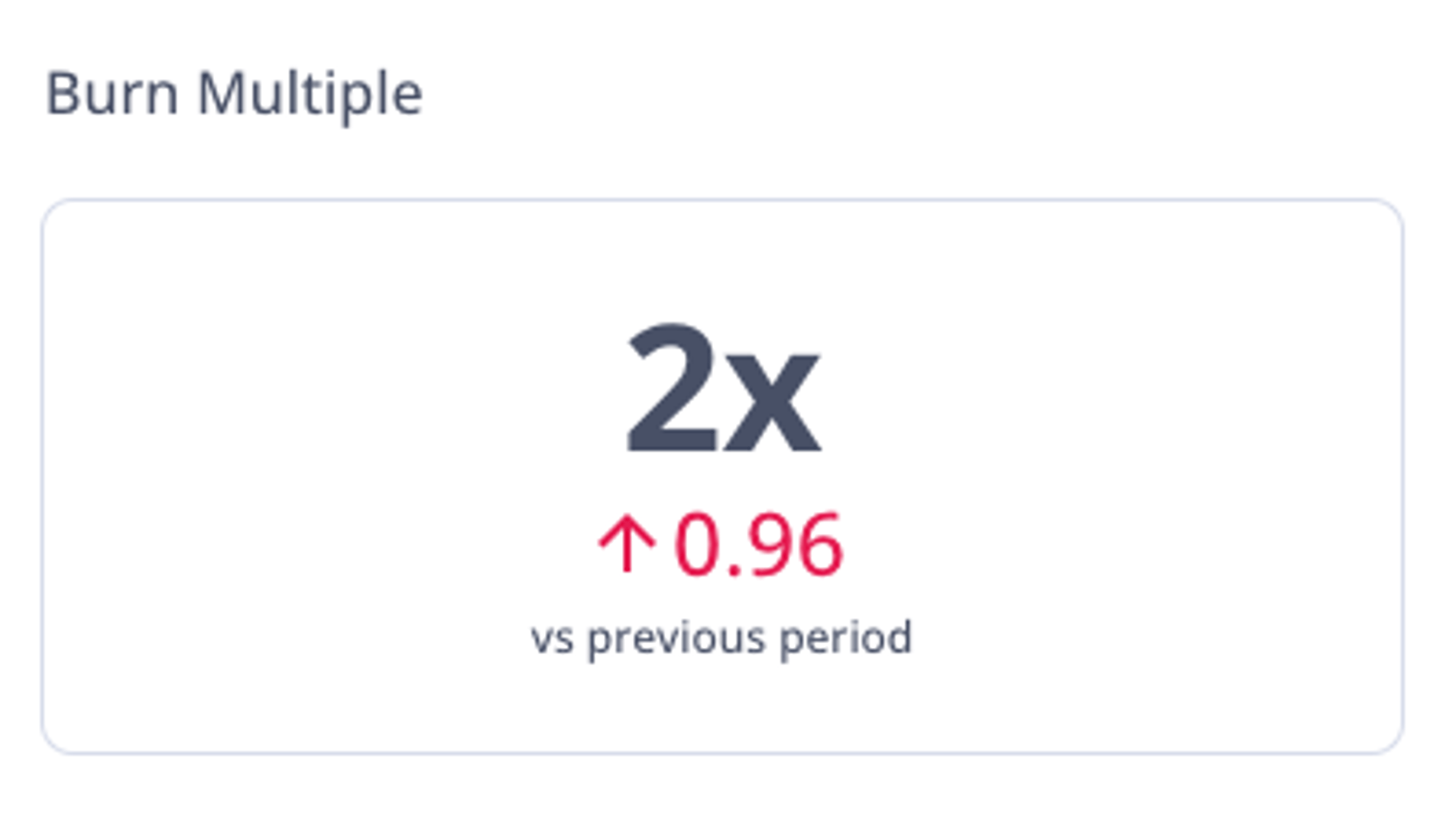

Burn Multiple

Expert contributor: David Sacks

Burn Multiple shows how much cash a startup burns to add each incremental dollar of ARR. Lower is better. It reflects how efficiently the company turns spend into durable growth.

Customer Acquisition Cost (CAC)

Expert contributor: Mandy Leavell

Customer Acquisition Cost (CAC) is the cost to acquire one new customer. Include fully?loaded sales and marketing costs divided by the number of new customers in the period.

Customer Acquisition Cost Ratio (CAC Ratio)

Expert contributor: Vinny Prajka

CAC Ratio measures sales and marketing efficiency: for each dollar invested, how much new subscription contract value is generated, adjusted for gross margin. Your target depends on market context, growth goals, and delivery efficiency.

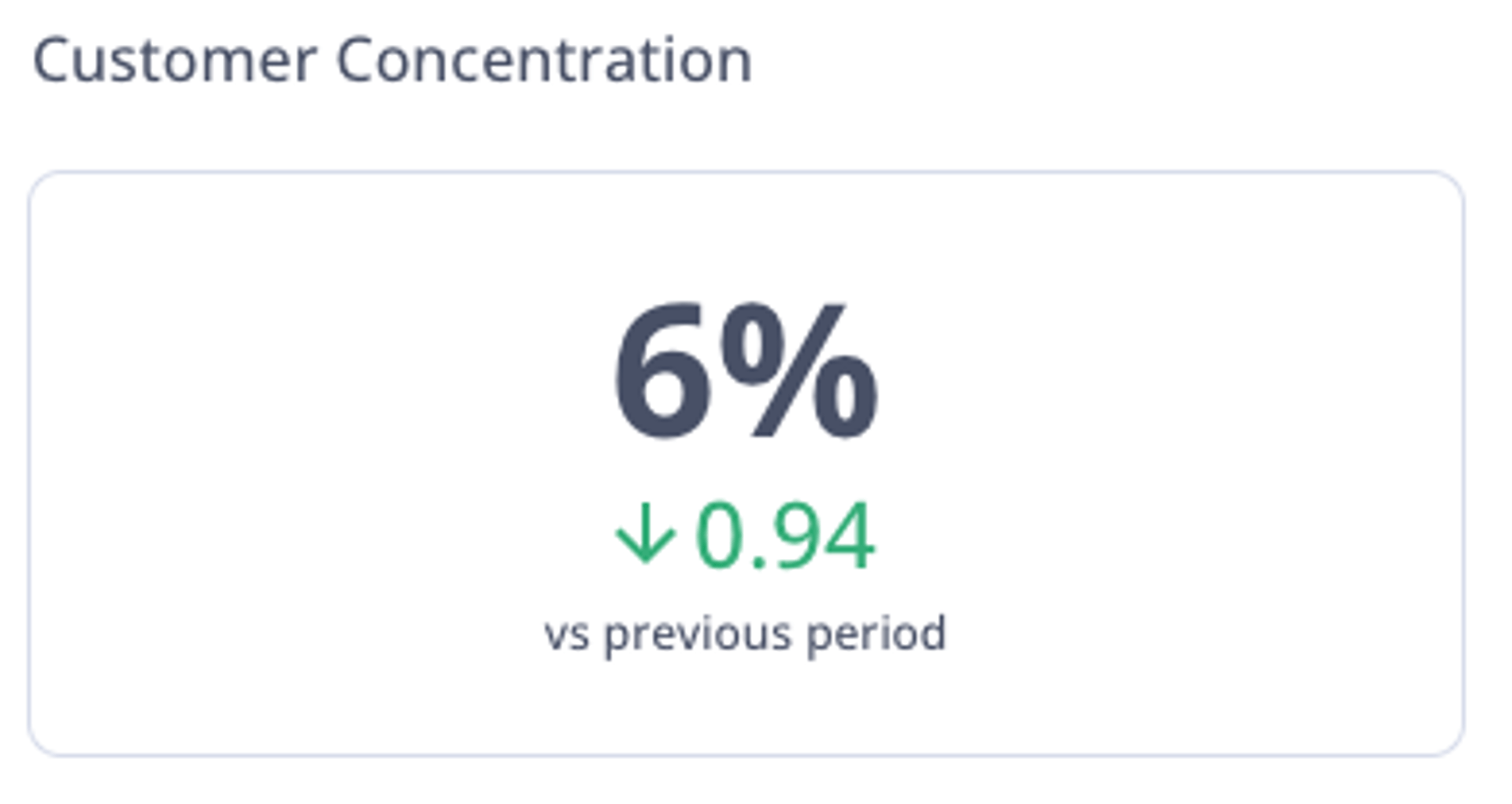

Customer Concentration

Customer Concentration, or Customer Revenue Concentration, is the share of total revenue generated by your highest?paying client or a group of top?paying clients. High concentration increases risk if a key account is lost. Some teams value the focus and deeper relationships that come with larger accounts, but the trade?offs include demanding requirements and revenue volatility.

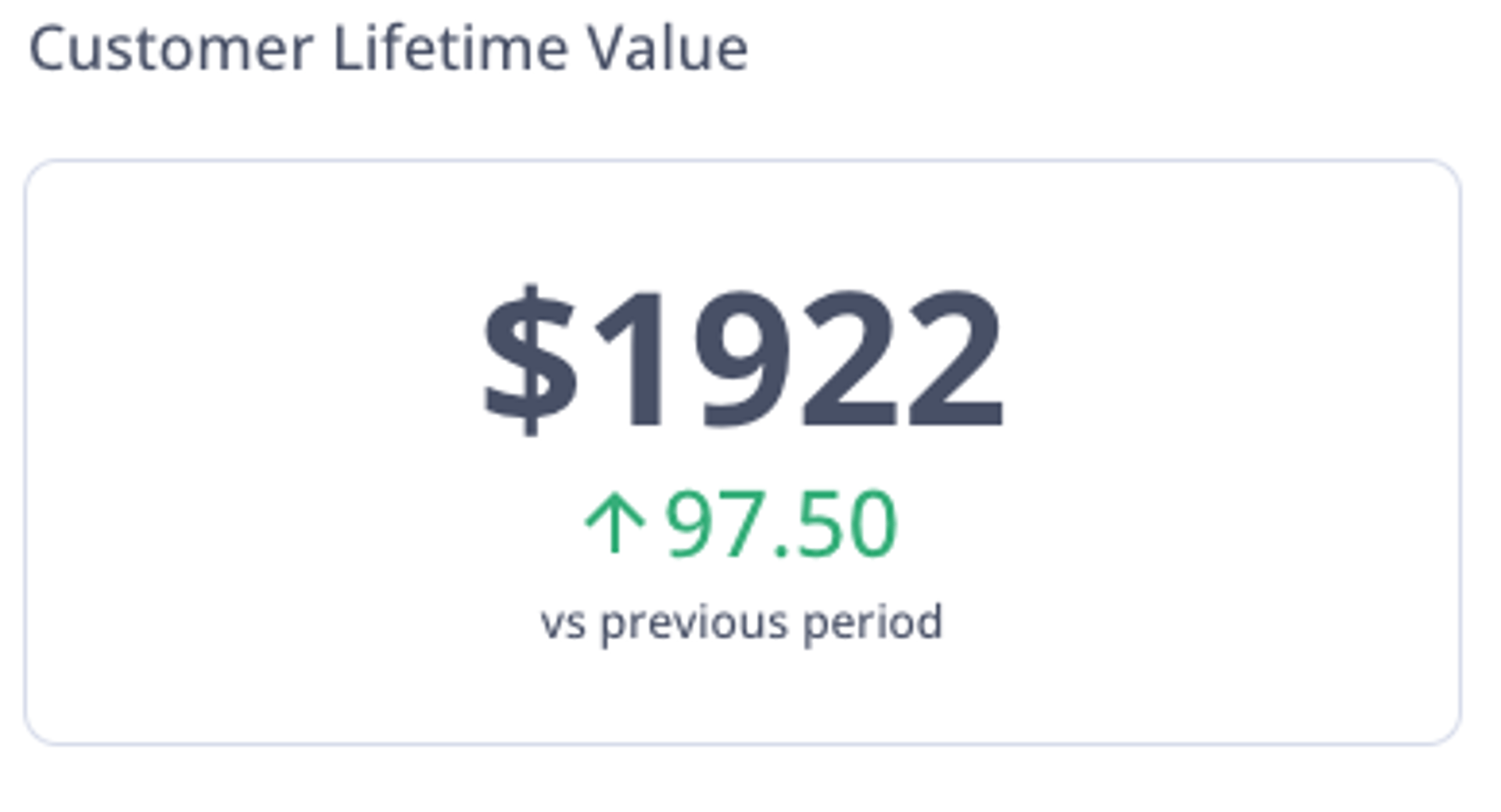

Customer Lifetime Value (LTV)

Expert contributor: Pablo Srugo

Customer Lifetime Value (LTV) estimates total revenue from a typical customer over their relationship with your company. Use it to identify high?value segments and to guide acquisition and retention spend.

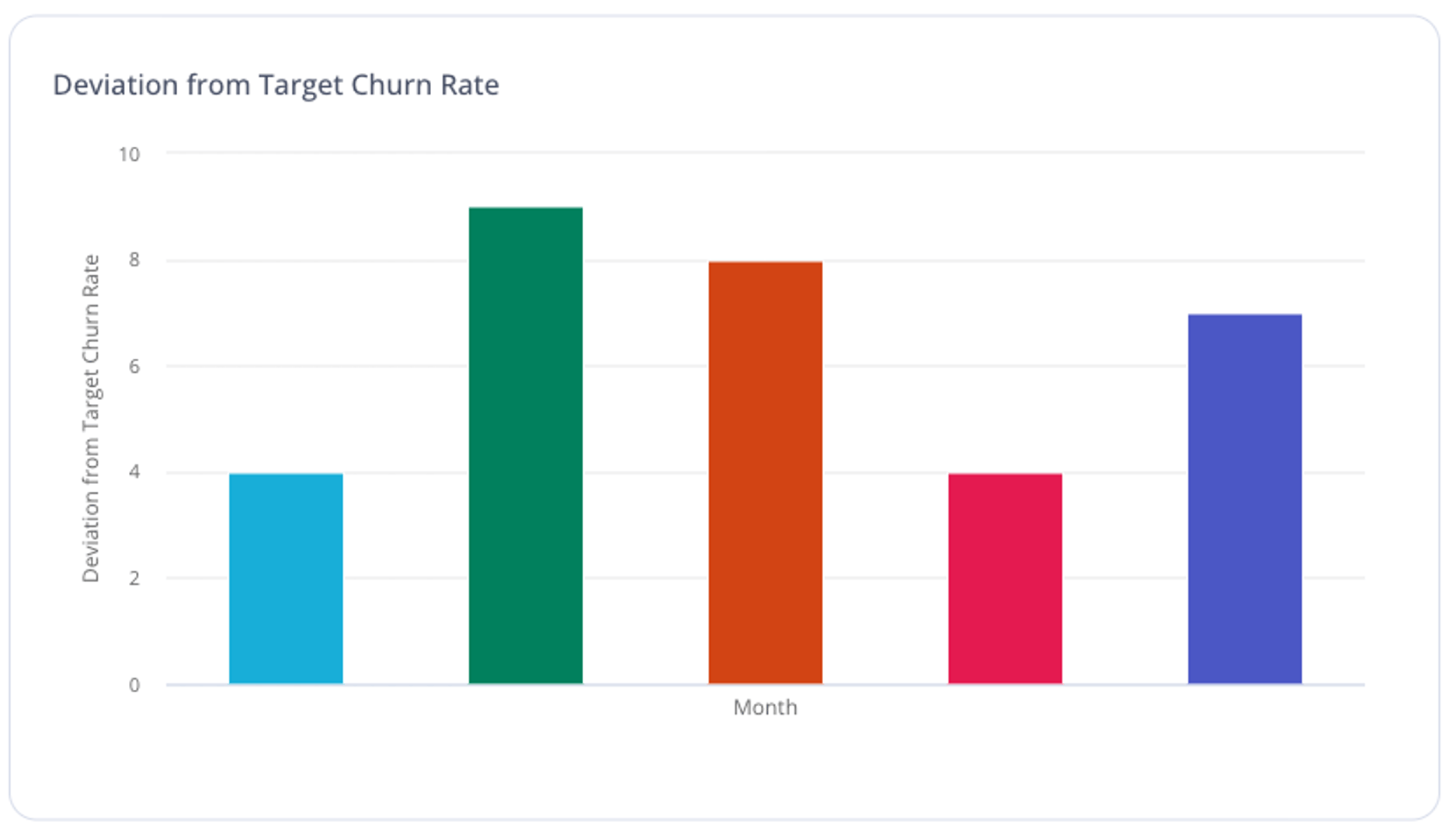

Deviation from Target Churn Rate

Expert contributor: Douglas Alves

This metric measures how far you are from the churn rate you’re aiming to achieve in a given period. Calculate it as forecast churn minus target churn.

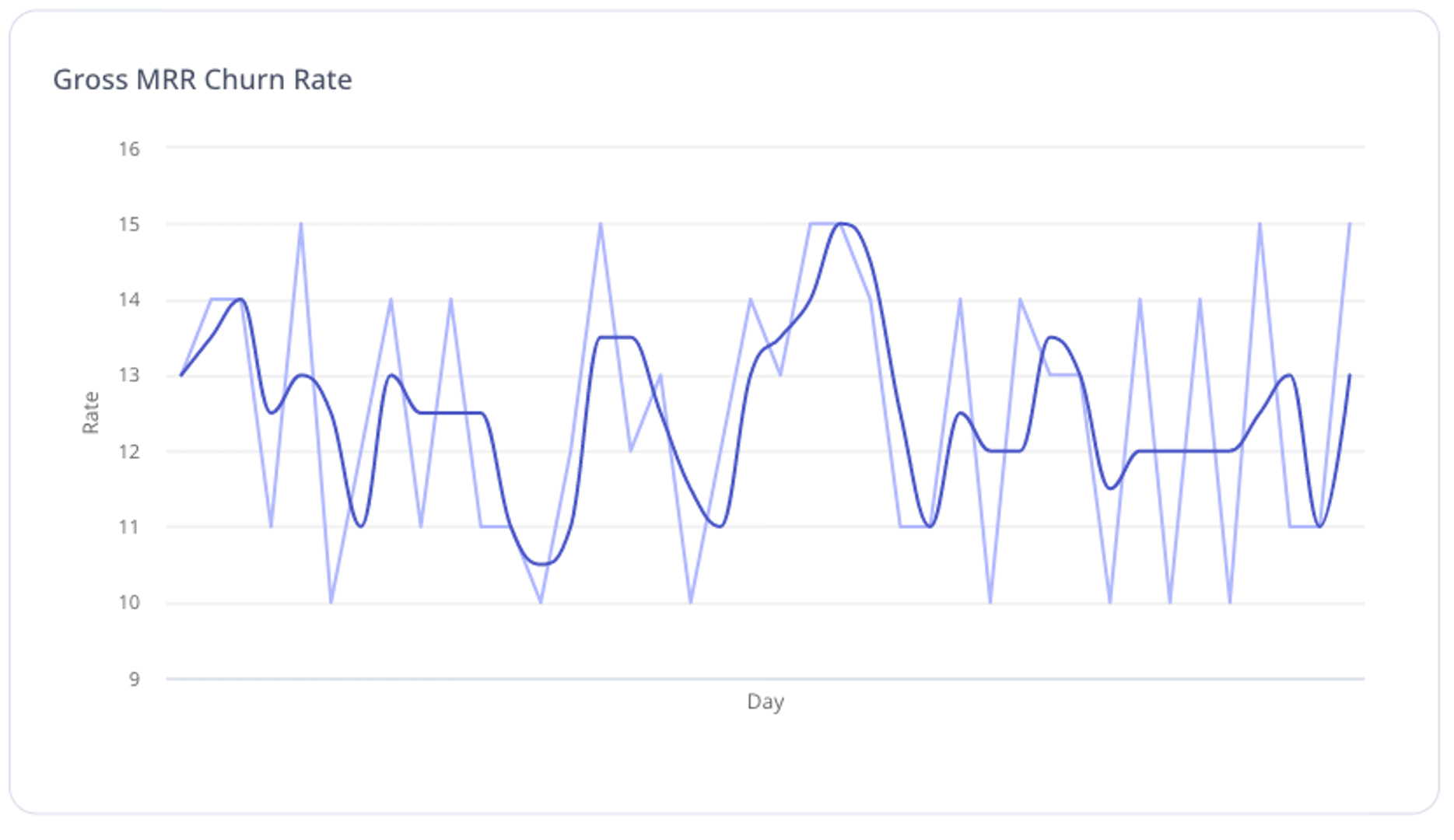

Gross MRR Churn Rate

Expert contributor: Pablo Srugo

Gross Monthly Recurring Revenue Churn Rate is the percentage of recurring revenue lost to cancellations and downgrades. Often tracked monthly, but an annual view works too.

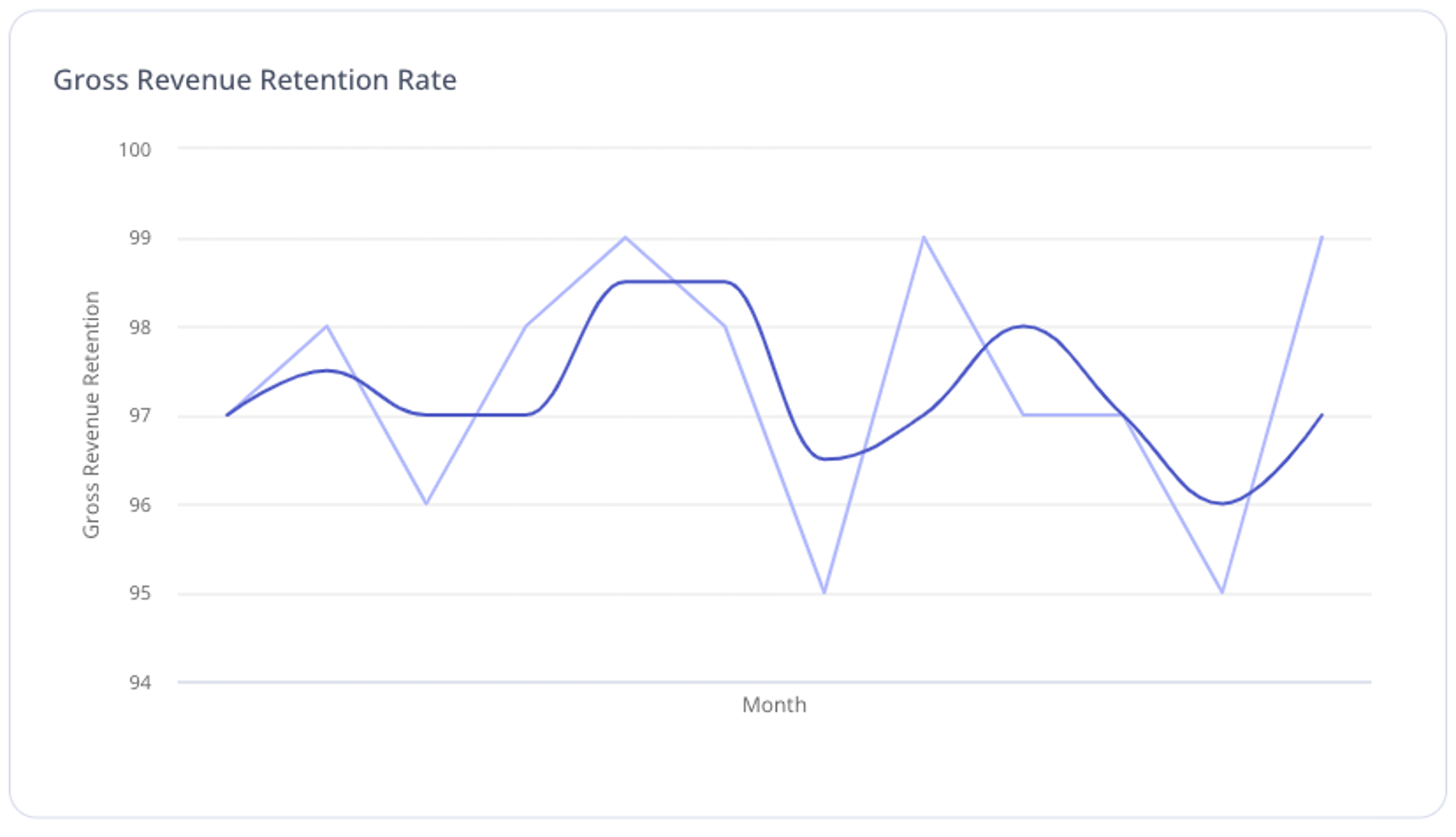

Gross Revenue Retention Rate (GRR)

Expert contributor: Lauren Thibodeau

Gross Revenue Retention (GRR) is the percentage of recurring revenue retained from existing customers in a period, including downgrades and cancellations, and excluding expansion.

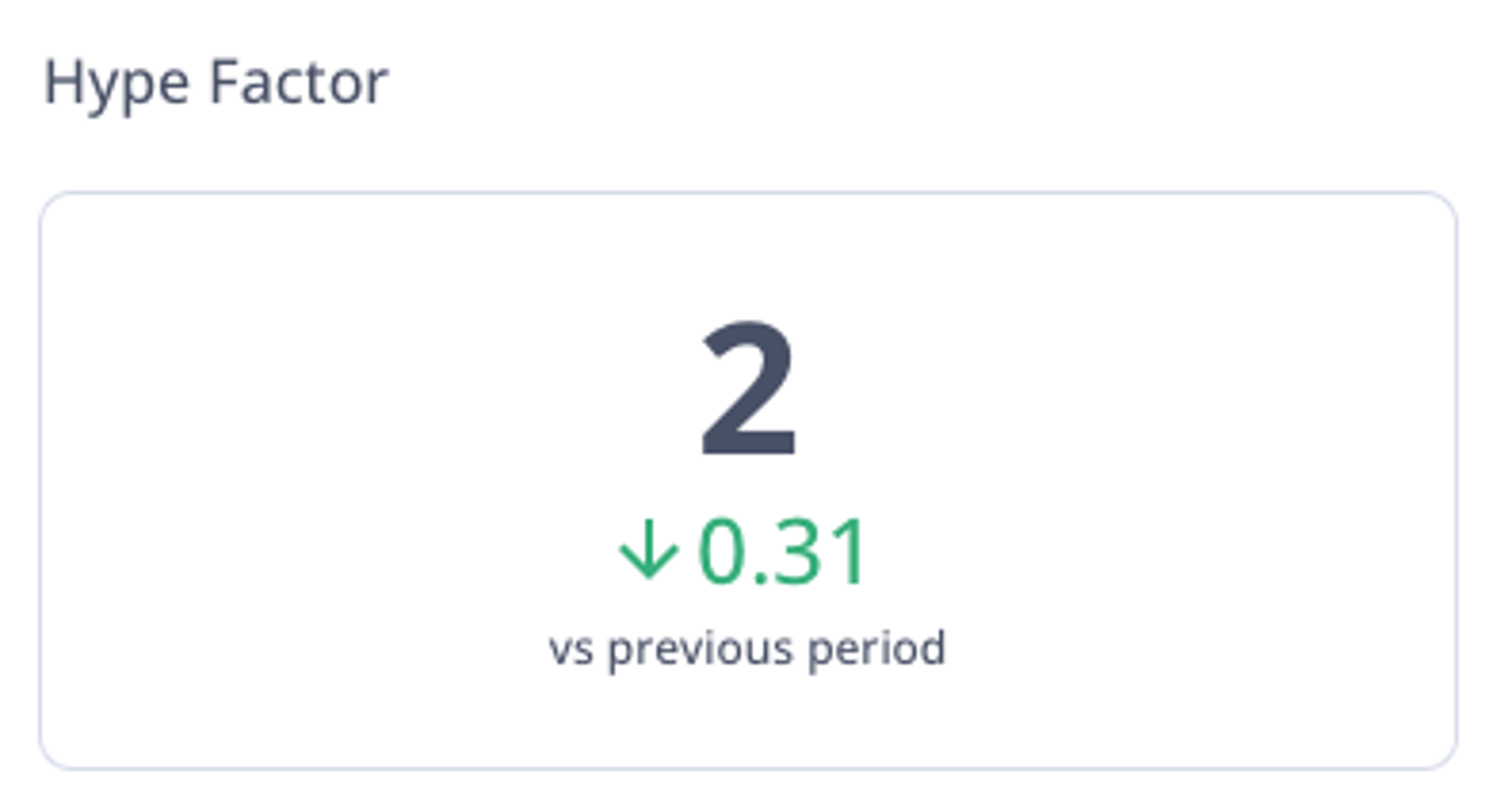

Hype Factor

Expert contributor: Dave Kellogg

Hype Factor is an efficiency metric showing how well a company converts capital raised into ARR. ARR has direct value as it turns into GAAP revenue annually. Hype helps only if it creates halo effects that increase interest and ARR.

Lifetime Value to Cost of Acquisition Ratio (LTV/CAC)

Expert contributor: Eckhard Ortwein

LTV/CAC compares the lifetime revenue expected from a customer to the cost to acquire that customer. Ratios above 3:1 are often cited as healthy for SaaS, but context matters.

Logo Churn

Expert contributor: Soha Yasrebi

Logo Churn is the number or percentage of customers who end their subscription in a period. Lower logo churn unlocks stronger net revenue retention.

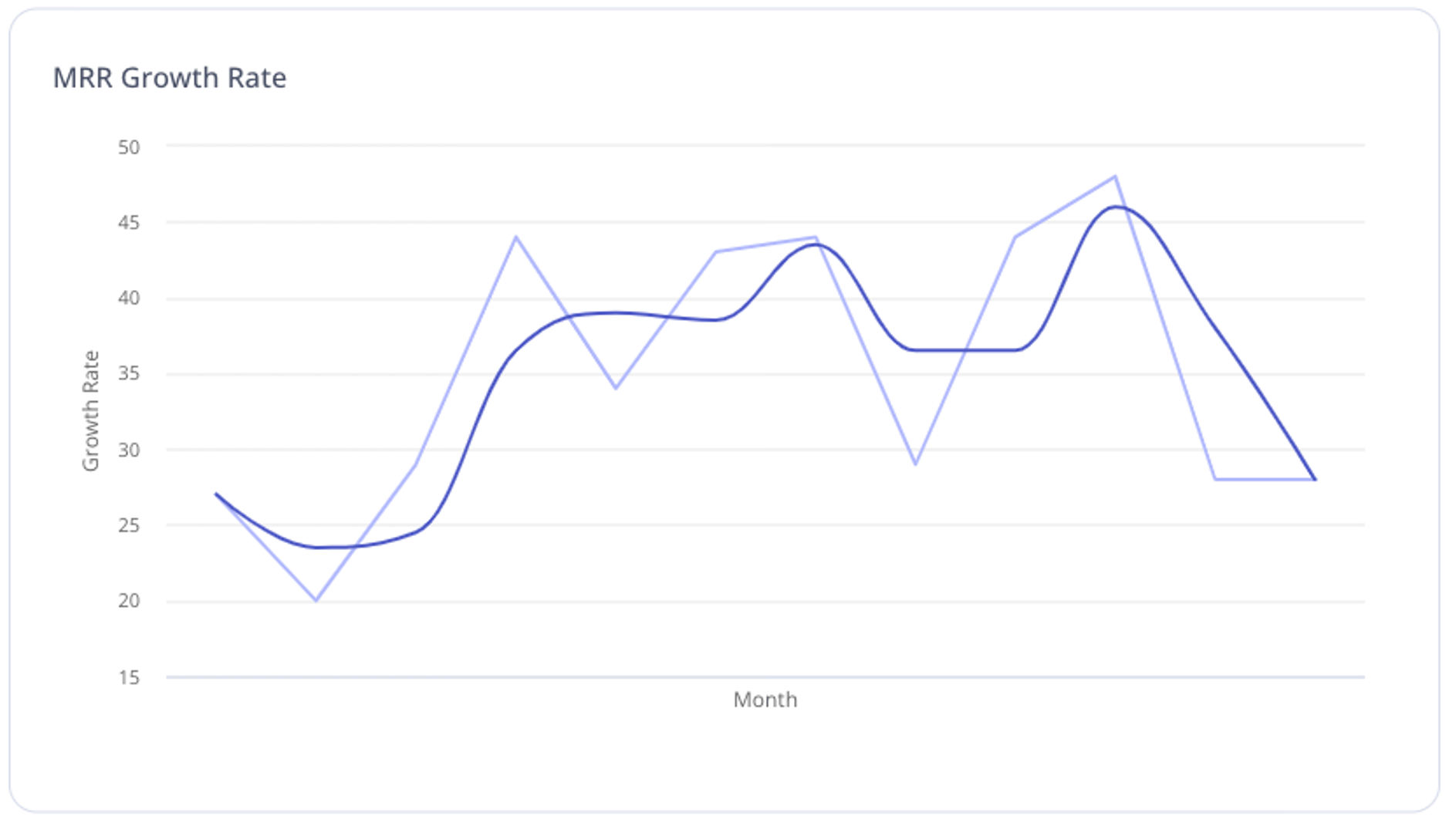

MRR Growth Rate

Expert contributors: Taylor Wilson, Snita Balsara

Monthly Recurring Revenue (MRR) Growth Rate expresses how quickly MRR is increasing. Track monthly or annually, and pair it with churn and expansion metrics.

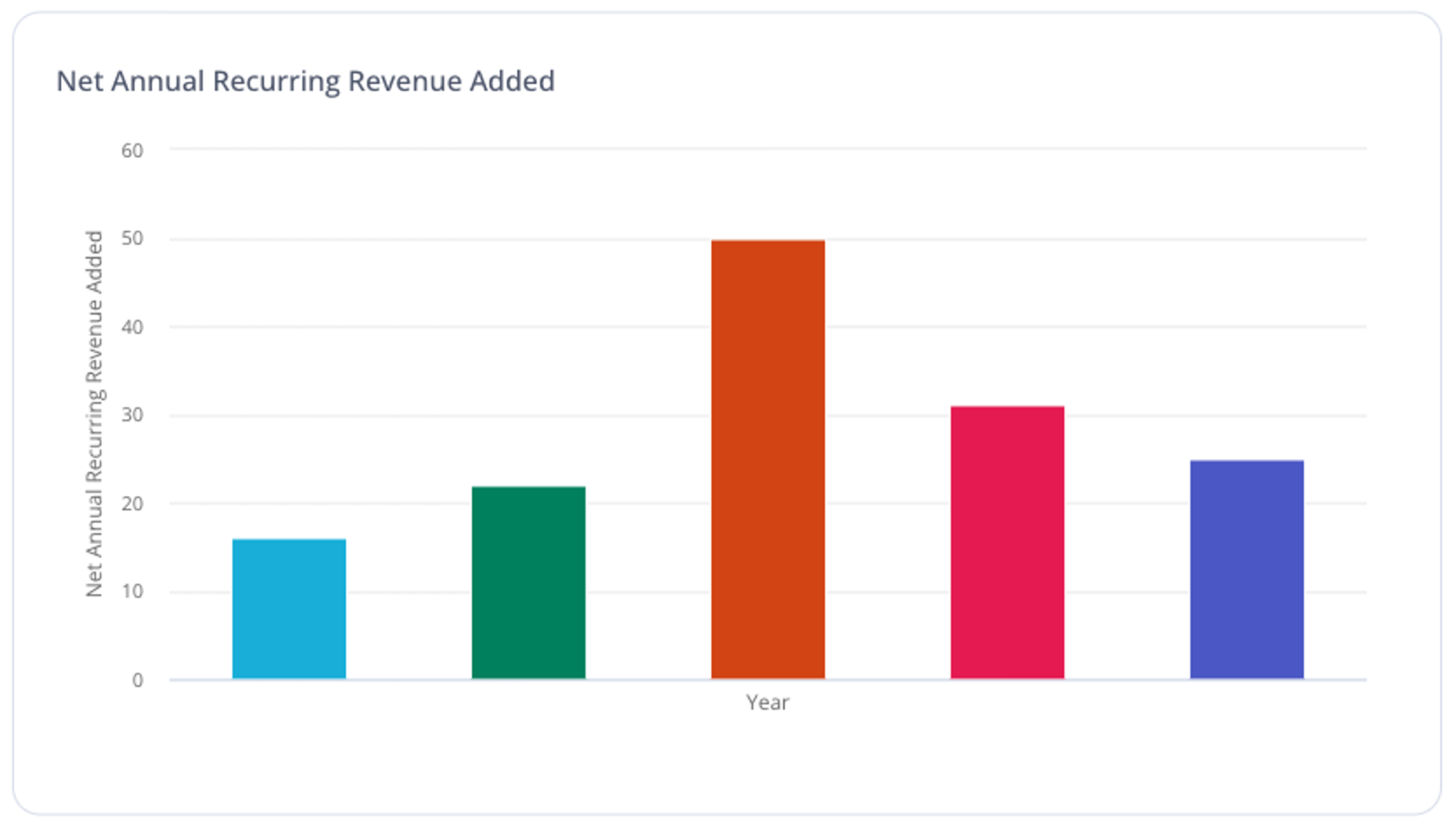

Net Annual Recurring Revenue Added (Net ARR Added)

Expert contributor: Paula Diaz

Net ARR Added is the net change in annual recurring revenue from new logos, expansion, down?sell, and churn in a period. Use it to understand the components of growth.

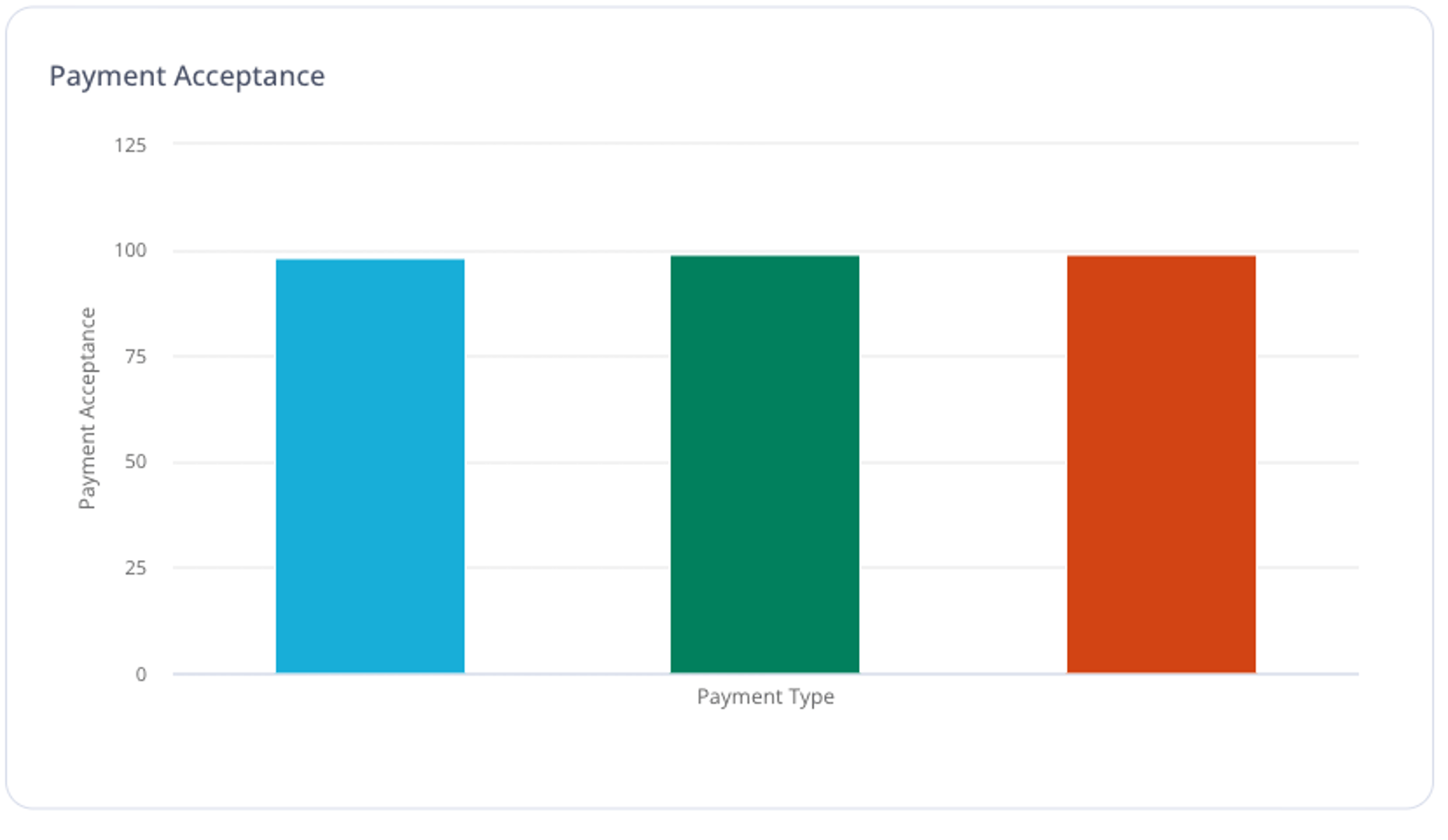

Payment Acceptance

Expert contributor: Ed Fry

Payment acceptance is the percentage of successful payments out of attempted payments. In card processing, this is often called the “authorization rate.”

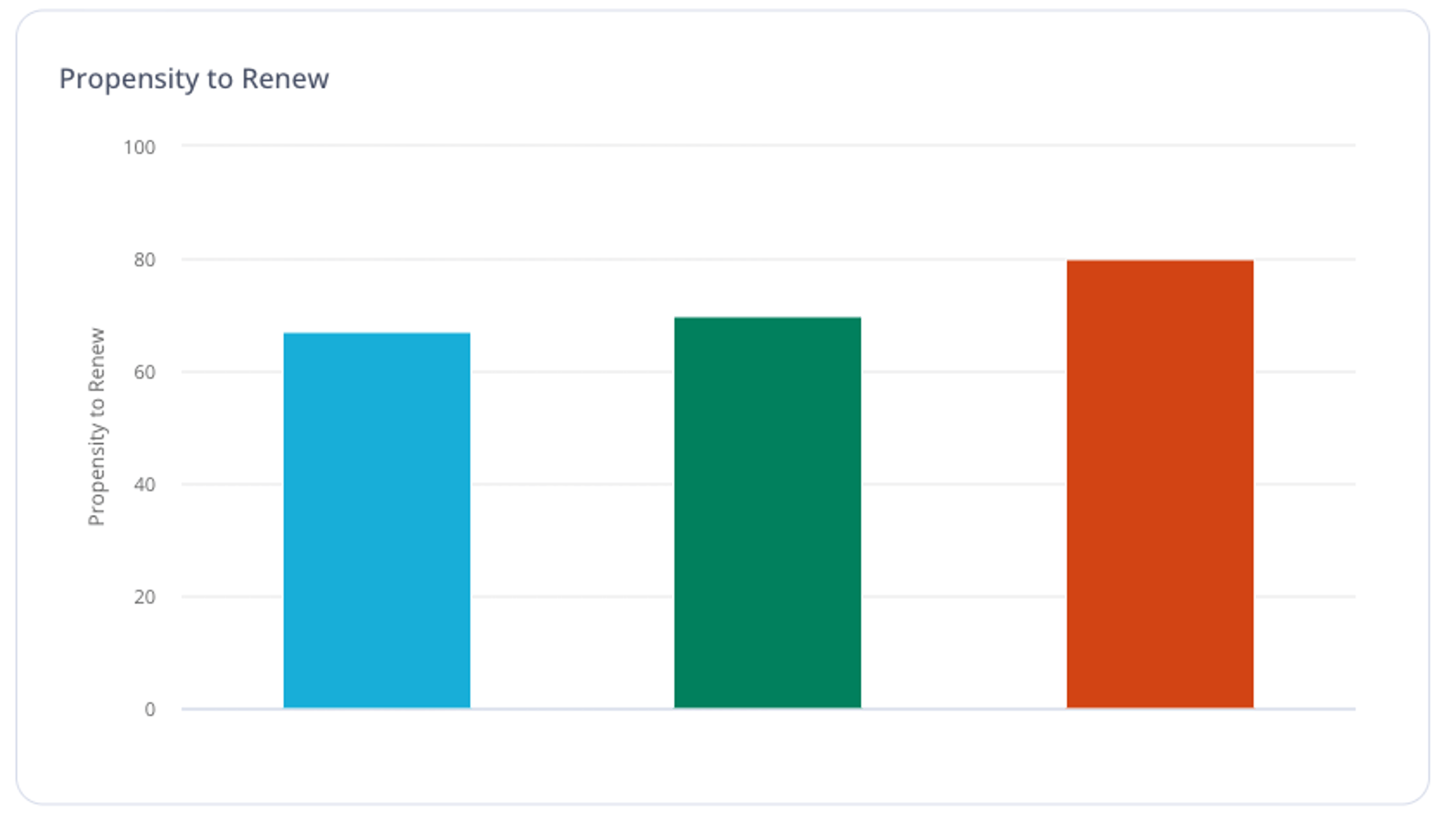

Propensity to Renew

Expert contributor: Jennifer Batley

Propensity to Renew estimates the likelihood a customer will renew their contract, often sourced from customer surveys. It’s an early indicator of revenue risk and potential logo churn.

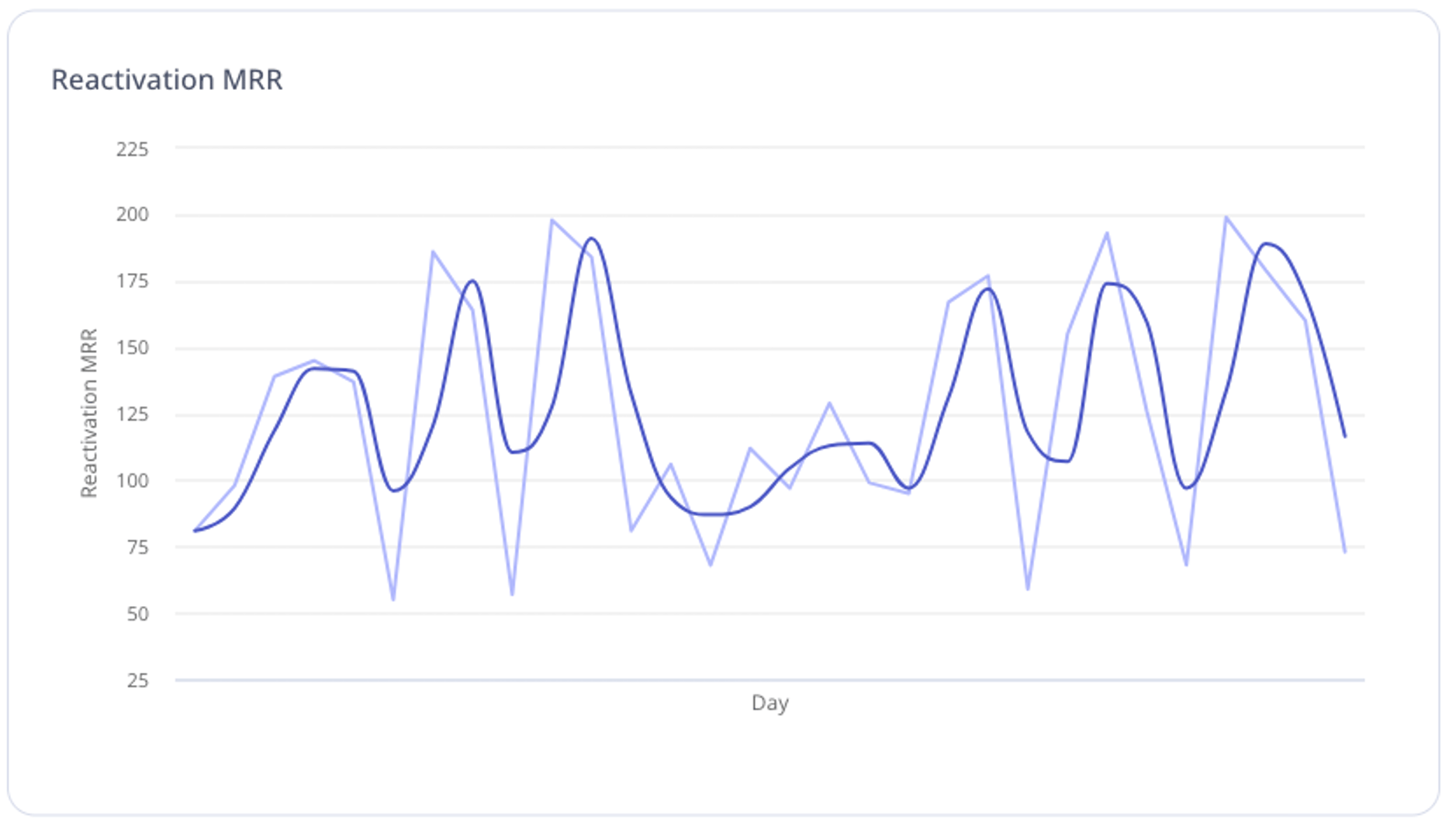

Reactivation MRR

Expert contributor: Susan Luo

Reactivation MRR is recurring revenue from customers who previously cancelled service and returned within the current tracking period.

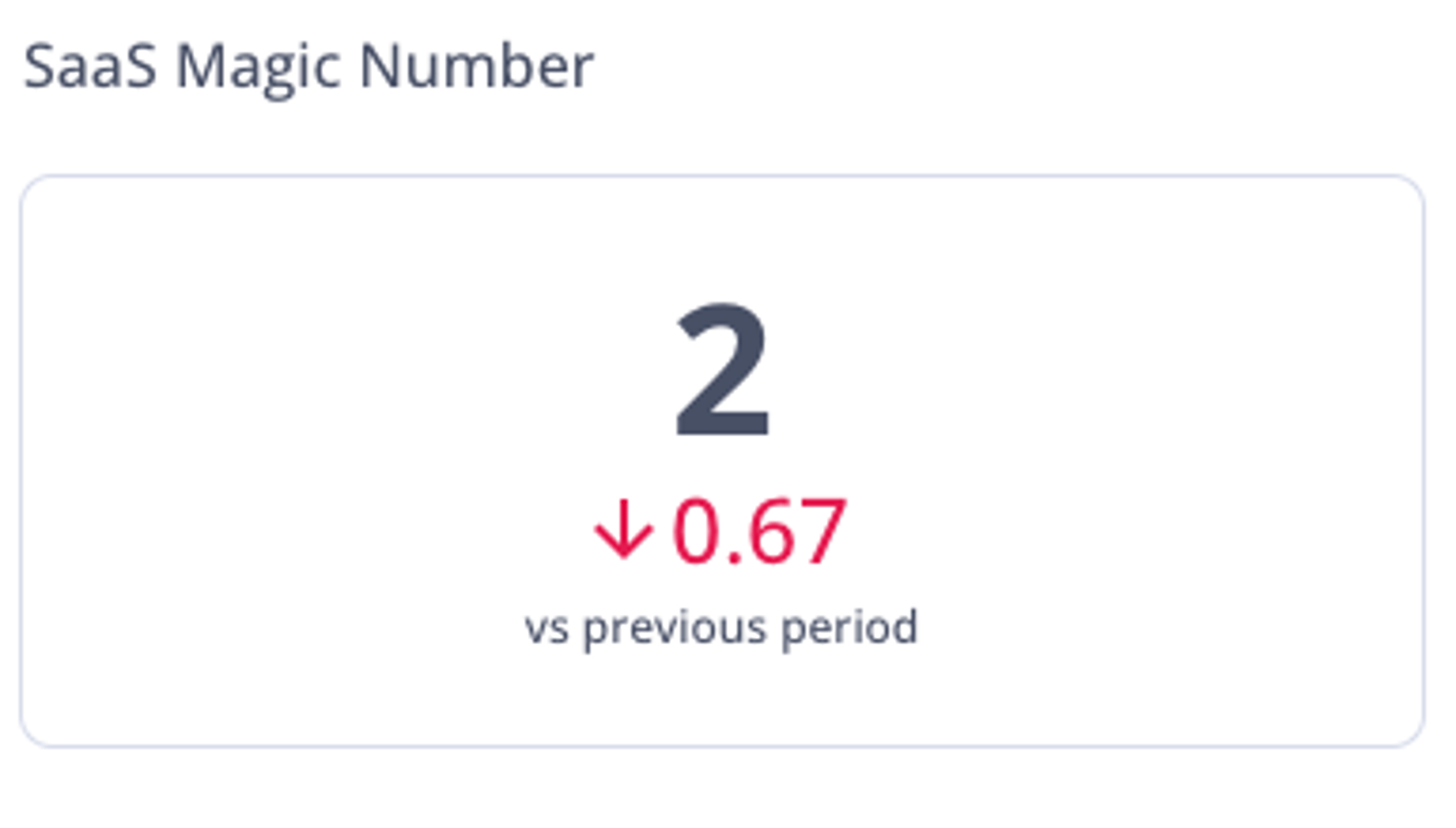

SaaS Magic Number

Expert contributors: Will Cordes, Alamin Mollick

The SaaS Magic Number estimates ARR gained for every sales and marketing dollar. Use it to judge the sustainability of go?to?market spend.

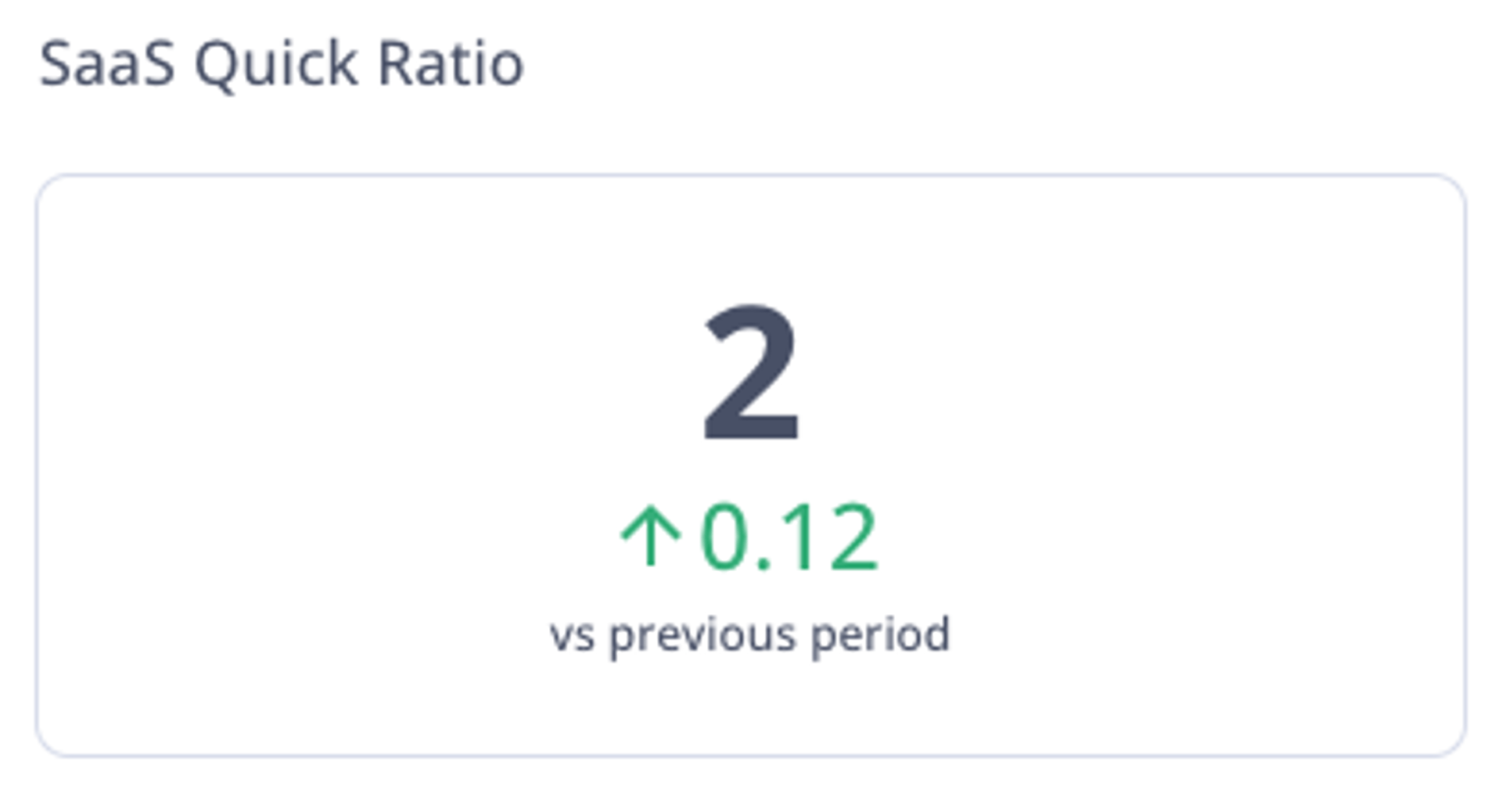

SaaS Quick Ratio

Expert contributor: Susan Richards

SaaS Quick Ratio assesses growth efficiency by comparing new and expansion MRR against churn and contraction. Higher ratios signal healthier growth.

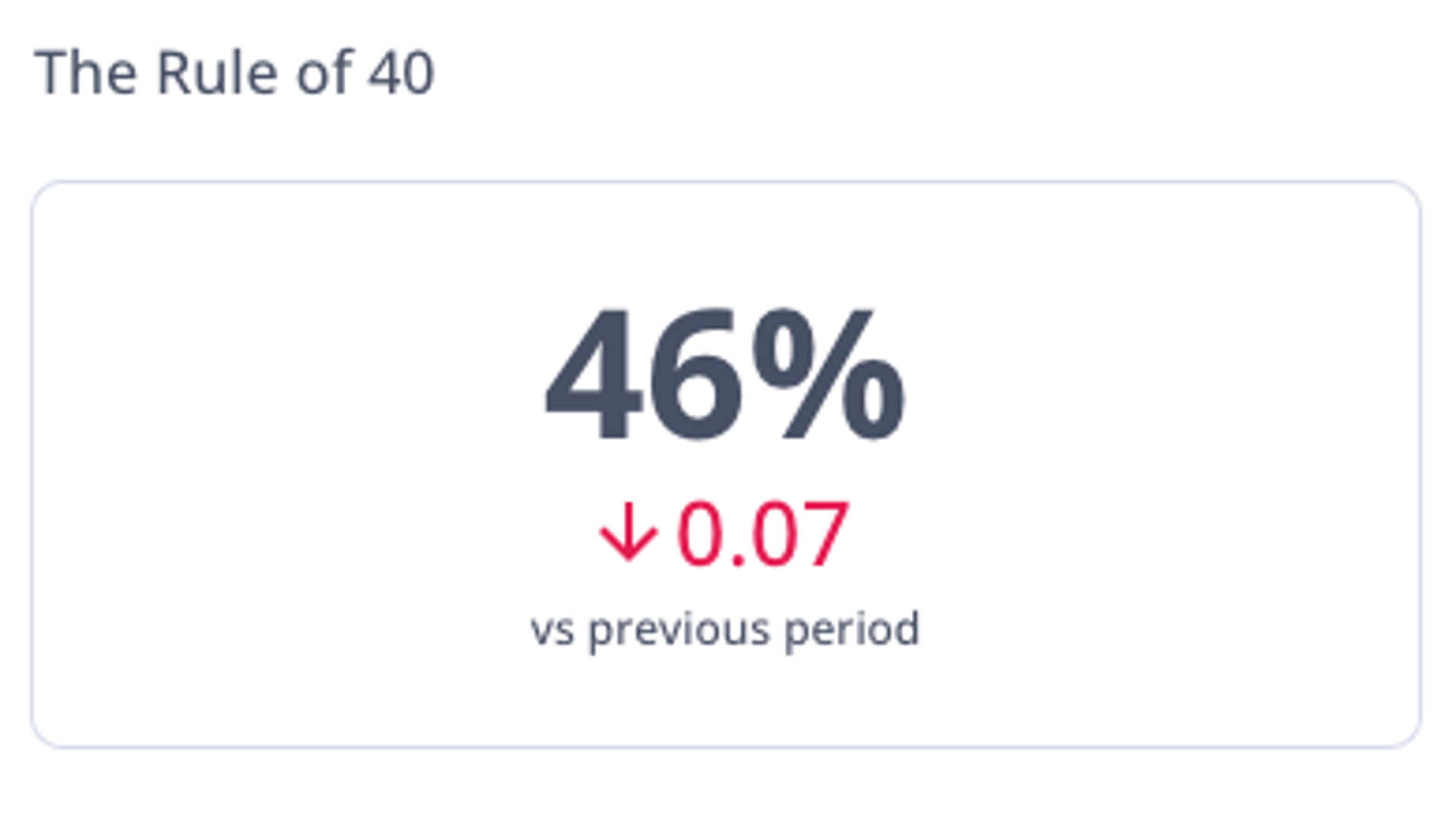

The Rule of 40

Expert contributors: Ben Murray, Adrian Bunter

The Rule of 40 balances revenue growth and profit margin to provide a quick read on company health.

Total Addressable Market (TAM)

Expert contributor: Lauren Thibodeau

Total Addressable Market (TAM) estimates the full revenue opportunity for a product or service if you captured 100% of the market.

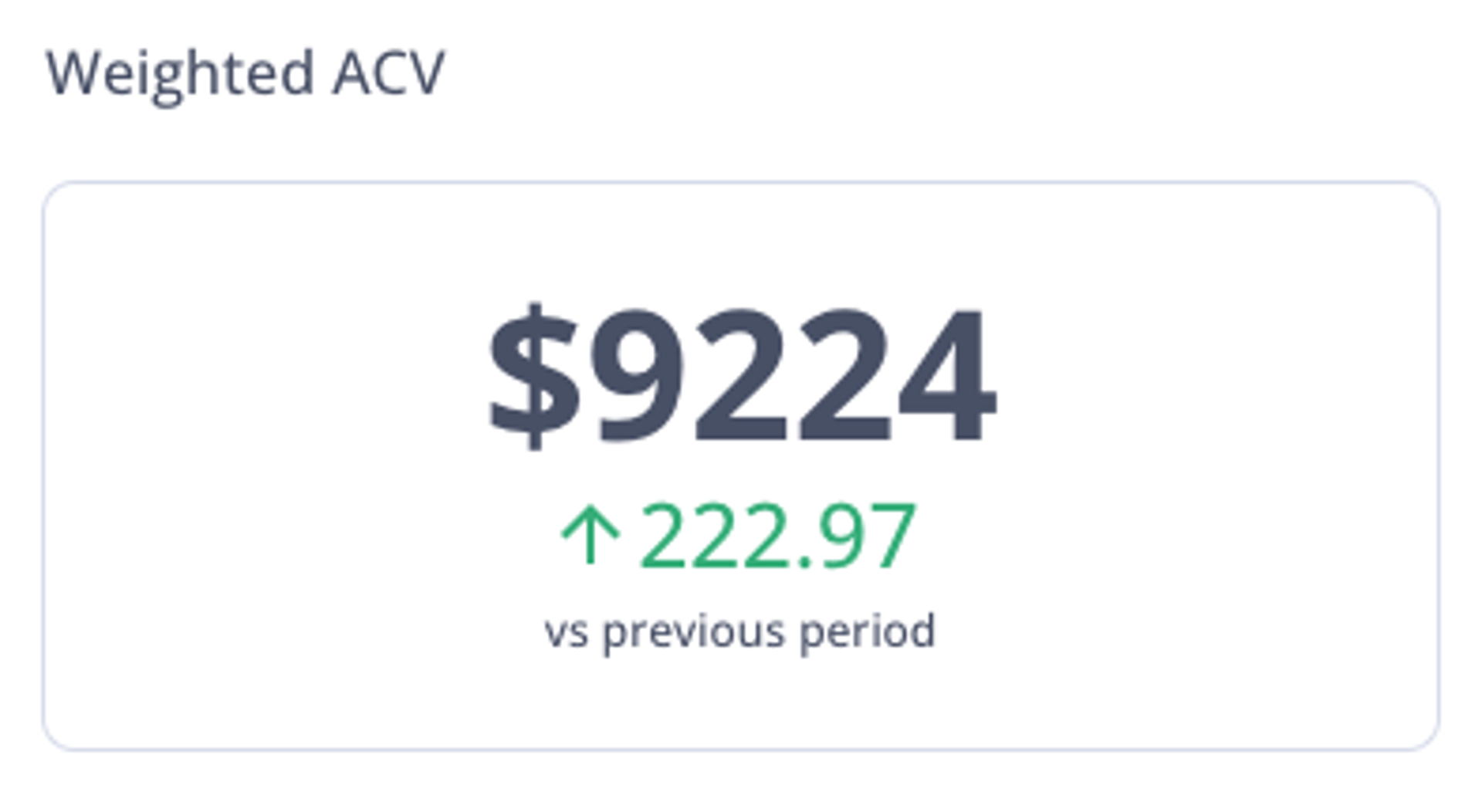

Weighted ACV (WACV)

Expert contributor: Nnamdi Iregbulem

Weighted Annual Contract Value (WACV) calculates the average contract value using a weighted average proportional to each contract’s size. It’s useful when customer spend varies widely.

One of the pillars of trustworthy metrics is expert input and peer review. For clear definitions and references, explore MetricHQ. Track these metrics in Klipfolio PowerMetrics to standardize definitions, monitor trends, and share context with your team.

Related Articles

The Hidden Value of SaaS Sign Up Rate Benchmarks

By Priyaanka Arora — January 10th, 2026

Top 10 Marketing Dashboard Ideas for Tech Companies

17 KPIs Every Data-Driven Manager Needs to Lead Their Team

By Danielle Poleski — October 14th, 2025