Startups blogs

A collection of our most recent articles on

Mastering the funnel: Mapping your customer’s journey to revenue growth

By Allan Wille, Co-Founder — April 12, 2019

How to use burndown charts to manage agile software releases

By Ali Pourshahid — January 10, 2019

Small Business (SMB) Analytics in 2024

By Matt Shealy — December 26, 2021

The key business metrics from 8 SaaS startup pitch decks

By Jonathan Milne — June 20, 2018

The Power of Words

By Holly Ebbs — August 12, 2020

6 reasons every SaaS startup needs a customer retention dashboard

By Trish Mermuys — April 5, 2016

SaaS growth stage 101: control and fuel

By Cameron Conaway — July 4, 2017

Wicket is empowering data-informed decisions with Klipfolio

By Mitch Dupuis — April 3, 2019

How $12M in Series B funding will accelerate our mission to give businesses real-time access to all of their metrics

By Allan Wille, Co-Founder — January 5, 2017

Resistance is fertile: On slow content for anxious startups

By Mark Brownlee — July 23, 2017

Celebrating 10 years in business!

By Jonathan Taylor — February 1, 2012

3 Key Financial Reports to Understand as Your Business Grows

By Jody Grunden — May 22, 2019

Thriving in a tempest: What we learned about product management during Klipfolio’s start-up phase

By Scott Lawrence — October 31, 2017

How we are using A-B testing to refine our pricing model – Part 1

By Allan Wille, Co-Founder — February 26, 2016

How we are using A-B testing to refine our pricing model – Part 2

By Allan Wille, Co-Founder — March 4, 2016

How smart businesses are making better decisions

By Alastair Barlow — September 27, 2018

How to lead from the bottom on making your company data-driven

By Mark Brownlee — November 27, 2017

The spaghetti mess we created when we tried to integrate our data systems - and how we got out of it

By Allan Wille, Co-Founder — May 29, 2015

15 reasons why you should join our team at Klipfolio

By Ali Pourshahid — November 21, 2017

4 Lessons Jobber Learned While Growing Their Marketing Team

By Moly Milosovic — September 20, 2017

Six Tips to Stage your Company with Confidence

By Mike Pascoe — June 30, 2020

Seven tips for maximizing the benefits of KPIs

By Allan Wille, Co-Founder — June 10, 2019

7 steps to measure team performance using data

By Matt Shealy — October 23, 2019

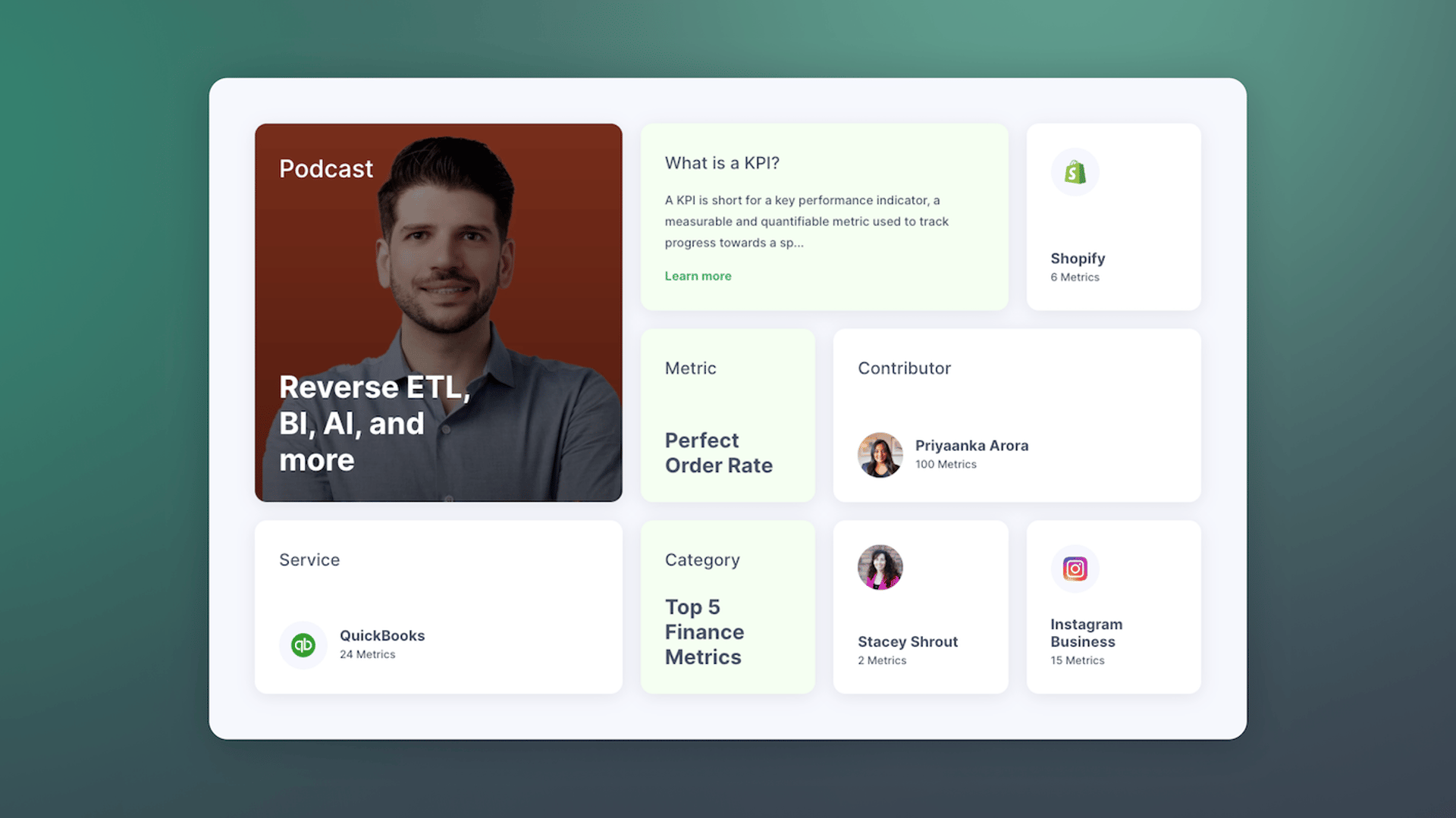

Promoting data literacy with metrichq.org and the power of AI

By Allan Wille, Co-Founder — October 12, 2023

It's about time – behind the scenes of Klipfolio getting funded

By Allan Wille, Co-Founder — February 13, 2014

Marketing momentum metrics and startup productivity

By Cameron Conaway — June 29, 2017